One week after the dTAO upgrade, in which areas should the Bittensor ecosystem improve?

TechFlow Selected TechFlow Selected

One week after the dTAO upgrade, in which areas should the Bittensor ecosystem improve?

The final validation depends on establishing a positive feedback loop between TAO price and subnet utility value; failure could trigger a sustained shift toward lightweight models in the Web3 AI sector.

Author: Kevin, the Researcher at BlockBooster

TL;DR

-

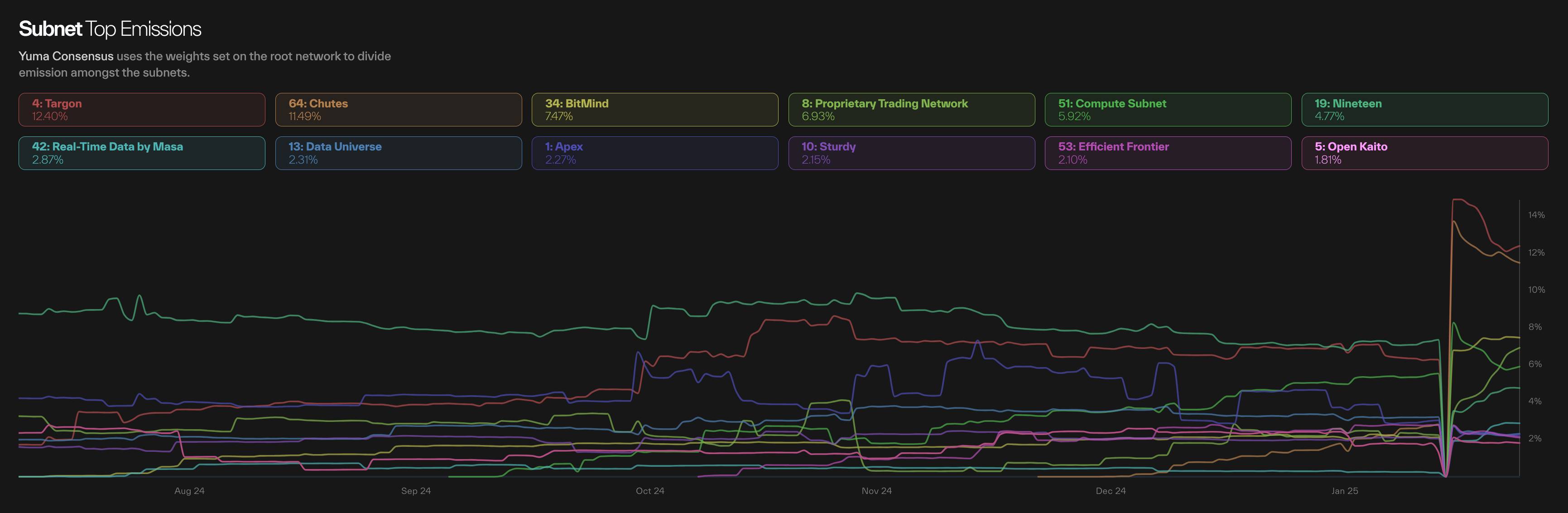

Bittensor transitions subnet reward distribution from fixed proportions to stake-weighted allocation via dTAO, with 50% injected into a liquidity pool, aiming to promote high-quality subnets through decentralized evaluation.

-

Early-stage volatility, APY traps, and adverse selection coexist, requiring resolution of three core tensions: miner quality screening, user knowledge barriers, and mismatch between market hype and fundamentals.

-

Among the current top 10 subnets, only one requires miners to submit open-source models. Most suffer from anonymous teams and lack of product anchoring, exposing infrastructure bottlenecks in Web3 AI.

-

The ultimate validation hinges on establishing a positive feedback loop between TAO price and subnet utility value. Failure could trigger a sustained shift toward lightweight solutions across the Web3 AI sector.

Background Recap

dTAO Reshapes Bittensor's Daily Token Release Mechanism:

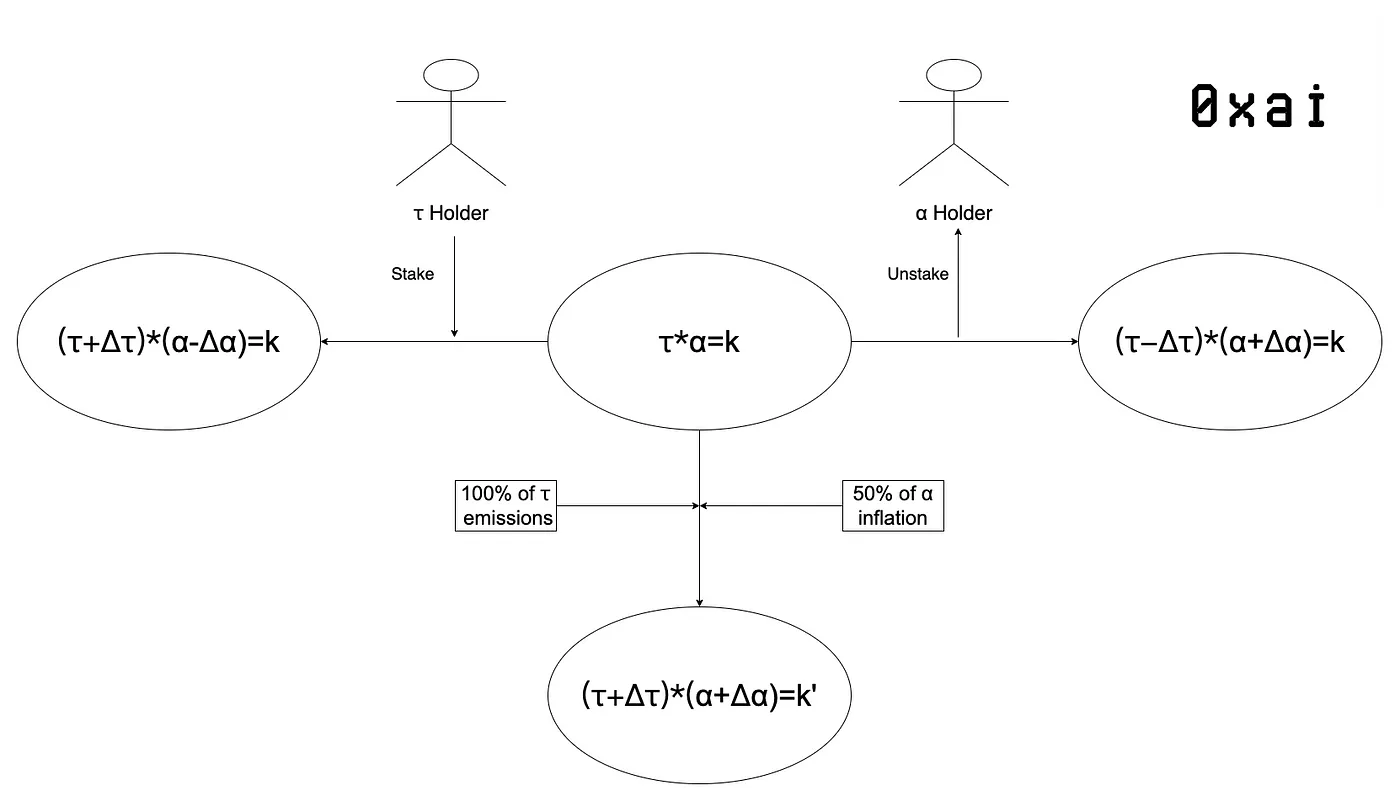

Previous model: Subnet rewards were distributed at fixed ratios—41% to validators, 41% to miners, and 18% to subnet owners. The amount of TAO released per subnet was determined by validator voting.

Post-dTAO model: Now, 50% of newly minted dTAO tokens are added to a liquidity pool, while the remaining 50% are allocated among validators, miners, and subnet owners based on decisions made within each subnet. The TAO issuance for each subnet is now determined by its staking weight.

Design Objectives of dTAO:

The primary goal of dTAO is to foster the development of subnets with real revenue potential, stimulate the emergence of practical use cases, and ensure these applications are properly evaluated.

Decentralized Subnet Evaluation: Moving beyond reliance on a small group of validators, the dynamic pricing of the dTAO pool determines how TAO emissions are allocated. TAO holders can stake their tokens to support subnets they believe in.

Increased Subnet Capacity: Removing the cap on the number of subnets encourages competition and innovation within the ecosystem.

Incentivizing Early Participation: Encourages users to pay attention to new subnets and motivates the community to evaluate them early. Validators who migrate earlier may receive higher rewards. Early migration means purchasing that subnet’s dTAO at a lower price, increasing the potential to earn more TAO in the future.

Promoting Focus on High-Quality Subnets: Further incentivizes miners and validators to seek out high-quality new subnets. Miners host models off-chain, and validation also occurs off-chain; the Bittensor network distributes rewards based solely on validator assessments. As long as an AI application fits the miner-validator framework, Bittensor can fairly evaluate it regardless of type. This high degree of inclusivity ensures participants at every stage are rewarded, reinforcing Bittensor’s overall value.

Three Scenarios Influencing dTAO Price Dynamics

Core Mechanism Recap

A fixed daily release of TAO and an equal amount of dTAO are injected into a liquidity pool, forming new liquidity parameters (k-value). Of the total dTAO issued, 50% enters the liquidity pool, while the remaining 50% is distributed among subnet owners, validators, and miners according to staking weights. Higher-weight subnets receive a larger share of TAO rewards.

Scenario One: Positive Feedback Loop Driven by Growing Staking Volume

When delegated TAO to validators increases steadily, subnet weights rise accordingly, expanding the miner reward allocation. Validators’ motivations for buying dTAO fall into two categories:

1. Short-Term Arbitrage Behavior

Subnet owners acting as validators push up prices by staking TAO (continuing the old emission model). However, the dTAO mechanism undermines the certainty of this strategy:

-

If irrational stakers outnumber quality-focused users, short-term arbitrage remains viable

-

Otherwise, early accumulated tokens rapidly devalue, compounded by the steady release schedule limiting token acquisition, potentially leading to displacement by superior subnets over time

2. Value Capture Logic

Subnets with genuine use cases attract users through real revenue generation. Stakers gain leveraged dTAO returns plus additional staking yields, creating a sustainable growth cycle.

Scenario Two: Stagnation Relative to Leaders

When a subnet’s staking volume grows but lags behind top projects, market cap may rise steadily but fail to maximize returns. Key factors to assess include:

-

Miner Quality Sets the Ceiling: TAO functions as an incentive platform for open-source models (not training), deriving value from the quality of models produced and deployed. The strategic direction of subnet owners combined with miner-submitted model quality defines the upper limit of development

-

Team Capability Reflection: Top-tier miners often come from the subnet’s own development team, meaning miner quality effectively reflects the team’s technical strength

Scenario Three: Death Spiral Triggered by Staking Outflows

A decline in staking volume easily triggers a vicious cycle (reduced stakes → lower rewards → further outflows). Specific causes include:

-

Competitive Elimination: A subnet has utility but inferior product quality, causing its weight to drop and eventually exit. This represents ideal ecological health, yet there is currently no clear evidence of TAO functioning as a "Web3 application incubator tool"

-

Expectation Collapse Effect: Market pessimism leads to withdrawal of speculative stakes. Once daily emissions begin declining, non-core miners accelerate departure, culminating in irreversible decline

Potential Risks and Investment Strategies

-

High Volatility Window: Initial dTAO releases involve large volumes with fixed daily amounts, likely causing extreme price swings in the first few weeks. During this period, root-net TAO staking serves as a risk mitigation strategy, providing stable base returns

-

APY Trap: Tempting short-term APYs may mask long-term risks such as poor liquidity and weak subnet competitiveness

-

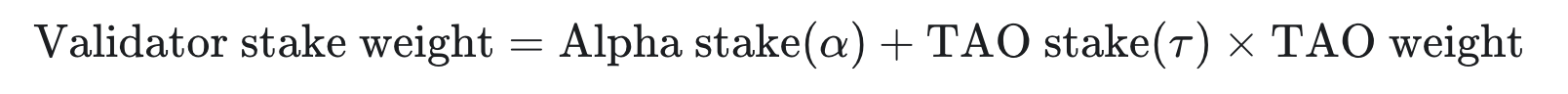

Weight Game Mechanics: Validator weight is determined by both subnet dTAO value and root-network TAO staking (composite weighting model). Within the first 100 days after launch, root-network staking still offers greater yield certainty

-

Meme-Like Trading Characteristics: Current subnet staking behavior shares similar risk profiles with Memecoin speculation

Value Investing vs. Market Misalignment

-

Paradox of Ecosystem Building: While dTAO aims to nurture utility-driven subnets, its value-investing nature creates challenges:

-

High Market Education Cost: Requires continuous assessment of miner quality, application scenarios, team background, and monetization models—posing cognitive barriers for non-AI-specialist investors

-

Lagging Hype Conversion: In contrast to Agent tokens, subnet tokens have yet to achieve comparable market consensus

Systemic Risks from Irrational Staking

-

Repeating Past Mistakes: If users continue blindly chasing emission metrics, it will lead to:

-

Validator rent-seeking: Replaying the self-voting flaws seen under the previous mechanism

-

Mechanism upgrade failure: Undermining dTAO’s intended function of quality filtering

-

Cognitive Threshold Requirement: Investors must be able to assess subnet quality—a capability gap exists between current market maturity and mechanism demands

Game-Theoretic Dilemma in Timing Investment

-

Optimal Entry Window: The best investment timing shifts to several months post-launch (when team capability and network potential become visible), but faces:

-

Risk of fading market attention

-

Liquidity contraction due to early speculators exiting

-

Dual Validation of Success:

-

A positive feedback loop forms between TAO price and subnet utility value

-

Validators choose to hold TAO positions rather than sell, seeking sustained income

Risks of Miner Quality失控

-

Adverse Selection Challenge:

-

Lack of quality filtering: Current mechanisms struggle to effectively differentiate miner contribution quality

-

Imbalanced incentive environment: Low-quality miners exploit the system, squeezing out high-quality developers

-

Ecosystem bottleneck: The open-source model incubation environment remains immature, risking a "race to the bottom" scenario

Three Contradictions in Investing in dTAO Subnets:

Core Contradiction:

-

Can subnets attract high-quality miner resources?

-

Is the user evaluation system effective?

Secondary Contradiction:

-

Do subnets possess real commercial application scenarios?

Potential Risk Factors:

-

Transparency and public disclosure of development teams

-

Reasonableness of revenue model design

-

Marketing execution capability

-

Possibility of external capital involvement

-

Token issuance mechanism design

Observations and Expectations

While open-source models represent a mainstream trend in technological evolution, they may face significant development bottlenecks in decentralized environments.

As an industry leader, Bittensor’s dTAO subnet ecosystem still exhibits notable quality deficiencies. Analysis of the top 10 subnets ranked by TAO reward emissions reveals: only one among the top 10 mandates miners to submit open-source models; the rest show weak connections between their miner communities and actual model development.

Open-source model training involves extremely high technical barriers, posing major challenges for Web3 developers. To maintain miner participation, most subnets actively lower technical entry thresholds and avoid enforcing open-source requirements to secure sufficient token incentives.

Even subnets not mandating open-source models exhibit concerning ecosystem quality.

Common Issues Among the Top 10 Subnets:

Lack of Verifiable Real-World Products

-

Excessively high proportion of anonymous development teams

-

dTAO tokens lack effective anchoring to product value

-

Revenue models lack market credibility

-

The underlying philosophy of dTAO is forward-looking, but existing Web3 infrastructure is insufficient to support its idealized ecosystem. This misalignment between vision and reality may lead to two outcomes:

-

Necessary downward revision of dTAO subnet valuation frameworks

-

If Bittensor’s open-source model platform fails validation, the Web3 AI sector may pivot toward lightweight directions such as Agent applications and middleware development

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News