Interpreting Origin: Moving Beyond Traditional ICOs, Resolving the Token Issuance Trilemma

TechFlow Selected TechFlow Selected

Interpreting Origin: Moving Beyond Traditional ICOs, Resolving the Token Issuance Trilemma

By balancing accessibility, engagement, and valuation, Origin has become a leader in next-generation token launches.

Author: Axis

Compiled by: TechFlow

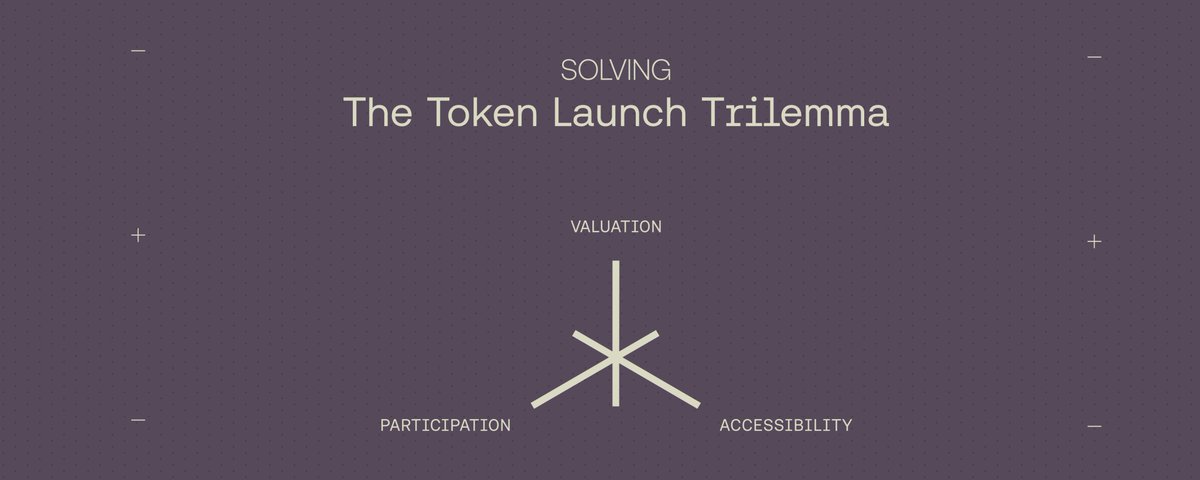

In our previous article, we explored the Token Launch Trilemma and introduced three key elements that any token launch must consider—Accessibility, Participation, and Valuation. At the end of that article, we mentioned that Axis is a modular auction protocol that enables users to easily run auctions for ERC20 tokens, potentially solving this trilemma.

Auctions, as an effective tool for price discovery, are backed by a dedicated field of research—Auction Theory. As we noted in our first article, auctions have already helped manage and facilitate billions of dollars in transactions within the crypto space.

However, current solutions for token launches remain suboptimal, failing to fully unlock the potential of auction design. Origin is a suite of token launch tools we've developed to change this situation and find the optimal solution within the trilemma.

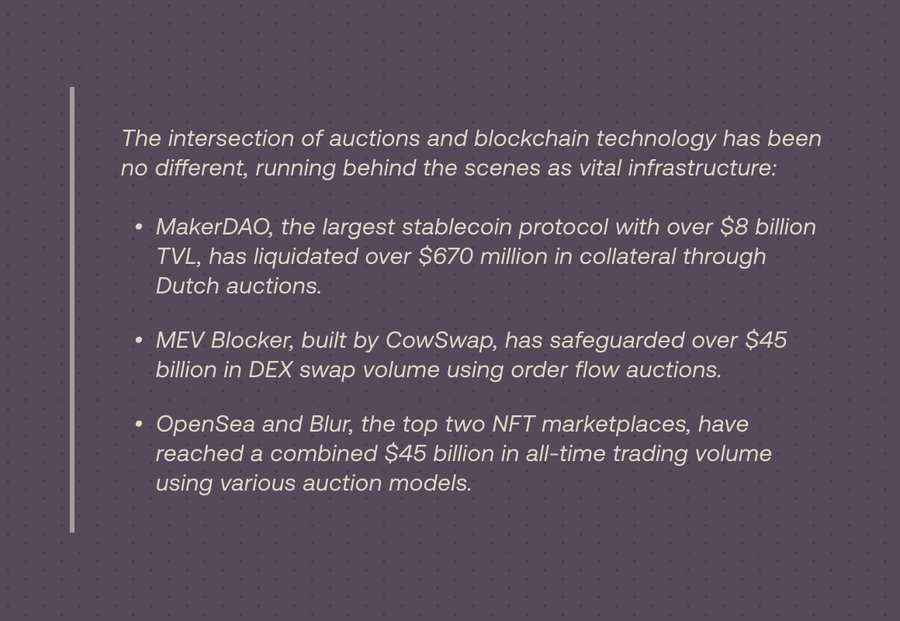

The combination of auctions and blockchain technology plays a critical infrastructural role in the industry, supporting operations across multiple key domains:

-

MakerDAO: As the largest stablecoin protocol today, with a total value locked (TVL) exceeding $8 billion, it has successfully liquidated over $670 million in collateral assets through Dutch auctions.

-

MEV Blocker: Developed by CowSwap, this tool uses order flow auction mechanisms to protect trades on decentralized exchanges (DEXs), having secured over $45 billion in transaction volume to date.

-

OpenSea and Blur: As two leading NFT marketplaces, these platforms have surpassed $45 billion in total trading volume and employ various auction models to optimize trading experience and price discovery. These examples clearly demonstrate the broad application and indispensable role of auction mechanisms in the blockchain ecosystem.

So, what's the problem? And why do these issues exist?

Traditional launch platforms repeatedly use outdated strategies across multiple market cycles, despite their evident flaws. Fixed-price ICOs remain a common choice—but why do we keep returning to this method? Let’s revisit @VitalikButerin's analysis from a 2021 article on the issue of fixed-price sales being set below market-clearing prices. He identified two main reasons: concerns about fairness and managing community sentiment.

"The basic principle of managing community sentiment is simple: you want the price to go up, not down... To avoid price drops, the only way is to set the sale price low enough to ensure the post-sale market price will almost certainly be higher. But how can this be achieved without triggering a 'feeding frenzy'—which ultimately becomes another form of auction in disguise?"

Out with the old, in with the new!

Origin offers a specially designed toolkit aimed at addressing these complexities and solving the "Token Launch Trilemma." While each auction type in Axis can be used independently, a multi-stage token launch strategy that combines the strengths of different systems may be the ideal approach.

Fixed-Price Sale

In the first stage, projects can initiate via a fixed-price sale operating on a "first-come, first-served" basis. Our smart contract includes an optional whitelist feature, allowing participation to be restricted to early community members. Additionally, Axis supports vesting token distributions to users over time, with flexible configurations—offering standard linear vesting by default, or integration with custom or third-party solutions. This design is crucial for aligning incentives. Early community members who wish to purchase tokens below market-clearing prices receive them gradually, ensuring long-term alignment of interests.

EMP Auction

In the second stage, projects can leverage Origin’s flagship auction mechanism to discover the token’s market-clearing price. In our next article, we’ll dive deeper into the Encrypted Marginal Price (EMP) system. Simply put, this system allocates tokens to the highest bidders, with the clearing price determined by the last successful bid that fills the allocation. Discovering the clearing price is essential, as it lays the foundation for Origin’s final stage—liquidity deployment.

Direct-to-Liquidity

Origin’s auction mechanism features a unique "Direct-to-Liquidity" function, enabling instant liquidity for tokens on decentralized exchanges (DEXs). This means funds raised from the auction can be directly used to establish an initial liquidity pool, with users able to choose whether to allocate all or part of the proceeds. This feature is optional and highly customizable, ensuring bidders clearly understand how their funds will be used before the auction begins. Compared to traditional manual processes prone to errors, this design adds a layer of programmatic security to the entire process.

It’s important to note that accurately determining a token’s clearing price requires careful analysis. Therefore, users unfamiliar with auction valuation may prefer to wait until the token is listed on a DEX before participating in trading.

How Origin Solves the Token Launch Trilemma

Now, let’s revisit Origin’s multi-stage approach within the framework of the Token Launch Trilemma:

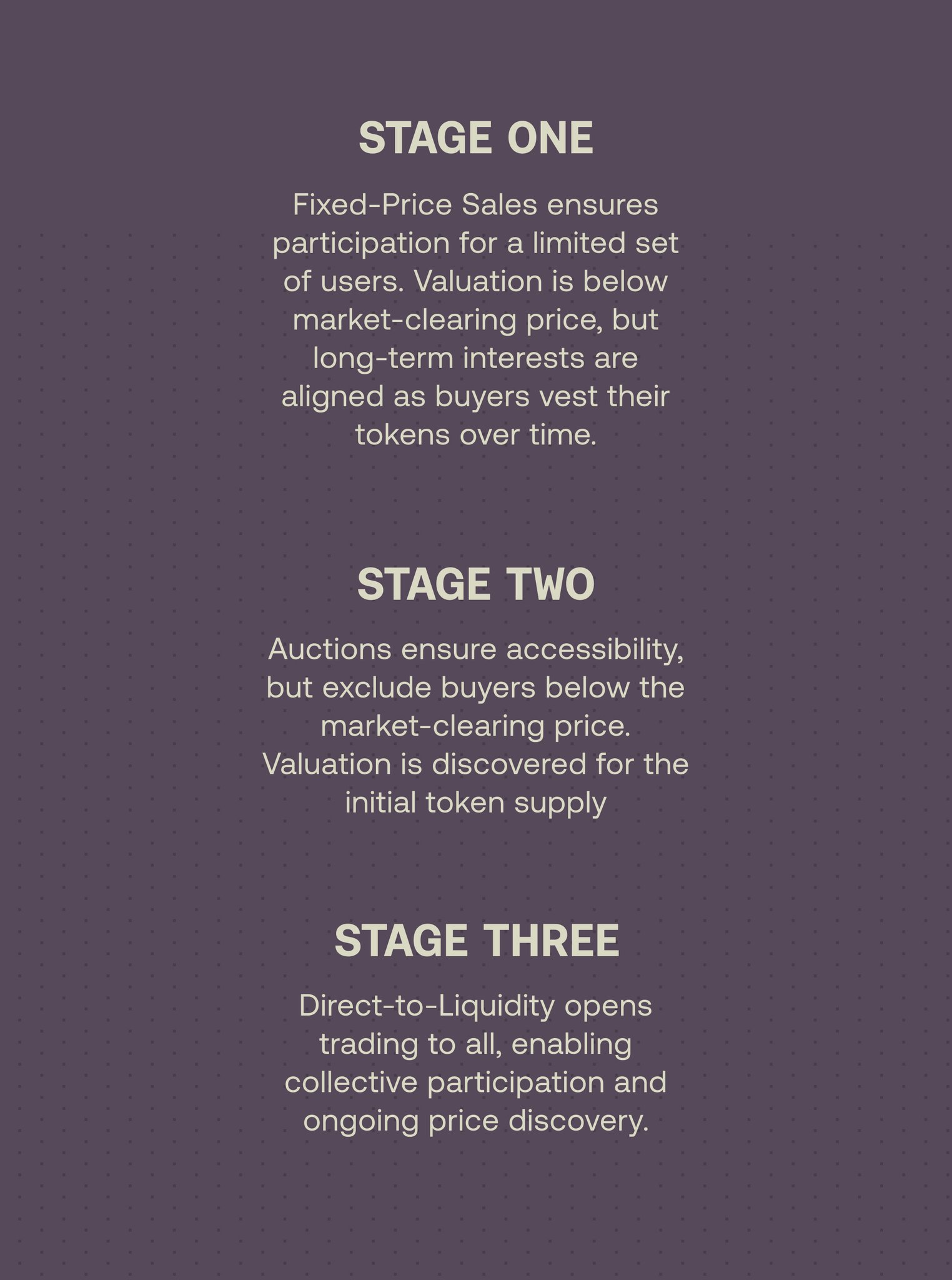

Stage One

The fixed-price sale aims to attract a specific user group. Pricing in this stage is set below the market-clearing level, but buyers unlock their tokens gradually over time, aligning their long-term interests with the project.

Stage Two

The auction mechanism ensures broader user participation while excluding bidders whose bids fall below the market-clearing price. At the same time, the market valuation of the initial token supply is established.

Stage Three

The direct-to-liquidity mechanism opens trading to everyone, promoting collective participation and supporting ongoing price exploration and discovery.

Returning to Vitalik’s 2017 perspective mentioned in our first Token Launch Trilemma article, he proposed a strategic trade-off:

"We can afford to make slight concessions on guaranteed participation and mitigate its impact by introducing time as a third dimension...

In any case, uncertainty in valuation or uncertainty in participation is always difficult to completely avoid. However, when given a choice, it seems wiser to prioritize accepting uncertainty in participation while minimizing uncertainty in valuation."

Origin’s phased launch strategy puts these insights into practice. By progressively expanding participation, each stage optimizes one core aspect of the trilemma, while together they form a balanced, holistic approach. This design ensures that even if some uncertainty exists in participation and valuation, the structure of the launch maximizes overall benefits for both the project and its users.

This approach not only effectively addresses the complexity of the Token Launch Trilemma but also sets a new standard for how tokens are brought to market. By balancing accessibility, participation, and valuation, Origin emerges as a leader in next-generation token launches.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News