After BTC's violent pullback in Q1, will it now replicate the 2017 trajectory?

TechFlow Selected TechFlow Selected

After BTC's violent pullback in Q1, will it now replicate the 2017 trajectory?

This article will assess the correlation between the current Bitcoin price trend and historical bull market cycles through data analysis, and explore potential future development paths for BTC.

Author: Bitcoin Magazine Pro Team

Translation: BitpushNews

After breaking through $100,000 and setting a new all-time high, Bitcoin has entered a sustained downward trend. This price correction has naturally sparked market skepticism about whether Bitcoin is still following the 2017 cycle pattern. This article evaluates the correlation between Bitcoin's current price movement and historical bull cycles through data analysis, and explores potential future trajectories for BTC.

Will It Mirror the 2017 Rally?

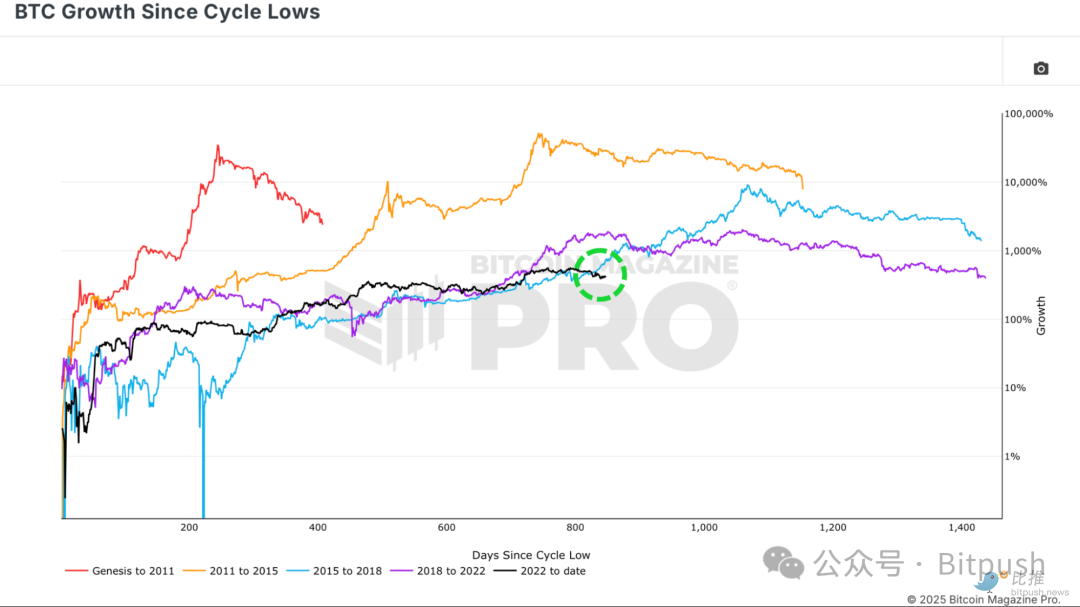

Since the bear market low in 2022, Bitcoin’s price trajectory has shown remarkable similarity to the 2015–2017 cycle—the historic bull run that peaked at $20,000 in December 2017.

However, Bitcoin’s recent downtrend marks the first significant divergence from the 2017 cycle. If strictly following the 2017 pattern, the past month should have been a period of renewed highs for Bitcoin. Instead, the market has seen sideways consolidation and declines, suggesting that the linkage between the two cycles may be weakening.

Figure 1: Current cycle trajectory recently deviates from historical patterns

Despite this recent divergence, the correlation between the current Bitcoin cycle and the 2017 cycle remains abnormally high. Earlier this year, the correlation with the 2015–2017 cycle was around 92%. The recent price deviation has slightly reduced it to 91%, which still represents an extremely high level in financial markets.

Investor Behavior Analysis

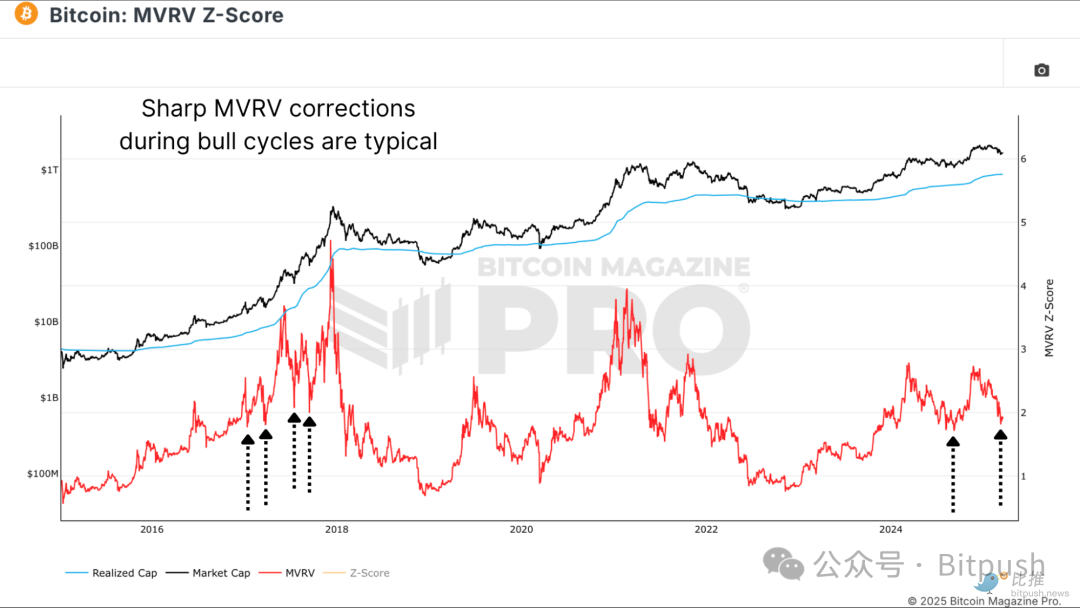

The MVRV (Market Value to Realized Value) ratio is a key metric for assessing investor behavior, measuring the relationship between Bitcoin’s current market price and the average cost basis of all on-chain BTC holders.

A sharp rise in the MVRV ratio indicates significantly expanded unrealized profits for investors, often signaling the formation of a market top. Conversely, when the ratio falls back toward realized value, it suggests Bitcoin’s price is approaching the average holding cost of investors—typically marking the beginning of a market bottoming phase.

Figure 2: MVRV ratio continues to show similar volatility patterns as in the 2017 cycle

Latest Trends in MVRV

The recent decline in the MVRV ratio reflects Bitcoin’s pullback from its all-time highs. However, the overall structure still resembles the 2017 cycle—early bull surge followed by multiple deep corrections—keeping the correlation between the two cycles at around 80%.

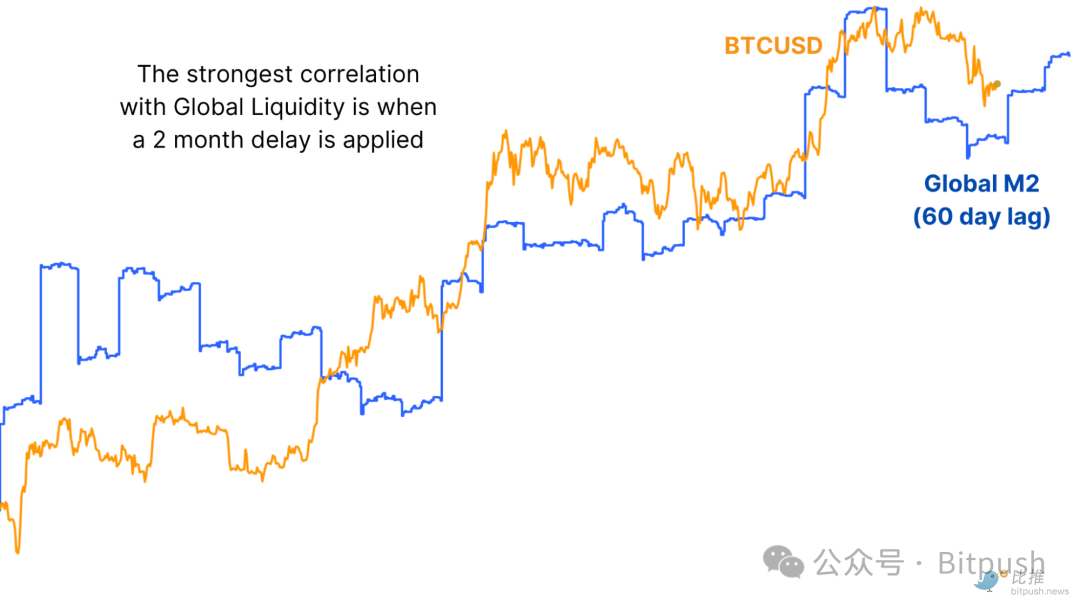

Data Lag Effects

One possible reason for the current divergence is the impact of data lags. For example, Bitcoin’s price movement is highly correlated with global liquidity (broad money supply across major economies), but historical data shows that changes in liquidity typically take about two months to reflect in Bitcoin prices.

Figure 3: Global M2 money supply has a lagged transmission effect on Bitcoin prices

Validating the Lag Effect

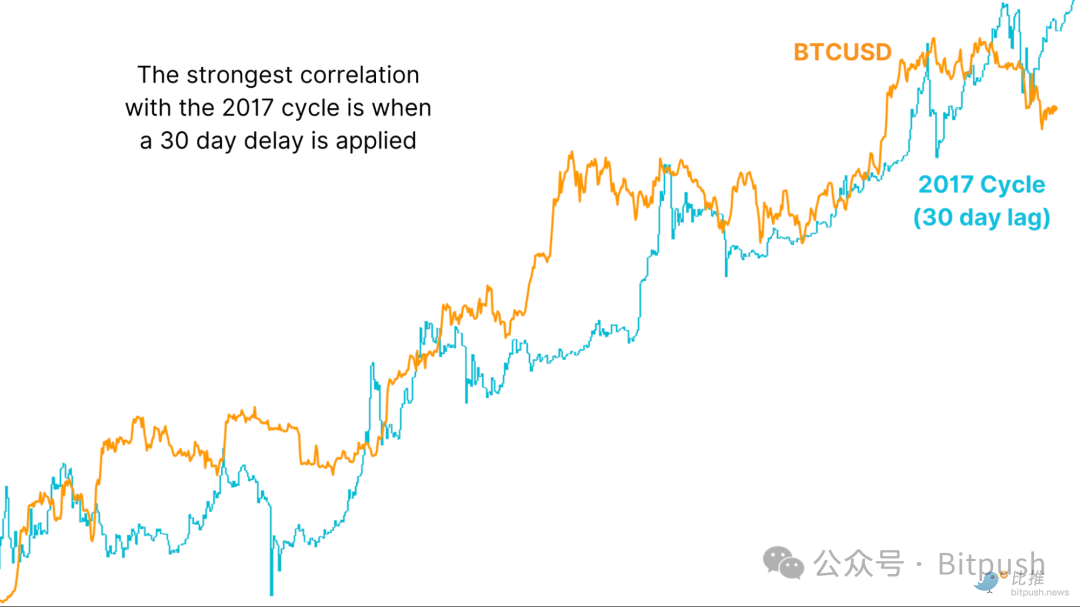

If we apply a 30-day lag adjustment to the current Bitcoin price trajectory relative to the 2017 cycle, their correlation increases to 93%, the highest recorded level between these two cycles. This lag-adjusted alignment suggests that Bitcoin may soon rejoin the 2017 path, indicating a strong upward move could be imminent.

Figure 4: Price trajectory aligns closely with 2017 data after applying a 30-day lag adjustment

Key Conclusion

History doesn't repeat itself exactly, but it often rhymes. While the current Bitcoin cycle may not replicate the exponential surge seen in 2017, underlying market psychology continues to show striking similarities. If Bitcoin realigns with the lagged 2017 cycle, historical patterns suggest it may soon recover from its current correction and enter a breakout rally.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News