Bloomberg: Have U.S. Treasuries Really Lost Their Safe-Haven Appeal?

TechFlow Selected TechFlow Selected

Bloomberg: Have U.S. Treasuries Really Lost Their Safe-Haven Appeal?

No investment offers the same level of liquidity and depth as the U.S. Treasury market, and unwinding positions from the U.S. Treasury market would take years.

By Alice Atkins & Liz Capo McCormick, Bloomberg

Translated by Felix, PANews

Investors typically flock to U.S. Treasuries to seek shelter from financial market turmoil. During the global financial crisis, after 9/11, and even when the U.S. credit rating was downgraded, Treasury prices rallied.

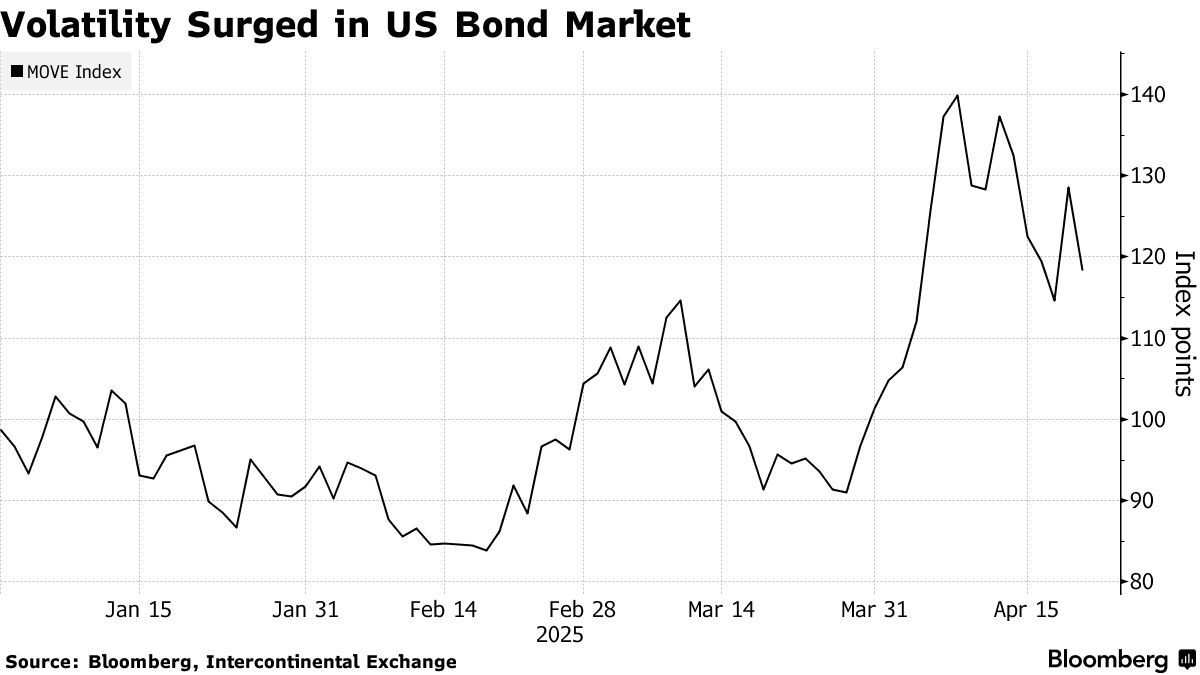

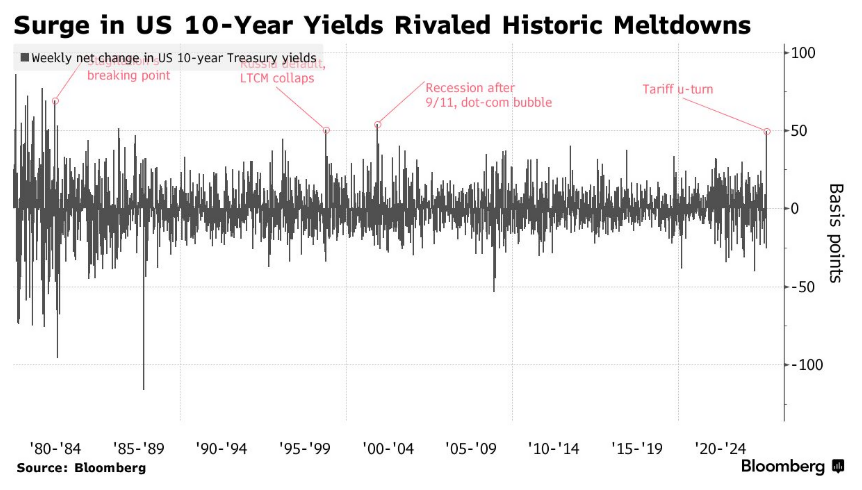

But in early April, something unusual happened amid the chaos triggered by President Trump's implementation of "reciprocal" tariffs. As risk assets such as stocks and cryptocurrencies plummeted, U.S. Treasury prices did not rise—they fell. Treasury yields posted their largest weekly gain in over two decades.

For years, the $29 trillion U.S. Treasury market has been seen as a safe haven during market turbulence—a unique advantage for the world’s largest economy. For decades, it helped keep America’s borrowing costs low. But recently, Treasuries have traded more like a risk asset. Former Treasury Secretary Lawrence Summers even said they were behaving like debt from an emerging-market nation.

This has profound implications for the global financial system. As the world’s “risk-free” asset, U.S. Treasuries serve as the benchmark for pricing everything from equities and sovereign bonds to mortgage rates—and also act as collateral for trillions of dollars in loans every day.

Below are some explanations offered by investors and market analysts for the anomalous behavior of U.S. Treasuries in April, along with potential alternative safe havens.

Tariff-Driven Inflation

Even though Trump paused most of his “reciprocal” tariffs for 90 days, tariffs on China remain far higher than previously expected. Tariffs on automobiles, steel, aluminum, and various goods from Canada and Mexico are still in place, and Trump has threatened additional import duties in the future.

There is concern that companies will pass these tariff costs on to consumers through higher prices. An inflation shock could dampen demand for Treasuries because it erodes the future value of their fixed interest payments.

If rising prices coincide with slowing or stagnant economic output (a scenario known as stagflation), monetary policy would enter a new era of uncertainty, forcing the Federal Reserve to choose between supporting growth and curbing inflation.

Flight to Cash

Some investors may have sold U.S. Treasuries and other American assets in favor of the ultimate safe haven: cash. With the Fed delaying rate cuts, assets in U.S. money market funds have surged, hitting a record high in the week ended April 2. Money market funds are generally treated as cash equivalents, with the added benefit of generating returns over time.

Policy Uncertainty

Investors demand higher returns when investing in countries experiencing political turmoil or economic instability. That’s partly why Argentine government bonds yielded as much as 13% in mid-April.

Trump’s unpredictable political tactics and aggressive tariff policies make it difficult to forecast how investor-friendly the U.S. environment will be a year from now.

Another factor drawing capital to the U.S. has been confidence in the strength of institutions—like the judiciary—to constrain the government and ensure policy continuity. But Trump’s willingness to challenge lawyers who stand in his way and pressure independent bodies like the Fed could undermine confidence in the checks and balances that once made America the top destination for foreign investment.

Fiscal Pressure

In the mid-1970s, the dollar replaced gold as the world’s reserve asset, and central banks began buying U.S. Treasuries to hold their dollar reserves. Because the federal government has never defaulted, Treasuries have long been considered a secure investment.

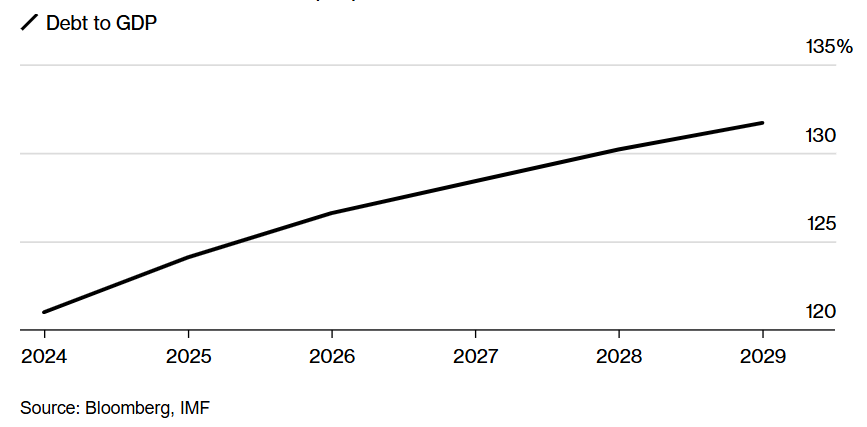

U.S. debt currently stands at 121% of GDP. Upon taking office, Trump bet on tax cuts spurring economic growth to reduce budget deficits, and more recently suggested tariff revenues could help shrink them too.

Yet there are concerns his policies could worsen national debt. Beyond proposed new tax cuts, Trump is pushing to make permanent the tax reductions enacted during his first term. If tariffs trigger a recession, the government may face pressure to increase spending.

Given this, Mike Riddell, fixed-income portfolio manager at Fidelity International, said the spiraling rise in Treasury yields could signal a "capital flight," as foreign investors grow less willing to finance America’s deficits. “The global ‘bond vigilantes’ are clearly still active,” he said.

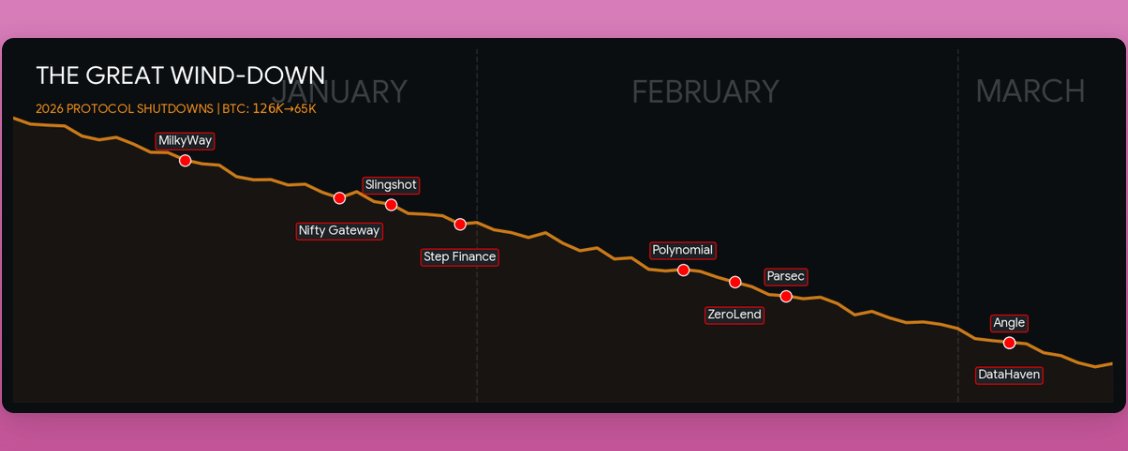

U.S. Debt Levels Are Projected to Rise

The IMF forecasts that U.S. debt will reach 131.7% of GDP by 2029.

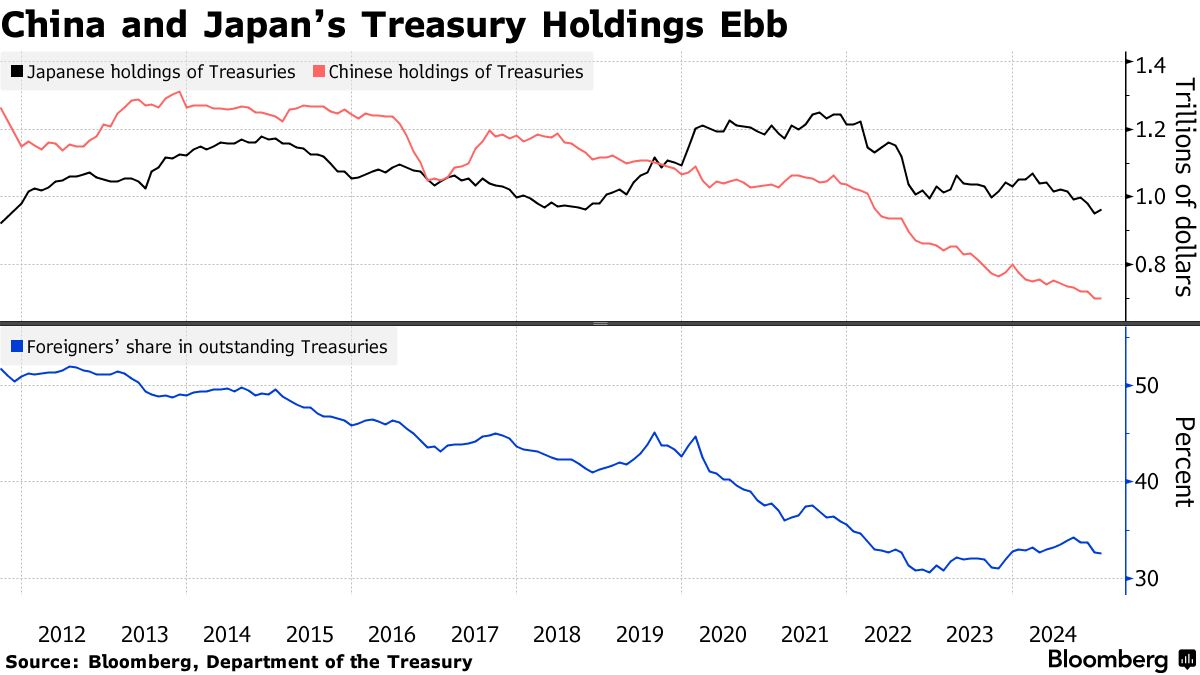

Foreign Selling

While hard to prove in real time, speculation often arises that foreign entities are selling when Treasury prices fall. This time, some believe it’s a response to Trump’s tariff policies. China and Japan are the largest holders of U.S. Treasuries. Official data shows both have been reducing their holdings for some time.

China’s trading activity is tightly guarded, making it difficult to assess its precise role. Yet strategists often note that China’s Treasury holdings could serve as leverage against the U.S.—even though large-scale sales might depress the value of China’s own foreign exchange reserves.

Hedge Fund Trades

Basis trades may have contributed to the surge in Treasury yields in early April. This popular hedge fund strategy profits from small price differences between cash Treasuries and futures contracts.

These spreads are typically narrow, so investors often use heavy leverage. When market volatility hits and investors rush to unwind positions to repay loans, problems can arise. The risk is a chain reaction that drives yields even higher—or worse, causes the Treasury market to seize up, as happened during the unwinding of basis trades in 2020.

Others point to the sudden collapse of a widely held bet that U.S. Treasuries would outperform interest rate swaps. In fact, swaps performed better, as banks liquidated bonds to meet client liquidity demands and then increased swap positions to maintain exposure in case bond prices rebounded.

If not U.S. Treasuries, then what?

European and Japanese fund managers are finding reliable alternatives to U.S. Treasuries, potentially encouraging them to shift allocations toward markets with seemingly more stable policy outlooks. In times of broad turmoil, German bunds have been among the main beneficiaries.

Gold, the traditional safe-haven asset, surged to a record high in April, outperforming nearly all other major asset classes. Central banks have been stockpiling the metal for some time, seeking to diversify reserves and reduce reliance on dollar-denominated assets. However, unlike bonds, gold offers no fixed income. Returns only come from selling at a higher price.

In the end, no investment matches the liquidity and depth of the U.S. Treasury market. A true exodus would take years, not weeks. Yet some market observers believe April’s moves may signal a shift in the global order—and a reassessment of the asset underpinning America’s economic dominance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News