The Truth Behind the Data: The Capital Battle Between Consumer Applications and Infrastructure

TechFlow Selected TechFlow Selected

The Truth Behind the Data: The Capital Battle Between Consumer Applications and Infrastructure

The funding structure in the Web3 space has long been dominated by a common assumption: infrastructure projects should inherently receive more capital support.

Original: Robert Osborne, Outlier Ventures

Translation: Yuliya, PANews

There are many misconceptions about Web3 fundraising. Within the industry, the tug-of-war between infrastructure projects and consumer-facing projects has become one of the longest-running debates. According to a post by Claire Kart, Chief Marketing Officer at Aztec Network, on X, infrastructure projects appear to be overly favored in the Web3 space.

Figure 1: Claire Kart, CMO of Aztec Network

But things are often not as they seem. What if our previous assumptions about venture capital preferences were wrong? What if, in fact, consumer projects are the ones receiving more benefits?

Web3 Fundraising: Defining the Problem

In the venture capital world, the prevailing view is that infrastructure projects receive disproportionate attention, with “infrastructure” seemingly dominating the VC market, leaving consumer projects underfunded.

Figure 2: Hira Siddiqui, Founder of Plurality Network

In such discussions, it's essential first to define basic concepts. Part of the disagreement and friction may stem from conflating “consumer projects” with “infrastructure projects.” Below are definitions for both types:

-

Consumer Projects: These aim to interact directly with end users, offering tools, services, or platforms that meet individual or retail needs. Consumer projects typically focus on enhancing user experience, providing financial services, enabling entertainment, or increasing community engagement. End users are the primary consumers of these projects. These solutions are usually more user-friendly, prioritize immediate personal or business needs, and do not require users to possess advanced technical knowledge.

-

Infrastructure Projects: These form the foundation of decentralized systems, focusing on building core technological layers that support secure, scalable, and interoperable networks. They include blockchain protocols, validation systems, cross-chain interoperability technologies, and others that enable other applications and services to operate. Deep infrastructure is often invisible to end users but is critical to system performance and reliability. These projects primarily serve developers, node operators, and those responsible for maintaining and scaling blockchain systems.

According to fundraising data from Messari, industry project classifications don’t need redefining and can be directly applied to existing frameworks.

Consumer Application Projects include: consulting & advisory, cryptocurrencies, data, entertainment, financial services, governance, HR & community tools, investment management, marketplaces, metaverse & gaming, news & information, security, synthetic assets, and wallets.

Infrastructure Projects include: web and network services, node tools, cross-chain interoperability, networks, physical infrastructure networks, computing networks, mining & validation, developer tools, and consumer infrastructure.

It’s important to note that the boundary of the “consumer infrastructure” category is somewhat blurred. It refers to frameworks supporting user-facing applications but isn't necessarily visible to end users. For this article, “consumer infrastructure” will be classified as an infrastructure project.

The Significance of the Debate

Why is this debate so important? Why do founders and investors feel compelled to draw clear lines on this issue? Recently, Boccaccio from Blockworks, Mike Dudas from 6th Man Ventures, and Haseeb Qureshi from Dragonfly briefly touched upon this topic during a panel at the 2025 New York DAS Conference. However, their short exchange was insufficient to resolve the matter.

Figure 3:New York Digital Assets Summit, "Is Venture Capital Still Relevant?", Boccaccio (left), Haseeb Qureshi (center), Mike Dudas (right).

Proponents of infrastructure argue they are the “invisible architects” of the on-chain future—digital railways must be laid before consumers can move at high speed. Without sufficient scalability to handle traffic surges or robust security to prevent attacks and vulnerabilities, mass adoption remains mere talk. As Haseeb Qureshi said during the panel: “Have we built the blockchain yet? Is this the final form? If we want more than 10 million people using public chains, then no—we’re not done.”

Figure 4: Antonio Palma

By investing in technology development, the goal is to simplify the building process, reduce friction for the next dApp creator, and ultimately enable broad interaction between blockchains and users. This isn’t just a short-term bet—it’s a long-term plan: build infrastructure to pave the way for powerful consumer dApps.

On the other hand, supporters of consumer projects criticize the current system for being heavily biased toward infrastructure. Even the most successful consumer apps are now considering shifting into infrastructure: Uniswap is building a modular AMM framework, Coinbase has launched its own L2, and even social apps like Farcaster are positioning themselves as social protocols.

Figure 5: David Phelps, Co-founder of JokeRace

As Mike Dudas noted during the panel, the current market structure means infrastructure projects are default “favorites” in the eyes of VCs—even though actual liquidity involved in these projects is often low.

Thus, supporters of consumer projects believe the role of venture capital creates artificial market distortion: if more capital were allocated to consumer applications, mass adoption could be achieved. Cumbersome wallets and complex interfaces remain the biggest barriers to entry, rendering even the most powerful blockchains nearly invisible to the general public. What truly drives the market, they argue, is the “killer app.” While efficient and secure infrastructure is crucial, if the seats are uncomfortable and the journey unpleasant, no one will buy tickets.

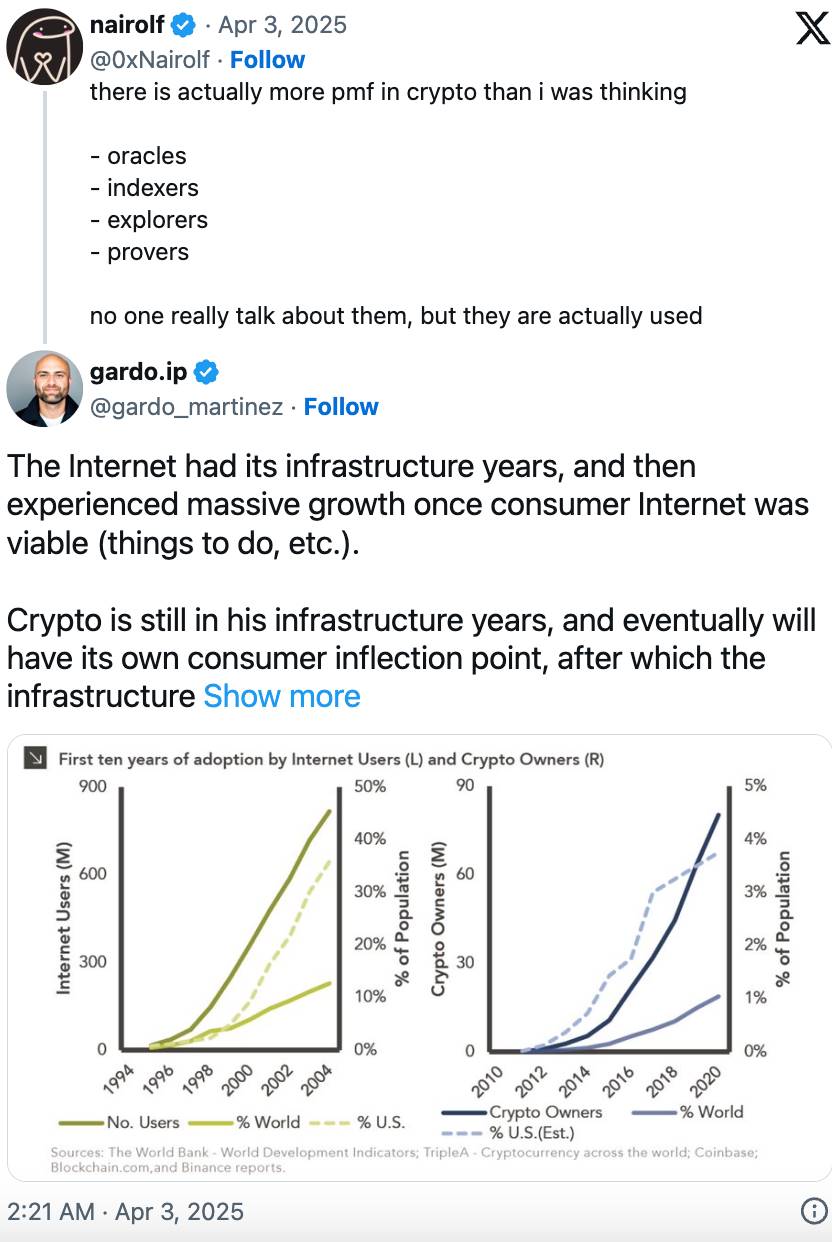

Figure 6: Gardo Martinez, Senior Product Manager at Story Protocol

The funding structure in Web3 has long been dominated by a common assumption: infrastructure projects inherently deserve greater capital support. The logic behind this view is that Web3 is still in its early stages, and foundational infrastructure is not yet fully mature—thus, market focus naturally leans more toward infrastructure than consumer-facing applications.

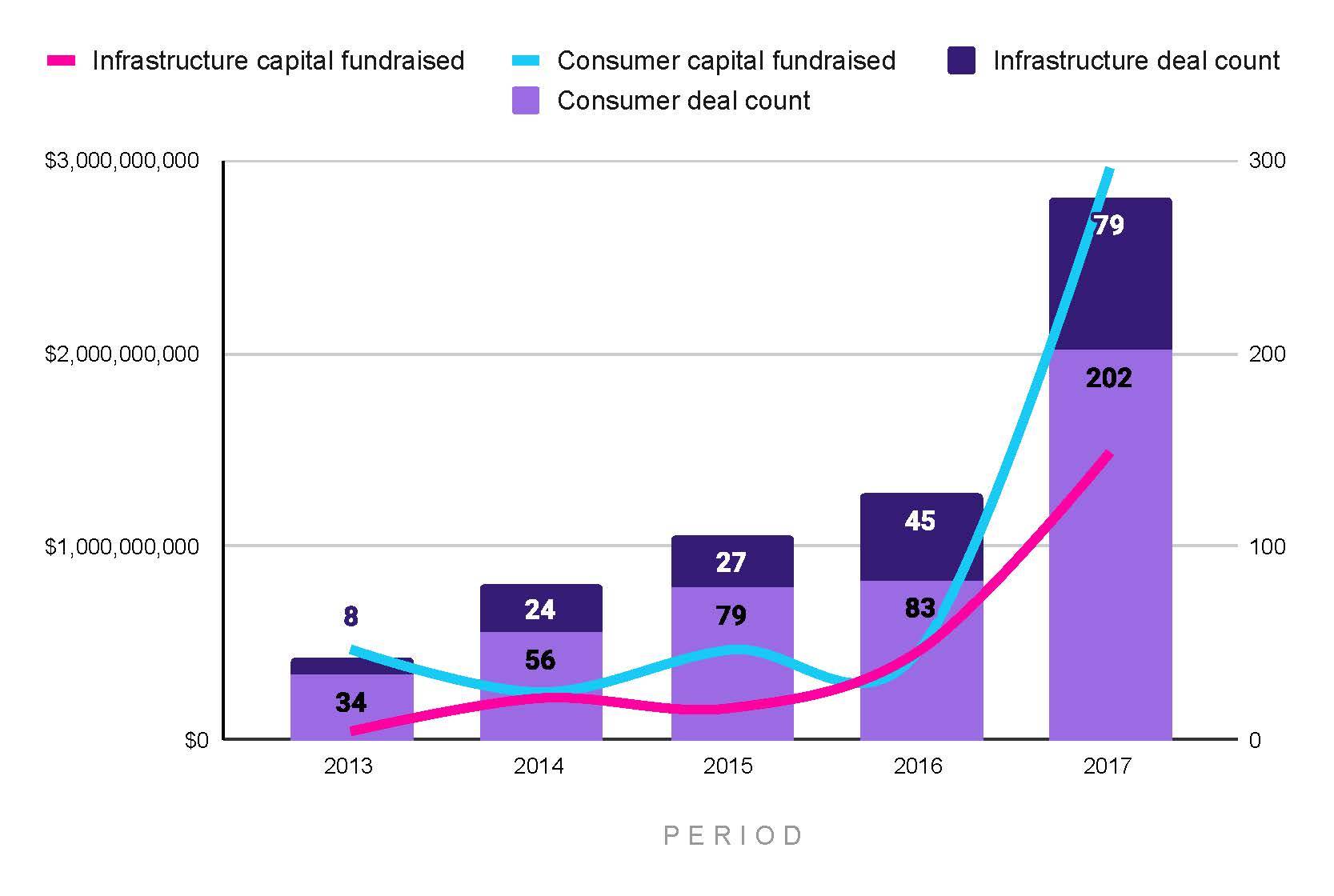

Figure 7: Funding amounts and number of deals for consumer and infrastructure projects across stages from 2013 to 2017

However, early data reveals a different trend (see Figure 7). Starting from 2013, between 2013 and 2017, 72% of funding deals came from consumer projects, while infrastructure projects accounted for only 33% of total capital raised. Although the two categories were roughly equal in total funding amount in 2014 and 2016, the number of successfully funded consumer projects remained higher each year—indicating that while infrastructure rounds were fewer, they carried larger average sizes (see Figure 12). By 2017, consumer projects once again dominated Web3 venture investment.

Overall, capital deployment during this period was minuscule compared to later years and couldn’t serve as the core foundation of the Web3 ecosystem. Due to limited data samples, analysis of this phase is treated separately from the main argument. From 2018 to 2024, massive capital inflows made earlier VC interest look like a drop in the ocean.

Nonetheless, these initial figures raise key questions: Have infrastructure projects really received more funding than consumer projects? Is our collective perception based on a flawed premise?

Is There a Preference for Consumer Projects?

Looking at Web3 fundraising data from 2018 to 2024, the recent surge in attention toward infrastructure appears to be a new trend—whereas consumer applications have actually enjoyed greater investor favor.

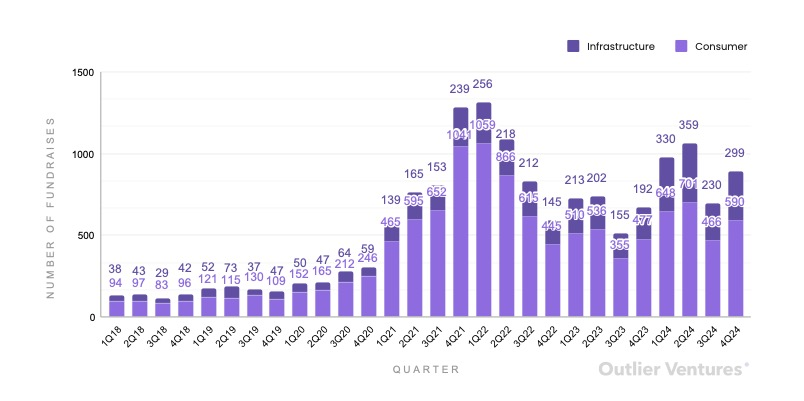

Figure 8: Total number of quarterly funding deals for infrastructure and consumer projects from 2018 to 2024

From 2018 to 2024, consumer applications accounted for 74% of all funding deals. Even in 2023 and 2024, consumer projects still represented 68% of all funding transactions (see Figure 8).

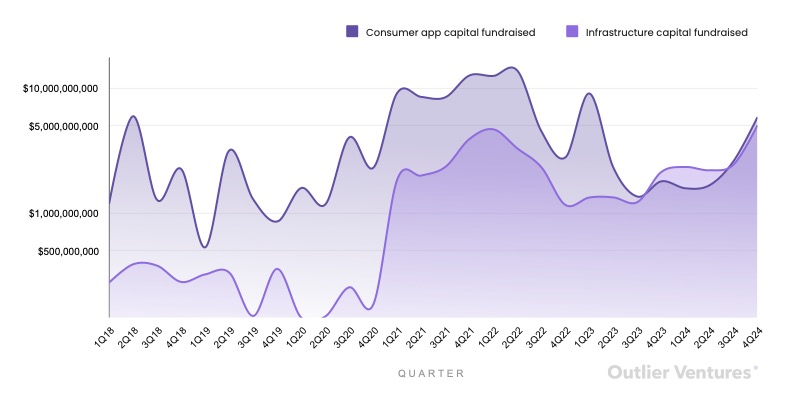

However, when looking at total capital raised, the trajectory for infrastructure projects changed. From 2018 to 2020, infrastructure lagged behind consumer apps, attracting only 11% of capital. In 2021, this began to shift, although consumer projects still captured the majority of funding volume. Infrastructure accounted for 19% of capital raised in 2021 and 2022, rising to 25% in 2023 and 43% in 2024 (see Figure 9). In fact, from Q4 2023 to Q2 2024, infrastructure projects surpassed consumer projects in total capital raised.

Figure 9: Quarterly total funding amounts for consumer and infrastructure projects from 2018 to 2024

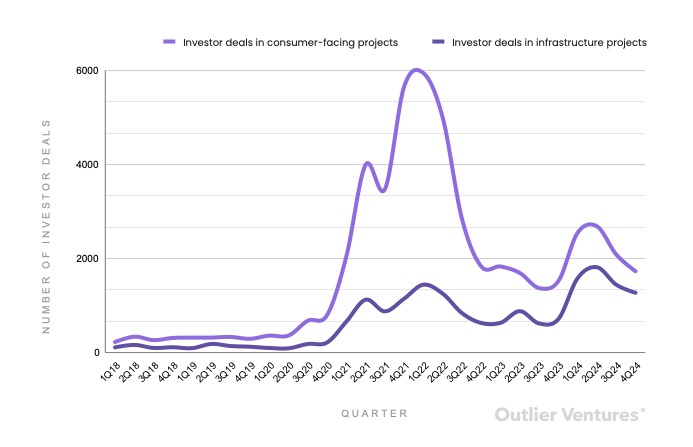

Another important dimension is investor participation. Despite claims that most investors prefer infrastructure, data from 2018 to 2024 shows consistently higher investor engagement in consumer projects. Particularly between 2021 and 2022, 79% of investor deals occurred in consumer projects (see Figure 10).

Figure 10: Total number of quarterly investor deals for consumer and infrastructure project categories from 2018 to 2024

Although the initial capital influx into consumer projects was delayed during the pandemic, this aligns with typical 6- to 9-month fundraising cycles. Pandemic lockdowns drove people to shift attention and disposable income online, fueling a boom in Web3 consumer applications.

Yet this boom didn’t last. The market crash in Q2 2022 is widely attributed to the collapse of Terra/Luna in May. When UST depegged, over $40 billion in market value vanished instantly, triggering a chain reaction. Major funds like Three Arrows Capital and Celsius imploded, exposing DeFi’s fragility. Combined with rising inflation, higher interest rates, and tightening liquidity, the entire crypto market plunged into crisis. FTX’s bankruptcy in November 2022 further eroded market confidence.

From a venture capital perspective, the crypto market rebound at the end of 2023 and into 2024 did not translate into a parallel recovery in VC activity. This is because the market remains in a post-pandemic “hangover” phase. Investment returns between Q4 2020 and Q4 2023 fell short of expectations, revealing premature bets on consumer projects and the immaturity of crypto VC. Although consumer projects continue to lead in number of investor deals, the gap between infrastructure and consumer projects has clearly narrowed. In 2024, infrastructure projects accounted for 40% of investor deals.

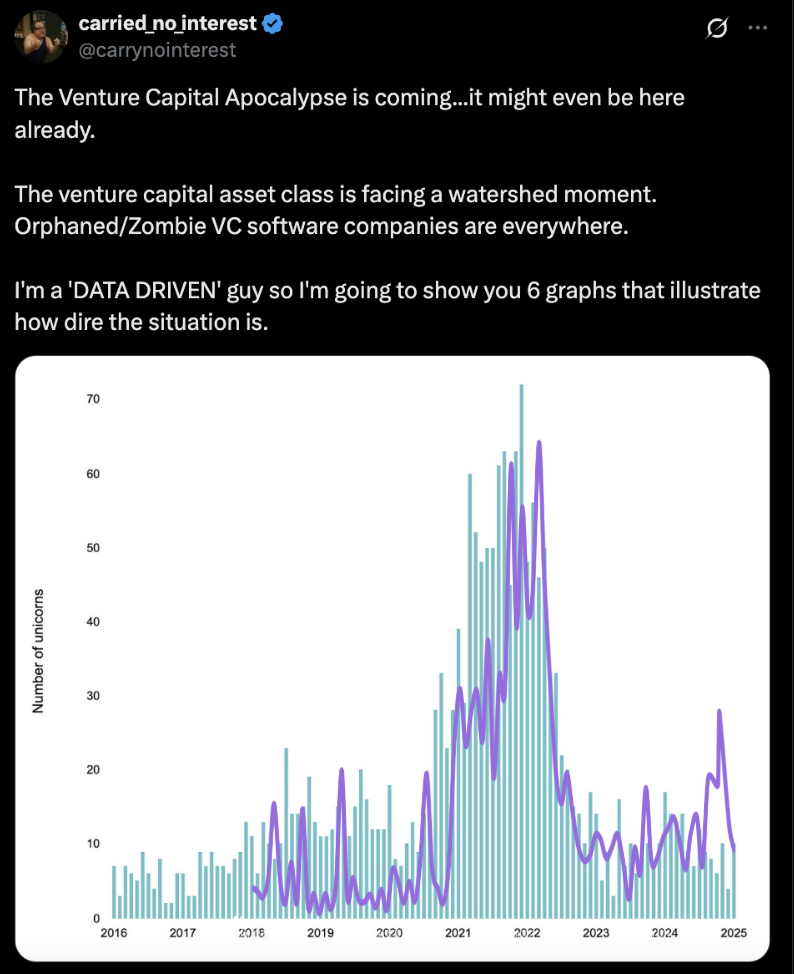

This isn’t unique to Web3. Between 2020 and 2021, massive capital flooded into traditional VC markets. Private equity investor “@carrynointerest” pointed out that this period of capital misallocation would lead to a prolonged wave of VC failures. With lack of M&A exits, rising interest rates, and declining software valuations, many VC-backed companies became “orphans” or “zombie” firms.

If we compare total Web3 fundraising with the number of traditional VC unicorns, the trends are strikingly similar (see Figure 11). As shown in Figures 8, 9, 10, and 12, consumer projects have long dominated both capital and deal counts. The failure of Web3 VC, fundamentally, reflects the failure of consumer-focused investments. Given this understanding, investors should logically shift focus toward infrastructure.

Figure 11: Number of startup unicorns from 2016 to 2025, alongside total funds raised by Web3 consumer and infrastructure projects

In reality, however, the reallocation of capital away from consumer projects remains limited. This is closely tied to Web3’s funding mechanisms. Unlike traditional equity, token-based fundraising allows partial exits even before a project launches, enabling investors to achieve some return even on failed projects.

Moreover, due to longer development cycles and higher demands for protocol security and token economics, Web3 infrastructure projects often adopt longer vesting and unlocking schedules. Their tokens typically play core roles in network operations (e.g., staking or governance), necessitating avoidance of short-term concentrated unlocks. In contrast, consumer projects prioritize market speed, user growth, and early liquidity, often designing shorter lock-up periods to quickly capture market hype and speculative demand.

This structural difference creates a capital recycling effect: early liquidity from one consumer project feeds into the next, continuously driving investment in the sector and cushioning the impact of failures. As a result, the Web3 VC market has, to some extent, avoided the severe corrections experienced by traditional VC.

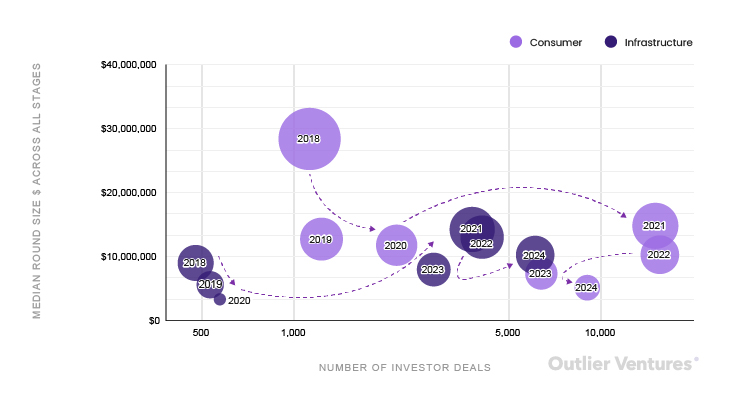

As a supplementary metric, combining total funding with number of funding rounds allows us to calculate median round sizes for consumer and infrastructure projects, and together with investor deal counts, map out their respective fundraising trajectories (see Figure 12).

Figure 12: Median funding round size by stage for consumer and infrastructure projects from 2018 to 2024, alongside annual investor deal counts

-

From 2018 to 2020, consumer projects dominated the market. In 2021, median round sizes for both categories came close for the first time (consumer: $14.8M, infrastructure: $14.2M), but consumer projects still saw four times as many investor deals.

-

Starting in 2022, infrastructure’s median round size exceeded that of consumer projects ($13M vs $11M) and continued through 2024.

-

In 2024, the median funding size for infrastructure projects was twice that of consumer projects.

Despite growing infrastructure round sizes, consumer projects still maintain a lead in investor deal counts. In 2024, consumer projects had 50% more investor deals than infrastructure. This indicates that consumer projects remain diverse and attractive (see Figures 9 and 10).

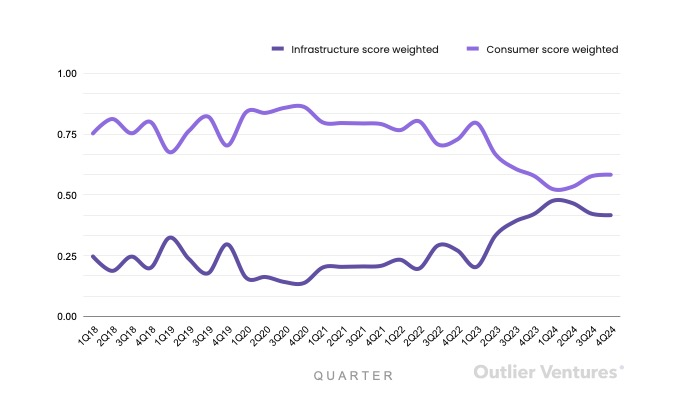

Risk Preference Index

To systematically measure venture capital preference, this study introduces a “Risk Preference Index” (see Figure 13), which integrates capital share, deal count share, and investor share into a single score ranging from 0 to 1, with 0.5 representing neutrality. Weights are assigned as follows: capital share (50%), deal count (30%), investor count (20%). Capital share is the strongest signal, reflecting deep due diligence and strong conviction; deal count reflects market breadth but varies widely in size; investor count reflects market热度, albeit with lower signal-to-noise ratio.

To date, the index has never shown infrastructure scoring above consumer projects. The closest was in Q1 2024, when infrastructure reached 0.48. At its core, this index serves as a barometer of VC confidence.

Figure 13: Risk Preference Score

Reconsidering Capital Allocation in Web3 Fundraising

There is no “correct” answer to the ideal funding split between consumer and infrastructure projects—it depends on market maturity, stage-specific needs, and environmental shifts. In emerging tech ecosystems like Web3, it’s natural for infrastructure projects to attract significant capital early on. The infrastructure layer takes longer to build and often exhibits “winner-takes-all” dynamics, making large-scale, concentrated investments rational. Infrastructure enables scale, performance, and security—all prerequisites for mass consumer adoption. In this context, VC bias toward infrastructure seems justified.

Yet the data tells another story. Venture capital has consistently favored consumer projects, behaving as if infrastructure challenges have already been solved—at least for now.

This mismatch raises critical questions. Did the industry shift focus to consumer applications too soon, without adequately stress-testing the infrastructure? Are we prioritizing short-term liquidity over long-term resilience in capital allocation? Or have we underestimated the current maturity of infrastructure while neglecting the user experience layer that will drive mainstream adoption?

These aren’t binary choices. In Web3, capital allocation should reflect the ecosystem’s actual maturity—not our aspirations for it. The path forward isn’t about favoring one side, but recalibrating confidence with reality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News