The "uninvestable" U.S. Treasuries might be the highest-returning asset in 2026

TechFlow Selected TechFlow Selected

The "uninvestable" U.S. Treasuries might be the highest-returning asset in 2026

2026 will ultimately become the year of bonds.

Author: Common Sense Investor (CSI)

Translation: TechFlow

TechFlow Editorial: As the macro environment undergoes dramatic shifts in 2026, market logic is undergoing a profound transformation. Veteran macro trader Common Sense Investor (CSI) presents a contrarian view: 2026 will be the year bonds outperform stocks.

Based on the U.S. government's mounting interest burden, gold signaling deflationary pressures, extremely crowded short positions in bonds, and looming trade conflicts, the author argues that long-duration U.S. Treasuries (such as TLT) are poised at an inflection point offering "asymmetric payoff" potential.

At a time when the market widely considers bonds “uninvestable,” this article uses rigorous macro-mathematical reasoning to reveal why long-dated bonds may become the highest-returning asset class in 2026.

The article proceeds as follows:

Why I’m Overweighting TLT and TMF — And Why Stocks Will Underperform in 2026

I write this with full conviction: 2026 is destined to be the year bonds outperform stocks. This isn’t because bonds are “safe,” but because macro mathematics, positioning dynamics, and policy constraints are converging in unprecedented fashion—and such configurations rarely end with “higher for longer” interest rates.

I am backing my view with real capital.

TLT (the ETF tracking U.S. Treasury bonds with maturities over 20 years) and TMF (a 3x leveraged ETF on long-dated Treasuries) currently make up approximately 60% of my portfolio. This piece consolidates data from my recent posts, adds fresh macro context, and outlines a compelling bull case for long-duration bonds—especially TLT.

Core Arguments Summary:

- Gold’s Signal: Gold’s historical behavior does not forecast sustained inflation—it signals deflation or deflation risk.

- Fiscal Deficit: The U.S. fiscal math is breaking down: ~$1.2 trillion in annual interest expenses, and rising.

- Issuance Structure: The Treasury’s tilt toward short-term issuance quietly amplifies systemic refinancing risk.

- Short Squeeze Risk: Long-dated bonds are among the most crowded short trades in the market.

- Economic Indicators: Inflation is cooling, sentiment is weak, and labor market stress is building.

- Geopolitics: Geopolitical and trade headlines are shifting toward “risk-off,” not “reflation.”

- Policy Intervention: When cracks appear, policy invariably shifts to suppress long-end yields.

This combination has historically been rocket fuel for TLT.

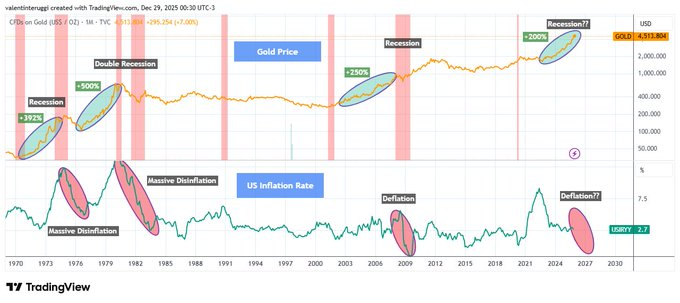

Gold Is Not Always an Inflation Warning Signal

Whenever gold rises over 200% within a short period, it does not signal runaway inflation—but rather economic stress, recession, and declining real interest rates (see Figure 1 below).

Historical patterns show:

- After gold’s surge in the 1970s came recession + disinflation.

- After its spike in the early 1980s came double-dip recessions and broken inflation.

- Early 2000s gold gains foreshadowed the 2001 recession.

- The 2008 breakout preceded a deflationary shock.

Since 2020, gold has again risen about 200%. This pattern has never ended in persistent inflation.

When growth turns, gold behaves more like a safe-haven asset.

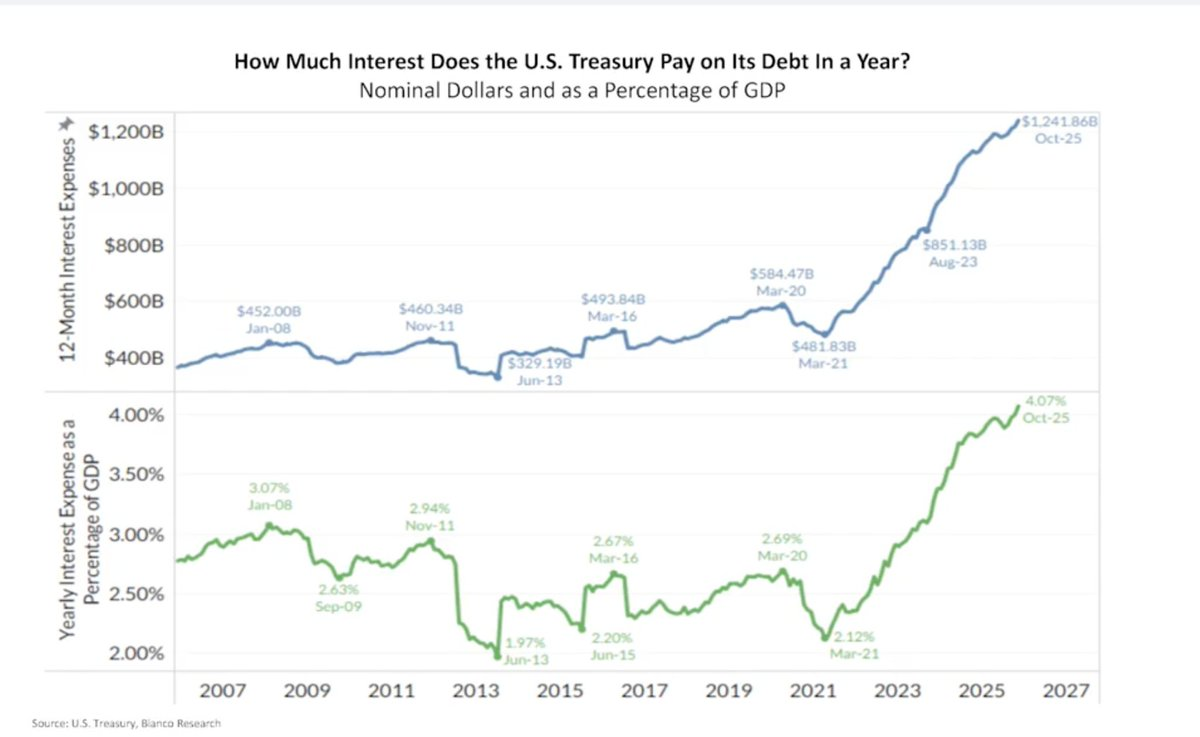

U.S. Interest Expenses Are Compounding Rapidly

The U.S. now pays around $1.2 trillion annually in interest—approximately 4% of GDP (see Figure 2 below).

This is no longer theoretical. It’s real money flowing out—and when long-term yields remain high, interest costs compound rapidly.

This is what’s known as fiscal dominance:

- Higher rates → higher deficits

- Higher deficits → more debt issuance

- More issuance → higher term premium

- Higher term premium → even higher interest costs!

This death spiral won’t resolve itself under “higher for longer.” It must be resolved through policy intervention!

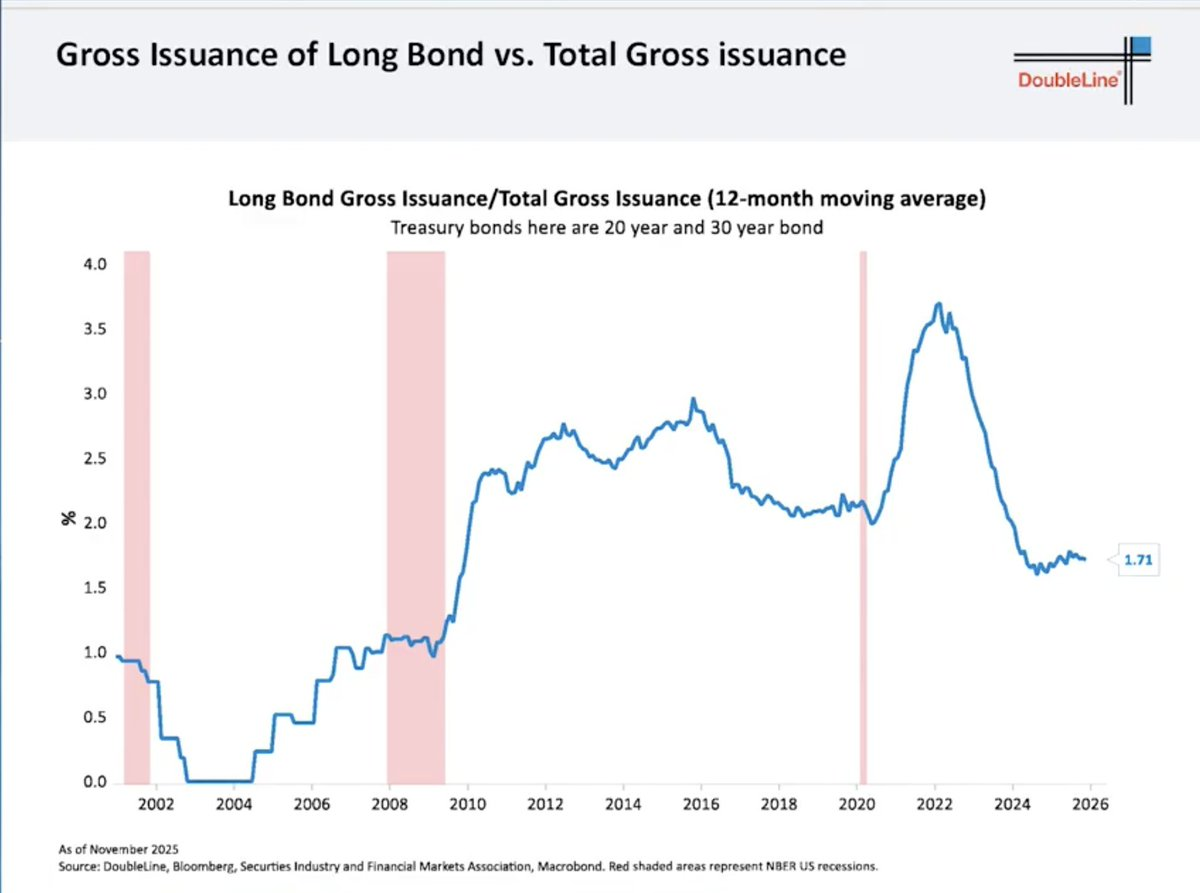

The Treasury’s Short-Term Trap

To ease near-term pain, the Treasury has drastically cut long-dated bond issuance:

- 20- and 30-year bonds now account for only ~1.7% of total issuance (see Figure 3 below).

- The rest has been pushed into short-term Treasury bills.

This doesn’t solve the problem—it merely kicks it forward:

- Short-term debt must constantly roll over.

- Refinancing will occur at future interest rates.

- The market sees the risk and demands higher term premiums.

Ironically, this is precisely why long-end yields stay elevated—and why they could collapse sharply once growth falters.

The Fed’s Last Resort: Yield Curve Control

The Fed controls short-term rates, not long-term ones. But when long-end yields:

- Threaten economic growth

- Trigger an explosion in fiscal costs

- Destabilize asset markets

…the Fed has historically done one of two things:

- Purchase long-term bonds (QE – Quantitative Easing)

- Ceil long-term yields (Yield Curve Control)

The Fed doesn’t act preemptively. They intervene only after pressure becomes undeniable.

Historical precedents:

- 2008–2014: 30-year yield fell from ~4.5% to ~2.2% → TLT surged +70%

- 2020: 30-year yield dropped from ~2.4% to ~1.2% → TLT rose +40% in under 12 months

This isn’t theory—it’s already happened!

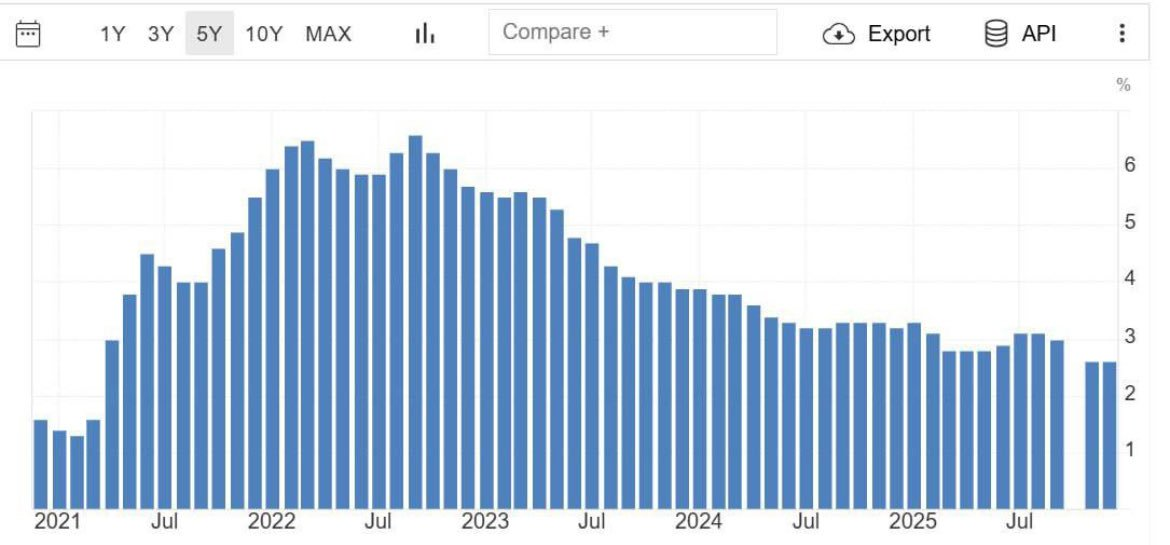

Inflation Is Cooling, Economic Cracks Are Emerging

Recent data shows core inflation reverting to 2021 levels (see Figure 4).

- CPI momentum is fading.

- Consumer confidence is at a decade-low.

- Credit stress is accumulating.

- Labor market is showing signs of strain.

Markets are forward-looking. The bond market is already sniffing this out.

Extremely Crowded Short Positions

Short interest in TLT is exceptionally high:

- About 144 million shares sold short.

- Days to cover exceed 4 days.

Crowded trades don’t unwind slowly—they reverse violently, especially when narrative shifts occur.

And critically:

“Shorts piled in after the move began—not before.”

This is classic late-cycle behavior!

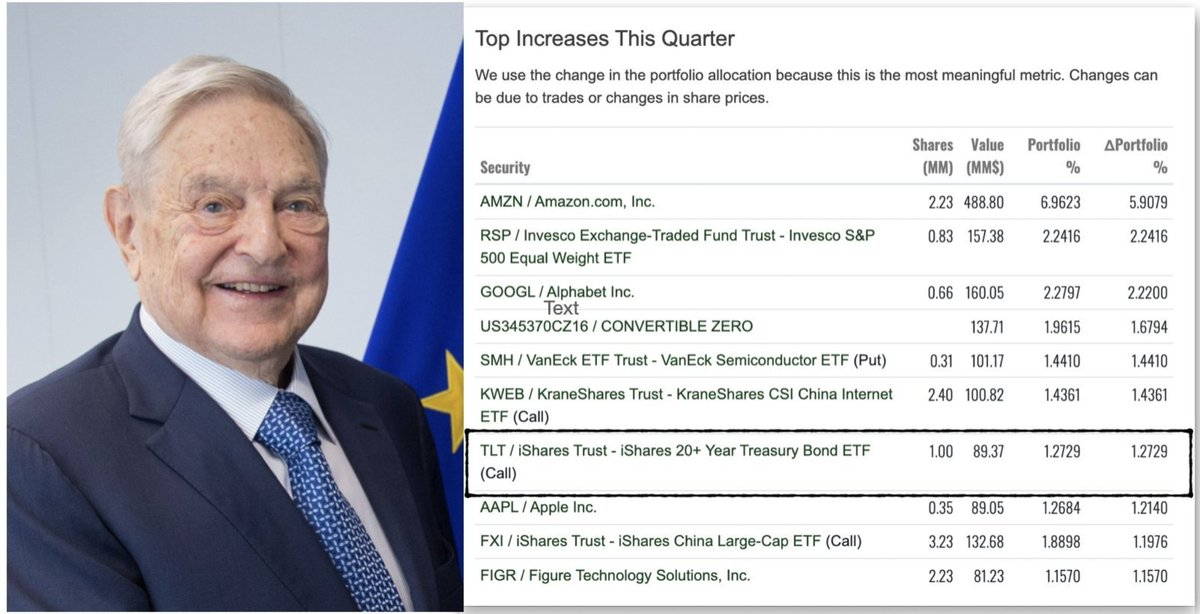

Smart Money Is Moving In

Recently disclosed 13F filings show a major fund accumulating large quantities of TLT call options during the quarter.

Regardless of who’s behind it, the message is clear: sophisticated capital is beginning to reposition into duration. Even George Soros’s fund was revealed in the latest 13F to hold TLT call options.

Tariff Tensions Bring Deflationary Shock

Latest headlines reinforce the “risk-off” narrative. President Trump has issued new tariff threats over the Denmark/Greenland dispute, prompting European officials to publicly discuss freezing or suspending the EU-U.S. tariff agreement in response.

Trade tensions will:

- Hamper growth

- Squeeze profit margins

- Reduce demand

- Drive capital into bonds rather than equities

This is not an inflationary impulse—it’s a deflationary shock.

Valuation Mismatch: Stocks vs Bonds

Today’s stock prices assume:

- Strong growth

- Stable profit margins

- Benign financing conditions

Bond prices reflect:

- Fiscal stress

- Sticky inflation concerns

- Permanently high yields

If either narrative proves wrong, returns will diverge sharply.

Long-duration bonds have convexity—stocks do not.

$TLT Bull Case Scenario

TLT offers:

- An effective duration of ~15.5 years

- A running yield of ~4.4–4.7% while you wait

Scenario Analysis:

- If long-end yields fall by 100 basis points (bps), TLT delivers a price return of +15–18%.

- If yields drop 150 bps, TLT returns +25–30%.

- If yields fall 200 bps (not extreme historically), TLT surges +35–45% or more!

And that doesn’t include coupon income, convexity benefits, or acceleration from short-covering. This is why I see “asymmetric upside.”

Conclusion

To be honest: after the devastation of 2022, I swore I’d never touch long-duration bonds again. Watching duration assets get crushed was deeply painful.

But markets don’t care about your emotional scars—they only respond to probabilities and prices.

When everyone agrees bonds are “uninvestable,” when sentiment hits rock bottom, when short positions pile up, and when yields are high amid rising growth risks…

That’s exactly when I start buying!

- TLT + TMF now make up ~60% of my portfolio. I earned 75% in the 2025 stock rally and redeployed most of those gains into bond ETFs by November 2025.

- I am now “holding bonds for yield” (earning over 4%) while waiting for the turn.

- My positioning is based on shifts in policy and growth—not empty narratives.

2026 will ultimately be the year of the bond.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News