Bybit partners with SignalPlus and Yuezigeyu to revisit the basics of options

TechFlow Selected TechFlow Selected

Bybit partners with SignalPlus and Yuezigeyu to revisit the basics of options

This is not just a course about "making money," but also a practice about "professionalism."

Introduction

Options—an asset that fascinates and intimidates countless traders.

It resembles a cryptic scripture filled with complex Greek letters and bewildering strategy combinations. Many want to learn, but don't know where to begin; many start learning, yet remain utterly confused.

On August 25th at 8:30 PM, during the debut of Bybit x SignalPlus's Options Masterclass, Yuezi Brother, a trader with 11 years of experience, offered a fresh solution to this problem. In this recap, we review his lecture content and highlight three compelling takeaways from the course.

Highlight One: Building a System, Strengthening Foundations—An Options Worldview Starting from "Tai Chi"

Most existing tutorials tend to open with dry definitions, immediately followed by throwing a dozen strategies at learners, plunging them into an ocean of knowledge without a clear主线 (main thread).

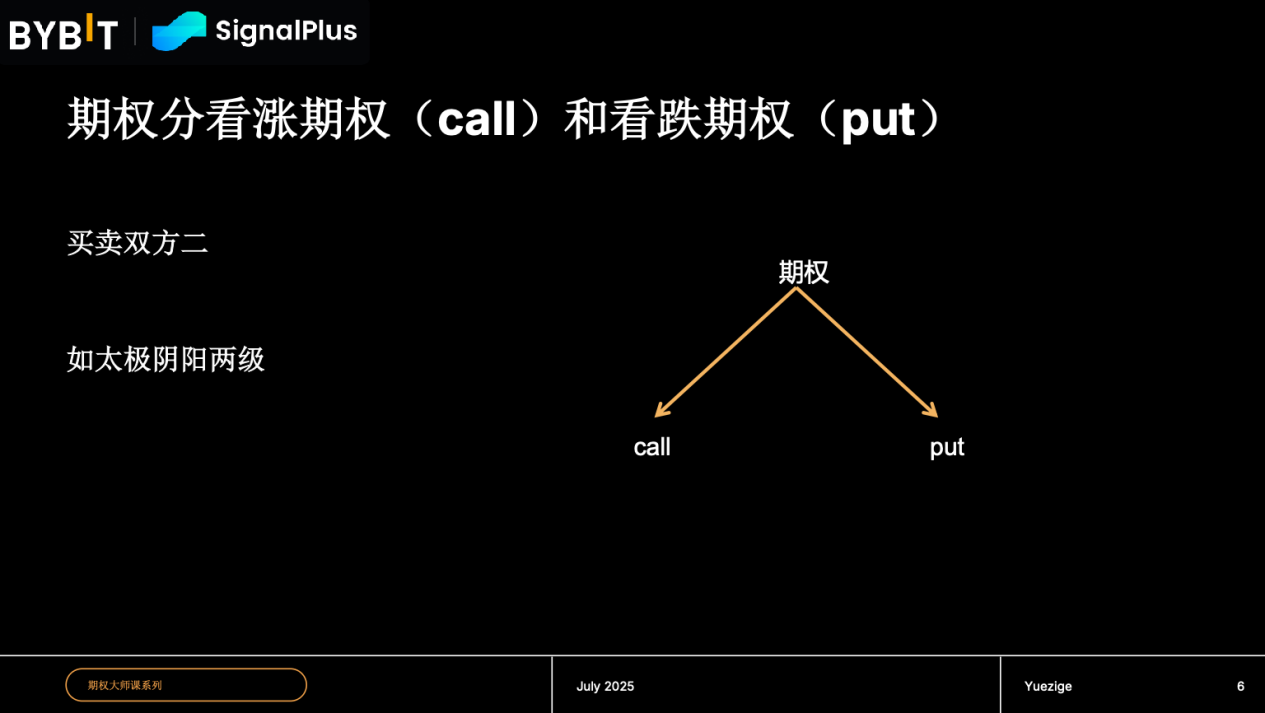

Yuezi Brother took the opposite approach. He didn’t start with strategies, but instead built a worldview for students. He likened options to "Tai Chi"—from chaos emerges duality, giving rise to the two poles of "Call" and "Put," vividly illustrating the fundamental principles of options.

The brilliance of this analogy lies in:

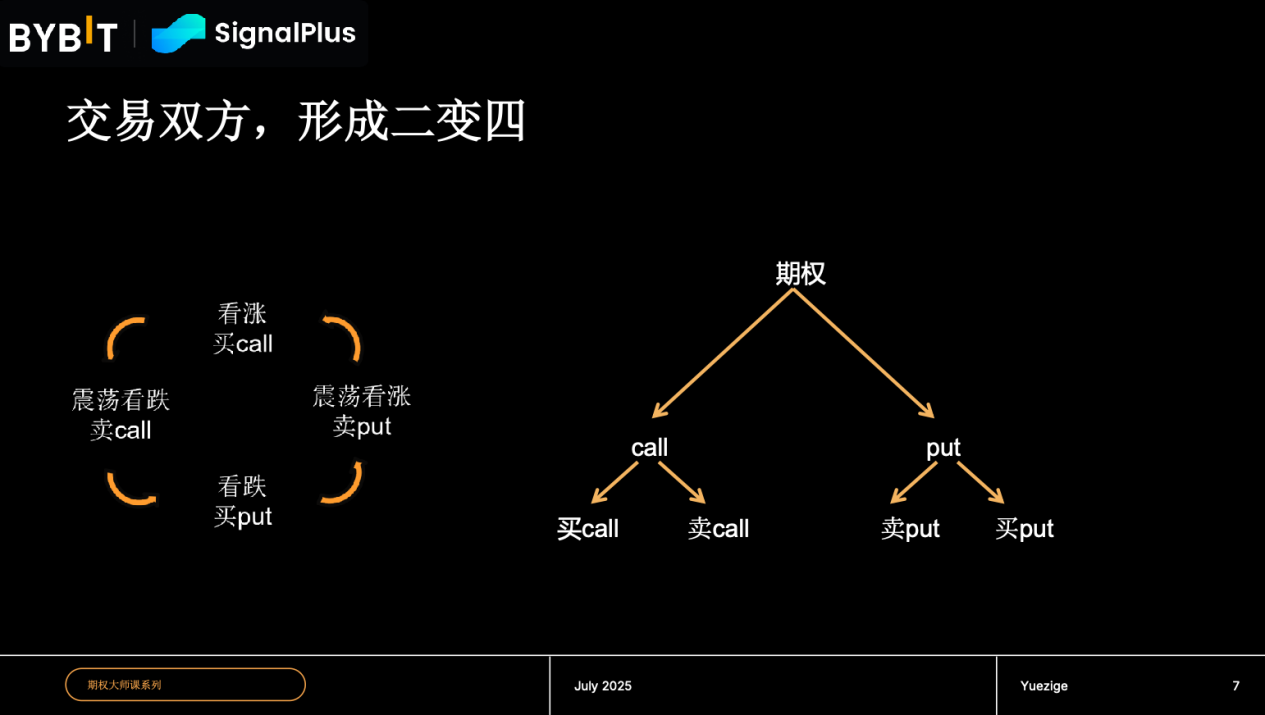

1. Clarifying the core: The most fundamental structure of the options world consists of two entirely separate markets—Call and Put. He repeatedly emphasized, "The counterparty to buying a call is selling a call, not buying a put." This seemingly simple correction instantly clears up the biggest conceptual confusion for beginners.

2. Demonstrating evolution: From "one becomes two" (Call/Put), to "two becomes four" (buy/sell sides), then to "four becomes twelve" (basic combination strategies), he clearly outlined an "evolutionary tree" of options strategies.

The Bybit x SignalPlus Options Masterclass does not give students a pile of fragmented "knowledge points," but rather a coherent "knowledge system" they can use to deduce and summarize on their own. Students clearly perceive that all complex strategies originate from these two simple, opposing poles. Learning thus becomes less about rote memorization and more a logical, rule-based exploration process.

Highlight Two: Teaching Principles, Not Blind Faith in Models—"Not Losing" Matters More Than "How to Win"

"I've already lost so much, isn't it time I made some profit?" This is the inner cry of countless traders.

Yuezi Brother敏锐ly captured this sentiment and spent considerable time discussing the "trading mindset" behind strategies. His core philosophy: "No pain, no gain."

He shared several simple yet profound insights:

• Accept the norm: "Being wrong is normal." He bluntly told students that making mistakes is routine in trading, especially when being a buyer. This simple statement instantly built rapport and greatly eased beginners' anxiety.

• Stay patient: "Let the bullet fly." He advised against obsessing over minute-by-minute price movements after placing a trade, warning against frequent adjustments.

• Capped risk: He recommended newcomers allocate only 10%-20% of their total capital to experiment with options—like learning to drive in a used car, not a Rolls-Royce. He even went further, reminding students to monitor the maintenance margin (MM) and keep it around a safe 30% level.

This consistent emphasis on risk awareness and an honest perspective on failure elevates the course beyond mere technical instruction. The Bybit x SignalPlus Options Masterclass teaches not just how to execute trades, but also the mindset and survival principles of a professional trader.

Highlight Three: Starting with Practice, Not Just Theory—The Clever First Step of "Starting with 100U"

No matter how well you understand theory, you'll never learn to swim without getting in the water.

Perhaps the course’s most brilliant design was its final assignment. Instead of asking students to write notes or solve theoretical problems, Yuezi Brother gave a highly practical task:

"Place your first options trade with no more than 100U."

This assignment carries several layers of meaning:

1. Lowering the barrier, eliminating fear: 100U allows everyone to take their first step stress-free. It shows students that options are not an exclusive "noble game" requiring tens of thousands to participate.

2. Fast feedback, enhanced intuition: Using end-of-week options expiring within three days enables students to experience the full life cycle of a trade—from birth to death—in the shortest time possible, gaining direct insight into time decay and P&L fluctuations.

3. Unity of knowledge and action: From predicting market direction and selecting a strategy, to placing orders and closing positions, this assignment itself is a complete trading workflow simulation.

This practice-first approach ensures the course content never remains theoretical. It encourages students to transform knowledge into real trading skills, gaining authentic experience under controlled risk.

Conclusion

A great course should not be a solo performance by the instructor, but a catalyst that sparks thinking and drives action.

Through the three dimensions of building a system, teaching principles, and starting with practice, Yuezi Brother’s debut session in the Bybit x SignalPlus Options Masterclass made complex options trading structured, manageable, and approachable.

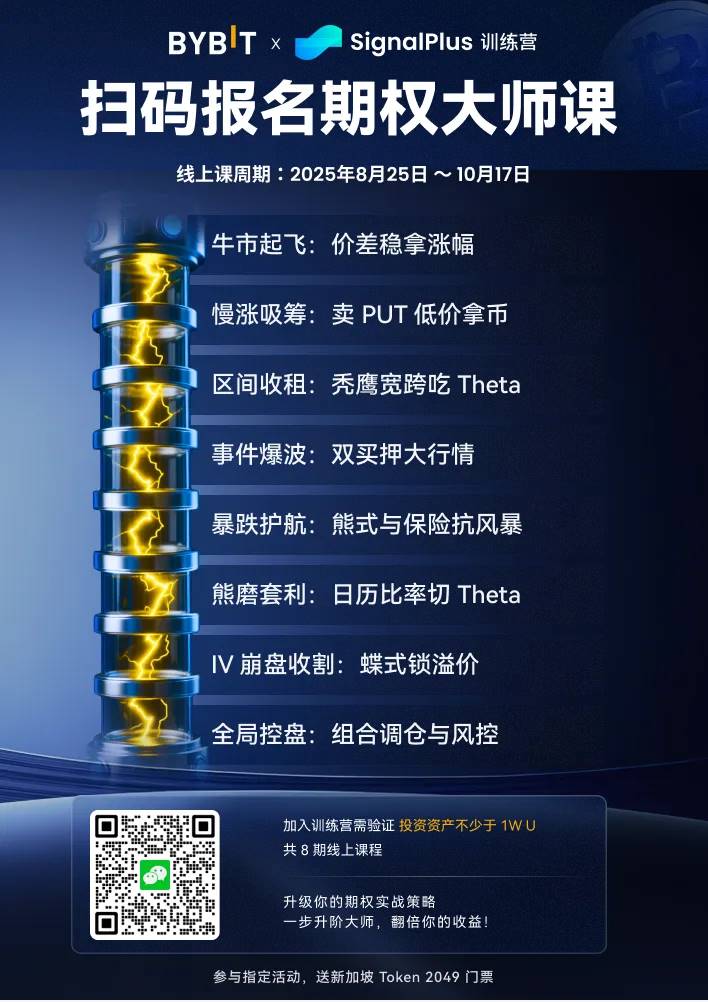

This is not merely a class about "making money," but a journey of mastering professionalism. If you resonate with this learning philosophy and aspire to build your own logically consistent trading framework, we welcome you to join the upcoming sessions of the Options Masterclass.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News