Revisiting familiar grounds: What subnets in Bittensor are worth watching?

TechFlow Selected TechFlow Selected

Revisiting familiar grounds: What subnets in Bittensor are worth watching?

Bittensor falls into the category of "Darwinian AI," artificial intelligence evolved through natural selection.

Author: 0xJeff

Translation: TechFlow

Crypto has always been thrilling for me, with something new to learn constantly. Naturally curious, I enjoy asking technical folks lots of seemingly dumb questions just to glimpse their insights and learn from their valuable experiences. Artificial intelligence is no exception—in fact, as Web2 tech giants continuously improve their models and major applications roll out AI-powered use cases, progress is accelerating rapidly.

@canva launched AI tools enabling non-technical artists and creators to easily build interactive experiences and enhance their creations with AI;

@YouTube introduced a new AI tool allowing creators to generate background music for videos;

Ride-hailing companies like Grab are deploying agent AI to support merchant and driver partners;

E-commerce platforms such as Lazada are introducing generative AI tools to help sellers with sales, marketing, and customer service.

The list goes on. Practical applications leveraging generative AI and agent AI to improve workflows are increasingly being adopted by enterprises and retail users alike. The benefit of these technologies lies in their accessibility—you can find free or low-cost solutions almost anywhere, and the returns far outweigh the financial costs.

Yet people often overlook the hidden trade-offs when using these AI products, such as:

-

Who owns your data?

-

Could someone steal your ideas and build a competing product?

-

Is the platform secure? Could your data be leaked?

-

If the platform goes down (like AWS once did), could it disrupt your business? Is customer funds at risk?

-

Will you always have access to your platform? Do you need identity verification? If the platform shuts down, do you still own your product or business?

There are many more concerns (if you haven't read it yet, I discussed this topic in greater detail in my previous post).

Centralized players hold centralized power, making decisions that could (unintentionally) significantly impact your life. You might think this doesn’t matter—perhaps you don’t use these tools frequently, or you trust these companies to act in users’ best interests. That’s fine. You may even want to invest in these AI startups, as they’re entering massive addressable markets. But here's the problem—you can’t invest. Unless you're at @ycombinator or a top-tier VC firm, you simply don’t get access to these deals.

In contrast, in the Web3 AI space, there are numerous investable AI ecosystems where teams are actively working to bring decentralized AI products and services to users. One of the leading investable decentralized AI ecosystems is @opentensor (Bittensor).

Bittensor: Darwinian AI

Bittensor falls under the category of "Darwinian AI"—AI evolved through natural selection. Think of it as an AI version of *The Hunger Games*, where each subnet runs its own "Hunger Games" and "miners" are the tributes (or participants). They compete using their models and data on specific tasks. Only the strongest models (those performing best) are rewarded. Weaker models are either replaced or evolve (through training, tuning, or learning from others). Over time, this creates a stronger, more diverse, and high-performance AI ecosystem.

What makes Bittensor particularly exciting is its competitive and incentive design aimed at aligning incentives across different stakeholders. I outlined the challenges facing Web3 AI agent teams in the tweet below…

In short, current agent tokens work well for speculators and teams as hype vehicles, but poorly for acquiring and retaining users—and especially fail as long-term incentives for talent (developers, founders, etc.) when token prices drop.

Bittensor addresses this via a market-driven mechanism that allocates $TAO emissions to subnets, thereby incentivizing and supporting team operations. The market decides which subnets receive more emissions by staking $TAO on them. Once staked, $TAO converts into Alpha subnet tokens. The more people stake, the higher the price of Alpha tokens, and the greater the emission yield (in Alpha tokens) you receive.

The $TAO emission schedule closely mirrors BTC, with a fixed supply of 21 million tokens and a halving every four years (currently 7,200 $TAO distributed daily to subnets). The first $TAO halving is expected around January 5, 2026, when circulating supply reaches 10.5 million tokens.

Why This Matters for Investors

I won’t dive deep into technicalities—just want to share why I believe Bittensor is one of the most exciting ecosystems from a trading/investment perspective.

Beyond the above dynamics, trading Alpha subnet tokens is like simultaneously trading and “mining.”

This is because whenever Alpha token prices rise, you not only benefit from price appreciation but also earn $TAO emissions (paid in Alpha tokens).

If a subnet performs well and climbs in ranking, your initial $TAO stake can experience dramatic price growth plus significant emission gains. The earlier you stake your $TAO into a subnet, the higher your annual percentage yield (APY), since fewer people and less $TAO are staked (the market hasn’t noticed yet).

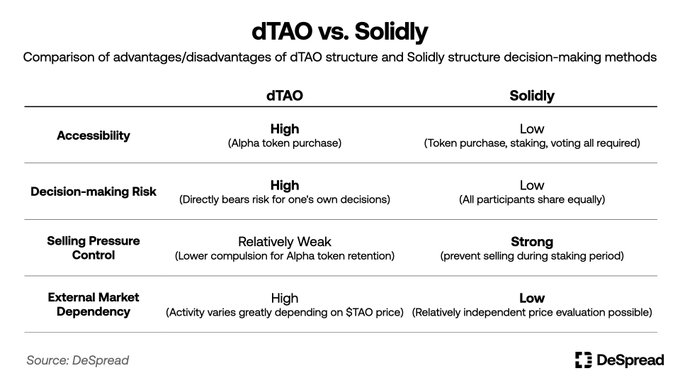

dTAO vs Solidly

Source: @DeSpreadTeam

Solidly’s ve(3,3) model requires long-term locking and continuous engagement. Misguided emissions (voting for wrong liquidity pools) result in losses shared by all holders (emissions dumped, causing price drops across the board).

In contrast, dTAO does not require long-term lockups—anyone can enter or exit anytime—but entry (staking on subnets) demands substantial due diligence/self-research. Investing in the wrong subnet could lead to significant losses (since people can easily exit without lockup periods or other restrictions).

But Jeff, the fully diluted valuation (FDV) is so high! How can we invest in subnets with market caps over $500 million?

FDV may not be the right metric here, as subnets are still in early stages—market cap (MC) may be more appropriate (especially for short-to-medium term traders). If concerned about inflation, consider the 18%/41%/41% split—the portions of emissions (in Alpha tokens) allocated to subnet owners, validators, and miners respectively. As a staker/Alpha token holder, you benefit from the 41% validator portion, since you delegate your $TAO to them when staking.

Many subnet owners continue holding their emitted Alpha tokens as a signal of confidence, and many engage in active dialogue with validators and miners to encourage market support and discourage mass dumping (you can explore this data on taostats).

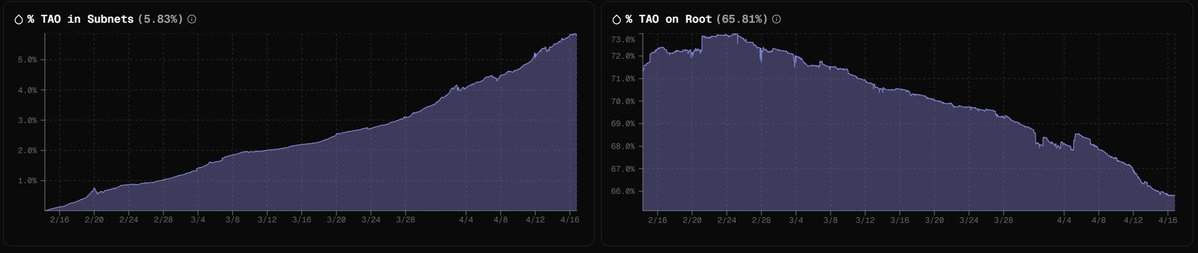

Taken together, the chart below is one of the best representations of Bittensor ecosystem trends.

Source: taoapp

Since dTAO launched in February, %TAO in Roots (the OG subnet managing Bittensor’s incentive system) has steadily declined, while %TAO in subnets has risen consistently. This indicates stakers/investors are becoming more risk-seeking (staking on Root yields ~20–25% conservative APY, with no Alpha token price upside). This trend aligns with how quickly subnet teams are launching products. Since dTAO went live, teams must build publicly, develop products users want, iterate quickly, achieve product-market fit, attract users, and rapidly generate real-world utility with actual revenue. Since joining this ecosystem, I’ve observed teams shipping products much faster than in any other ecosystem (driven by competition and incentive structures).

This brings us to subnets and their unique investable decentralized AI (DeAI) use cases.

Leading Subnets and Use Cases

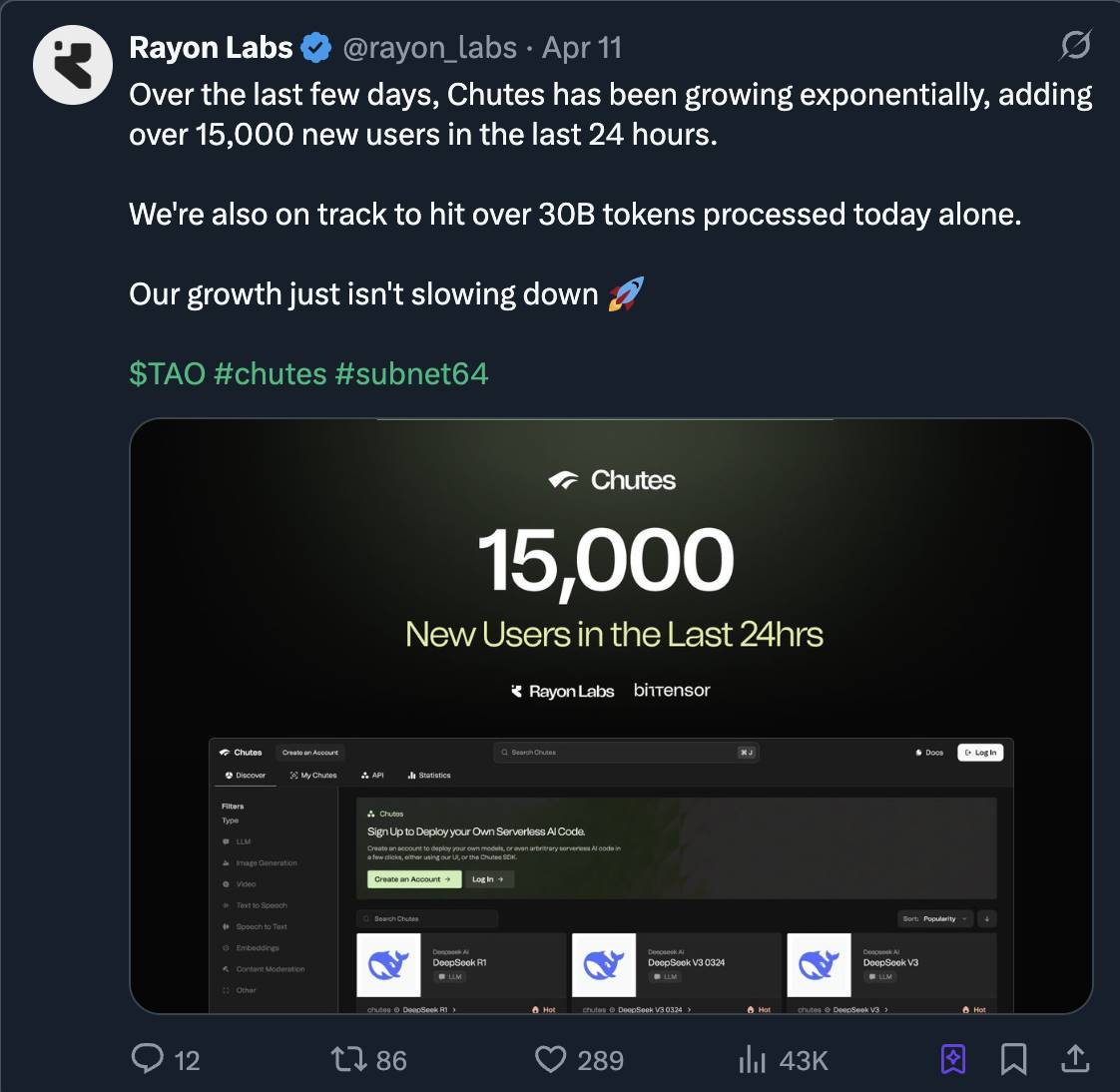

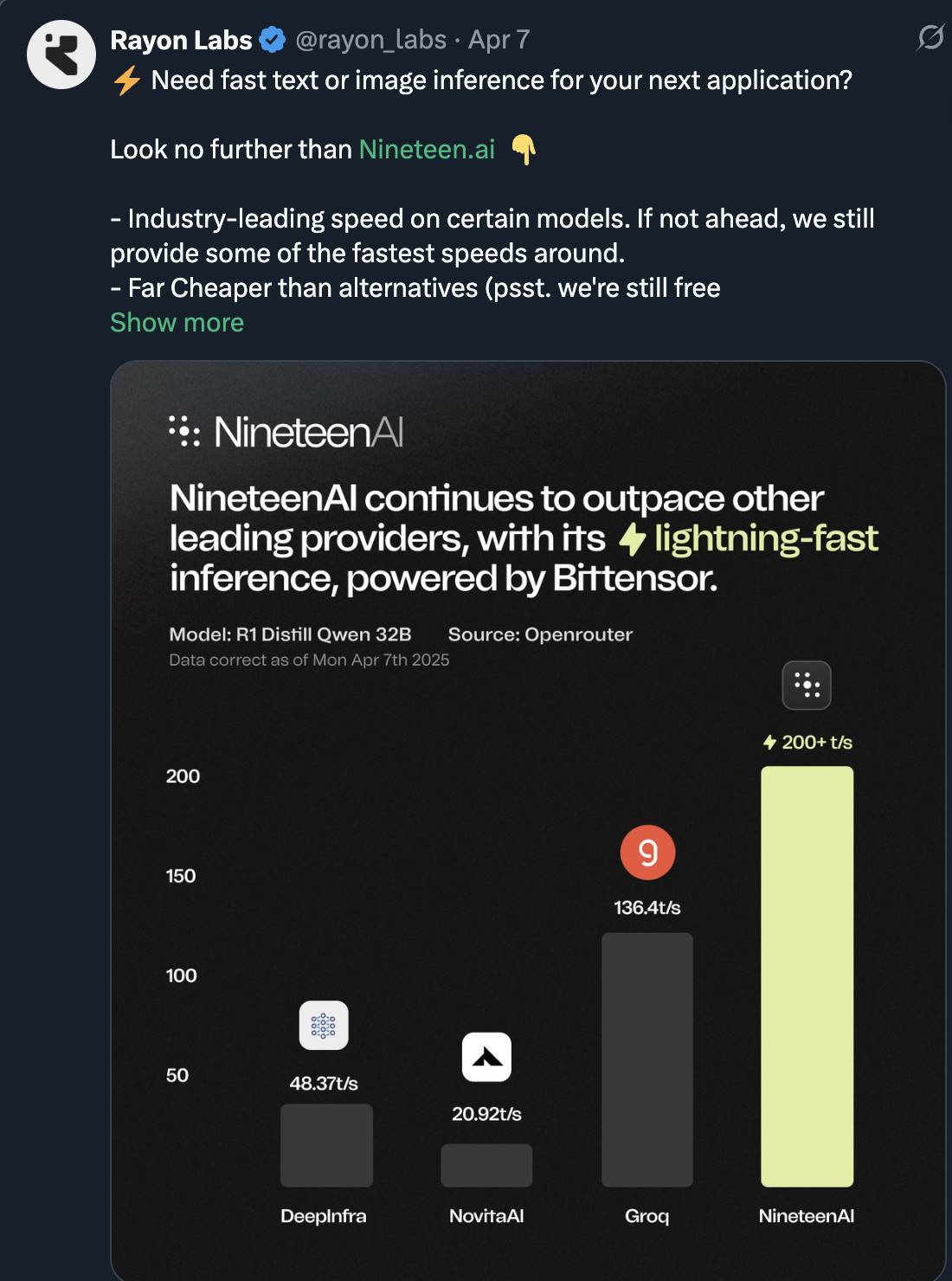

The team widely regarded as #1 in product-market fit (PMF) is @rayon_labs, focused on serving everyday users, with strong execution and consistent public building, including SN64 (Chutes), SN56 (Gradients), and SN19 (Nineteen).

Chutes—provides infrastructure to easily deploy your AI in a serverless manner. Recent AWS outages exemplify exactly why we need such services—if you rely on centralized providers, downtime due to single points of failure could knock your AI application offline (leading to potential financial loss or exploits).

Gradients—allows anyone (even without coding knowledge) to train their own AI models (for professional use cases, image generation, custom LLMs). The recently launched v3 is cheaper than competitors.

Nineteen—offers a fast, scalable, and decentralized AI inference platform (anyone can use it for text and image generation, as it’s significantly faster than comparable offerings).

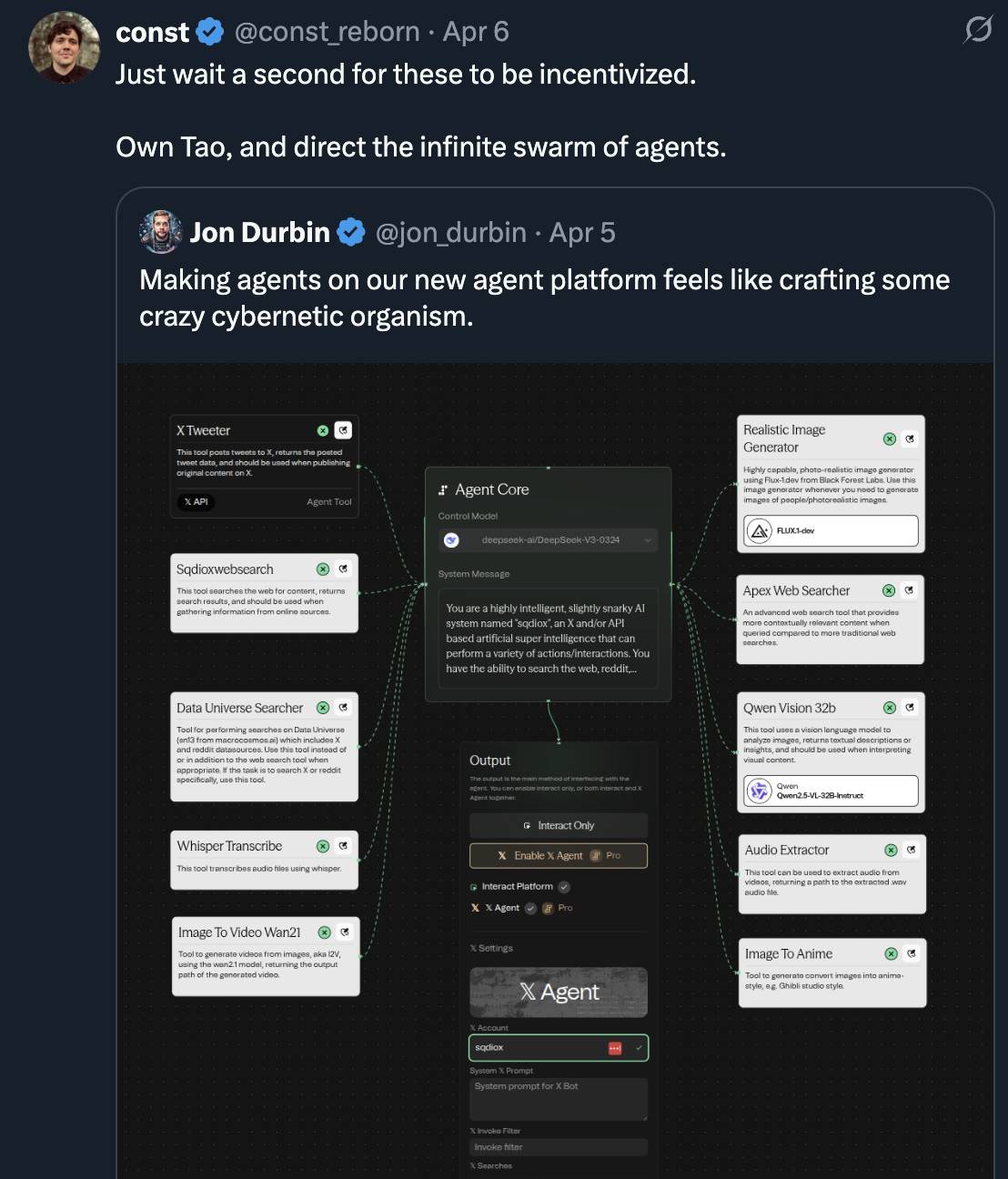

In addition, Rayon is launching Squad AI Agent Platform—an easy-to-use, drag-and-drop node-style AI agent builder that has already generated significant community buzz.

These three subnets collectively command over one-third of $TAO emissions—a testament to the team’s ability to build openly and deliver high-quality products users want (Rayon is hailed by many subnet owners as the top team).

-

Gradients grew 13x in one month (current market cap: $32M)

-

Chutes grew 2.3x (market cap: $63M)

-

Nineteen grew 3x (market cap: $18M)

This trend shows no signs of slowing, especially as Chutes adoption continues rising (currently the top-ranked subnet).

Beyond Rayon Labs’ subnets, there are many other interesting teams—including protein folding, deepfake/AI content detection, 3D modeling, trading strategies, and roleplay LLMs. I haven’t explored all of them yet, but I find those under the “prediction systems” category (taopill) particularly compelling.

SN41 @sportstensor

Many may know them via @AskBillyBets—Sportstensor is the intelligent system powering Billy’s decisions (Billy’s core team is @ContangoDigital, a VC investing in decentralized AI (DeAI) and Bittensor subnet validators/miners).

SN41’s product—the Sportstensor model—is fascinating. It’s a competition among miners to develop the best model and dataset for predicting sports outcomes.

For example: In the latest NBA season, if you followed the crowd and bet on popular favorites, you’d achieve roughly 68% accuracy/win rate. Does this mean everyone betting on favorites made money? No—in fact, they lost money. Betting $100 on every favorite would result in a negative return, losing about $1,700 overall.

While favorites tend to win more often, their odds are lower—meaning even when you win, you earn less. People heavily concentrate bets on favorites, driving down underdog payout odds, meaning if you correctly pick an underdog, there’s substantial profit potential.

This is where the Sportstensor model comes in. Miners use their own machine learning models (e.g., Monte Carlo, Random Forest, Linear Regression) and proprietary or free data to generate predictions. Sportstensor then aggregates these results (via average/median) to identify market edges.

The actual market odds might be 25:75. The model might show 45:55. That 15-point gap represents an edge. If the model identifies many such edges, you don’t need a high win rate to accumulate positive returns over time.

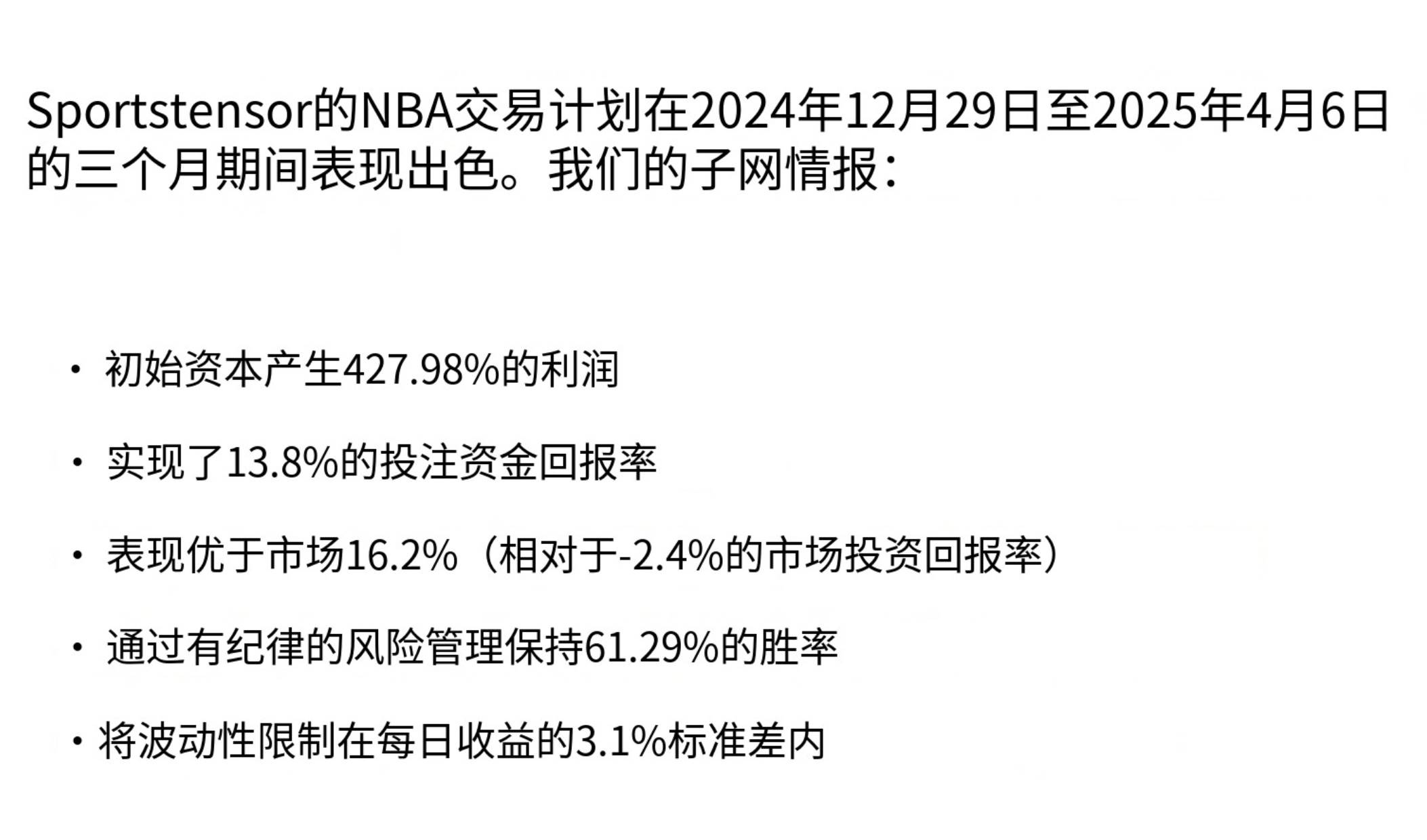

Source: Sportstensor, translated by TechFlow

Check out their full trading report (if you want to dive deeper): These are the model results they shared in their latest update. The numbers are quite impressive. The team also operates a monthly betting fund starting with $10K as a buffer, reinvesting profits into smarter bets. At month-end, they use profits to buy back their Alpha tokens. In March alone, the team earned ~$18K in profit.

Results vary depending on how you apply the intelligence. For instance, the smart system might show odds of 35:65, while actual market odds are 40:60. Someone might bet here, while you might not—because the gap is smaller, offering insufficient edge. Billy uses the intelligence differently than Sportstensor does. (No one currently knows how to consistently achieve positive ROI, as this field is still very early.)

Sportstensor plans to further monetize their intelligence by creating a dashboard that helps users easily understand insights and make informed betting decisions.

I personally love this team because their product has multiple expansion paths. We’ve already seen Billy gain massive attention and excite sports fans who bet alongside him. With coverage across many sports, agents can transform how people feel, interact, and bet.

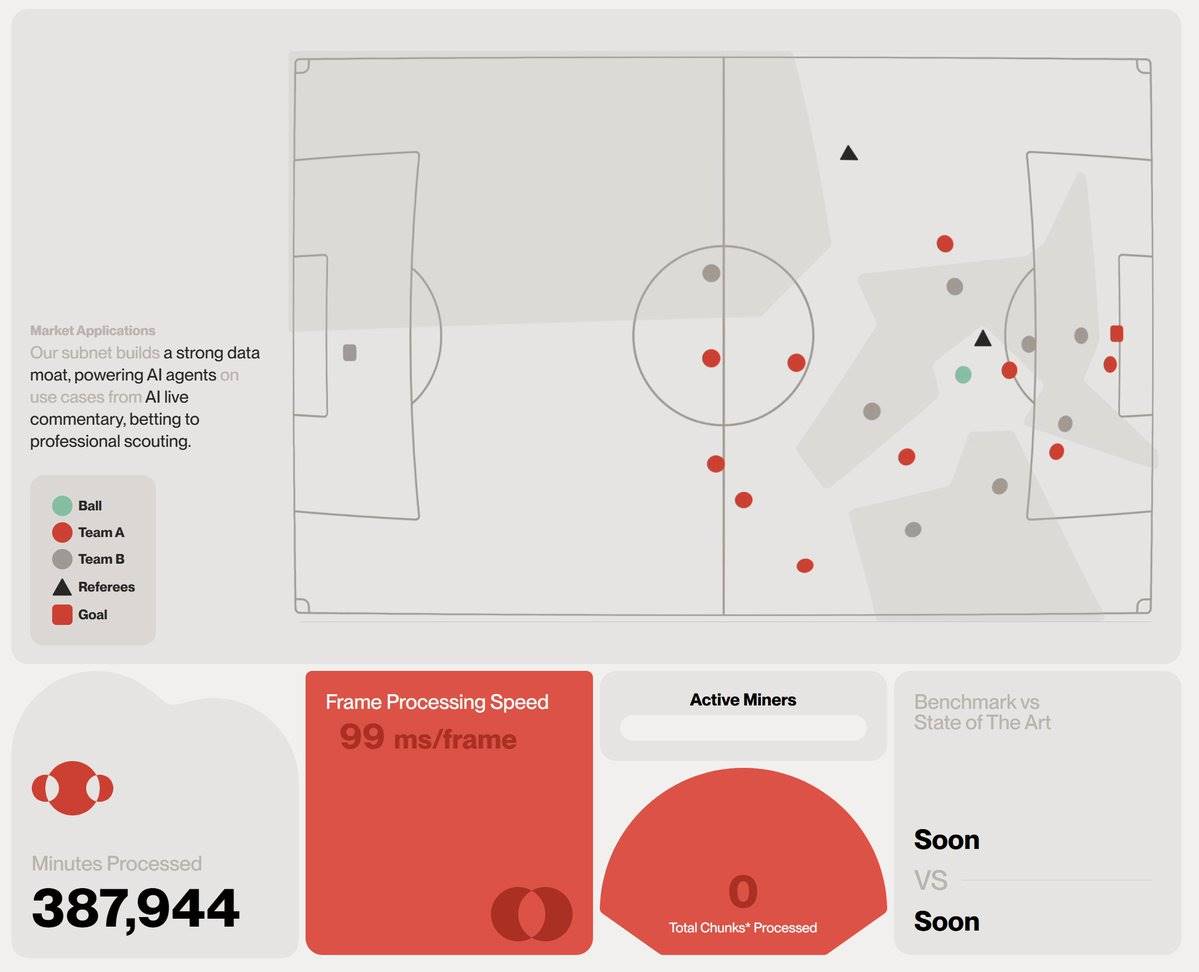

SN44 @webuildscore

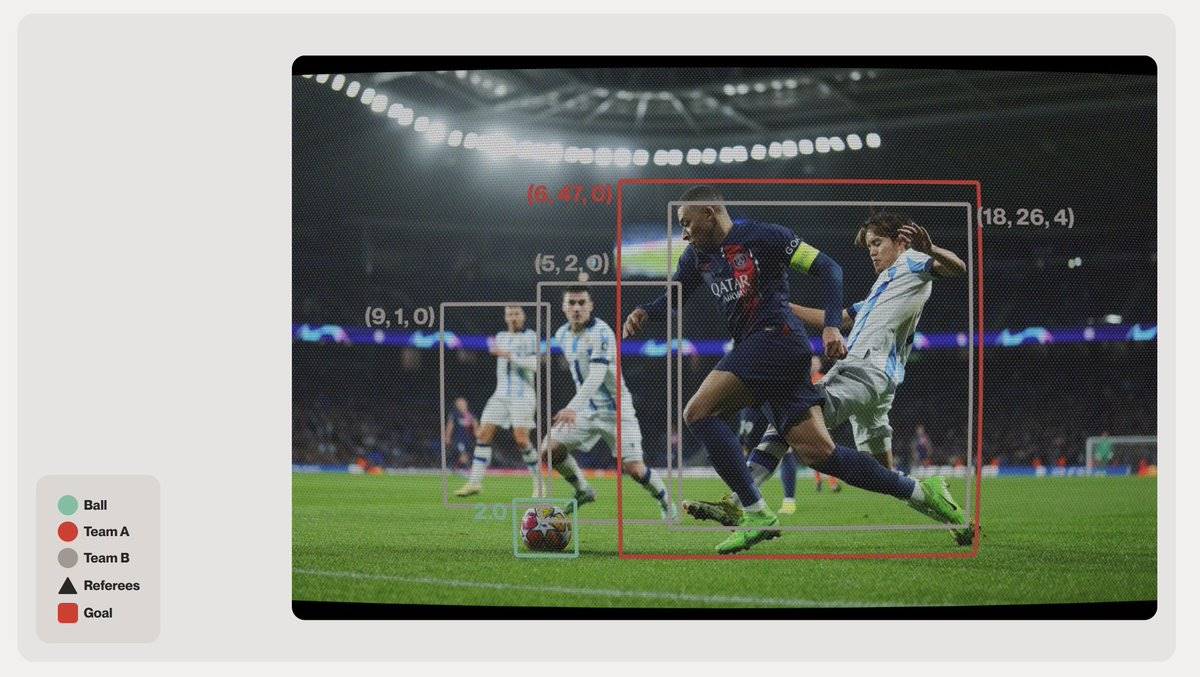

Score initially attempted a system similar to Sportstensor but pivoted to computer vision after realizing the greater value in predicting future events. To understand this, you need computer vision to analyze what’s happening on screen—enabling AI to recognize objects, locate them, label data, then apply various algorithms to derive conclusions (e.g., probability of a player making a certain move)—and convert all this into a universal score for improving player performance and identifying talent early.

Miners compete to accurately label objects (their primary objective). Score currently uses internal algorithms to derive final scores.

When scoring players (similar to setting Elo ratings for chess or League of Legends, but more granular and dynamic, adjusting based on each player’s decisions and impacts during games), club owners can do powerful things—like discovering talent at a young age. If you have footage of your child playing, you can analyze it the same way professionals do. This quantifies the entire football world using one unified method.

With proprietary data, Score can monetize scores and insights by selling to data brokers, club owners, sports data firms, and betting companies.

For consumer applications, Score is taking a different approach.

@thedkingdao, a sports hedge fund DAO, is one of Score’s clients, using Score data to develop betting models and turn them into executable betting strategies. The v2 terminal launches tomorrow (users will access full models via subscription tiers—from game analysis to advanced fund management queries like optimal betting partners, using agents to craft personal strategies). Users can lock funds into Vault products where agents automatically place bets and distribute returns—expected to launch next month or before summer.

Soon, users will be able to upload videos directly onto Score’s self-service platform, where miners will label them. While typical soccer match footage takes hours to process, miners can label a 90-minute game in just 10–12 minutes—much faster than elsewhere. Users can then use labeled data for their own models and applications.

I personally love Score because it can extend beyond sports—into areas like autonomous vehicles, robotics, etc. In a world flooded with low-quality data, high-quality proprietary data is highly valuable.

SN18 @zeussubnet

This is a newly launched subnet gaining significant attention. I haven’t had a chance to speak with the team yet, but the product is very intriguing.

Zeus is a machine-learning-based climate/weather forecasting subnet aiming to outperform traditional models with faster, more accurate predictions.

This intelligence is highly sought after by hedge funds—accurate weather forecasts enable better commodity price predictions (hedge funds pay millions for such insights, as successful trades can yield hundreds of millions in profit).

The Zeus subnet is relatively new, having recently acquired subnet 18. Its Alpha token surged 210% in the past 7 days.

Other subnets I’m interested in but haven’t deeply explored yet include:

-

@404gen_ SN17 — Infrastructure for generating AI-created 3D assets. Enables creation of 3D models for games, AI characters, virtual streamers, etc. Recent integration with @unity could enable seamless 3D model generation, transforming the creative workflow for Unity’s 1.2 million monthly active users.

-

@metanova_labs SN68 — DeSci drug discovery subnet, turning drug discovery into a collaborative high-speed race, tackling traditional challenges like cost and time (which normally take over a decade and cost billions).

There are many other subnets—I’ll share more as I get deeper into them. I started with the ones easiest to understand (since I’m not technical).

Summary

I’ve tried to avoid getting too technical. There are excellent resources available covering detailed explanations of dTAO, emissions, incentive distribution, and all stakeholders.

Based on what I've learned during Agent Season (Oct 24 to present), I believe flexibility is key. I’ve held too many project investments that became illiquid. dTAO offers a fairly elegant mechanism to flexibly shift between and exit different investable DeAI startups.

Currently, participation is still low, so users can experience 80%–150%+ APY, plus potential subnet token price appreciation. This dynamic may change within the next six months as more participants join and TAO’s ecosystem develops better bridges, wallets, and trading infrastructure.

For now, I suggest you enjoy TAO’s PvE season and explore more cool DeAI tech with me :D

Thanks for reading my first article. Looking forward to seeing you in the next one!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News