Origin Protocol: One-click minting of OUSD and OETH, using different strategy combinations to boost yields

TechFlow Selected TechFlow Selected

Origin Protocol: One-click minting of OUSD and OETH, using different strategy combinations to boost yields

In the LSD War, the real winners may never be on the battlefield.

On May 17, Origin DeFi launched Origin Ether (OETH), an innovative yield-generating token using leading liquid staking derivatives (LSDs) as collateral.

The core functionality of the Origin Protocol enables one-click minting of the yield-bearing stablecoin OUSD and the yield-enhanced Ethereum derivative OETH, utilizing a diversified set of strategies to maximize returns.

Governance follows a ve model, where key protocol parameters are managed by holders who stake OGV, the protocol’s governance token.

Mechanism

OUSD and OETH are the flagship products of Origin Protocol. Their defining feature is delivering maximum yield to holders while maintaining a strict 1:1 peg with their underlying assets.

OUSD is backed 1:1 by USDT, USDC, and DAI, ensuring that 1 OUSD consistently trades at approximately 1 USD.

Likewise, OETH is backed 1:1 by ETH and liquid staking derivatives (such as stETH, rETH, and sfrxETH), meaning 1 OETH maintains parity with 1 ETH in value.

Properties

OUSD:

▪️ 1 OUSD = 1 USD

▪️ Backed 1:1 by stablecoins (USDT, USDC, and DAI)

▪️ Generates yield by deploying underlying assets across diversified DeFi protocols

▪️ Elastic supply that continuously distributes additional OUSD to holders

▪️ Fully on-chain, open-source, and permissionless

OETH:

▪️ 1 OETH = 1 ETH

▪️ Backed 1:1 by ETH and liquid staking derivatives

▪️ Earns higher yields than individual LSDs such as rETH, stETH, or sfrxETH

▪️ No need for users to manually stake or claim rewards

▪️ Earns yield through providing DeFi liquidity and holding blue-chip liquid staking tokens

Purchasing and Selling

Users can upgrade their existing stablecoins to OUSD via app.ousd.com or convert ETH and LSDs into OETH via app.oeth.com. Upon upgrading, their OUSD and OETH begin accruing yield immediately. When trading, Origin DApps automatically consider slippage and gas fees, intelligently routing users to the most favorable prices. This means DApps prioritize purchasing already-circulating OUSD or OETH from the market rather than minting new tokens from the treasury. The capital from holders is deployed across a diversified suite of yield strategies, balancing risk and periodically rebalancing to maintain strong returns over time.

Users may redeem their OUSD or OETH for the underlying collateral at any time. As with purchases, the Origin DApp evaluates slippage, gas costs, and treasury exit fees to offer optimal pricing. Typically, users are directed to sell their OUSD or OETH on AMMs instead of redeeming through the treasury, which would incur protocol exit fees.

When users redeem OUSD via the treasury, a 0.25% exit fee is charged. This fee is redistributed as additional yield to remaining participants in the treasury (i.e., other OUSD or OETH holders). This mechanism acts as a security feature, deterring attackers from exploiting lagging oracles to drain stablecoins during mispricing events. Additionally, the exit fee incentivizes long-term holding over short-term speculation. After redemption, the treasury returns tokens in proportion to the user’s current holdings. This non-selective design protects the treasury when supported stablecoins lose their peg.

OUSD

Price Stability Mechanism

The protocol uses Chainlink oracles to monitor stablecoin exchange rates and dynamically adjusts minting and redemption rates to maintain OUSD’s 1:1 peg with USD.

Yield Strategy

OUSD generates yield through stablecoin lending and liquidity provision. It earns returns via stablecoin loans on Compound, Morpho, and Aave, as well as liquidity provision on Curve and Convex. OUSD’s 30-day and 365-day trailing yields have consistently ranged between 4% and 7%. Notably, OUSD’s yield exceeds that of any single protocol used by Origin Dollar.

Aave and Compound

Borrowers on Aave and Compound post various types of collateral—such as ETH, BTC, and other tokens—to borrow assets. These platforms require over-collateralization and liquidate borrowers whose leverage exceeds predefined thresholds. For example, a user posting ETH as collateral on Aave can borrow up to 82.5% of its value. If their borrowed USDC reaches 85% of their ETH's value, their position is liquidated. Using this mechanism, OUSD lends stablecoins on these platforms to earn interest, distributing the proceeds to OUSD holders. These returns come from interest and fees generated by stablecoin pools on Aave and Compound.

Curve (CRV) and Convex (CVX)

Liquidity providers on Curve enable traders to swap assets—such as DAI, USDC, and USDT—for a fee. Curve also rewards LPs with CRV tokens. Convex acts as a yield optimizer for Curve, offering priority access to CRV emissions. LPs can stake their Curve positions on Convex to earn enhanced rewards and CVX tokens. In return, Convex receives a portion of the CRV rewards. OUSD serves as a liquidity provider for the DAI-USDC-USDT-OUSD pool, collecting trading fees and selling earned CRV tokens to acquire more stablecoins. Through these mechanisms, users gain exposure to both token incentives and transaction fees.

OETH

Yield Strategy

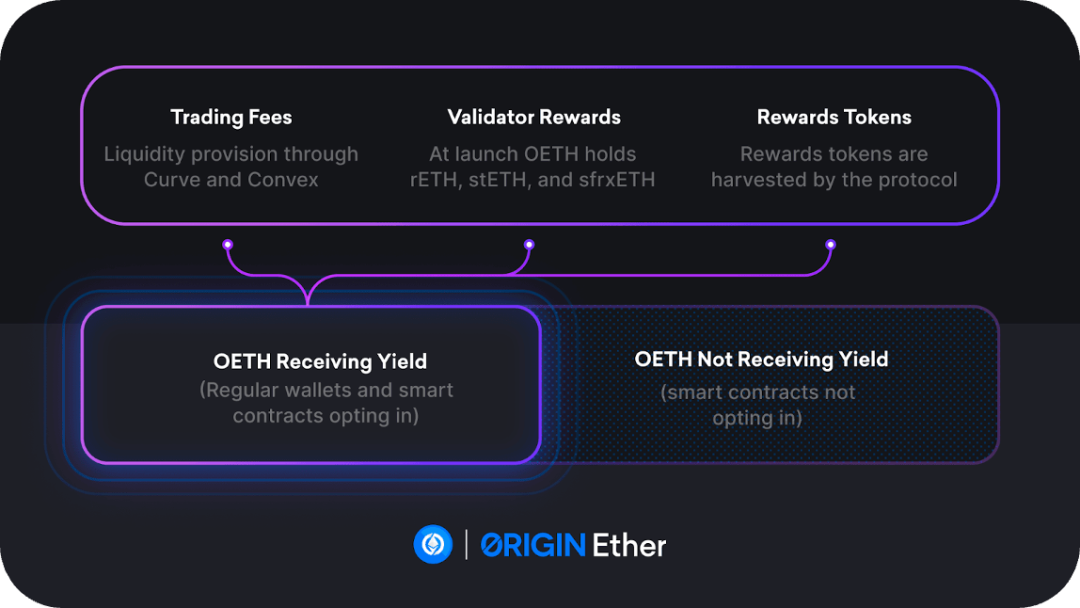

OETH generates yield similarly to OUSD, leveraging its collateral across multiple revenue streams. By default, OETH tokens held in smart contracts do not earn yield; instead, those earnings are redirected to regular holders’ wallets. The key distinction between OETH and OUSD is that OETH additionally earns yield from liquid staking tokens (LSTs).

▪️ Validator rewards

▪️ Transaction fees

▪️ Reward tokens

By holding stETH and staked frxETH, Origin Ether increases its ETH balance through staking rewards. OETH also benefits from the appreciation of Rocket Pool ETH (rETH), which gains value from validator rewards. By holding a basket of liquid staking derivatives, Origin Ether optimizes validator rewards while offering users diversified exposure to liquid staking.

Origin Ether earns additional yield through its Convex AMO (Automated Market Operations) strategy. OETH collateral is used to provide liquidity for the OETH-ETH pools on Curve and Convex, allowing holders to capture higher returns from trading fees in these liquidity pools. Finally, OETH earns yield from accumulated reward tokens, starting with CRV and CVX.

Tokenomics

The initial circulating supply of OGV is 1 billion tokens, with a total initial supply of 4 billion OGV to be fully distributed over four years.

Initial allocation of OGV tokens:

▪️ 25% airdropped to OGN holders

▪️ 1.25% for pre-launch liquidity mining

▪️ 25% for future liquidity mining incentives

▪️ 10% for dollar holders

▪️ 10% for current open-source contributors

▪️ 10% for future open-source contributors

▪️ 18.75% DAO reserve

The majority of tokens are allocated to parties outside Origin’s control, effectively preventing Origin or affiliated entities from dominating voting power.

Origin Protocol did not conduct any private or public fundraising for OGV. The token was launched to the community in July 2022, and over the coming years, most tokens will be distributed to OUSD holders, OETH holders, and liquidity providers.

Vote-Escrow OGV (veOGV)

OGV holders can receive veOGV by locking their OGV in the OETH staking protocol. veOGV holders earn protocol revenues and direct the allocation of token incentives generated by the Origin Ether protocol. The OETH protocol takes a 20% performance fee from OETH-generated yields. This fee is used to acquire CVX tokens, which are then reinvested into the OETH-ETH Curve pool, increasing both CVX and CRV reward amounts. This significantly boosts the yield for Origin Ether’s AMO strategy and enhances returns on deployed capital.

Under decentralized governance, veOGV holders can vote to adjust the protocol fee percentage, redirect it directly to OGV stakers, or allocate it toward acquiring new tokens for the Origin Ether ecosystem. Protocol revenues may also be used to buy back OGV and distribute it to veOGV holders.

The amount of OGV received through veOGV staking depends on the quantity of OGV staked and the duration of the lock-up period.

Team Information

Origin Ether was created by Origin Protocol Labs and is governed by the community of OGV stakers. Origin was founded by Josh Fraser and Matthew Liu, later joined by executives from PayPal, Coinbase, Lyft, Dropbox, and Google, along with top engineers from web2 startups, to build the Origin Protocol ecosystem.

Origin’s primary investor is Pantera Capital, the world’s oldest cryptocurrency fund. Other notable investors include Foundation Capital, Blocktower, Blockchain.com, KBW Ventures, Spartan Capital, PreAngel Fund, Hashed, Kenetic Capital, FBG, QCP Capital, and Smart Contract Japan. Prominent angel investors include YouTube co-founder Steve Chen, Reddit co-founder Alexis Ohanian, Y Combinator partner Garry Tan, and Akamai founder Randall Kaplan.

Summary

As a new entrant in the LSDFi space, Origin Protocol leverages multiple yield strategies to enhance returns, further intensifying competition in an already crowded LSDFi landscape and escalating liquidity battles among xETH variants. Yet upon deeper reflection, the true winners of the LSD War may ultimately remain off the battlefield.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News