Bittensor Subnet Investment Guide: Seizing the Next Wave of AI

TechFlow Selected TechFlow Selected

Bittensor Subnet Investment Guide: Seizing the Next Wave of AI

Since February, subnets have achieved rapid growth. This article provides an overview of key subnets and offers investment strategies.

Author: Biteye Core Contributor @lviswang

1. Market Overview: dTAO Upgrade Sparks Ecosystem Boom

On February 13, 2025, the Bittensor network underwent a historic Dynamic TAO (dTAO) upgrade, transitioning the network from centralized governance to market-driven, decentralized resource allocation. After the upgrade, each subnet received its own alpha token, allowing TAO holders to freely choose investment targets—truly enabling a market-based value discovery mechanism.

Data shows the dTAO upgrade unleashed tremendous innovative vitality. Within just a few months, Bittensor grew from 32 subnets to 118 active subnets—an increase of 269%. These subnets span various AI industry verticals, ranging from foundational text inference and image generation to cutting-edge applications like protein folding and quantitative trading, forming the most comprehensive decentralized AI ecosystem to date.

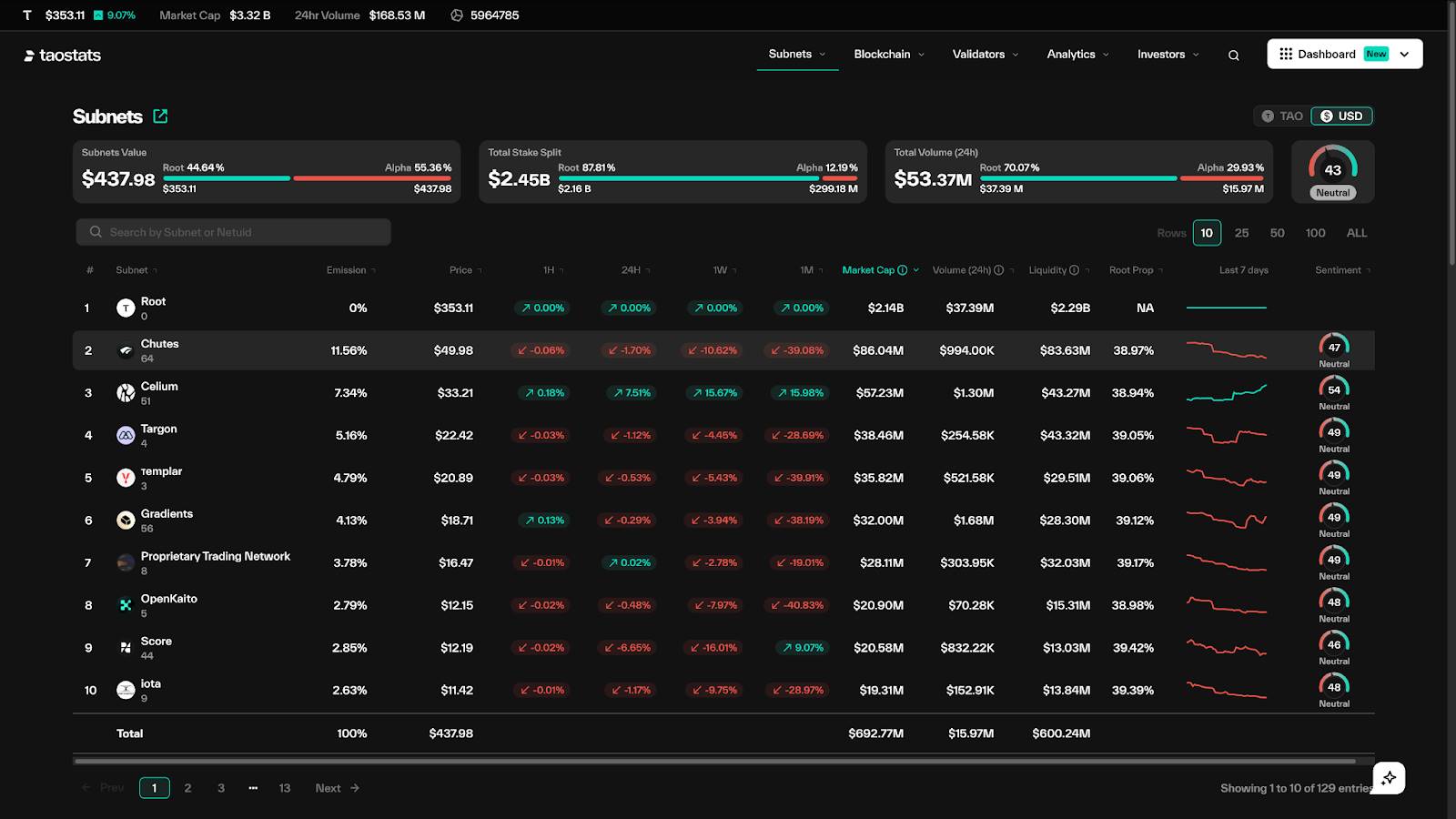

Market performance has also been outstanding. The combined market cap of top subnets surged from $4 million pre-upgrade to $690 million, with stable annual staking yields between 16–19%. Network incentives are allocated based on market-driven TAO staking rates, with the top 10 subnets accounting for 51.76% of total network emissions—reflecting a clear market-driven survival-of-the-fittest mechanism.

https://taostats.io/subnets

2. Core Subnet Analysis (Top 10 by Emissions)

1. @chutes_ai, Chutes (SN64) – Serverless AI Computing

Core Value: Revolutionizing AI model deployment and drastically reducing compute costs

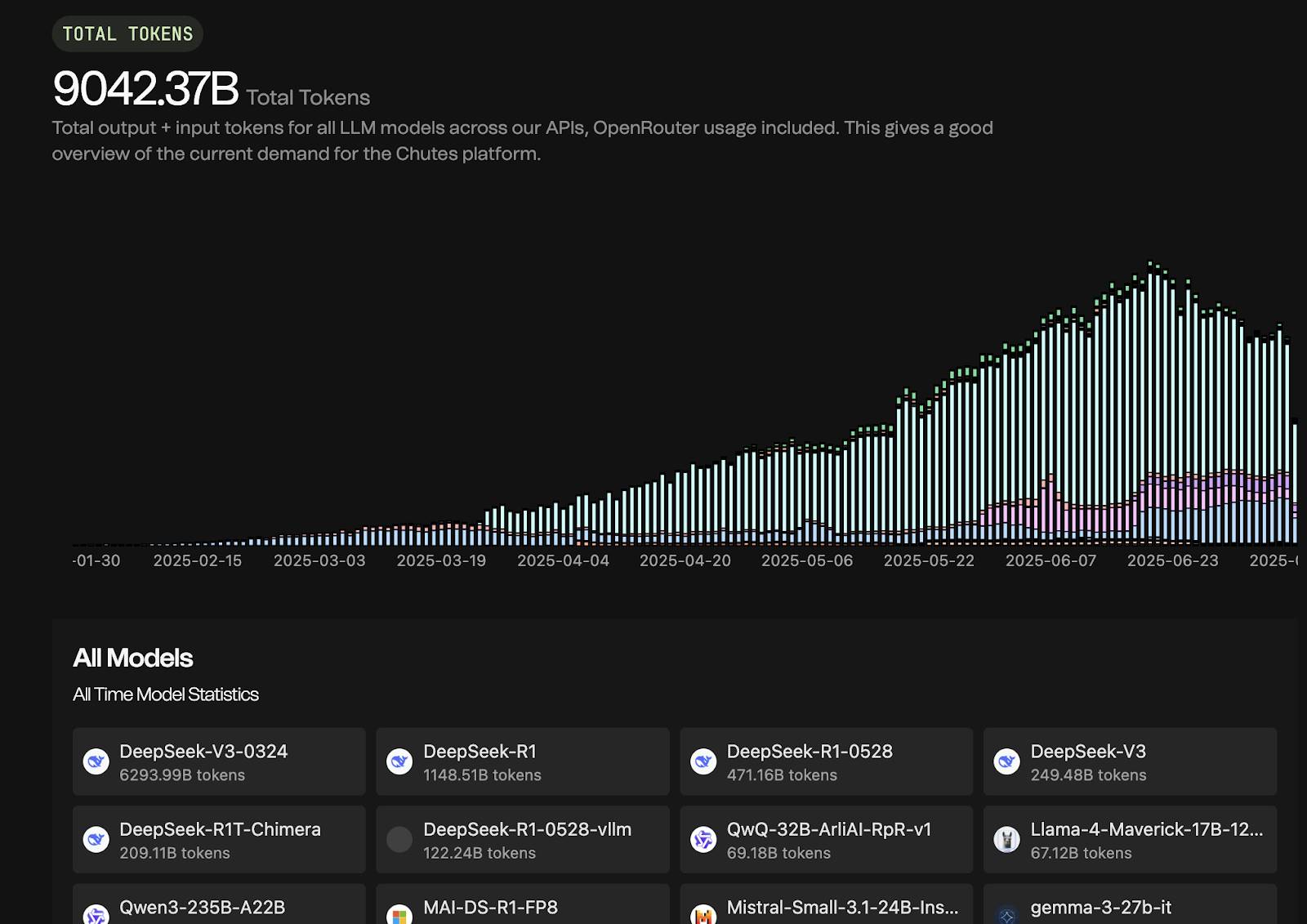

Chutes employs an "instant launch" architecture that reduces AI model startup time to just 200 milliseconds—10x faster than traditional cloud services. With over 8,000 GPU nodes worldwide, it supports mainstream models from DeepSeek R1 to GPT-4, processing over 5 million requests daily with response latency under 50ms.

The business model is mature, using a freemium strategy to attract users. Integrated via the OpenRouter platform, Chutes provides compute power for popular models like DeepSeek V3, earning revenue from each API call. Its cost advantage is significant—85% cheaper than AWS Lambda. To date, total token usage exceeds 9042.37B, serving over 3,000 enterprise clients.

It reached a $100 million market cap nine weeks after dTAO launch, currently valued at $79M. With deep technological moats, strong commercial traction, and high market recognition, Chutes stands as the leading subnet.

https://chutes.ai/app/research

2. @celiumcompute, Celium (SN51) – Hardware Compute Optimization

Core Value: Low-level hardware optimization to enhance AI compute efficiency

Developed by Datura AI, Celium focuses on hardware-level compute optimization. Through four core technical modules—GPU scheduling, hardware abstraction, performance optimization, and energy efficiency management—it maximizes hardware utilization. It supports full-range hardware including NVIDIA A100/H100, AMD MI200, and Intel Xe, offering prices 90% lower than comparable products and 45% higher computational efficiency.

https://celiumcompute.ai/

Celium is currently the second-largest emitter on Bittensor, accounting for 7.28% of network emissions. As hardware optimization is a core component of AI infrastructure with high technical barriers and upward pricing trends, Celium holds a current market cap of $56M.

3. @TargonCompute, Targon (SN4) – Decentralized AI Inference Platform

Core Value: Confidential computing technology ensuring data privacy and security

Targon’s core is the Targon Virtual Machine (TVM), a secure confidential computing platform supporting AI model training, inference, and verification. TVM leverages Intel TDX and NVIDIA confidential computing technologies to ensure end-to-end security and privacy throughout the AI workflow. The system supports encryption from hardware to application layers, enabling users to access powerful AI services without exposing their data.

Targon features high technical barriers and a clear business model with stable revenue streams. It has launched a buyback mechanism where all income is used to repurchase tokens—the latest buyback totaling $18,000.

4. @tplr_ai, τemplar (SN3) – AI Research & Distributed Training

Core Value: Large-scale collaborative AI model training lowering entry barriers

Templar is a pioneering subnet on Bittensor dedicated to large-scale distributed AI model training, aiming to become “the best model training platform in the world.” It enables collaborative training using GPU resources contributed by participants globally, focusing on cutting-edge model co-training and innovation with strong anti-cheating and coordination mechanisms.

Technically, Templar successfully completed training of a 1.2B parameter model through over 20,000 training cycles involving approximately 200 GPUs. In 2024, it upgraded to a commit-reveal mechanism to enhance decentralization and security. In 2025, it advanced to training models exceeding 70B parameters, achieving benchmark performance comparable to industry standards and receiving personal endorsement from Bittensor founder Const.

With strong technical advantages, Templar currently holds a $35M market cap and accounts for 4.79% of emissions.

5. @gradients_ai, Gradients (SN56) – Decentralized AI Training

Core Value: Democratizing AI training and significantly lowering cost barriers

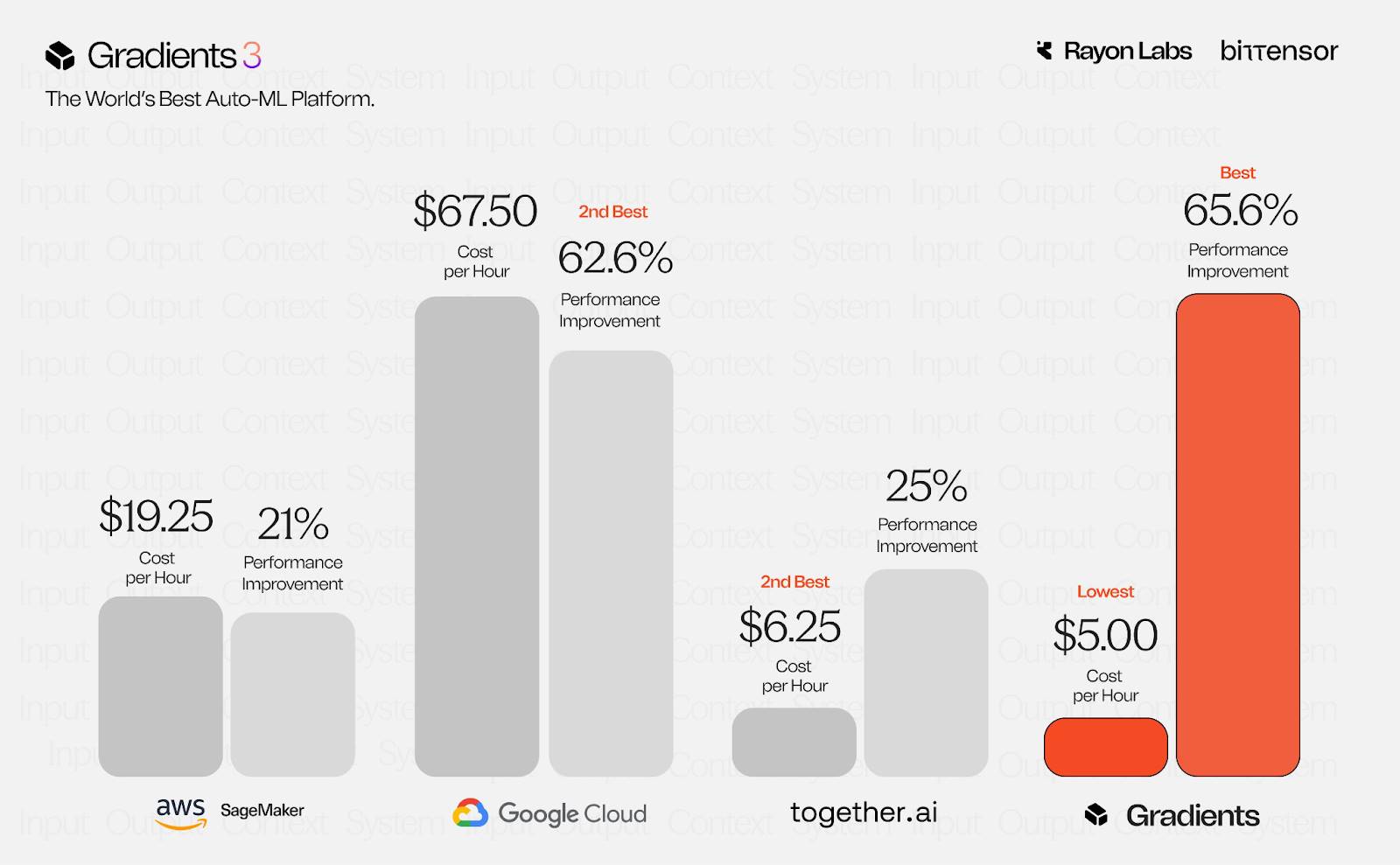

Also developed by Rayon Labs, Gradients tackles the high cost of AI training through distributed training. Its intelligent scheduling system uses gradient synchronization to efficiently distribute tasks across thousands of GPUs. It has completed training of a 118 trillion-parameter model at just $5 per hour—70% cheaper than traditional cloud services—and 40% faster than centralized solutions. Its one-click interface lowers the barrier to entry, with over 500 projects already using it for model fine-tuning across healthcare, finance, and education sectors.

Currently valued at $30M, with strong market demand and clear technical advantages, Gradients is a subnet worth long-term attention.

https://x.com/rayon_labs/status/1911932682004496800

6. @taoshiio, Proprietary Trading (SN8) – Financial Quantitative Trading

Core Value: AI-powered multi-asset trading signals and financial forecasting

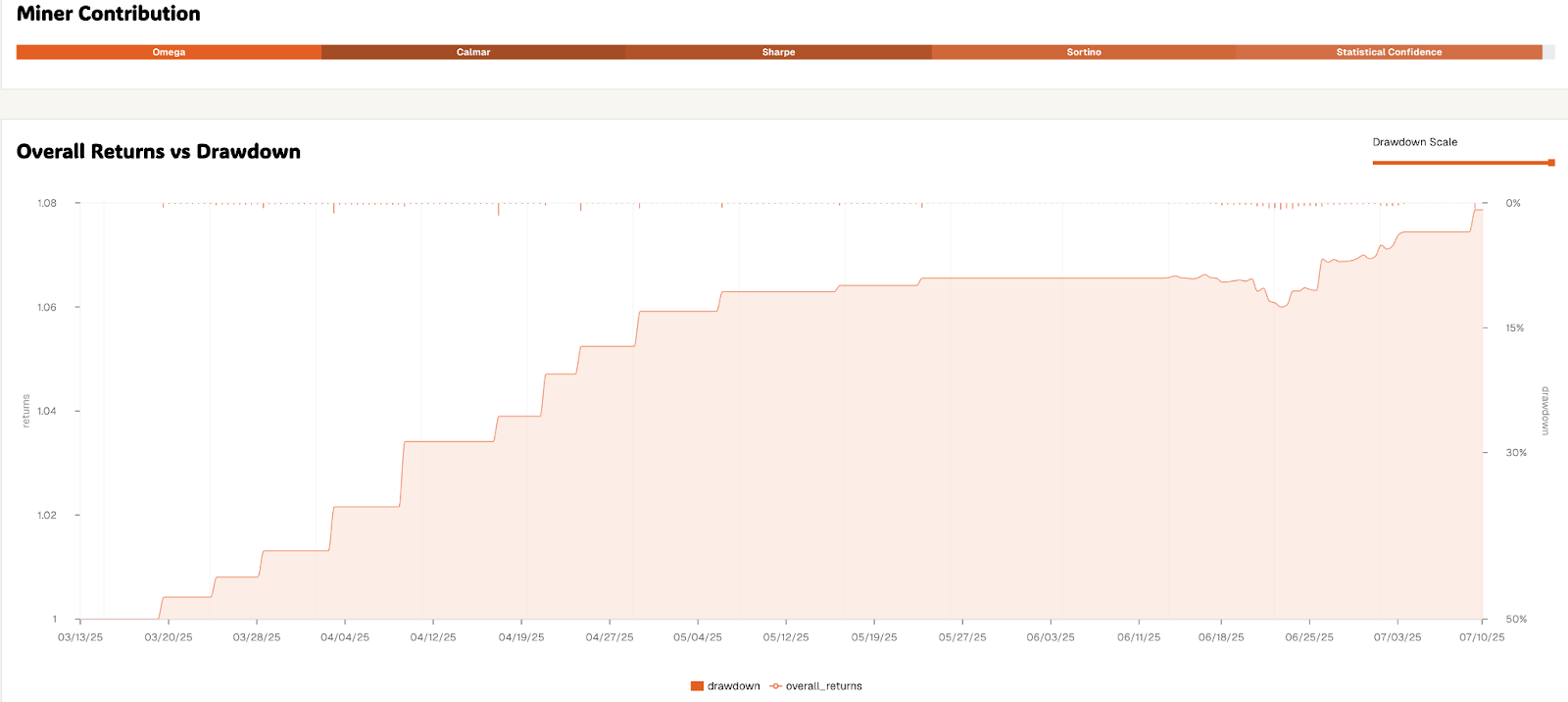

SN8 is a decentralized quantitative trading and financial prediction platform generating AI-driven multi-asset trading signals. Its proprietary trading network applies machine learning to financial market forecasting, building a multi-layered predictive modeling architecture. Its time-series prediction models combine LSTM and Transformer techniques to handle complex temporal data, while its sentiment analysis module processes social media and news content to provide auxiliary emotional indicators for predictions.

The platform dashboard displays returns and backtests of strategies provided by different miners. By combining AI and blockchain, SN8 offers an innovative approach to financial market trading, currently holding a market cap of $27M.

https://dashboard.taoshi.io/miner/5Fhhc5Uex4XFiY7V3yndpjsPnfKp9F4EhrzWJg7cY6sWhYGS

7. @_scorevision, Score (SN44) – Sports Analytics & Evaluation

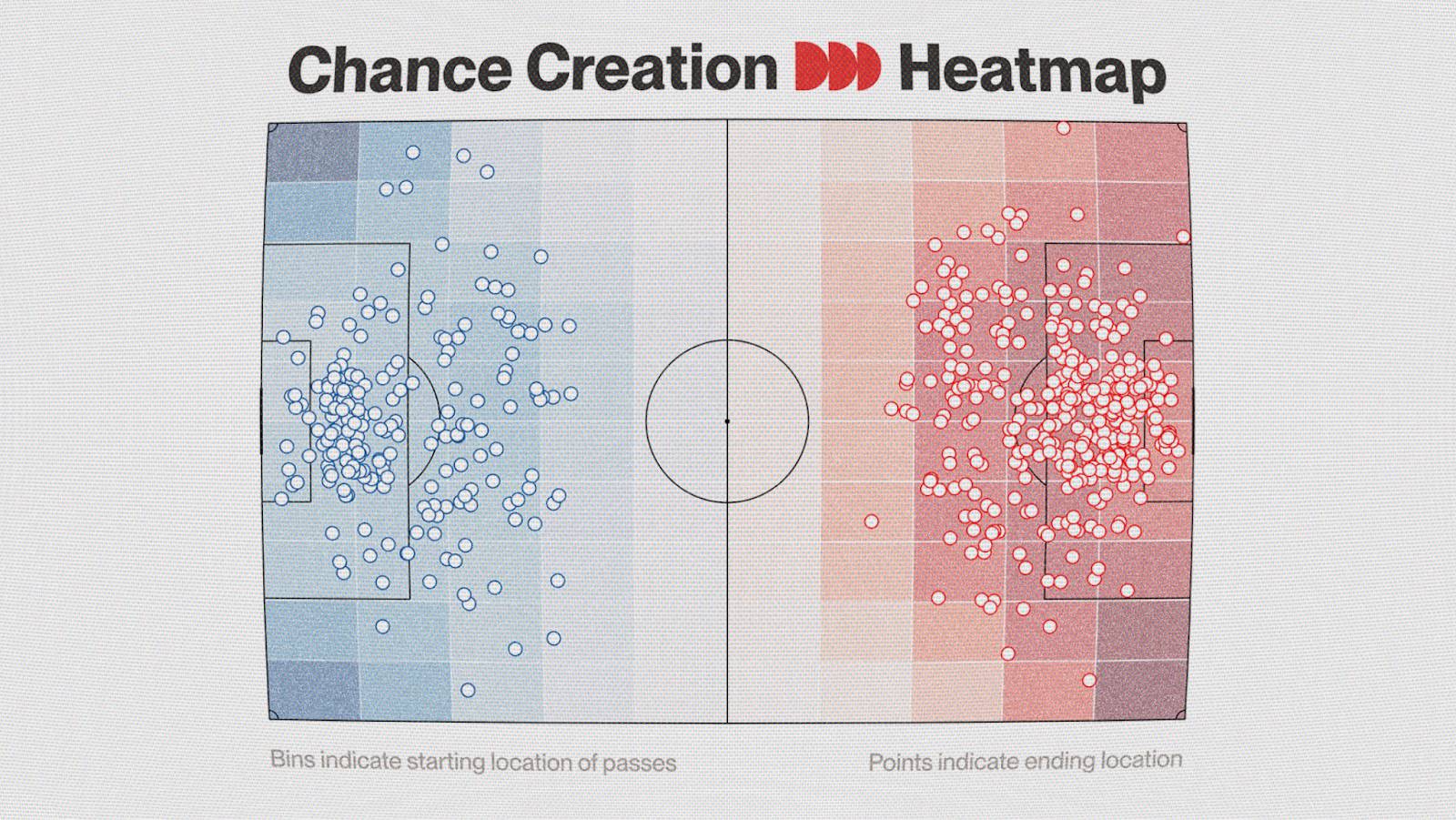

Core Value: Sports video analysis targeting the $600 billion football industry

Score is a computer vision framework focused on sports video analysis, leveraging lightweight validation techniques to reduce the cost of complex video analysis. Using a two-step verification process—pitch detection and CLIP-based object inspection—it slashes traditional game annotation costs (which could reach thousands of dollars per match) by 90–99%. In collaboration with Data Universe, its DKING AI agent achieves an average prediction accuracy of 70%, with single-day peaks reaching 100%.

https://x.com/webuildscore/status/1942893100516401598

With the massive scale of the sports industry and significant technological innovation, Score presents a clear use case and promising market potential—making it a subnet worth watching.

8. @openkaito, OpenKaito (SN5) – Open-Source Text Inference

Core Value: Development of text embedding models and optimization of information retrieval

OpenKaito focuses on developing text embedding models, backed by Kaito, a key player in the InfoFi space. As a community-driven open-source project, it aims to build high-quality text understanding and reasoning capabilities, particularly in information retrieval and semantic search.

The subnet is still in early development, primarily focused on building an ecosystem around text embedding models. Upcoming integration with Yaps could significantly expand its application scenarios and user base.

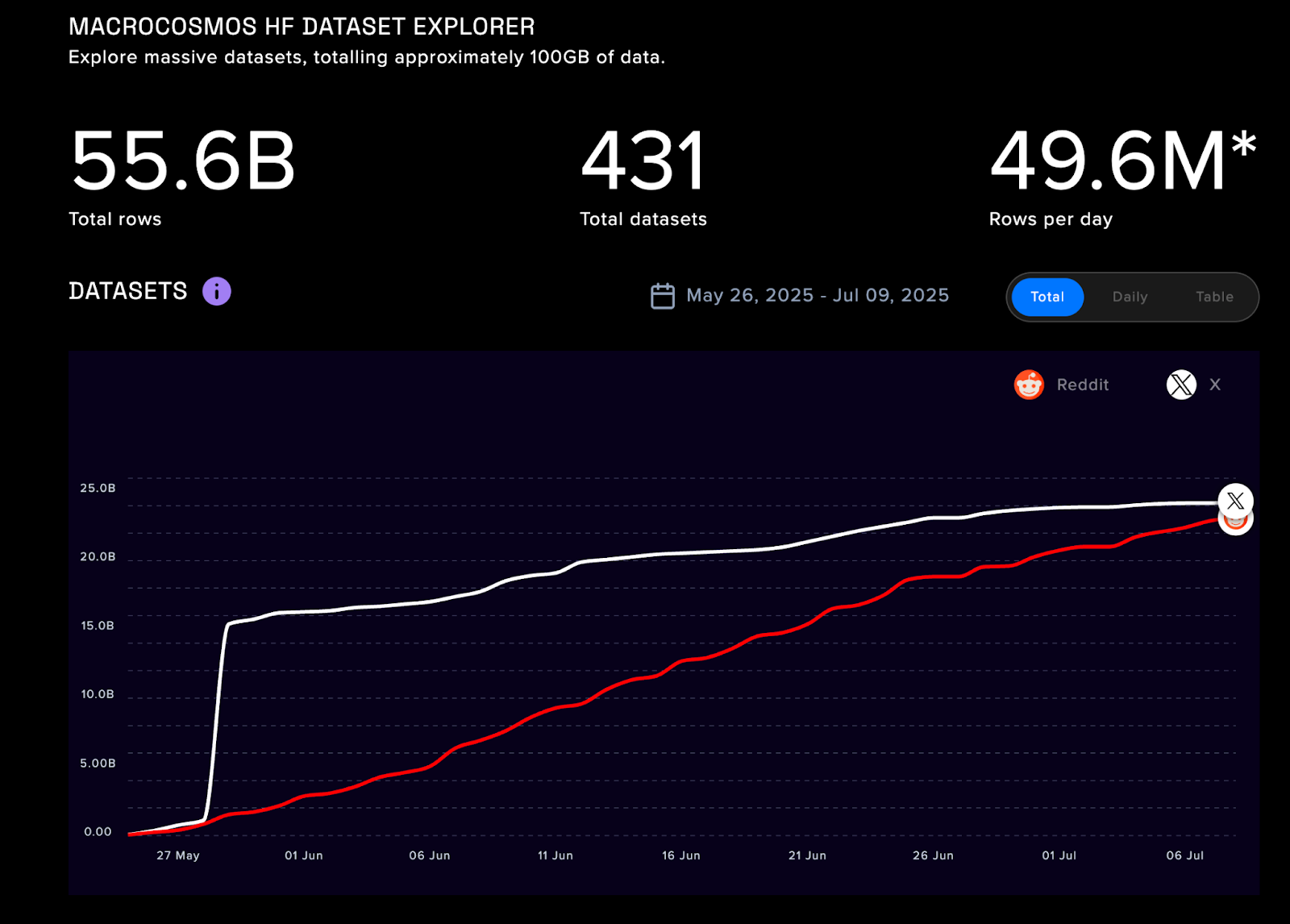

9. @MacrocosmosAI, Data Universe (SN13) – AI Data Infrastructure

Core Value: Large-scale data processing and AI training data supply

Data Universe processes 500 million rows of data daily, accumulating over 55.6 billion rows, with support for up to 100GB storage. Its DataEntity architecture delivers core functions such as data standardization, index optimization, and distributed storage. An innovative "gravity" voting mechanism enables dynamic weight adjustments.

https://www.macrocosmos.ai/sn13/dashboard

Data is the oil of AI, and infrastructure plays a stable and critical role. As a key data provider for multiple subnets—including deep collaboration with Score—Data Universe exemplifies the strategic importance of foundational infrastructure.

10. @taohash, TAOHash (SN14) – PoW Compute Mining

Core Value: Bridging traditional mining with AI computing and integrating compute resources

TAOHash allows Bitcoin miners to redirect their hashpower to the Bittensor network, earning alpha tokens that can be staked or traded. This hybrid model combines traditional Proof-of-Work mining with AI computation, creating new revenue streams for miners.

In just a few weeks, it attracted over 6 EH/s of hashpower (approximately 0.7% of global Bitcoin hashpower), demonstrating strong market acceptance. Miners can now dynamically choose between traditional Bitcoin mining and earning TAOHash tokens, optimizing returns based on market conditions.

11. @CreatorBid, Creator.Bid – Launchpad for AI Agent Ecosystem

Although not a subnet itself, Creator.Bid plays a crucial coordinating role within the Bittensor ecosystem. Its ecosystem rests on three pillars. The Launchpad module offers fair and transparent AI agent launches, using sniper-resistant smart contracts and curated launch mechanisms to provide secure and trustworthy onboarding for new AI agents. The Tokenomics module unifies the ecosystem through the BID token, offering sustainable revenue models for agents. The Hub module delivers robust API-driven services, including content automation, social media APIs, and fine-tuned image models.

The platform’s core innovation lies in the concept of Agent Keys—digital membership tokens that allow creators to build communities around AI agents and enable shared ownership. Each AI agent receives a unique identity via the Agent Name Service (ANS), implemented as NFTs to guarantee non-repeating identifiers. Users can generate fully functional AI agents simply by inputting personality traits—no coding required.

While Creator.Bid is built on the Base network, it maintains deep collaboration with the Bittensor ecosystem. Through operating the TAO Council, it brings together top-tier subnets like BitMind (SN34) and Dippy (SN11 & SN58), serving as the "coordinating layer where TAO-aligned agents, subnets, and builders converge."

This collaborative value stems from combining strengths across networks: Bittensor provides powerful AI inference and training capabilities, while Creator.Bid offers a user-friendly agent creation and launch platform. Together, developers can leverage Bittensor’s AI power to build agents and then tokenize and communityize them via Creator.Bid’s Launchpad.

The partnership with Masa’s AI Agent Arena (SN59) further demonstrates this synergy. Creator.Bid supplies agent creation tools, enabling users to rapidly deploy competitive AI agents into the arena. This cross-ecosystem collaboration is emerging as a key trend in the decentralized AI space.

3. Ecosystem Analysis

Core Technical Advantages

Bittensor’s technological innovations have created a unique decentralized AI ecosystem. Its Yuma consensus algorithm ensures network quality through decentralized validation, while the dTAO upgrade introduced a market-driven resource allocation mechanism that significantly boosts efficiency. Each subnet includes an AMM mechanism for price discovery between TAO and alpha tokens, allowing market forces to directly influence AI resource allocation.

Inter-subnet collaboration protocols enable distributed processing of complex AI tasks, generating strong network effects. A dual incentive structure—combining TAO emissions with alpha token appreciation—ensures long-term participation. Founders, miners, validators, and stakers all receive appropriate rewards, forming a sustainable economic loop.

Competitive Advantages and Challenges

Compared to traditional centralized AI providers, Bittensor offers a truly decentralized alternative with superior cost efficiency. Multiple subnets demonstrate significant cost advantages—for example, Chutes is 85% cheaper than AWS. This advantage arises from efficiency gains inherent in decentralized architectures. The open ecosystem accelerates innovation, with continuous growth in both the number and quality of subnets—outpacing internal R&D in traditional enterprises.

However, the ecosystem faces real challenges. Technical barriers remain high: despite improving tools, mining and validation still require substantial technical expertise. Regulatory uncertainty poses another risk, as decentralized AI networks may face varying policies across jurisdictions. Traditional cloud providers like AWS and Google Cloud won’t stand idle—they’re expected to launch competitive offerings. As the network scales, maintaining a balance between performance and decentralization becomes an increasing challenge.

Nonetheless, explosive growth in the AI industry presents massive opportunities for Bittensor. Goldman Sachs predicts global AI investment will approach $200 billion in 2025, providing strong demand for infrastructure. The global AI market is projected to grow from $294 billion in 2025 to $1.77 trillion by 2032, representing a 29% CAGR—creating vast room for decentralized AI infrastructure.

Supportive government policies toward AI development open a favorable window for decentralized AI infrastructure. Growing concerns about data privacy and AI safety are increasing demand for technologies like confidential computing—a core strength of subnets like Targon. Institutional investor interest in AI infrastructure continues to rise, with participation from major players like DCG and Polychain providing capital and strategic support.

4. Investment Strategy Framework

Investing in Bittensor subnets requires a systematic evaluation framework. Technically, assess the degree of innovation and depth of moat, team expertise and execution capability, and synergies with other ecosystem projects. From a market perspective, analyze target market size and growth potential, competitive landscape and differentiation, user adoption and network effects, as well as regulatory environment and policy risks. Financially, examine current valuation and historical performance, TAO emission share and growth trends, soundness of tokenomics design, and liquidity and trading depth.

For risk management, diversification is fundamental. Investors should spread allocations across different types of subnets: infrastructure-focused (e.g., Chutes, Celium), application-oriented (e.g., Score, BitMind), and protocol-layer (e.g., Targon, Templar). Adjust strategies based on subnet maturity—early-stage projects carry higher risk but greater upside, while mature ones offer stability with limited growth. Given that alpha tokens may have lower liquidity than TAO, maintain prudent capital allocation and sufficient liquidity buffers.

The first halving event in November 2025 will serve as a major market catalyst. Reduced emissions will increase the scarcity of existing subnets and may eliminate underperforming projects, reshaping the network’s economic landscape. Investors can position ahead of time, taking advantage of the pre-halving allocation window.

In the medium term, the number of subnets is expected to surpass 500, covering every niche of the AI industry. Growth in enterprise applications will drive demand for confidential computing and data privacy subnets. Cross-subnet collaboration will become more frequent, forming complex AI service supply chains. As regulatory frameworks clarify, compliant subnets will gain distinct advantages.

In the long run, Bittensor could become a cornerstone of global AI infrastructure. Traditional AI companies may adopt hybrid models, migrating parts of their operations to decentralized networks. New business models and use cases will continuously emerge, interoperability with other blockchain networks will improve, and a broader decentralized ecosystem will take shape. This evolution mirrors the early development of internet infrastructure—investors who identify and engage with key nodes early will be best positioned for outsized returns.

5. Conclusion

The Bittensor ecosystem represents a new paradigm in AI infrastructure development. Through market-driven resource allocation and decentralized governance, it creates fertile ground for AI innovation—demonstrating remarkable vitality and growth potential. Against the backdrop of rapid AI advancement, Bittensor and its subnet ecosystem warrant sustained attention and in-depth research.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News