CITIC Construction Investment: Can Stablecoins Save the US Dollar and US Treasuries?

TechFlow Selected TechFlow Selected

CITIC Construction Investment: Can Stablecoins Save the US Dollar and US Treasuries?

Starting from the micro-level operational logic of stablecoins, deconstruct the mechanisms underlying their operation and review the development history of stablecoins.

Authors: Zhou Junzhi, Tian Yunnong, CSC Research Macro Team

CITIC Construction Bank believes that the current total scale of stablecoins is relatively small compared to U.S. Treasuries. The market should not expect short-term regulatory policies on stablecoins to drive large-scale增持 (increased holdings) of dollar-denominated assets (i.e., the widely anticipated "stablecoin rescue" of the U.S. dollar and U.S. Treasuries).

What the market should focus on is whether stablecoins can usher in a new era of development—allowing payment demand that has fled the dollar-based monetary system and shifted into digital currency systems like Bitcoin to return to the centralized monetary system by adopting a "stablecoin wrapper."

Core Views

Post-pandemic geopolitical tensions have escalated, and America’s unrestrained fiscal easing has triggered skepticism toward U.S. credit assets, while tariff wars have intensified concerns about financial order restructuring. In recent years, increasing payment flows have moved away from the dollar-dominated centralized monetary system into digital payment ecosystems (e.g., Bitcoin).

Stablecoins are “dual-nature” currencies that combine characteristics of both centralized and digital money. Policies aimed at promoting stablecoin development must focus on strengthening their stability mechanisms—specifically, enhancing market-wide “trust consensus” in stablecoins. This is precisely where recent stablecoin regulations are centered.

In terms of current scale comparison between stablecoins and U.S. dollars/Treasuries, pushing stablecoin growth will not generate significant inflows into dollar or Treasury assets in the short term.

From a medium- to long-term perspective, steady development of stablecoins could first allow fiat currencies (such as the U.S. dollar) to ride the wave of Bitcoin's market expansion; secondly, it enables fiat currencies to adopt a digital layer via stablecoins, thus bridging the divide between centralized credit money and decentralized digital currencies.

Summary

Recently, the U.S. and Hong Kong have successively introduced regulatory frameworks for stablecoins, and Circle’s listing on Nasdaq has reignited market interest in stablecoins.

This comes amid weakening U.S. Treasury markets and growing global doubts over American creditworthiness. A popular narrative has emerged—that stablecoin development will save the U.S. dollar and U.S. Treasuries. But is this really true?

1. What Are Stablecoins?

Stablecoins operate based on four key elements:

1. Stablecoins run on blockchains.

2. When issuing stablecoins, issuers must hold 100% real-world asset reserves.

3. Issuers are private-sector entities, not official bodies such as central banks.

4. The value of stablecoins remains stable, typically pegged 1:1 to a fiat currency.

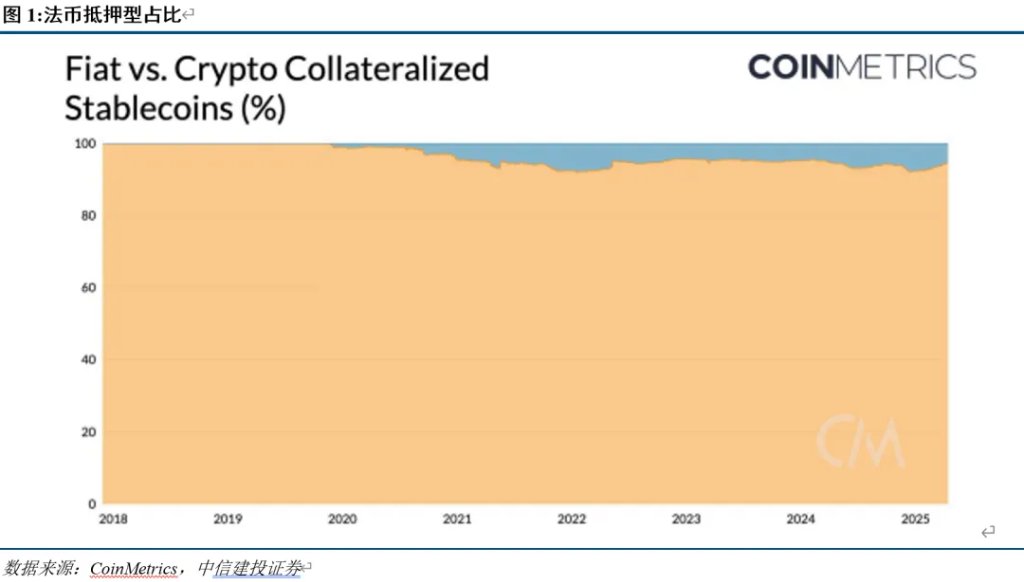

There are three main types of stablecoins: fiat-collateralized, crypto-collateralized, and algorithmic.

Fiat-collateralized stablecoins are backed by fiat assets; crypto-collateralized ones are tied to cryptocurrency assets; algorithmic stablecoins use smart contracts to dynamically manage supply and value.

2. How Do Stablecoins Maintain Stability?

Stablecoins are inherently digital currencies. Historical collapses stemmed from public loss of confidence in their 1:1 parity, and there have been numerous such incidents. Therefore, achieving price stability is far from easy.

The dominant model today involves fiat-pegged stablecoins. For these, maintaining stability hinges on two key factors: sufficient reserve assets and transparent information disclosure.

The “stability” of a stablecoin is not an absolute guarantee provided by a perfectly designed mechanism, but rather a balance between a relatively risk-resilient structure and market trust.

In short, the key to a stablecoin’s “stability” lies in “trust consensus”—that is, holders believe they can always redeem equivalent fiat or collateral from the issuer. To ensure this, stablecoin issuers must hold high-quality, liquid assets and maintain transparency.

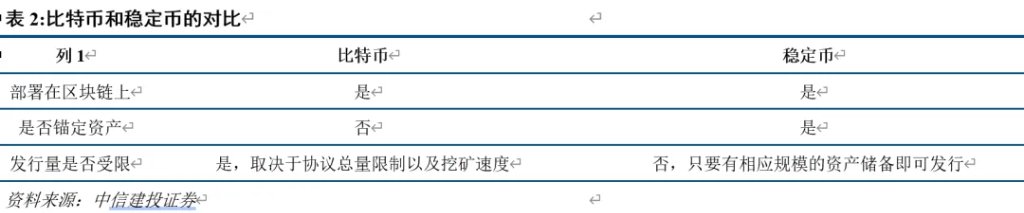

3. How Are Stablecoins Different From Bitcoin?

Both stablecoins and Bitcoin are blockchain-based digital currencies, sharing three common traits: virtual assets, privacy, and potential decentralization.

The biggest difference lies in whether they are pegged to specific external assets at issuance, leading to vastly different levels of price stability.

First, stablecoins aim to maintain price stability (at least nominally), whereas Bitcoin is inherently volatile.

Stablecoins derive their value by being pegged to external assets, with reserve assets serving as the foundation for price stability. Bitcoin’s value depends solely on market supply and demand. Due to limited supply and rising adoption, Bitcoin has trended upward despite volatility.

Second, Bitcoin is highly scarce, while stablecoins generally are not.

Stablecoin supply depends on reserve size and user demand, making them less scarce.

Bitcoin has a fixed cap of 21 million coins, and block rewards have already undergone four halvings, reinforcing its scarcity.

Third, stablecoins are regulated toward monetary compliance, while Bitcoin regulation focuses more on virtual asset management.

Under strong oversight globally, stablecoins have gradually become compliant, with countries legislating reserve requirements and licensing for issuers.

Bitcoin, being fully decentralized, faces inconsistent regulatory attitudes worldwide due to differing national stances on virtual assets.

4. What Drives Stablecoin Development? Lessons From Its Evolution

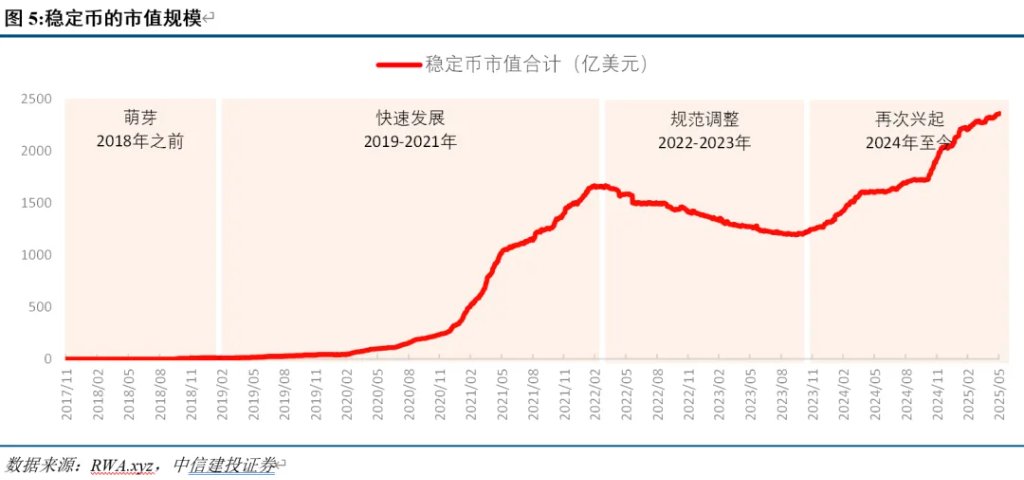

Stablecoin development can be broadly divided into four phases: before 2018, 2019–2021, 2022–2023, and 2024 to present.

Emergence Phase (pre-2018): Early stage with limited growth.

The first generation of stablecoins appeared in 2014, including USDT issued by Tether.

Rapid Growth Phase (2019–2021): Fueled by the DeFi ecosystem, stablecoins expanded rapidly.

After 2019, the rise of DeFi, especially the “DeFi Summer” of 2020 featuring booming lending protocols like Aave and yield farming, increased demand for stablecoins as pricing and payment tools within the crypto world.

Regulation & Adjustment Phase (2022–2023): Amid failures and regulatory scrutiny, the sector adjusted.

In May 2022, TerraUSD (UST) lost its peg and collapsed, triggering market fears about stablecoin instability and attracting regulatory attention. Subsequently, the U.S. and Europe proposed the *Stablecoin TRUST Act* and the *Markets in Crypto-Assets Regulation* (MiCA), respectively.

Resurgence Phase (2024–present): The dawn of the tokenized money era brought massive expansion.

Since 2023, the crypto ecosystem has grown rapidly. In early 2024, the SEC approved spot Bitcoin ETFs, reigniting the crypto market and driving fast-growing demand for stablecoins as intermediary currencies.

The drivers behind stablecoin growth include three aspects: crypto market development, payment convenience, and privacy.

Stablecoins are now the primary unit of account and payment method in the crypto market. Their payment efficiency surpasses other cryptocurrencies and even fiat, with lower costs. Privacy also strengthens their appeal in certain use cases.

The main weakness of stablecoins centers on trust crises that may trigger runs.

5. Direct and Underlying Objectives of Stablecoin Policies

Recent regulatory actions in the U.S. and Hong Kong signal efforts to guide stablecoins toward more stable development—marking the beginning of a second era for stablecoins.

The core direction of policy-making revolves around the stability mechanism—the “trust consensus.”

Specifically, policies aim to externally reinforce credibility by clearly defining what constitutes a compliant stablecoin and establishing clear regulatory oversight.

First, eliminate conceptual confusion around stablecoins to prevent fundamental risks.

Second, refine standards for collateral assets to strengthen the internal stability of stablecoins.

Third, build a regulatory framework so that stablecoin development gains official legitimacy.

6. What Might Be the Future Path of Stablecoin Development?

Stablecoins are essentially the adhesive—or bridge—between fiat currencies (mainly the U.S. dollar) and digital currencies (mainly Bitcoin).

Thus, stablecoin development fundamentally aims to mend the split between digital and credit-based money.

Understanding how the current rift between the dollar-based system and digital currencies like Bitcoin emerged—and how stablecoins might heal it—is likely the true intent behind recent regulatory moves to formalize stablecoin frameworks and promote their stable growth.

Traditional correspondent banking suffers from inefficiency, high transaction costs, limited coverage, and low transparency. Post-pandemic geopolitical competition has led some nations to exit the modern cross-border payment system. Meanwhile, massive fiscal and monetary easing in the U.S. has eroded dollar credibility. Trust in dollar-based international transactions has weakened.

In April 2025, U.S. reciprocal tariffs disrupted global trade rules, creating uncertainty in global economic and trade orders and amplifying financial market volatility. This further accelerated the rise of tokenized money.

Bitcoin’s rapid growth reflects declining global confidence in the dollar-centric monetary system. More payments are attempting to escape the dollar-dominated centralized system. Digital currencies—offering privacy and ease of payment—are becoming the top choice for decentralized alternatives.

At this juncture, regulating and promoting stablecoin development serves two strategic purposes for fiat assets:

First, as a pricing and payment tool in crypto markets, stablecoins are pegged to fiat (e.g., USD). As Bitcoin expands, it requires more stablecoin holdings, which in turn increases demand for dollars and Treasuries—allowing fiat (e.g., USD) to piggyback on Bitcoin’s market cap growth.

Second, stablecoins offer the payment efficiency and privacy typical of digital currencies, yet remain anchored to fiat (e.g., USD). As stablecoins gain traction in transactions, fiat assets (e.g., USD and Treasuries) can expand through the “digital wrapper” of stablecoins.

The most pressing market question is: how much fiat asset accumulation—such as increased holdings of dollars and Treasuries—could stablecoins ultimately bring?

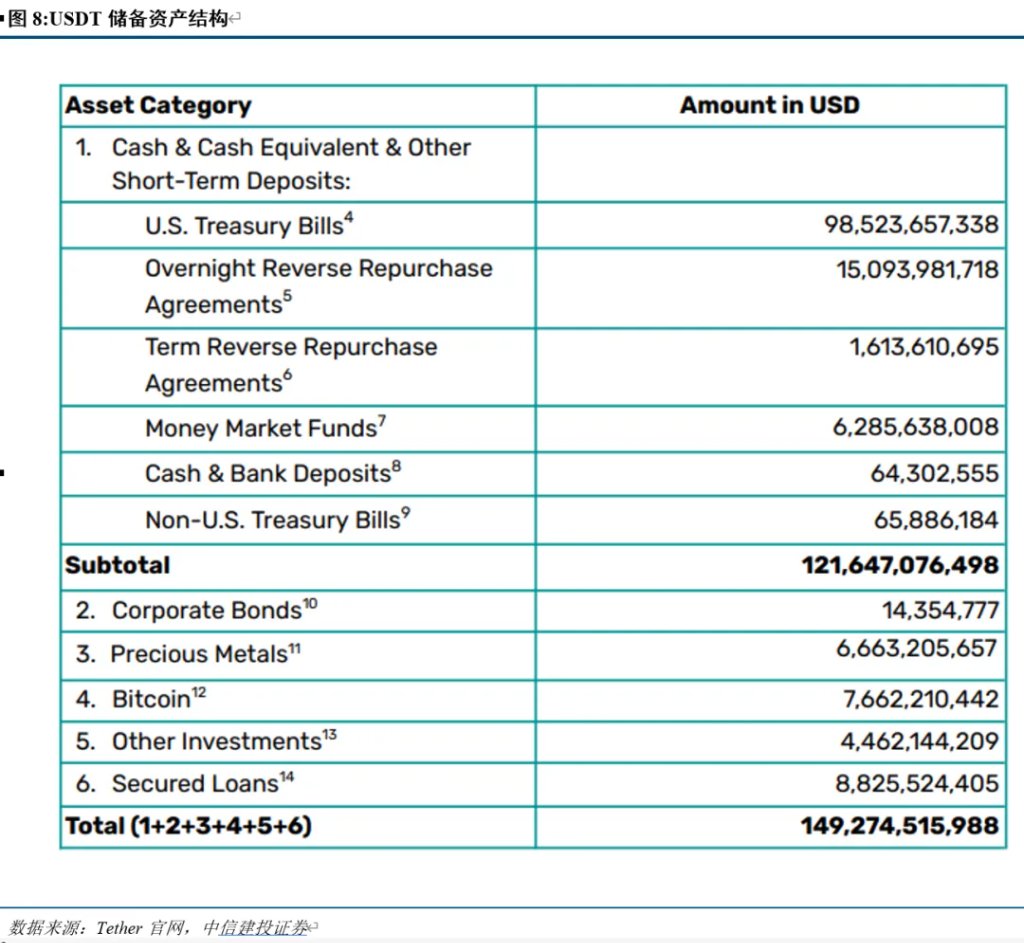

Our analysis shows that the total size of stablecoins remains small relative to U.S. Treasuries. In Q1 2025, USDT and USDC held approximately $120 billion in short-term U.S. Treasuries combined. With total outstanding short-term U.S. debt around $6 trillion, this represents just 2%.

In other words, the market should not expect short-term regulatory changes to significantly boost dollar asset holdings (i.e., the so-called “rescue” of the dollar and Treasuries via stablecoins). Instead, the market should focus on whether stablecoins can enter a new developmental phase—one that brings payment demand fleeing the dollar system back into the centralized monetary framework through a “stablecoin wrapper.” This may well reflect the true intention behind governments like the U.S. establishing stablecoin development frameworks.

Introduction

On May 19, the U.S. Senate passed the *Guidance and Establishment of National Innovation in United States Stablecoins Act*. On May 30, the Hong Kong Special Administrative Government published the *Stablecoin Ordinance* in the Gazette, sparking renewed market interest in stablecoins.

On June 5, Circle Internet (issuer of USDC) listed on Nasdaq, closing up 168.48% on its first day, marking the start of a new chapter in stablecoin development.

Market attention to stablecoins has also been accompanied by speculation: Does regulatory standardization mean stablecoins will soon grow mainstream? Since most stablecoins are pegged to fiat (primarily the U.S. dollar), and their underlying reserves include U.S. dollars and Treasuries (mostly short-term), does this imply that regulatory goals ultimately aim to expand stablecoins and thereby support the U.S. dollar and short-term Treasuries?

Amid recent weakness in U.S. Treasuries and growing global skepticism toward U.S. credit assets, a popular narrative has taken hold—that stablecoin development will save the U.S. dollar and U.S. Treasuries. Is this actually true?

We begin by analyzing the micro-level mechanics of stablecoins—deconstructing their operational mechanisms and reviewing their historical evolution—to deeply understand the true intent behind recent stablecoin policies, and ultimately grasp future trends in Bitcoin’s development path.

Full Analysis Below:

How Are Stablecoins Stabilized?

(1) Basic Mechanism of Stablecoins

What are stablecoins? We can summarize them using several keywords: digital currency (blockchain-based), pegged to reserve assets, privately issued, stable value.

Stablecoin issuers are private entities—not official institutions like central banks or monetary authorities.

Stablecoin issuance requires backing by real-world assets. For every unit issued, the issuer must hold 100% equivalent in real-world assets—typically sovereign credit instruments such as government bonds, fiat currencies, precious metals, or cryptocurrencies. These can be used singly or in combination as reserves.

Stablecoins operate on blockchains, enabling them to serve as exchange media on cryptocurrency exchanges. For example, one can convert USD to USDT and then use USDT to buy Bitcoin.

To illustrate: Private entity Xiao Tai (the issuer) holds a certain amount of real-world assets—such as USD, U.S. Treasuries, gold, Bitcoin, or Ethereum. After obtaining authorization to issue stablecoins, Xiao Tai can mint an equivalent amount of stablecoins on a 1:1 basis, which then circulate on the blockchain.

We can think of stablecoins as helping express prices in the crypto world—they act as a bridge between the real and digital worlds.

Bitcoin and Ethereum suffer from extreme price volatility, making them unsuitable as reliable mediums of exchange or units of account over time.

Stablecoins were created precisely to solve this problem—by being pegged 1:1 to real-world assets, they maintain price stability while still operating on blockchains, facilitating seamless on-chain transactions.

(2) Three Types of Stablecoins

Stablecoins can be categorized into three types based on their stabilization mechanisms and collateral differences.

1. Fiat-Collateralized

Backed 1:1 by fiat or government bonds—for example, using USD or U.S. Treasuries as collateral. Representative examples include USDT and USDC.

Fiat-collateralized stablecoins dominate the market, accounting for over 90% of all stablecoins, with the vast majority pegged to the U.S. dollar.

USDT issuance works roughly in two steps: (1) Users deposit USD into Tether’s bank account; (2) Tether mints an equivalent amount of USDT into the user’s wallet, which they can then spend.

To redeem USD, users send USDT back to Tether, who destroys the tokens and returns the equivalent USD.

2. Crypto-Collateralized

Generated by locking major cryptocurrencies—such as BTC or ETH—as collateral. DAI is a representative example.

Dai operates under an “over-collateralization” model: users lock ETH into MakerDAO’s system, and the protocol issues Dai at a discounted rate based on ETH’s value.

If the value of collateral drops below a threshold (e.g., 150%), users must either add more collateral or repay their Dai, otherwise the system automatically liquidates the position.

3. Algorithmic

Algorithmic stablecoins use smart contracts to dynamically adjust supply and value—buying back when oversupplied, minting when undersupplied. Reserves may mix fiat and crypto assets. Examples include FRAX and AMPL.

(3) How Do Stablecoins Maintain Price Stability?

The two pillars of stablecoin stability are high-quality reserve assets and transparency.

“Stability” is not absolute but achieved through mechanisms resilient enough to withstand shocks and earn market trust, thereby maintaining relative price stability.

In short, the key to stablecoin “stability” is “trust consensus”—holders must believe they can always redeem equivalent fiat or collateral from the issuer. To achieve this, issuers must hold highly liquid, high-quality assets and maintain full transparency.

First, most stablecoin reserves consist primarily of short-term U.S. Treasuries, along with bank deposits and commercial paper.

Issuers invest a portion of accumulated reserves (mainly earning interest) and profit from conversion fees, making stablecoin operations a scale-driven business.

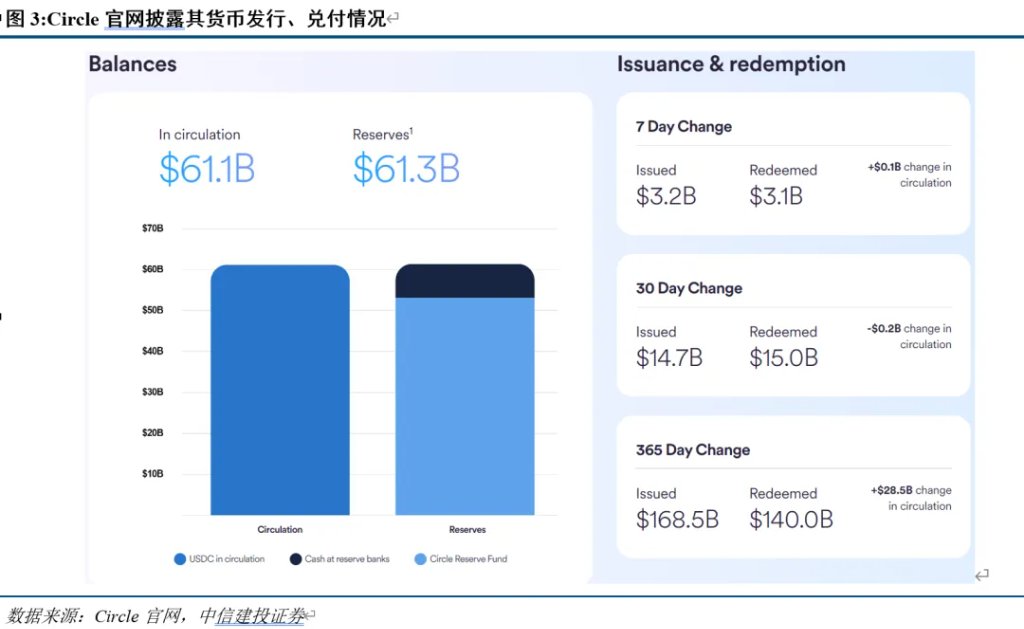

Take Circle as an example: As of now, USDC has over $60 billion in circulation. Its reserves include $50 billion in the Circle Reserve Fund (a money market fund managed by BlackRock, investing in short-term U.S. Treasuries, overnight reverse repos, and bank deposits), plus over $8 billion in direct bank deposits.

Interest income is Circle’s primary revenue source—$1.676 billion in 2024, with 98.6% coming from reserve asset yields.

Second, issuers regularly disclose details of their reserve assets and circulating supply.

Most stablecoin issuers feature a “Transparency” section on their websites, disclosing reserve composition, sizes, and stablecoin circulation data—to reassure users they can always redeem fiat from the issuer.

Circle’s “Transparency” page makes this clear: “USDC is always redeemable 1:1 for US dollars, and EURC is always redeemable 1:1 for euros. Always.”

We can better understand this through the case of USDC briefly losing its peg in March 2023.

On March 13, 2023, USDC depegged to $0.88 due to $3.3 billion (8.25% of total reserves) held at Silicon Valley Bank. Holders feared redemption failure and began selling off.

Circle’s founder quickly tweeted that transfers of the $3.3 billion were underway to other banks, and if full recovery wasn’t possible, the company would consider using corporate resources or outside capital to cover any shortfall—effectively promising users the SVB-linked funds were safe.

Shortly after, USDC returned to its $1.00 peg.

How Are Stablecoins Different From Bitcoin?

Since the creation and spread of digital currencies, discussions about transactional money have bifurcated into decentralized digital currencies and sovereign fiat currencies.

From the perspectives of digitization and decentralization, stablecoins are undoubtedly digital currencies. Yet because most are pegged to fiat (especially USD), they also carry certain fiat-like characteristics.

Hence, stablecoins possess features of both decentralized digital currencies and stable fiat values—making them “dual-nature” currencies straddling the gap between decentralized crypto and traditional fiat.

(1) Stablecoins and Bitcoin: Decentralized Digital Currencies with Privacy

Stablecoins and Bitcoin share three similarities: virtual assets, privacy, and potential decentralization.

These stem from both being blockchain-based digital currencies, hence virtual in nature.

Bitcoin is the native coin of the Bitcoin blockchain.

Stablecoins are derivative tokens deployed by developers on public blockchains—mostly Ethereum.

Digital currencies and their transactions are recorded on distributed ledgers.

A distributed ledger records transactions among network participants—including digital asset swaps or virtual currency transfers. Every historical transaction is precisely recorded, immutable, and visible to all nodes in the network.

When there are enough nodes, no single sovereign entity can control the ledger—hence it is “decentralized.”

The ledger only records addresses (not real-world identities), preserving privacy.

For example, if User A holds $1 of a stablecoin, every node in the public blockchain ledger records that Address A holds $1 of that stablecoin.

When A uses that $1 stablecoin to buy $1 worth of ETH from B, each ledger updates to record: Address A sent $1 stablecoin to Address B in exchange for $1 ETH. No participant—including A and B—knows each other’s real identity; they only know activity occurred at those addresses.

(2) Key Difference Between Stablecoins and Bitcoin: Price Stability

The biggest distinction lies in whether they are pegged to specific external assets at issuance.

Bitcoin’s supply follows protocol-defined limits and block rewards, without being pegged to any other asset. Its exchange rate against fiat (e.g., USD) fluctuates constantly, giving it stronger asset characteristics—and greater price volatility.

To maintain price stability, stablecoins must be pegged to real-world fiat values, requiring issuers to back them with corresponding reserve assets under most mechanisms.

(3) Stablecoins vs. Bitcoin: One for Transactions, One for Investment

Differences in operational logic lead to divergent roles.

1. Value Depends on Collateral Redemption Capability

Stablecoins derive value by being pegged to external assets—e.g., fiat-collateralized require 1:1 USD reserves, crypto-collateralized require over-collateralized ETH.

Crucially, reserve assets are key to maintaining stablecoin value.

When issuers hold sufficient reserves to back issuance and redemptions, and disclose data transparently—users trust the system, and stability holds.

But if reserves are insufficient to meet redemptions—especially during a run—the stablecoin’s value can swing wildly.

Bitcoin’s value depends purely on market supply and demand, unbacked by other assets.

Therefore, stablecoins usually maintain stable prices, while Bitcoin is highly volatile. In normal conditions, stablecoins are better suited as payment tools due to stable value measurement.

However, stablecoins face the risk of sudden devaluation during runs; Bitcoin does not.

2. Scarcity Determined by Pegged Assets

Stablecoin supply depends on reserve size and user demand—low scarcity.

Bitcoin has a fixed supply (21 million), with block rewards halved four times—high scarcity.

3. Compliance (Depends on Whether Anchored to Regulated Assets)

Stablecoins are increasingly compliant under strict national regulations, with laws specifying reserve requirements and issuer licensing.

Bitcoin, as a decentralized asset, faces unclear regulatory boundaries and is vulnerable to policy shocks.

These differences shape their core functions—one a payment tool, the other an investment vehicle.

Stablecoins are ideal as payment tools and DeFi infrastructure, linking on-chain finance with real-world assets, forming the settlement backbone of the digital economy.

Bitcoin is better positioned as a store of value—an investment asset fueled by narratives of scarcity and financial system restructuring.

What Drives Stablecoin Development? Insights From Its History

(1) Four Phases of Stablecoin Development

Stablecoin evolution can be divided into four stages: pre-2018, 2019–2021, 2022–2023, and 2024 to present.

Emergence Phase (pre-2018): Initial growth with limited scale.

The first stablecoins emerged in 2014—Tether’s USDT among them. USDT was the first large-scale fiat-collateralized stablecoin and remains the most dominant today.

In 2017, MakerDAO launched DAI—the first successful crypto-collateralized stablecoin template. Later that year, major crypto exchanges began listing USDT trading pairs.

In 2018, Circle launched USDC. Soon after, TUSD, GUSD, and others followed.

Rapid Growth Phase (2019–2021): Riding the DeFi wave, stablecoins expanded rapidly.

Post-2019, the DeFi ecosystem surged. The 2020 “DeFi Summer” saw explosive growth in lending protocols like Aave and yield farming.

As stablecoins serve as the primary unit of account and payment in crypto, DeFi growth directly boosted stablecoin demand.

Regulation & Adjustment Phase (2022–2023): Failures and regulatory scrutiny prompted industry correction.

In May 2022, TerraUSD (UST) collapsed after losing its peg, triggering widespread concern over stablecoin stability and drawing regulatory attention.

In 2022, the U.S. proposed the *Stablecoin TRUST Act*, requiring 1:1 backing of issued stablecoins by reserves and licensing for issuers.

In April 2023, the European Parliament passed MiCA, clarifying regulated crypto assets and setting transparency and disclosure requirements for issuance, public offerings, and exchange listings.

Resurgence Phase (2024–present): The rise of the tokenized money era brought massive expansion.

Since 2023, the crypto ecosystem has advanced rapidly, introducing new concepts that laid the groundwork for stablecoin growth.

In early 2024, SEC-approved spot Bitcoin ETFs relaunched the bull market, sharply increasing demand for stablecoins as intermediate currencies.

In May 2025, the UK, U.S., and Hong Kong passed stablecoin-related bills, regulating reserve backing, audit rules, and issuance licenses.

(2) Drivers and Risks of Stablecoin Development

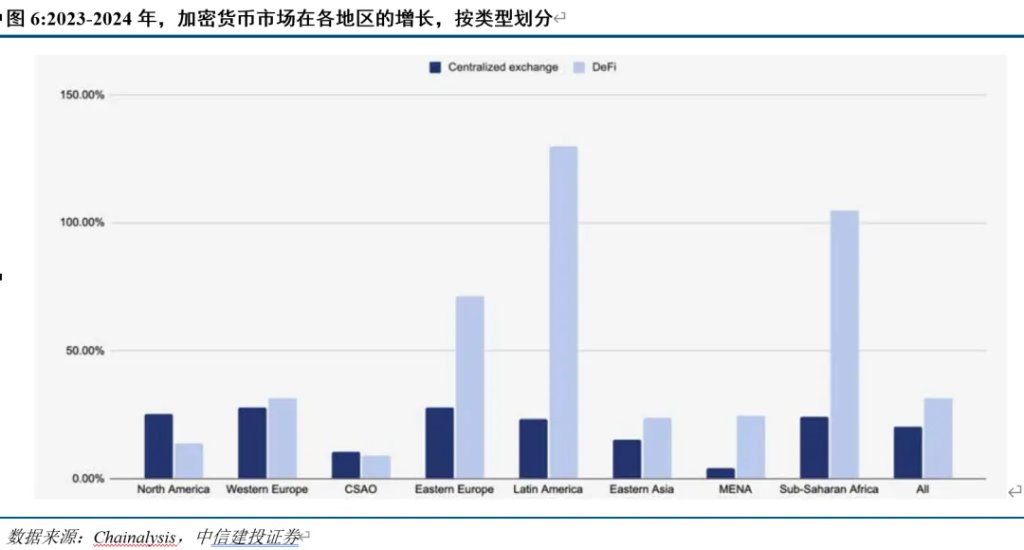

Three main drivers: crypto market growth, payment convenience, and privacy.

Stablecoins are the dominant pricing and payment tools in crypto markets. Market expansion drives stablecoin demand—for instance, heightened Bitcoin trading boosts need for stablecoins as intermediaries.

Within the digital ecosystem, stablecoins offer superior payment efficiency and lower costs than other cryptos or fiat.

Blockchain-based stablecoins enable near-instant, 24/7 settlement without manual intervention—transactions often complete within minutes.

Peer-to-peer transactions eliminate intermediaries, reducing fees.

Privacy enhances utility in certain contexts.

For example, DeFi usage has grown fastest in sub-Saharan Africa, Latin America, and Eastern Europe.

Main risks: runs and unauthorized issuance—both potentially causing value to collapse to zero.

During mass redemptions, issuers must sell reserve assets (e.g., Treasuries, cash, commercial paper). If liquidity dries up, the stablecoin depegs and may plummet.

Due to opacity between reserves and issuance, issuers may engage in moral hazard—issuing stablecoins without adequate backing.

Since 2017, Tether (issuer of USDT) has repeatedly faced scrutiny over its reserves due to banking disputes involving affiliated exchange Bitfinex, with allegations of “printing stablecoins out of thin air,” leading to legal investigations.

In March 2021, after paying a $40 million fine, Tether committed to regular reserve disclosures.

Direct and Fundamental Goals of Stablecoin Policy

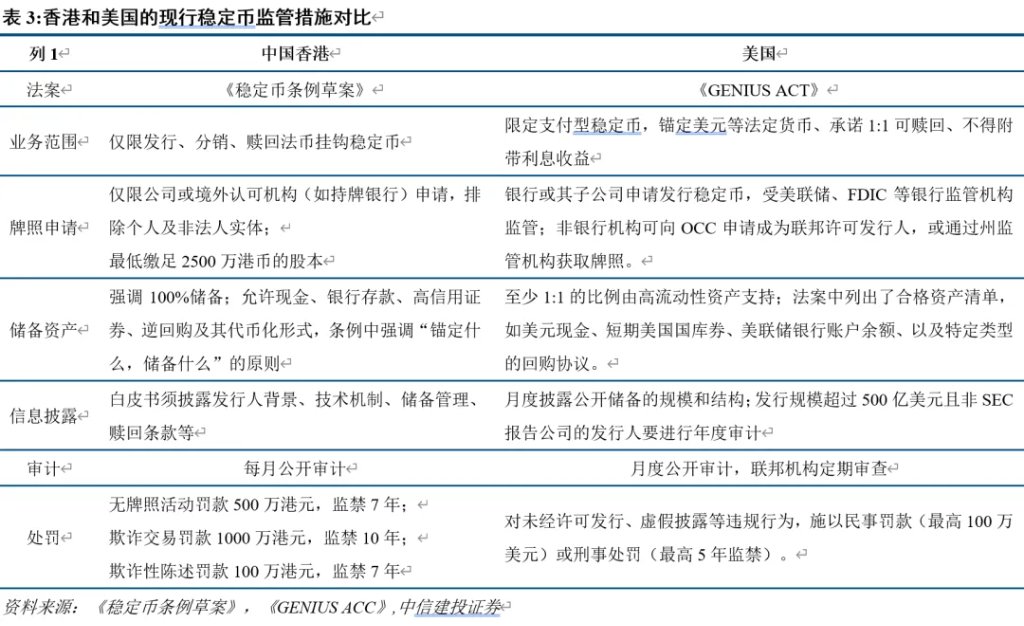

(1) Deconstructing Recent Stablecoin Regulations

The U.S. Senate passed procedural legislation for the GENIUS Act.

On May 19 local time, the U.S. Senate passed procedural legislation for the *Guidance and Establishment of National Innovation in United States Stablecoins Act* (shortened to GENIUS Act).

Key provisions of the GENIUS Act include:

Federal Licensing: Issuers with over $10 billion in circulation must obtain federal licenses and undergo supervision.

Full Reserve Backing: Stablecoins must be 1:1 backed by high-quality liquid assets (e.g., U.S. Treasuries and cash).

Mandatory Audits: Issuers must conduct monthly public audits and disclose reserve holdings.

Hong Kong’s Stablecoin Ordinance Becomes Law

The Hong Kong SAR government published the *Stablecoin Ordinance* in the Gazette on May 30, making it official law.

Key clauses include:

Licensing System: Issuers (excluding individuals or unincorporated entities) must apply for licenses, with a minimum HK$25 million registered capital. No license, no issuance.

Reserve Management: Reserve assets must exceed the face value of issued stablecoins, following the principle of “peg what you hold, hold what you peg.”

Audit & Disclosure: White papers must detail issuer background, technical mechanisms, reserve management, and redemption terms, with regular audits required.

(2) Underlying Logic and True Intent of Policy

The introduction of regulatory frameworks marks the beginning of a second era for stablecoins—because the goal is to make them more stable.

In reality, policy design centers on strengthening the “trust consensus” mechanism of stablecoins. Additionally, policies provide external credibility by clearly defining compliant stablecoins and enforcing transparent oversight.

Policies enhance stablecoin stability through three layers:

First, eliminate conceptual misunderstandings to prevent foundational risks.

The draft *Stablecoin Ordinance* defines stablecoins as intended for payment, debt settlement, and investment. They must be pegged to a single or basket of assets and cannot be issued by central authorities.

The *GENIUS Act* regulates payment-oriented stablecoins—meant for payment or settlement—and prohibits issuers from offering interest or returns on stablecoins.

Second, standardize collateral assets to strengthen the core stability of stablecoins.

Both the *Stablecoin Ordinance* and *GENIUS Act* require at least 100% real-world asset backing, regular audits, disclosures, and detailed redemption mechanisms in white papers.

The aim is to formalize issuance, increase transparency, and reduce risks of runs and unauthorized issuance—especially critical as global stablecoin transaction volumes have already surpassed Visa.

Third, establish a regulatory framework to give stablecoin development official legitimacy.

The draft ordinance names the Hong Kong Monetary Authority as the regulator, overseeing issuance to promote monetary and financial stability.

The *GENIUS Act* adopts a dual-track system: issuers below $10 billion can opt for state-level regulation; those above must accept federal oversight. State and federal frameworks are similar, with state regulators overseeing state-licensed issuers, and federal agencies including the OCC (for non-bank entities) and the Federal Reserve (for depository institutions).

Can Stablecoins Rescue the Dollar and U.S. Treasuries?

Stablecoins are fundamentally the glue—or bridge—between fiat (mainly USD) and digital currencies (mainly Bitcoin).

Thus, their development aims to repair the split between the dollar and Bitcoin. For example, after the U.S. introduced reciprocal tariffs, signs of financial restructuring reappeared, driving more investment into Bitcoin.

To dissect this logic and answer “what lies ahead for stablecoins,” we break it down into four questions—from surface to depth:

Question 1: What Has Happened to the Dollar in International Payments Recently?

The dollar-based international payment system is weakening. A key indicator: cross-border payment volume and value continue to grow, yet active correspondent banks have declined by about one-fifth.

Main reasons: (1) Traditional correspondent banking suffers from low efficiency, high cost, limited reach, and poor transparency; (2) Geopolitical friction has driven some countries out of the modern cross-border system; (3) Post-pandemic, massive fiscal and monetary easing in the U.S. has abused dollar credit.

The three pillars of the international payment system—dollar, banking network, SWIFT—are showing fragility, prompting search for alternatives.

Consequently, borderless assets like cryptocurrencies (e.g., Bitcoin) and gold have seen sustained market cap growth since the pandemic.

Question 2: What Has Driven Bitcoin’s Growth Since 2023?

Global “dedollarization” has intensified since 2023. A landmark event: On April 1, 2022, Russia began requiring “unfriendly” countries to settle gas payments in rubles.

Global bifurcation and simmering financial restructuring have elevated attention to cryptocurrencies. Since 2023, new concepts like Ordinals and Blur tokens have surged, and Bitcoin reached $100,000 by end-2024.

In April 2025, U.S. “reciprocal tariffs” reshaped global trade and supply chains, intensifying financial market volatility. Against this backdrop of financial restructuring, Bitcoin rose again.

Question 3: What Is the Significance of More Stable Stablecoin Development for Bitcoin and Dollar-Based International Payments?

Cryptocurrencies are decentralized and inherently opposed to fiat-based credit money. However, Bitcoin and Ethereum suffer from excessive price volatility, making them unstable as units of account—better suited as stores of value than daily currencies. Stablecoins were created to establish a stable unit of account in crypto, requiring fiat pegs to maintain price stability.

One side of stablecoins is fiat; the other is digital currencies like Bitcoin—bridging the virtual and real worlds.

Against financial restructuring, international payments are trending toward decentralization. Cryptocurrencies offer far greater efficiency and lower transfer costs than traditional banking systems, without sanction risks—making them viable alternatives. The fiat-centered system risks losing dominance.

Stablecoins bind digital currencies in international payments back to the dollar. Though built on blockchain and possessing decentralization traits, stablecoins still rely on national credit assets for stability.

Vigorously developing stablecoins—using them as digital carriers for cross-border payments—offers the U.S. dollar and other fiat currencies a chance to retain leadership in the international payment system. This explains why the U.S. is actively building crypto strategic reserves and enacting supportive regulations to standardize stablecoin issuance.

Question 4: How Much Support Could Stablecoin Growth Provide to U.S. Treasuries?

Currently, the total scale of stablecoins is small relative to U.S. Treasuries.

Most major stablecoins are pegged to the dollar. To manage redemptions and earn interest, they mainly hold short-term U.S. Treasuries as reserves.

USDT and USDC together account for over 85% of the stablecoin market. Combined, they hold about $120 billion in short-term U.S. Treasuries.

According to USDT’s Q1 2025 audit report, ~$100 billion in short-term U.S. Treasuries were held—about two-thirds of total assets.

USDC’s Q1 2025 reserves included ~$20 billion in short-term U.S. Treasuries—40% of total assets.

Total outstanding short-term U.S. Treasuries are ~$6 trillion—so $120 billion represents just 2%.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News