Where are the opportunities for retail investors in Bittensor's dTAO upgrade?

TechFlow Selected TechFlow Selected

Where are the opportunities for retail investors in Bittensor's dTAO upgrade?

The significance of this entire event for Bittensor is equivalent to Virtuals Protocol launching the AI Agent LaunchPad last October, after which $VIRTUAL surged over 50x at its peak.

Author: Siwei Guai Guai

Bittensor's dTAO upgrade has been highly anticipated and is finally launching on February 14. What exactly is this dTAO upgrade? Check out @HelloLydia13's thread titled "Five-Minute Guide to Bittensor."

For retail investors, the most crucial change is that all 64 existing subnet projects on Bittensor can now issue their own tokens. This means Bittensor effectively gains its own ecosystem—a clear major利好 for $TAO.

The significance of this event for Bittensor is comparable to Virtuals Protocol launching its AI Agent LaunchPad in October last year, after which $VIRTUAL surged over 50x at its peak.

The dTAO upgrade introduces market competition into Bittensor’s Yuma consensus, essentially decentralizing value discovery across subnets.

The previous model of $TAO distribution determined by root network voting will now shift to being allocated based on the value ratio between $TAO and dTAO tokens within each subnet's dTAO token pool. $TAO holders can "vote with their feet" by purchasing subnet tokens to decide which subnets should receive greater $TAO rewards.

The more market demand there is for a particular dTAO token, the larger the $TAO emission share its corresponding subnet will receive. Since holders of that dTAO token benefit as a result, this further fuels market demand for the token, creating a positive feedback loop for its value. Therefore, to capture a share of Bittensor ecosystem growth, a more exciting strategy than simply holding $TAO is staking $TAO to obtain different subnet dTAO tokens (here, "staking" essentially means using $TAO to buy corresponding subnet tokens).

Because the mechanism shifts from staking to trading subnet tokens, $TAO staking returns are no longer guaranteed. However, correctly betting on promising subnet tokens could yield outsized returns. This will attract significant speculative capital and arbitrageurs to the Bittensor ecosystem.

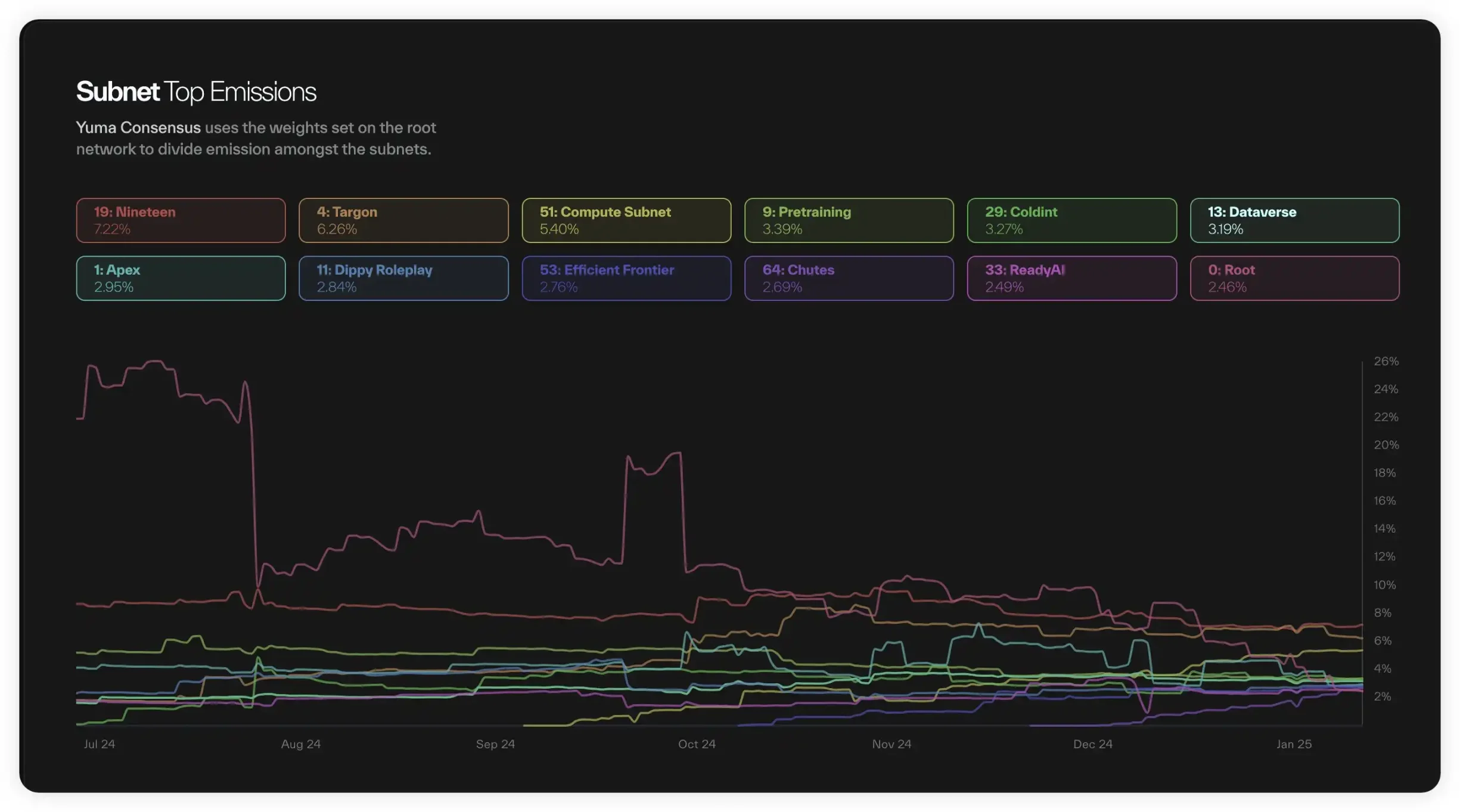

To identify promising subnet tokens, one approach is to see which subnets currently receive higher $TAO emissions.

Related investment opportunities also include DEX projects offering dTAO trading platforms. @taodotbot and @HotKeySwap are established projects that launched tokens early. $HOTKEY has a market cap of only $5 million, roughly 1/7th of $TAOBOT. Meanwhile, veteran TAO liquid staking protocol @TensorplexLabs recently announced plans to launch its own dTAO trading platform @BackpropFinance.

However, the official account hasn't posted much yet. For details, refer to this post.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News