BTC falls below $90,000 threshold—what are the experts predicting for the market outlook?

TechFlow Selected TechFlow Selected

BTC falls below $90,000 threshold—what are the experts predicting for the market outlook?

Arthur Hayes remains bearish, targeting $70,000; Chris Burniske firmly believes this is just a bull market pullback.

Author: Azuma, Odaily Planet Daily

This morning, we just published a market update titled "Market Accelerates Downward—Is BTC Really Headed to 70,000?" We thought we were mentally prepared for further declines, but didn't expect a new round of accelerated selling to hit so quickly.

At around 15:30, BTC broke below the $90,000 mark for the first time in nearly a month and a half. According to OKX data:

-

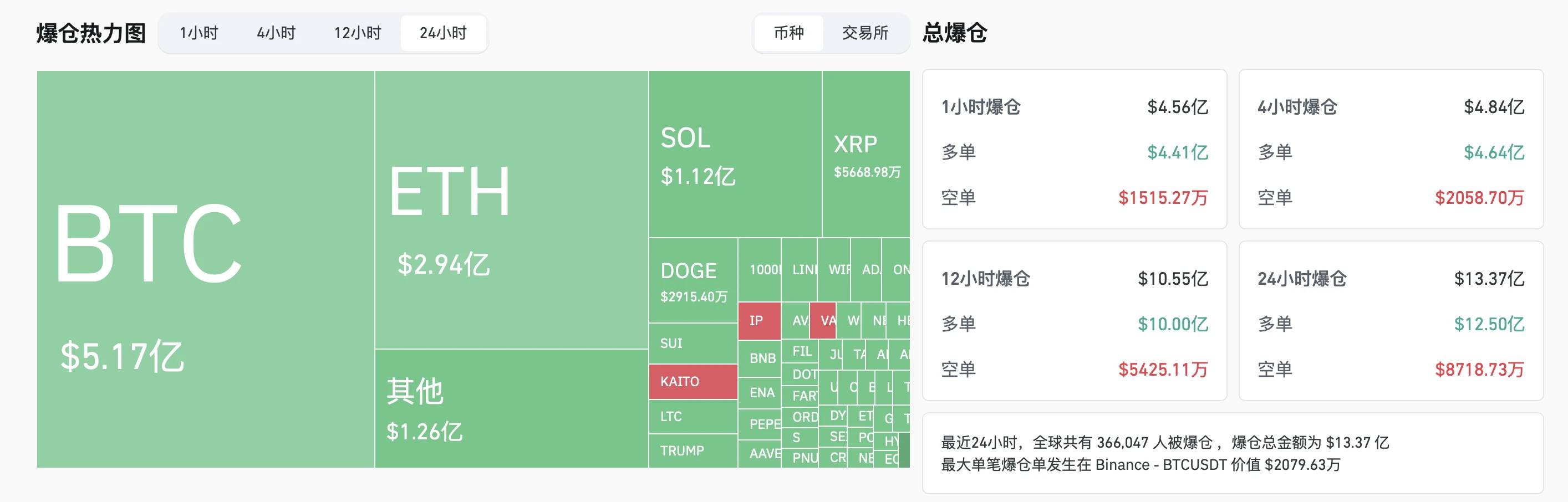

BTC briefly dropped as low as $88,189, currently trading at $89,204, down 6.80% over the past 24 hours;

-

ETH briefly fell to $2,315, now at $2,378.01, down 12.5% over 24 hours;

-

SOL dipped to $132.8, now at $136.5, down 15.12% over 24 hours;

-

Other altcoins and on-chain memecoins aren’t worth elaborating on—most are down more than 10%, even exceeding 20%.

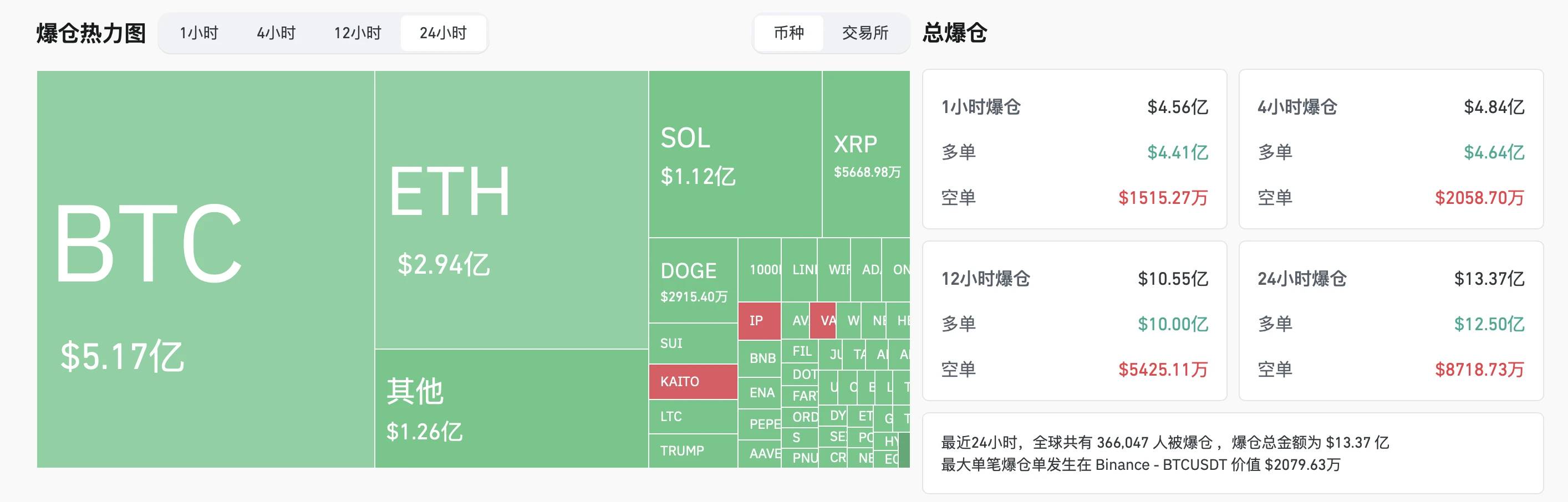

In derivatives data, Coinglass shows that total liquidations across all platforms reached $1.337 billion in the past 24 hours, with the vast majority being long positions—$1.25 billion. By asset, BTC saw $517 million in liquidations, while ETH had $294 million.

Targeted Strike Against a Major Contract Trader?

Regarding the cause of this sharp drop, some community members interpret it as powerful players deliberately targeting a large contract trader (nicknamed "Set 10 Big Goals First") who held long BTC positions on a CEX.

Community screenshots show the user’s average entry price was $100,320.8, holding as much as 5,184.527 BTC, with an estimated liquidation price at $82,592.68.

However, as the market accelerated downward, the whale appears to have exited early. On-chain analyst Ai Auntie reported that the long BTC contract holder cut losses—over the past five minutes, they sold 1,783.48 BTC at an average price of $89,138, totaling $159 million.

Meanwhile, X user jasonleo, suspected to be the trader themselves, responded regarding this position. jasonleo admitted “acknowledging the mistake and exiting, giving back profits,” but clarified there was no “loss-making exit—principal remains intact,” due to delayed live account integration, meaning earlier profits weren’t captured by on-chain data platforms.

The trader concluded: “From $700 million profit to zero, missing the final shot toward a $1 billion target—what a pity.”

What Are Industry Leaders and Institutions Saying?

In our morning article, we briefly covered views from Arthur Hayes, co-founder of BitMEX, and Chris Burniske, partner at Placeholder, on future outlooks—Arthur Hayes remains bearish, forecasting a drop to $70,000; Chris Burniske firmly believes this is merely a bull market correction.

To help readers better assess the market outlook, we’ve compiled additional perspectives from key figures and institutions, detailed below.

OKX: Multiple Factors Trigger This Downturn—Future Outlook Hinges on Influx of New Capital

Zhao Wei, Senior Researcher at OKX Research Institute, analyzed that this market decline was driven by multiple factors including global trade tensions, U.S. stock market plunge, leveraged liquidations, institutional fund withdrawals, frequent security incidents, and fading hype around the SOL ecosystem.

On the macro front, tightening liquidity continues to pressure risk assets. Rising expectations of a Bank of Japan rate hike pushed the yen past the 149 level against the dollar, directly impacting the world's largest carry-trade vehicle. Meanwhile, the Nasdaq has declined over 4% for three consecutive days, reducing tech valuations and lowering market risk appetite, further affecting high-beta assets like Bitcoin. Additionally, a stronger dollar increases risk-free yields, attracting capital back into safer assets and accelerating outflows from high-risk investments.

In the crypto market, internal fragilities have been amplified during this downturn. First, the reversal of institutional capital flows has become a critical pressure point. Recently, spot Bitcoin and Ethereum ETFs have seen continuous net outflows, breaching cost bases for some institutional holders and triggering algorithmic sell-offs. Second, in the derivatives market, major institutions have significantly reduced their Ethereum futures exposure, signaling a shift in market sentiment. Furthermore, the SOL ecosystem faces liquidity challenges—on-chain memecoin trading volume is declining, speculative capital is leaving, market makers are reducing quote depth, on-chain liquidations are surging, and protocol revenues are falling, potentially forcing a revaluation of SOL’s ecosystem model. A wave of leveraged liquidations has further intensified market volatility, with some crypto assets breaking key support levels, triggering cascading DeFi liquidations. At the same time, recent security breaches have worsened market trust issues, raising investor concerns about asset safety and further weakening confidence in the crypto space.

Going forward, market direction will depend on both macro conditions and internal dynamics, but the core factor remains sustained inflows of new capital. However, with current global economic uncertainty and rising tariff pressures dampening risk appetite, crypto recovery will require a return of institutional funds and the emergence of new killer applications to reshape narratives and achieve healthy market adjustments. Currently, the crypto market is experiencing a confluence of three pressures: tightening macro liquidity, internal ecosystem rebalancing, and exposure of structural fragility. Users should closely monitor cycles of technological innovation in the industry, earnings reports from U.S. tech stocks, and the pace of policy adjustments by global central banks. Only when stablecoin inflows resume positive growth, futures open interest bottoms and rebounds, and major coins stabilize on weekly charts can a market recovery phase be confirmed.

Matrixport: Further Decline Likely, Limited Buying Demand

Matrixport commented on today’s market move: “Bitcoin has broken below the ascending expanding wedge, which isn’t what we hoped for, but this pattern typically signals downside risk unless price quickly rebounds back inside the wedge. The likelihood of further decline remains high, especially given this breakdown occurred during a period of weak trading activity, indicating limited buying interest on dips.”

“While we still expect room for price gains in the second half of the year, this technical breakdown has made market sentiment more cautious. Moreover, not only Bitcoin has broken down—Ethereum has also fallen below the key support zone of $2,600–$2,800.”

Raoul Pal: Just a Correction—Learn to Filter Out the Noise

Raoul Pal, co-founder and CEO of Real Vision, commented on the dip: “Stay patient. The current market structure is very similar to 2017. Back then, BTC experienced five corrections greater than 28%, each lasting 2–3 months before reaching new highs, while altcoins generally dropped over 65%. The market is full of noise—go do something more meaningful than staring at charts.”

Ansem: Watch for Recovery Above 96,500, Beware of Broader Equity Market Drop

Prominent trader Ansem posted on X that the key focus going forward is whether BTC can reclaim the ~$96,500 level. But more importantly, if the crypto market is already pricing in broader risk-off sentiment, and if equity indices collapse in the coming weeks, this could mark the beginning of a downtrend rather than just a minor pullback within an uptrend.

CoinDesk Analyst: Nasdaq Drop + BOJ Rate Hike Fears Spark Crash

Omkar Godbole, Managing Editor of CoinDesk’s Market Analysis team, attributed this crypto crash to rising expectations of a Bank of Japan rate hike and falling Nasdaq futures. Market data shows Nasdaq futures down 0.3%, extending a three-day losing streak—the tech index has declined over 4% since February 18.

The safe-haven yen traded at 149.38 per dollar, nearing Monday’s near-three-month high of 148.84. As markets bet on a BOJ rate hike, the yen has gained nearly 6% in six weeks. The BOJ’s hawkish tone and yen strength echo last July’s situation—when the central bank raised rates, the yen surged, sparking broad risk aversion, causing Bitcoin to plunge from around $65,000 to $50,000 within days.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News