Why does the stablecoin market cap keep hitting new highs while BTC is still falling?

TechFlow Selected TechFlow Selected

Why does the stablecoin market cap keep hitting new highs while BTC is still falling?

Stablecoins are currently the largest application in the crypto market or blockchain space.

Author: Blockchain Knight

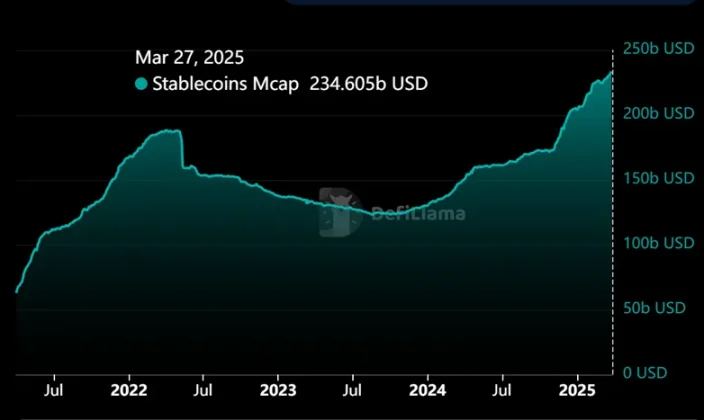

According to data from DefiLlama, the market capitalization of stablecoins reached a new all-time high last week, surpassing $234.6 billion—nearly doubling from its August 2023 low of $124 billion. USDT continues to lead the stablecoin market, holding over 62% market share.

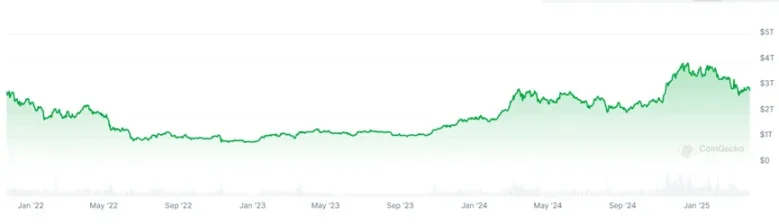

Meanwhile, the total cryptocurrency market cap has followed a somewhat similar trajectory over the past two years, roughly doubling from around $2 trillion in mid-2023 to about $4 trillion. However, the peak was reached in December last year, and it has since pulled back to around $2.8 trillion—a decline of approximately 30%, diverging from the continued growth in stablecoin market cap.

This raises an interesting question: Why is the stablecoin market cap continuing to grow while the overall crypto market cap keeps falling?

As shown in the chart below comparing total stablecoin market cap with BTC market cap, the two moved almost in tandem before December last year. Increases in BTC price were typically accompanied by rising stablecoin market caps, and BTC downturns dragged stablecoin valuations down as well—albeit with differing volatility.

Data shows that during the 2020–2021 bull run, USDT issuance had a strong positive correlation with BTC price, with a correlation coefficient exceeding 0.85, confirming this historical alignment.

The current divergence resembles early 2022, when stablecoin market cap expanded even as BTC prices retreated. However, the author believes this cycle’s stablecoin dynamics may differ significantly from that period.

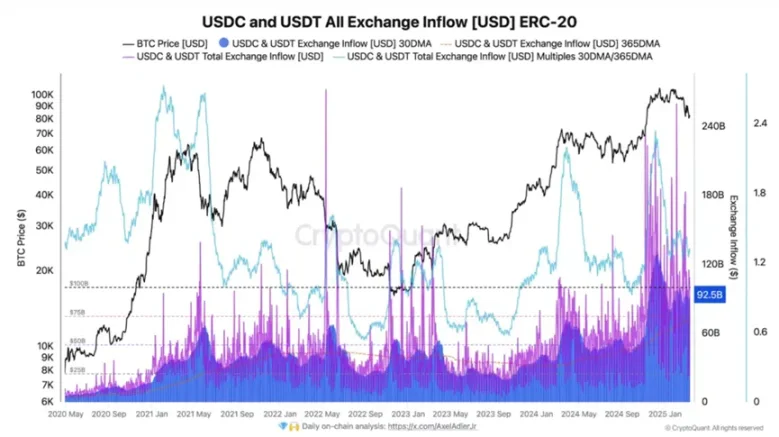

First, the decoupling between stablecoin supply and BTC price can be attributed to the fact that newly issued capital in this cycle hasn't flowed broadly into the BTC spot market. Data indicates that as of March 2025, derivatives open interest remains elevated at $54 billion, while net inflows of spot stablecoins into exchanges are relatively weak. This suggests that a large portion of newly minted stablecoins are being used for leveraged trading (e.g., futures and perpetual contracts) rather than direct holding, and increasingly serve as hedging instruments.

Second, whereas stablecoins were previously used primarily within the crypto ecosystem, today they are expanding beyond crypto into real-world applications—"moving from virtual to tangible."

According to a Visa survey, in emerging markets, approximately 47% of users employ stablecoins for USD savings, 43% for better currency exchange, and nearly 40% for real-world payments (goods, cross-border remittances, or salary disbursements). In countries like Turkey and Egypt, where inflation exceeds 50%, stablecoin ownership has surged 400% year-on-year, becoming a core asset preservation tool for residents.

Major payment players like PayPal have integrated their stablecoin PYUSD across over one million merchants including eBay and Shopify. In Q1 2025 alone, PYUSD transaction volume surpassed $1.2 billion. BlackRock projects that by 2028, the stablecoin market could reach $2.8 trillion, capturing 5% of global cross-border payments and 15% of the gig economy.

Therefore, the expansion of stablecoin market cap is no longer solely tied to crypto market growth but also driven by broadening real-world adoption. This shift explains why the historical correlation with crypto assets is weakening numerically. So, what stablecoin metrics should we focus on now?

The author suggests paying close attention to stablecoin inflows into major exchanges. Historically, sharp increases in such inflows have coincided with local market tops or bottoms, often signaling heightened volatility ahead. The most recent surge exceeded $92.5 billion—one of the highest levels ever recorded.

Despite significant market fluctuations, these ups and downs are driving meaningful change, pushing the industry forward—even if not perfectly aligned with price movements.

As a recent anecdote illustrates, the Financial Times reported that financial giant Fidelity Investments is advancing plans to launch its own stablecoin, currently in late-stage testing. It's clear that more traditional financial institutions are entering the stablecoin race.

We must acknowledge that stablecoins represent the largest application in the crypto or blockchain space today. While the underlying value and infrastructure they bring may quietly reshape aspects of finance, true transformation has yet to occur—though user expansion within Web3 is undoubtedly underway.

Will the broader crypto market eventually benefit from the growing stablecoin market cap? As an old saying goes: “Since you’re already here, don’t hold back. When geese fly by, they leave behind feathers; when wind passes through, it leaves traces.” Something will inevitably be left behind.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News