Next Bull Market Driver: An Overview of Mainstream Paradigms, Opportunities, and Challenges in Web3 Consumer Applications

TechFlow Selected TechFlow Selected

Next Bull Market Driver: An Overview of Mainstream Paradigms, Opportunities, and Challenges in Web3 Consumer Applications

Only with greater Mass Adoption of consumer-grade applications will this overbuilt infrastructure ecosystem achieve genuine user adoption and sustainable commercial value.

Author: @Web3Mario

Abstract: Market sentiment has recently been rather bleak. As anticipated policy-driven tailwinds materialize below expectations, and high-profile meme coins linked to figures like Trump have drained liquidity from the crypto speculative market, the two-year-long wave of cryptocurrency speculation—driven by macroeconomic tailwinds and liquidity inflows—appears to be coming to an end.

In response, an increasing number of investors and believers are now contemplating the next value narrative for the Web3 industry. Among these discussions, Web3 consumer applications have emerged as a focal point. Only through mass adoption driven by more consumer-grade applications can this overbuilt infrastructure ecosystem achieve genuine user adoption and sustainable commercial value.

Given this context, I’ve spent considerable time reflecting on Web3 consumer applications and would like to share some insights with you.

This article provides an overview of current mainstream paradigms in Web3 consumer applications, exploring their respective opportunities and challenges. In follow-up articles, I will continue to share specific market opportunity insights and welcome conversations with readers.

What Is a Web3 Consumer Application?

A "Consumer Application," or To C application in Chinese context, targets everyday individual users rather than enterprise clients. Open your App Store—nearly all apps there fall into this category. A Web3 Consumer Application refers to software applications面向 consumers that incorporate Web3 characteristics.

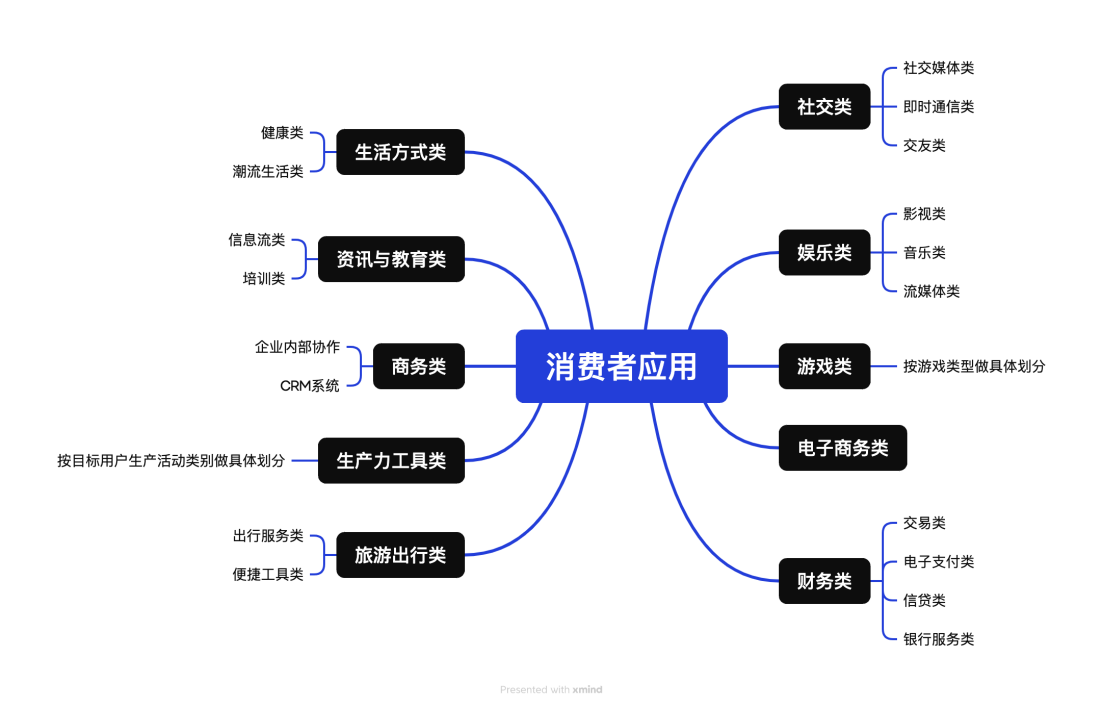

Typically, following standard App Store categorizations, we can broadly divide the entire Consumer Application landscape into 10 main categories, each with further subcategories. As markets mature, many new products combine features across categories to differentiate themselves. Still, we can classify them based on core value propositions.

Current Paradigms of Web3 Consumer Applications: Opportunities and Challenges

To date, I identify three common paradigms in Web3 consumer applications:

1. Leveraging technical features of Web3 infrastructure to improve existing problems in traditional consumer applications:

This is a prevalent approach. Given that much investment in Web3 has focused on infrastructure development, creators using this paradigm aim to leverage Web3's technological advantages to strengthen product competitiveness or offer novel services. These innovations generally deliver benefits in two key areas:

l Ultimate privacy protection and data sovereignty:

n Opportunity: Privacy has long been a central theme in Web3 infrastructure innovation—from early asymmetric encryption-based identity systems to advanced integrations of technologies like ZK, FHE, and TEE. Many Web3 technologists operate under a strong assumption of distrust, striving to build networks that require no third-party trust while enabling secure information and value exchange. The most direct benefit is user ownership of data—personal information can remain stored locally on trusted hardware or software, minimizing privacy breaches. Numerous Web3 consumer applications follow this model, especially those branded as “decentralized X,” such as decentralized social media platforms, AI models, or video-sharing sites.

n Challenge: Years of market validation show limited competitive advantage when privacy is the sole selling point. Two reasons: First, average consumers only prioritize privacy after major data breaches or violations occur. In most cases, stronger regulations effectively mitigate these concerns. Thus, if enhanced privacy comes at the cost of worse usability or higher expenses, its appeal diminishes significantly. Second, most consumer app business models rely on extracting value from aggregated user data (e.g., targeted advertising). Overemphasizing privacy fragments data into silos, undermining established monetization strategies. If projects then resort to "Tokenomics" for sustainability, they introduce unnecessary speculative elements. This diverts team resources toward managing token dynamics and hinders Product-Market Fit (PMF) discovery—a point discussed further below.

l Low-cost, global, 24/7 trusted execution environment:

n Opportunity: The emergence of numerous Layer 1 and Layer 2 blockchains offers developers a new globally accessible, always-on, multi-party trusted environment for program execution. Traditional software providers run applications independently—on private servers or cloud infrastructure—which introduces trust costs in multi-party scenarios, especially when parties are equally powerful or handling sensitive data (e.g., cross-border payments). Web3’s execution environment reduces these trust-related development and usage costs. Stablecoins exemplify this use case effectively.

n Challenge: While cost reduction and efficiency gains are compelling, identifying viable use cases remains difficult. The benefits manifest only when a service involves multiple independent parties of comparable scale dealing with highly sensitive data—an admittedly narrow condition. So far, most such applications reside within financial services.

2. Using crypto assets to design new marketing strategies, loyalty programs, or business models:

Similar to the first paradigm, developers adopting this approach seek to enhance their products in already validated markets by integrating Web3 elements. However, they specifically focus on leveraging the high financialization of crypto assets to innovate in marketing, user retention, or monetization.

All investment assets possess two types of value: commodity value (utility in real-world use cases, e.g., housing for real estate) and financial value (trading/speculative value). Crypto assets are uniquely characterized by extremely high financial value relative to their utility. For many developers, introducing crypto assets brings three potential benefits:

l Reducing customer acquisition costs via token-based campaigns like Airdrops:

n Opportunity: Early-stage user acquisition at low cost is critical for consumer apps. Tokens, being costless to mint yet highly financially attractive, allow startups to acquire users without spending cash on ads or promotions. Compared to paying for traffic, distributing tokens offers superior cost-effectiveness—functionally acting as "advertising tokens." Many projects in ecosystems like TON or Web3 gaming adopt this strategy.

n Challenge: This method faces two key issues. First, converting acquired users into active product users is extremely difficult. Most attracted participants are crypto speculators focused solely on rewards, not product utility. With professional airdrop farmers and farming syndicates dominating participation, turning them into genuine users becomes nearly impossible. This may also lead teams to misjudge PMF and overinvest in flawed directions. Second, as this model proliferates, the marginal return on airdrop-driven acquisition declines—requiring increasingly larger incentives to maintain attention, thus raising effective costs.

l X-to-Earn based user loyalty programs:

n Opportunity: Retention and engagement are ongoing challenges. Similar to marketing, leveraging token financialization can reduce the cost of keeping users active. The most representative model is "X-to-Earn"—rewarding predefined user behaviors with tokens to build loyalty programs.

n Challenge: Relying on earning incentives shifts user focus from product functionality to yield generation. Once returns decline, user engagement plummets—especially damaging for apps dependent on User-Generated Content (UGC). If yields depend on the project’s own token price, teams face constant pressure to manage valuation. During bear markets, maintaining such programs incurs unsustainable operational costs.

l Direct monetization through token financialization:

n Opportunity: Traditional consumer apps typically monetize either through ad revenue after achieving scale or via premium subscriptions. Both paths are challenging—one slow, the other hard. Crypto tokens offer a third path: direct monetization by selling tokens to raise capital.

n Challenge: This model is clearly unsustainable. After the initial growth phase, lack of new capital inflows turns it into a zero-sum game, inevitably pitting project interests against user interests and accelerating churn. Without robust operating revenue, teams must rely on fundraising, making survival contingent on volatile market conditions—a precarious dependency.

3. Fully serving native Web3 users by addressing their unique pain points:

The final paradigm encompasses consumer applications built exclusively for native Web3 users. These can be divided into two innovation directions:

l Creating new narratives and monetizing previously unexplored value elements among native Web3 users, forming new asset classes:

n Opportunity: By offering new speculative assets (e.g., in SocialFi), projects gain pricing power from day one, capturing monopoly-like profits. In traditional industries, such dominance requires years of competition and barrier-building.

n Challenge: This approach heavily depends on team connections—specifically, securing endorsement from influential figures who hold “pricing power” over crypto assets within the native community. Two difficulties arise: First, pricing authority shifts dynamically—from early crypto OGs to VCs, CEXs, KOLs, and now even politicians and celebrities. Recognizing these transitions and aligning with emerging powerholders demands exceptional market sensitivity and network agility. Second, gaining cooperation from such gatekeepers often requires substantial concessions. You're not just competing within an app category—you’re vying for attention among *all* new crypto asset creators targeting the same influencers. It’s an intensely competitive arena.

l Providing tool-based products that fulfill unmet needs of native Web3 users, or improving their experience with better, more convenient solutions:

n Opportunity: This paradigm holds the most long-term potential. As crypto adoption grows, the base of native users expands, enabling deeper segmentation. Because these tools address real, specific needs, they tend to achieve PMF more reliably and build stronger business models—examples include trading analytics platforms, trading bots, and news aggregators.

n Challenge: Despite stronger fundamentals, development cycles are longer. Since success hinges on actual utility—not hype—PMF is easier to validate but harder to fund early on. Such projects rarely attract large investments initially, making it difficult to stay patient and mission-focused amid the noise of quick-rich stories fueled by token launches or sky-high valuations.

Of course, these three paradigms aren't mutually exclusive—many projects exhibit traits from multiple categories. For founders entering the Web3 consumer application space, the key lies in honestly assessing your strengths and goals to choose the most suitable paradigm.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News