Two swords of Damocles hanging over the United States: stablecoins and U.S. debt

TechFlow Selected TechFlow Selected

Two swords of Damocles hanging over the United States: stablecoins and U.S. debt

We cannot let corruption blind us to the broader reality: blockchain technology is here to stay.

Author: Musol

Not long ago, the U.S. Senate advanced the procedural motion for the GENIUS Act by a vote of 66 to 32, signaling that stablecoins are entering the "operational phase" of federal legislation.

The U.S. Senate voted 66 to 32 to advance debate on the GENIUS stablecoin bill. Source: U.S. Senate

This may be the first time in our generation witnessing the "on-chain issuance of the dollar" entering legislative focus; it may also be the first time we witness whether stablecoins and U.S. debt—the two swords of Damocles—will finally fall and pierce through humanity's last utopia. Behind this lies a profound restructuring of cryptocurrencies, the Web3 ecosystem, and the global payment landscape.

Pt.1. The Coin of Damocles

Why is the stablecoin bill so important?

As the name suggests, stablecoins are cryptocurrencies pegged to assets like the U.S. dollar, maintaining stable value. They serve as a "bridge" in the crypto market, widely used in trading, cross-border payments, and decentralized finance (DeFi). In 2024, the global stablecoin market surpassed $200 billion, with dollar-pegged stablecoins dominating. However, due to the lack of clear regulatory frameworks, the stablecoin industry has long operated in a gray zone, facing scrutiny over money laundering, fraud, and systemic risks.

The core objective of the GENIUS Act is to establish clear regulatory rules for stablecoin issuers, including:

-

Issuance requirements: Stablecoin issuers must obtain federal or state licenses and meet strict capital and reserve requirements.

-

Anti-money laundering and security: Strengthen anti-money laundering (AML) and know-your-customer (KYC) measures to ensure stablecoins are not used for illegal activities.

-

Consumer protection: Provide users with transparency and financial safeguards to prevent tragedies like the 2022 TerraUSD collapse.

-

Extraterritorial jurisdiction: Restrict foreign stablecoins from entering the U.S. market, reinforcing the dollar’s “dominance” in the crypto world.

This vote is not only about regulating the crypto industry but also seen as a strategic move by the U.S. in the global fintech competition. As U.S. Treasury Secretary Bessent stated: “Dollar-backed stablecoins will maintain the dollar’s status as the world’s primary reserve currency.”

Final outcome of the bill passage: Who wins, who loses?

If the GENIUS Act passes smoothly, several sectors will undergo major changes:

Winners:

-

Stablecoin issuers: Leading issuers such as Tether (USDT) and Circle (USDC) will gain legal recognition. Though compliance costs will rise, market trust will significantly increase.

-

Crypto exchanges: With clearer regulations, platforms like Coinbase and Kraken could attract more institutional capital, driving trading volume upward.

-

Dollar dominance: By restricting foreign stablecoins from entering the U.S., dollar-backed stablecoins will further solidify their global financial leadership. European Central Bank President Lagarde once warned: “Dollar-based stablecoins could threaten euro monetary sovereignty.”

-

Investors: The normalization of stablecoins will reduce market risk, attracting more traditional capital into crypto and pushing up asset prices.

Losers:

-

Non-compliant issuers: Small stablecoin projects unable to meet regulatory standards may be eliminated.

-

Foreign stablecoins: Euro- or yuan-pegged stablecoins will face restrictions in the U.S. market.

-

Decentralization idealists: Strict KYC and AML requirements may undermine cryptocurrency anonymity, sparking community backlash.

What lies behind the 'freedom' of stablecoins?

"From internal conflict to a death spiral, the higher you climb, the harder you fall."

Internal Conflict—Why does Trump support cryptocurrency development?

The two main pain points in cryptocurrency today are—how to exchange with fiat currencies & excessive volatility across different coins

To address these issues and build a more complete cryptocurrency ecosystem, Tether issued the USDT stablecoin. Tether claims that for every dollar received from a customer, one USDT is issued; when a customer returns one USDT and retrieves one dollar, one USDT is destroyed.

If everything works normally, one USDT equals one U.S. dollar.

With continued growth in cryptocurrency adoption, many merchants now accept crypto payments—for example, buying pizza. In such cases, USDT functions like a "banknote," replacing physical "gold and silver" to enable monetary circulation.

Seems flawless, doesn’t it?

Are there bugs? Yes.

BUG 1: Could Tether overissue? For instance, holding only $10 million in equivalent assets (whether dollars, U.S. Treasuries, or stocks), yet issuing 20 million USDTs. Even during the era of private banks issuing banknotes, this kind of overissuance was never fully avoidable. Tether has previously been blacklisted by banks in the U.S. and Taiwan over overissuance concerns, which serves as evidence.

If BUG1 remains speculative, then BUG2 represents a real vulnerability.

BUG 2: After receiving one dollar from a customer and issuing one USDT, Tether does not lock that dollar away—it instead uses it to purchase other assets, such as U.S. Treasuries. The U.S. Treasury or secondary-market bond sellers receiving that dollar will continue circulating it.

In short, the original one dollar in the real world never exits circulation, while the one USDT in the crypto world can also act as a "banknote" participating in real-world transactions.

The initial one dollar becomes two dollars.

If the U.S. Treasury sells one dollar worth of bonds, uses the proceeds to buy USDT, and Tether in turn buys more Treasuries with that dollar—and so on—eventually, Tether holds an infinite amount of U.S. Treasuries, while the U.S. Treasury holds an infinite amount of USDT...

And throughout all this, neither Tether nor the U.S. Treasury has violated any rules.

Death Spiral—Moral Transgression

Any form of monetary overissuance is immoral.

This is where inflation originates.

But frankly, we are powerless to stop it.

If you believe in American credibility, it would never have run up its national debt to $36 trillion.

If you’re pessimistic enough, the scenario outlined above will eventually become reality.

A death spiral could occur if USDT overissuance leads to insufficient purchasing power, prompting holders to rush to redeem from Tether, forcing Tether to sell Treasuries—triggering a collapse in an already fragile U.S. debt market.

Alternatively, if U.S. Treasuries collapse first, Tether’s reserve assets would sharply devalue, triggering a run on USDT and its subsequent depreciation.

Trump is currently clashing with the Federal Reserve. If the Fed refuses to yield, Trump might resort to cryptocurrencies to bypass the Fed, using BUG2 to temporarily relieve the U.S. debt crisis.

Drinking poison to quench thirst.

Self-deception—The higher you climb, the harder you fall

Any form of monetary overissuance is immoral. Tether can issue USDT—but either the dollar it receives must be permanently removed from real-world circulation, or USDT must not be used to buy pizza and remain confined within the crypto market, treated merely as a virtual game.

Either way, one dollar should never become two dollars. No matter how skillful the illusion, it remains just that—an illusion, a deceptive trick. The higher you climb through deception, the harder you will fall.

"We cannot let corruption blind us to the broader reality: blockchain technology is inevitable. If U.S. lawmakers fail to lead, others will—and they won’t do so in ways aligned with our interests or democratic values."

Pt.2. The Debt of Damocles

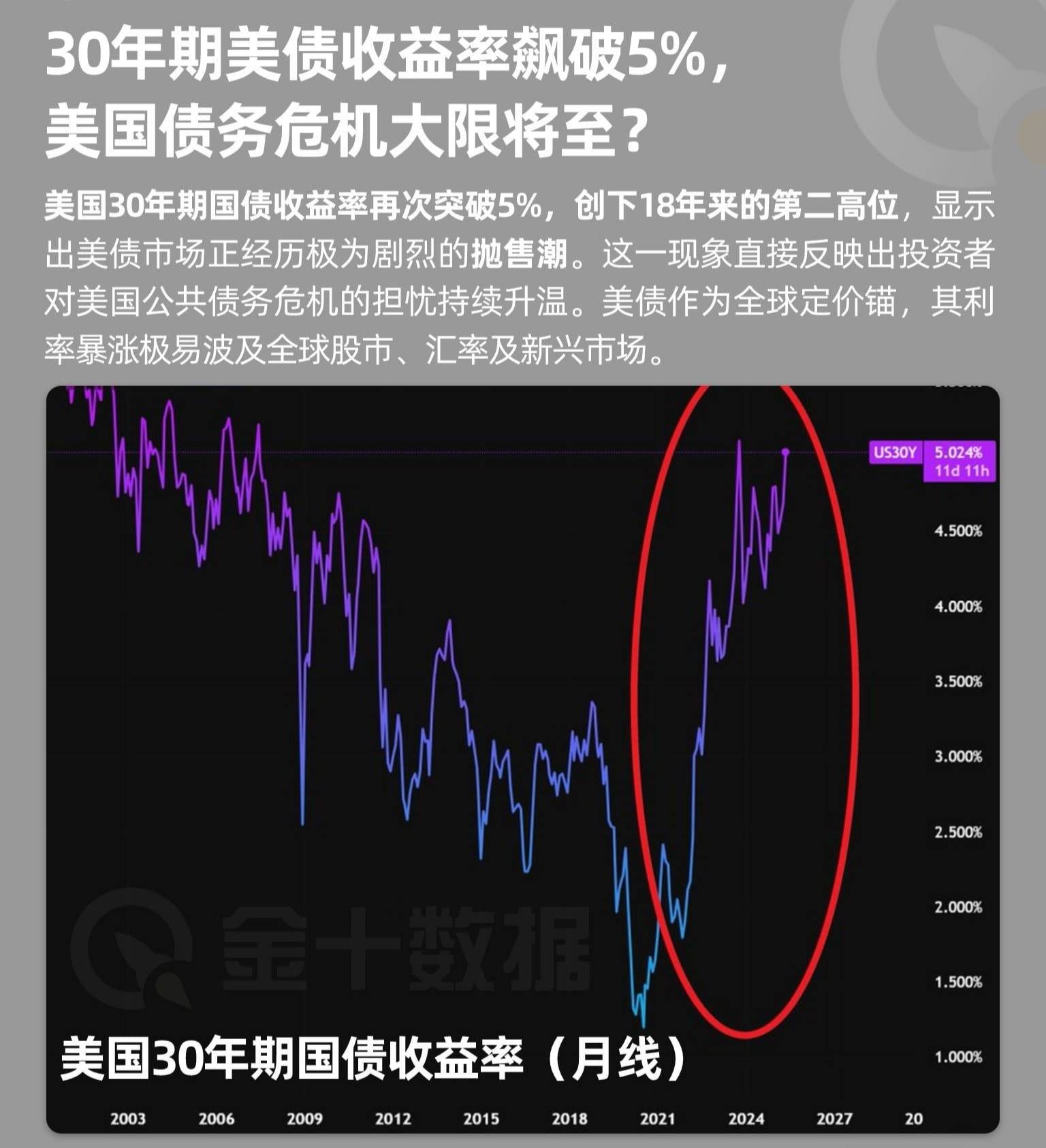

Source: Jinshi Data

In 2025 and 2026, massive amounts of U.S. debt will mature—this is the sword of Damocles hanging over America, and over Trump. Trump, at age 80, maintaining such an intense work schedule over the past 90 days, offers telling insight.

Historical accounts of dynastic decline are often imagined, always invoking the hope for a savior. But now, America stands as a living example, exuding the palpable aura of a dynasty in its final days—a feeling summed up by the realization—this hole cannot be filled, no matter who arrives.

Initially, Trump hoped to trigger an economic recession to lower national debt interest rates—using stock and currency crashes to save the bond market—but the result unexpectedly became a triple crash in stocks, bonds, and currency.

So Trump found a temporary excuse to calm the storm and retreated to plan his next steps. But this doesn’t mean the storm has passed. Trump genuinely intends to use tariffs to balance the budget. On the other hand, he also doesn’t want to decouple from China. A businessman’s thinking is both simple and complex—simple in that he’ll never refuse profit, complex in that he always wants a larger share of the pie, though ultimately all paths converge.

Of course, time solves everything.

Some claim cryptocurrency can solve America’s debt problem. Theoretically, this makes sense. Suppose countries use their own currencies to buy stablecoins, and the dollars backing those stablecoins are used to purchase U.S. Treasuries—it’s roughly equivalent to countries directly buying U.S. debt. Additionally, Bitcoin held by the U.S. government continues to appreciate, generating significant revenue. Yet, ideals are lush, reality is barren. The stablecoin market, worth hundreds of billions, is but a drop in the ocean compared to America’s $40 trillion debt—and the gap keeps widening. Even if BTC’s entire market cap were dedicated solely to this purpose, it would cover only one year’s interest payments on U.S. debt, let alone the fact that combined holdings by the U.S. government and corporations amount tojust 5% of BTC’s total supply.

In other words, even leveraging these two methods to tackle the debt would require years of accumulation and patience.

Therefore, the key question becomes—how long can U.S. debt endure, or how long can the dollar payment system last? The Bretton Woods system lasted only 27 years before collapsing; the current debt-based monetary system, existing since Bretton Woods’ demise, has now endured for 54 years. Regarding its cycle, we both hope for its survival and await its rebirth.

Perhaps decades from now, when people look back, they will realize a new era may have quietly begun right here, right now.

"The bleak autumn wind blows once again, but the world has changed."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News