Last Friday's liquidation review: diversify your trading platforms and choose battle-tested ones

TechFlow Selected TechFlow Selected

Last Friday's liquidation review: diversify your trading platforms and choose battle-tested ones

What happened on October 11, 2025

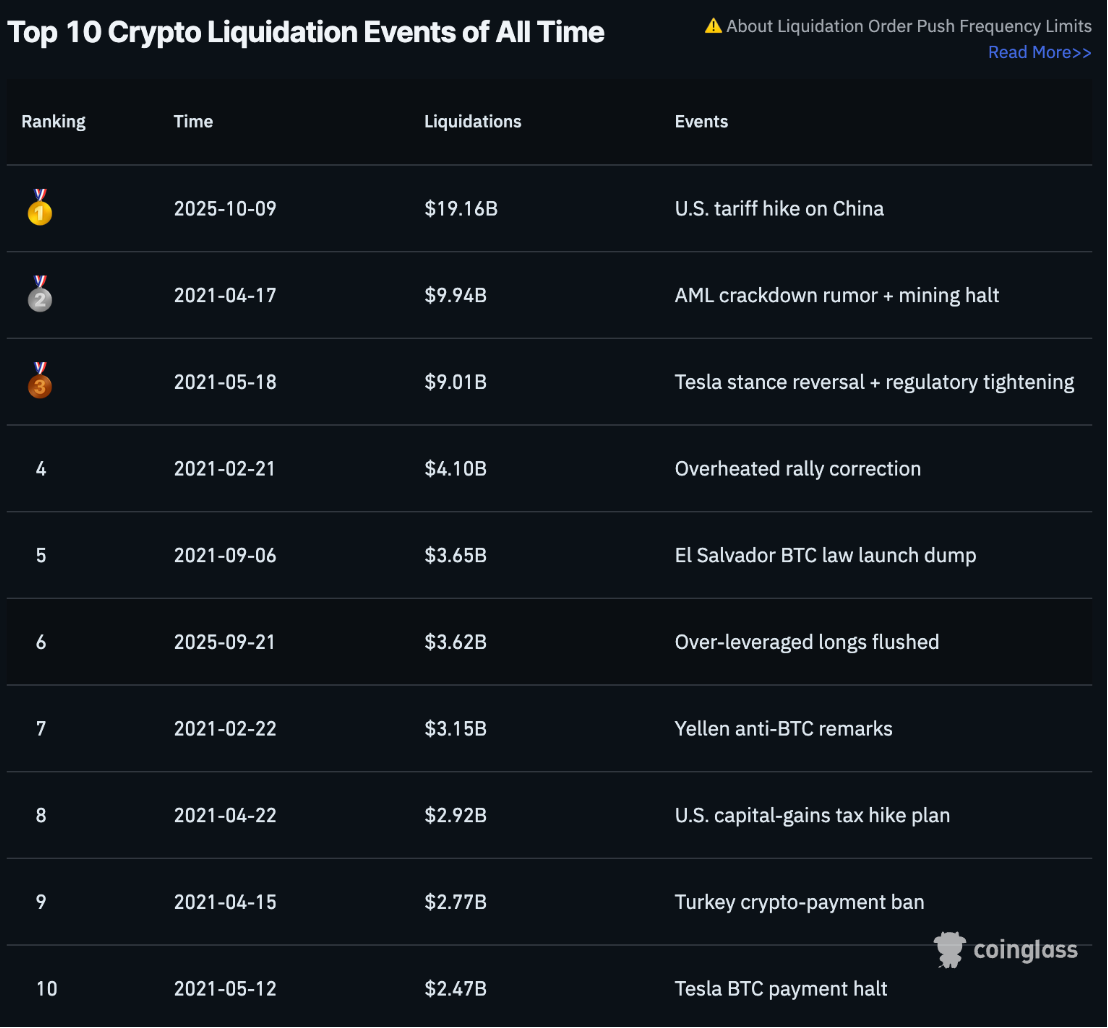

Source: CoinGlass

Last Friday, the cryptocurrency market experienced a dramatic and historic selloff, triggering the largest single-day liquidation event in history. Over $19 billion in leveraged positions were liquidated across major centralized exchanges, affecting more than 1.6 million traders globally. This unprecedented cascade of liquidations was triggered by a combination of macroeconomic shocks and technical vulnerabilities in exchange infrastructure.

The immediate catalyst was the U.S. announcement of 100% tariffs on Chinese imports, which sent shockwaves through global financial markets. Investors rushed to de-risk, and crypto assets—often seen as highly speculative—were hit first. Bitcoin plunged from around $121,000 to a low of $101,000 before recovering slightly; Ethereum dropped nearly 30%; Solana fell over 40%.

The world's largest cryptocurrency exchange bore the brunt of the liquidation tsunami, accounting for over $14 billion in losses on a single platform. Analysts pointed to flaws in its collateral pricing mechanism that may have accelerated the chain reaction of liquidations. Another decentralized exchange also saw billions of dollars in forced liquidations. The incident ultimately exposed systemic risks in exchanges' margin and leverage management, sparking calls for reform and better protective mechanisms.

Despite the chaos, some participants view this pullback as a healthy reset. With excessively leveraged positions cleared out, analysts suggest the market may now be better positioned for sustainable growth. However, the scale of losses and speed of decline serve as a stark reminder: financial markets are volatile, and the risks of excessive leverage are particularly severe.

When the crypto market erased over $19 billion in a single day, the operational resilience and transparency of major industry exchanges were put to the test. Bybit, the world’s second-largest crypto exchange by trading volume, demonstrated notable stability amid extreme volatility, emerging as a case study in exchange resilience under pressure.

Which tokens rebounded first after this historic liquidation?

We've witnessed strong rebounds in major cryptocurrencies following this landmark liquidation, with broader crypto market movements mirroring the recovery in traditional equities. Notably, the "TACO (Trump Will Always Chicken Out)" strategy has regained attention, indicating the market is digesting recent volatility and moving toward stabilization.

Bitcoin and Ethereum—the two largest assets by market cap—led the rebound, supported by sustained institutional buying. As sentiment shifts, investors are increasingly recognizing that this selloff may have been overstated, driven more by technical and structural factors than macro fundamentals.

Source: Bybit

Interestingly, platform tokens such as Mantle Network's native token MNT outperformed most altcoins during the rebound. This performance may be linked to widespread recognition of Bybit's resilience during turbulent times, thereby strengthening confidence in the Mantle ecosystem.

Why was Bybit more stable than other platforms

During this $19 billion liquidation wave, Bybit demonstrated exceptional operational resilience, maintaining 100% uptime across trading, deposits, and withdrawals. Its infrastructure supports up to 1.35 million transactions per second (TPS), allowing users to place orders and manage positions without delay even under extreme market conditions. This seamless experience under pressure has reinforced Bybit's reputation as a reliable exchange.

Bybit also set a new benchmark in transparency, updating real-time liquidation data every 500 milliseconds and recording $4.6 billion in liquidations—far surpassing competitors that update only once per second. Its API infrastructure ensures full visibility into market dynamics, helping traders and analysts assess risk more accurately and enhancing trust in the integrity of its data.

Bybit's integration with USDe further stabilized trading during the turmoil. While other platforms experienced severe de-pegging, USDe on Bybit remained relatively stable, holding between $0.92 and $0.95. The platform handled over $300 million in redemptions to USDT with minimal impact, thanks to its collaboration with Ethena Labs enabling 1:1 minting and redemption of USDe within the platform. This stability preserved liquidity and confidence, highlighting Bybit’s advantage in managing high-volatility environments.

Navigating volatility

Like other investment assets, cryptocurrencies typically exhibit higher volatility during turbulent periods—a trait unlikely to change in the short term. Their role as a hedge against traditional assets makes them prone to sharp price swings when markets are under stress.

The key lesson from this turbulence is clear: diversification. This means not only diversifying across asset classes but also across trading platforms. Just as you wouldn't keep all your cash in a single bank account, spreading your crypto trading and custody across multiple trusted exchanges is a rational additional layer of protection.

If you're seeking more stable returns and stronger risk management, consider earning passive income through flexible savings and fixed staking products, which offer relatively steady yields beyond daily price fluctuations. At the same time, make full use of advanced risk control tools such as stop-loss, take-profit, and equity trailing stop to lock in profits and limit downside exposure.

Finally, choosing platforms with high transparency and robust infrastructure can significantly reduce risk. While volatility is the norm in crypto, adhering to disciplined, well-informed strategies is key to navigating the space safely and sustainably.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News