The Death and Rebirth of Superblockchains: A Comparison of Ethereum, Solana, and BNB Chain

TechFlow Selected TechFlow Selected

The Death and Rebirth of Superblockchains: A Comparison of Ethereum, Solana, and BNB Chain

Injury of Zhongyong · Plotting intrigues · Old hand

Author: Zuoye

Ethereum has no dreams; Vitalik refuses to become a lifetime benevolent dictator;

Solana has no底线, the blockchain world's only remaining active conspiracy group;

BNB Chain has no future—beyond极致 marketing, it offers nothing but Binance traffic redirection.

Why Study Public Blockchains?

When you're connected to every retail investor in the crypto industry, you inevitably become infrastructure of the sector. To date, only BTC/ETH as public chains and Binance/Coinbase as exchanges have achieved this—decentralized versus centralized, each building a business that can connect with everyone.

By 2025, no new L1s, non-EVM chains, or market-influential public blockchains will emerge. L2s, Move VM, and Sonic/Bear Chain merely perform rituals around tokens. The battle between Solana and Base resembles corporate conglomerate rivalry far more than technological standard or roadmap disputes.

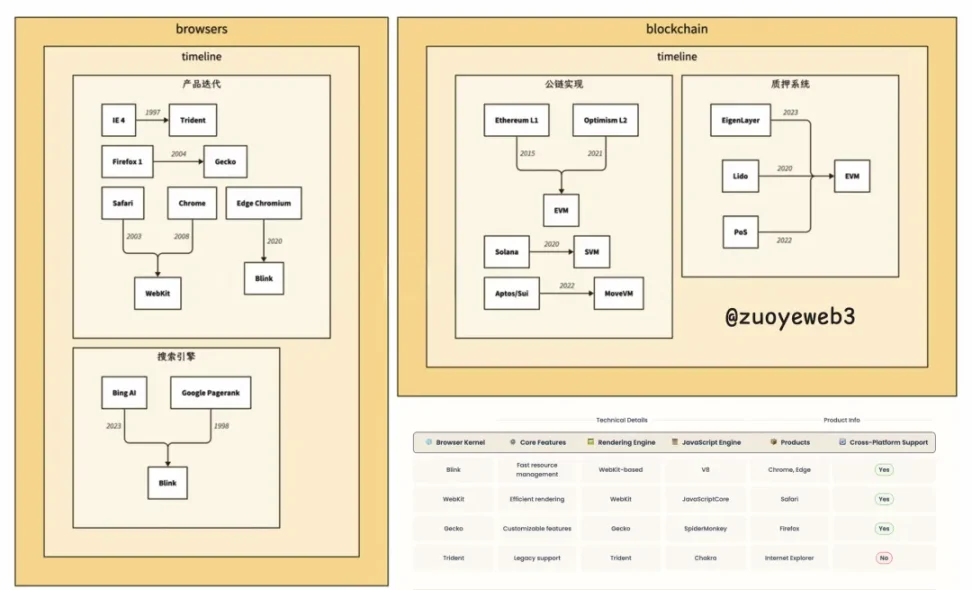

Caption: Public blockchains compared to browser history. Image source: @zuoyeweb3

Based on this, I summarize three themes for this article—essentially a historical retrospective on public blockchains. Just as the new Edge chose Chromium compatibility to restart, a wild era has ended.

-

Finance emerged originally to hedge operational risks, yet from inception, finance itself became the primary source of risk—from the railway protection movement that buried the Qing Dynasty to Bitcoin eroding fiat systems, the pattern holds universally.

-

The evolution of the internet is essentially a brief history of browser kernels, products, and search engines. Translated into blockchain terms: EVM/SVM → ETH/L2, EVM-compatible L1 → PoS node system + super dApps.

-

Public blockchains still rest upon the internet’s most fundamental protocols. After the lawless frontier and the age of exploration, human civilization progresses from villages to cities. The death and rebirth of mega-chains reflect where developers choose to go.

What Must Be Endured Before Becoming Bitcoin

Farewell to Bitcoin's successors, welcome to Base’s rise?

The Ethereum ecosystem embodies an anarchic, individualistic era—an ideal of decentralization, resistance against fiat systems, and the "world computer"—conceived for and dedicated to its time.

After a year of ridicule, Vitalik chose to promote Aya to chair of the Ethereum Foundation (EF). After all, Vitalik himself admitted he alone decides everything at EF.

Yet don't expect too much from Vitalik. He's deeply sentimental. Aya was the “mother who fed him” during his days sleeping on the floor at Kraken—a tender memory from the hero’s humble beginnings.

I won’t list data or charts to prove Ethereum’s problems because Ethereum itself, EF, and the EVM ecosystem aren’t fundamentally broken. BNB Chain and Base won’t switch to SVM anytime soon.

Looking at browser history, Firefox—the purest, most orthodox, and freest successor to Netscape—failed to inherit its glory. Instead, it was absorbed under Google’s dual assault of open-sourcing Chromium and commercializing search. Today, 90% of Firefox’s revenue comes from setting Google as its default search engine, making it de facto Google’s “official opposition.”

The same applies to today’s ETH/EVM ecosystem. Every dApp, every L2, every developer, VC, and KOL within the EVM sphere evolved through natural selection along unique historical trajectories and distinct ecological niches.

ETH, L2s, and EVM are tightly interwoven, forming the current public chain system with the strongest “network effects.” The inherent positive feedback loop of network effects amplifies ecosystem connections—this is precisely why people keep complaining but cannot leave.

Temporary rest doesn’t guarantee lasting peace. Even Trident IE was replaced by Chromium-based Edge. The root issue with Ethereum lies precisely in Vitalik himself—the collapse of governance has led to the current predicament.

Vitalik’s parents were Soviet defectors. He strongly opposes authoritarianism, centralization, and autocratic systems—seeds of the DAO concept. Yet, as previously stated, he openly claims sole authority over EF. The DAO hack and subsequent rollback already proved: absolute lack of decentralization leads to absolute centralization.

Caption: The person deciding the new EF leadership team is me. Image source: @VitalikButerin

Compare Satoshi Nakamoto, who disappeared after accomplishing his mission, leaving neither fame nor trace. Vitalik clearly exists in chaotic neutrality—unwilling to formally lead EF, yet determined to retain final decision-making power. Unfortunately, in governance structures, this is the worst possible state.

Since Machiavelli’s *The Prince*, Max Weber’s analysis of bureaucracy, and Taylor’s scientific management, the corporation has proven the most efficient human organizational model. Silicon Valley’s tech right-wing—figures like Musk and Peter Thiel—believe corporations should govern nations instead of bureaucrats. DOGE is their direct offspring.

But for organizations less focused on “capital efficiency,” such as technical hacker communities, how to govern and coordinate unpaid, globally distributed programmers becomes the social need driving foundations or DAOs. Linux and RISC-V Foundations set examples—but even they aren’t perfect. Communities always face conflicts; hearts aren’t always united.

For projects like Linux and Python, founders traditionally serve as Benevolent Dictators For Life (BDFL). But even that isn’t foolproof. Last October 24th, Linus banned a Russian maintainer—a messy incident. In 2018, after PEP 572 controversy, Python’s creator stepped down from BDFL role—an exit echoing the grace of Aptos co-founder Mo Shaikh resigning or multiple AVAX board members fleeing.

One thing must be acknowledged: in early tech organization development, founder stewardship is indispensable. But EF’s complexity goes further. Capital-efficient corporations answer only to shareholders; socially oriented tech foundations answer only to the project. Programmers remain free to choose or fork across organizations.

But EF differs from both. EF doesn’t need profitability—the ETH treasury is vast. Yet the EVM ecosystem does need profits. This is the awkwardness of Vitalik–EF–EVM. Vitalik performs BDFL duties but rejects the title. Downstream from EF are hungry ETH holders and a massive economic system—all operating under Vitalik’s personal will.

Understanding this explains why Aya’s “infinite garden” strategy is perfectly correct—it’s the only way to ensure EF follows Vitalik’s intent. She is the empire’s patchwork master, the central secretariat’s balancing queen.

Vitalik is like a child holding gold. A young prodigy cannot maintain balance in a complex world. So external help is brought in. But layer by layer, outsiders care more about profit. Vitalik cannot govern EF/Ethereum/EVM like a company, nor does he accept the formal BDFL role like a technical project. After DAO’s partial failure, Ethereum now operates in a state of strict low-speed失控—either slowly fading or being hijacked.

The community now discusses the Pectra upgrade, but attention has dropped to terrifyingly low levels—an omen of decline. Believe me, this won’t be fixed by ETH price pumps or meme coin mascots. Ethereum must now answer: Is it Vitalik’s decentralized, non-financial experiment? Aya’s infinite garden? Or the true “world computer”?

Vitalik personally clings to ideals of decentralization, non-finance, and non-sovereignty. But EF doesn’t. Nor can the broader EVM ecosystem claim to. Scale brings both advantage and curse.

Meanwhile, chains like Base have proven ETH L2s can balance efficiency and low cost. The parallel OP/ZK L2 approach is absolutely valid. Base can operate without a token—more like an advanced consortium chain. If this is EVM’s bouquet to the real world, it’s almost laughable.

Folks, look instead to distant Solana and BNB Chain—at least they’re serious about token prices.

The Blockchain World’s Last Conspiracy Group

Willowy willows, misty flowers droop.

Why compare Ethereum, Solana, and BNB Chain as mega-chains?

BTC needs no comparison. Ethereum’s EVM is the de facto industry standard—like Chrome dominating browsers. Solana resembles Safari: ultra-smooth but centralized. BNB Chain stands as the last surviving legacy among old coins like ADA and XRP with actual on-chain activity.

If crypto has palace intrigues, Solana is Empress Dowager Xi—after disaster strikes Lingyun Peak, she makes a triumphant comeback. Two examples: By February, Solana DEX trading volume surpassed Ethereum for four consecutive months. In March, Solayer’s market cap exceeded EigenLayer. Amid meme downturns, Solana still proves itself.

Especially the latter—staking/re-staking is Ethereum’s innovation, core to PoS systems. Also note: PoS nodes and super dApps correspond to search engines. Google is essentially an ad company, monetizing search traffic by selling ads. PoS chains earn income via staked nodes collecting gas fees. Super dApps generate these fees too—this is the fundamental alignment.

Thus, blockchain prosperity ultimately points to transaction volume. SOL’s token price and cheap gas fees strike a balance between incentivizing validators and encouraging user transactions. The cost? Being labeled a “server farm chain.” But responsibly said, Ethereum remains sufficiently decentralized—even with Lido controlling ~30% of staking.

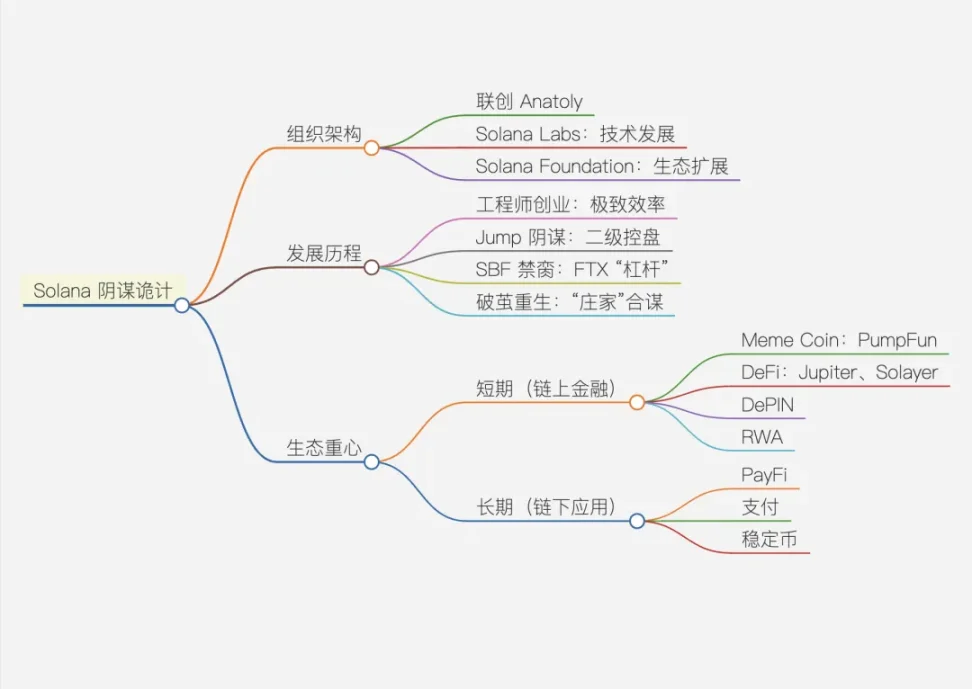

Hence, I love the term “token launch syndicate.” From day one, Solana grew entangled with conspiracies—from Jump and SBF’s tight control to Jupiter DeFi circles in the meme era. These groups carry more PayPal Mafia vibes—chasing extreme capital efficiency—than abstract notions of community or DAO.

Caption: Solana’s indomitable journey. Image source: @zuoyeweb3

In absolute scale, Solana/SVM lags far behind ETH/EVM. But Solana found its optimal strategy: embrace any conspiracy group. If you think token launch syndicates damage Solana’s image, recall Jump, SBF, and now the Trump family. I won’t say they’re good people—but there are certainly no saints.

Labs vs. Foundation: Labs focus on tech progress; the Foundation, led by Lily Liu, aggressively markets. Contrast this with Ethereum’s Vitalik-led, EVM-ecosystem-attracting model. Not suggesting EF should mimic SF—rather emphasizing Vitalik must align name with reality: either lead directly or fully delegate, focusing solely on spiritual guidance. Wanting both guarantees losing both.

Solana was born in darkness, embracing extreme capital efficiency under the banner of decentralization—giving back to token launch syndicates in full measure, delivering 80% gains to retail.

From this angle, Solana represents the inverse of scale effect—the relationship between public chain net income, total assets, and user count. Web2 and industrial firms grow assets with headcount. But in Web3, boosted by token prices, this rule breaks. BTC technically has zero employees. EF and Linux suffer bloat from large teams. Under relatively few controllers, Solana maximizes its economic value.

Caption: SOL vs ETH comparison. Data sources: CMC / Defillama / Token Terminal / Chain Spect

If measuring output per person, Solana deserves first place—here’s a little red flower. With just a quarter of Ethereum’s developer size, Solana surpasses Ethereum in active addresses and dApp revenue—especially impressive given its significant lag in DeFi TVL and stablecoin issuance.

That said, this achievement largely stems from PumpFun dominating meme coin launches. We cannot claim Solana DeFi has fully surpassed Ethereum, especially considering Ethereum’s scale across L2s and the wider EVM ecosystem. Let’s examine BNB Chain for contrast.

From Meme Coin Paradise to Big Brother’s Playhouse

The key isn’t brain size, but having the right ideas.

EVM is Chromium. BNB Chain’s best path is becoming Edge—with Binance playing Microsoft’s role as the ultimate top-tier traffic gateway. Earlier we noted Solana’s highest personnel efficiency. But BNB Chain dominates active addresses: 4.4 million, far exceeding Solana’s 3 million and Ethereum’s 300,000.

Perhaps Binance’s past glory overshadows all. Most still call BNB Chain “BSC.” This small detail reveals everything: BNB Chain’s brightest moments are behind it. Its future advancement cannot rely on memes, because BNB the token—not the ecosystem—is the true core. That’s BNB Chain’s strange beauty.

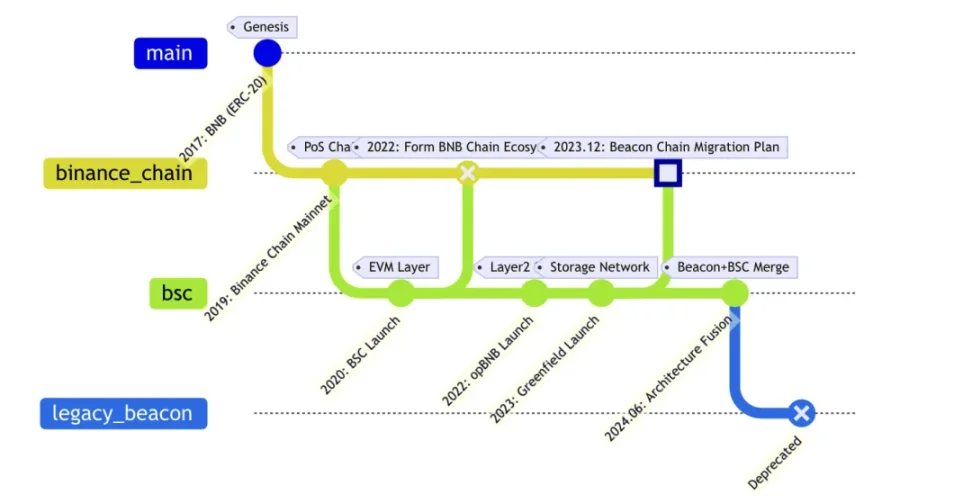

Caption: Evolution of BNB Chain. Data from Binance Academy. Image source: @zuoyeweb3

A quick gripe: BNB Chain’s naming changes highlight big-company disease—clearly passing through multiple leaders, each shifting priorities with industry hype cycles.

Name confusion manifests entropy. Entropy kills. Whether genius, technology, or money—all drift toward disorder and chaos.

Especially BNB Chain’s odd name—it’s as strange as saying “ETH Chain” or “SOL Chain.” Overemphasis on token price rather than ecosystem. As Solana and Ethereum show, moderation is true virtue.

If summarizing BNB Chain’s development philosophy, “follow strategy” fits best: initially mimicking Ethereum, now “copying” Solana. Note: this isn’t criticism. Good tools get adopted widely. AMM DEX swept all markets—can’t accuse everyone of copying Uniswap when Bancor came first.

But BNB Chain’s core flaw is applying exchange logic to chain-building—a fundamentally different mindset, dangerously conflated.

We can map today’s BNB Chain ecosystem mix:

-

Ethereum mindset: DeFi / Staking / RWA / DePIN / DeFAI / Meme

-

CZ mindset: AI First / DeSci / Meme

-

Solana mindset: Payments / Stablecoins / Meme

Meme isn’t prioritized merely because it’s “new.” It’s the consensus zone forged through tripartite博弈. Though CZ and Binance claim no ownership or management of BNB Chain, their influence remains immense.

Especially after CZ was barred from managing Binance, BNB Chain became his main battlefield. We can understand BNB and BNB Chain’s value through the post-split Binance ecosystem.

BNB holds dual identity: as Binance’s platform token, empowered by Binance’s main ecosystem; then as value backing for BNB Chain, satisfying both legacy high-tier node returns and new users seeking fast, low-cost meme surfing.

If Binance’s equity split is CZ/He Yi 9:1, then BNB price growth and node yields are the only ways to reward node users—ensuring large holders maintain willingness to hold BNB. Thus, retail gas fees must be consumed by爆款 hits.

As long as pump-and-dump (ecosystem funding) stays below user fee contributions, BNB becomes a cash cow. Especially now as CZ begins selling shares, BNB stability is critical. Remember, when Binance launched, it sold BNB—not equity. Maintaining BNB’s value and price are two sides of the same coin.

Only with this understanding can we grasp the meaning behind BNB Chain’s frequent liquidity subsidy campaigns: BNB Chain aims to be a cash flow shield for Binance’s main site—not a hemorrhaging spillway.

But no flower blooms 100 days. Power shifts. A Binance fully aligned with America’s political structure—can it survive midterm elections and another four years unchanged? Only heaven knows.

Because Base and Solana are more American, while Ethereum and BTC are more global. Today’s public chain paths split into two: 99% belong to America, 1% to all humanity. No middle ground exists.

Conclusion

Firefox, Netscape’s spiritual successor, nurtured Rust language. Rust preceded Solana and Move VM—a bond linking Web3 and Web2.

Vitalik once considered interning at Ripple, nearly becoming Sun’s colleague. Was it luck or misfortune? Sun failed to inject Eastern philosophy into Vitalik—and Tron earned the stigma of copying Ethereum.

In contrast, Solana’s story lacks legend, BNB’s reads like corporate history. Yet all eyes remain on Vitalik—he “defeated” Ethereum’s seven co-founders to become its chief spokesperson. A product of historical opportunity—and a heavy responsibility.

Milady!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News