Revisiting Bittensor: A Meme-Filled Subnet with a Broken Token Economy

TechFlow Selected TechFlow Selected

Revisiting Bittensor: A Meme-Filled Subnet with a Broken Token Economy

Cracks have appeared in the dTAO model just one month after its launch.

Author: donn

Translation: TechFlow

I'm always intrigued by novel tokenomics. Watching how crypto protocols tweak their incentive mechanisms is fascinating—sometimes they seem incredibly compelling, until inevitably collapsing. So when Bittensor launched its dynamic $TAO (dTAO) system on Valentine's Day, I was immediately drawn in.

The idea was simple: introduce a new, more "fair" way to distribute TAO emissions across subnets.

But just one month later, problems emerged. It turns out that designs which appear perfect often don't function as intended in free markets.

How dTAO Works

Here’s a simplified recap of how dTAO functions:

-

Each subnet has its own subnet token ($SN), existing as a native TAO-SN UniV2-style liquidity pool. Confusingly, although users are said to "stake" TAO for SN, it's functionally no different from simply exchanging TAO for SN. The only differences are that users cannot add liquidity directly to the pool or trade between subnet tokens directly (e.g., SN1 → SN2), though they can do so indirectly via TAO (SN1 → TAO → SN2).

-

TAO emissions are allocated proportionally based on the price of each $SN token. To smooth volatility and prevent manipulation, the system uses a moving average price.

-

The SN tokens themselves have high emission rates, with a supply cap of 21 million—similar to TAO and BTC. A portion of SN is allocated to the TAO-SN liquidity pool, while the remainder goes to subnet stakeholders (miners, validators, subnet owners). The amount sent to the TAO-SN pool is designed to balance incoming TAO emissions, keeping the SN price (in TAO terms) stable while increasing liquidity.

However, if the calculation indicates that a subnet requires more SN than allowed by the maximum issuance (based on the SN emission curve), then SN issuance is capped at the maximum, causing the SN price (in TAO) to rise.

The core assumption behind this mechanism is that subnets with higher market caps create more value for the Bittensor network and therefore deserve larger shares of TAO emissions.

In reality, however, the highest-priced tokens in crypto markets are usually those with the most attention, hype, Ponzi dynamics, and marketing resources—which is why L1 blockchains and memecoins consistently achieve relatively high valuations.

While the design intention may be noble—assuming that value-creating, revenue-generating subnets will use part of their income to buy back SN tokens, thereby increasing prices and earning more TAO emissions—this line of thinking is somewhat naive.

Memecoin-Filled Subnets and Broken Tokenomics

Prior to dTAO’s launch, I discussed its obvious flaws with several crypto analysts—the most glaring being that higher market cap ≠ higher revenue or greater value creation.

But I didn’t expect the theory to be proven so quickly in practice. The free market worked in a "beautiful" way.

Shortly before the upgrade, an anonymous actor took over subnet 281 and turned it into a memecoin project called “TAO Accumulation Corporation” (dubbed the “LOL subnet”). This had clearly nothing to do with AI.

As stated on its now-deleted GitHub page:

Miners don’t need to run any code; validators score miners based solely on how many subnet tokens they hold. The more tokens a miner holds, the higher their emissions.

What actually happened: Speculators bought SN28 tokens → SN28 price rose → SN28 received more TAO emissions → if SN issuance hit the cap, SN28 price continued rising → newly minted SN tokens were distributed proportionally to SN holders (“miners”) → people bought more SN to capture more TAO → prices rose further → the Ponzi cycle continued.

The result? TAO emissions officially began funding… memes! At one point, SN28 even became the seventh-largest subnet by market cap.

But why didn’t SN28 take over Bittensor? Centralization saved the day.

Within days, the Opentensor Foundation used its root stake to run custom validator code, incentivizing people to dump SN28 tokens—causing its price to crash 98% within hours.

Source: Bittensor Discord

SN28 token price crashed 98% after intervention by the Opentensor Foundation

Essentially, the Opentensor Foundation acted as a centralized entity, preventing the free market from exploiting the dTAO mechanism. This kind of centralized intervention is currently feasible only because we're in a slow transition phase from the old TAO emission model to the new dTAO system.

Transitioning from Old TAO Mechanism to dTAO

The old TAO mechanism allowed up to 64 validators who staked the most TAO on SN0 ("root subnet") to vote on which subnets receive TAO emissions.

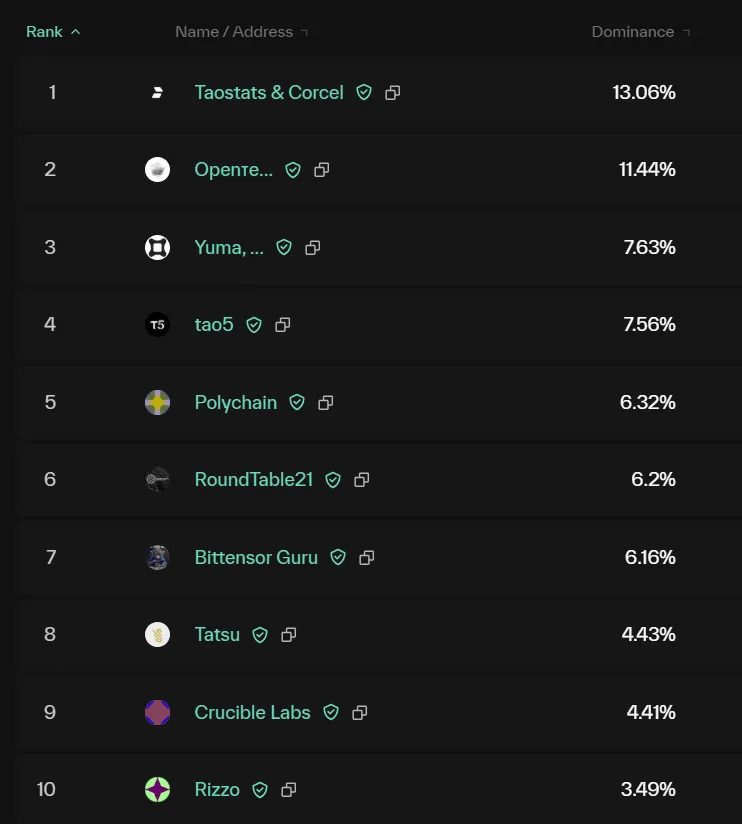

This mechanism itself created various incentive misalignments, particularly concentrated power among large validators (such as Opentensor Foundation, DCG Yuma, Dao5, Polychain, etc.). For example, they could theoretically direct TAO emissions toward subnets they’ve invested in or incubated—or toward subnets where they operate validator nodes and earn TAO rewards.

Top validators shown at taostats.io/validators

Therefore, moving away from this setup is a positive step toward decentralization. I applaud the team for choosing a more decentralized reward mechanism—even if it means potentially losing some emissions.

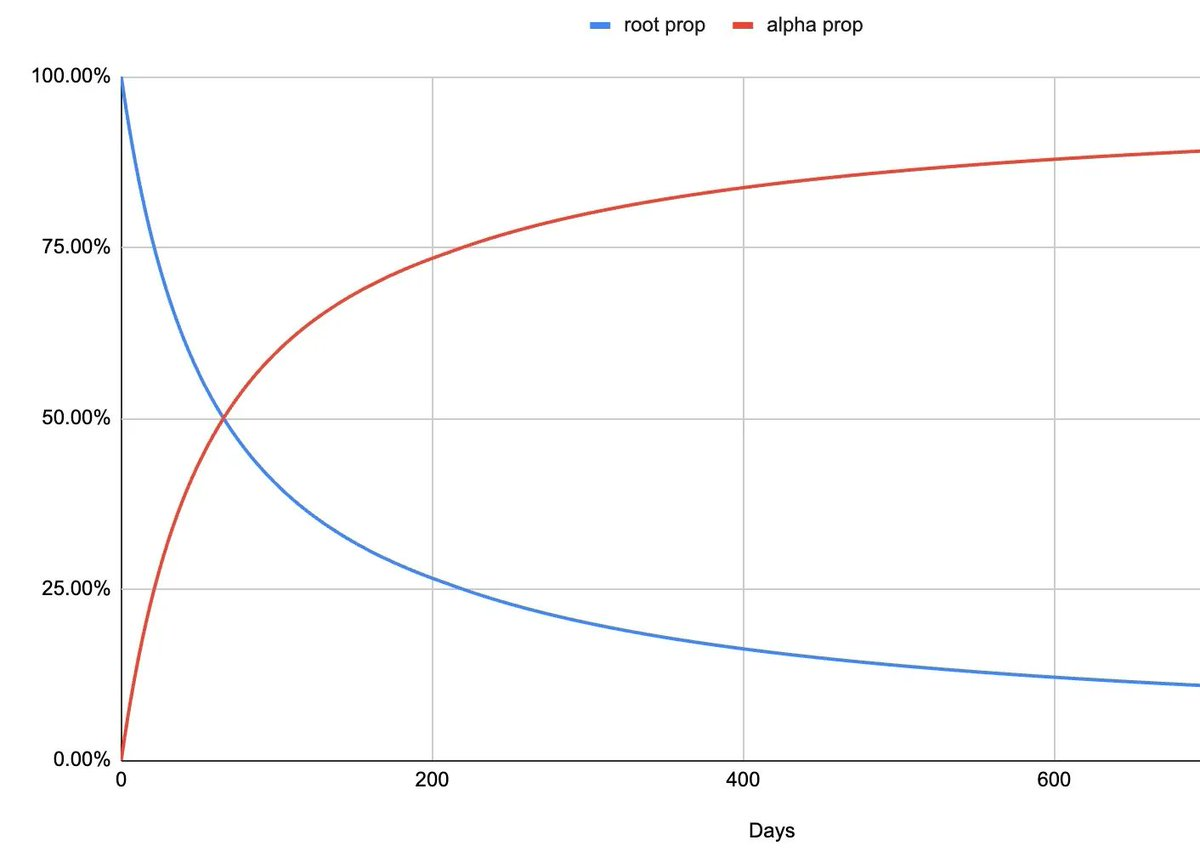

When the SN28 incident occurred, dTAO had been live for about a week, so SN0 (the blue line in the chart below) still controlled around 95% of emissions, enabling the Opentensor Foundation to intervene.

However, roughly one year from now, SN0’s control over emissions will drop to about 20%. This means that if another SN28-like event happens again, intervention via SN0 will be nearly impossible. In such a scenario, Bittensor could transform from a “decentralized AI” project into a memecoin-driven incentive network.

During this transition period, emission control shifts from the old mechanism (SN0 or "root property") to the new dTAO mechanism ("alpha property")

Admit It—It’s Not Just About Memes

Even assuming rational behavior during bear markets prevents full-blown memecoin mania, Bittensor could still evolve into a generic incentive network completely unrelated to AI.

Consider a thought experiment: someone launches a subnet dedicated to decentralized Bitcoin mining (not a particularly novel idea). Its goal is to efficiently incentivize Bitcoin mining operations, using the mined BTC as recurring revenue to buy back SN tokens and earn more TAO emissions.

Thus, TAO transforms from a decentralized AI project into a general-purpose incentive layer—where TAO emissions merely subsidize random operational expenses (OpEx) of various businesses, without advancing any coherent objective.

Technically, this aligns with the original intent of Yuma consensus, which aims to reach agreement on any form of "subjective" work—not necessarily limited to AI. Yet, the lack of a clear direction renders the entire system… meaningless.

Final Thoughts

The dTAO model has been live for only a month, and cracks are already showing.

Free-market incentives suggest that without centralized oversight, Bittensor might cease to be an AI project and instead become either a “attention network” dominated by memecoin subnets, or a “generic incentive network” driven by revenue-generating enterprises leveraging TAO emissions to subsidize operations—without meaningfully improving the Bittensor network.

I believe the network needs a true "objective function" to unify all subnets around a common goal. However, defining such a goal in AI—especially AGI—is notoriously difficult, as evidenced by the challenges we face in building fair large language model (LLM) evaluation frameworks… which is precisely why Yuma consensus was designed for "subjective" tasks.

As the saying goes: “Show me the incentives, and I’ll show you the outcome.”

Best regards!

Correction

In a previous version, I incorrectly stated that TAO emissions were proportional to market cap, whereas they are actually proportional to price. This error has been corrected—thanks to @nick_hotz for the correction.

Disclaimer

This article is for general informational purposes only and does not constitute investment advice, nor is it a recommendation or solicitation to buy or sell any investments. It should not be relied upon as a basis for evaluating any investment decision. The content should not be viewed as accounting, legal, tax, or investment advice. The views expressed are those of the author as of the date of publication and do not necessarily reflect the opinions of the author’s employer. Opinions are subject to change without notice, and no updates will be provided.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News