From the Debate of Two Paradigms to Public Chain Development: Infrastructure-First vs Application-Driven

TechFlow Selected TechFlow Selected

From the Debate of Two Paradigms to Public Chain Development: Infrastructure-First vs Application-Driven

The essence is competing for distribution—achieving more efficient user acquisition and retention.

Author: YettaS

The previous post received a lot of controversy for mentioning @berachain; yesterday, @cz_binance was also actively using memes to boost @BNBCHAIN; during the AMA with @DoveyWanCN, @forgivenever asked why we would support Movement.

That day, seeing @jinfizzbuzz write about @megaeth_labs, some people said it was too hype-heavy to talk about ecosystem before even launching a testnet; in recent days, @solayer_labs and @StoryProtocol's TGE have also fallen far short of expectations. Taking this opportunity, let me explain our logic behind investing in public chains. Every chain has its own starting point—what I say doesn't represent absolute truth, and discussion is welcome.

How did public chains operate in the past?

The essence of blockchain is the "chain." Since its inception, building infrastructure first has become an industry norm, directly giving rise to numerous general-purpose public chains (Generic Public Chain) that differentiate themselves through technology. The default approach became: set up the infrastructure first, then attract dApp developers. But we all know infrastructure alone can't attract users. What does? Application-driven growth—ICO, NFT, DeFi, Meme—applications that people can actually engage with. However, such applications don't emerge spontaneously. How did early public chains break through?

Through founder charisma, massive fundraising announcements, large-scale marketing and promotion, and TGEs with huge wealth effects. Today’s public chain marketing efforts are child’s play compared to what happened with EOS. The genius BM ran a year-long ICO, raised $4 billion, and then… nothing. Why did this seemingly empty path work? Because public attention is limited. When a chain remains unknown, no users or applications will come to your ecosystem on their own. This is exactly why VCs keep funding new chains.

What's wrong with public chains today?

The market's valuation logic for public chains is currently extremely distorted.

On one hand, the market is increasingly rejecting the "infrastructure-first" model, because only a handful of Generic Public Chains have truly developed thriving ecosystems. This is one reason investors have lost trust in VCs—huge amounts of capital were bet on many chains, but most failed to deliver on growth promises. The chart below by @defi_monk points directly at this issue.

On the other hand, public chains still represent the highest valuation ceiling in the entire industry. To date, no Dapp has proven it can outlive a public chain.

Ethereum has evolved over 10 years, Solana has gone through two full cycles, and their Dapps remain active.

In other words, despite skepticism around high valuations, public chains remain the closest thing to a long-term, high-ceiling sector.

So people have mixed feelings about this model—resenting how something with nothing tangible can be so highly valued, yet loving the potential upside if executed well.

This is actually a legacy issue in our industry—we need transformation.

How to transform?

A different path has now emerged: App-Specific Chains. This started with the phenomenon @AxieInfinity, which launched @Ronin_Network aiming to bring application-layer users into the chain ecosystem. The problem? Their app itself lost momentum before they could migrate users.

This cycle, @HyperliquidX further ignited this model, and now we see:

- @Uniswap — Unichain

- @JupiterExchange — Jupnet

- @OndoFinance — Ondo Chain

- @ethena_labs — Ethena Chain

Take Ethena, which I know best—they’re launching Ethereal next, a perp based on USDe, building an ecosystem around their core asset and application. This might be similar to Hangzhou? After Alibaba emerged, the entire e-commerce industry rose there.

This paradigm shift reflects the reality that applications are ultimately what bring the industry to the masses—it’s also market segmentation driven by commercial maturity. Everyone is challenging the traditional valuation system in different ways.

What are these two models really competing for?

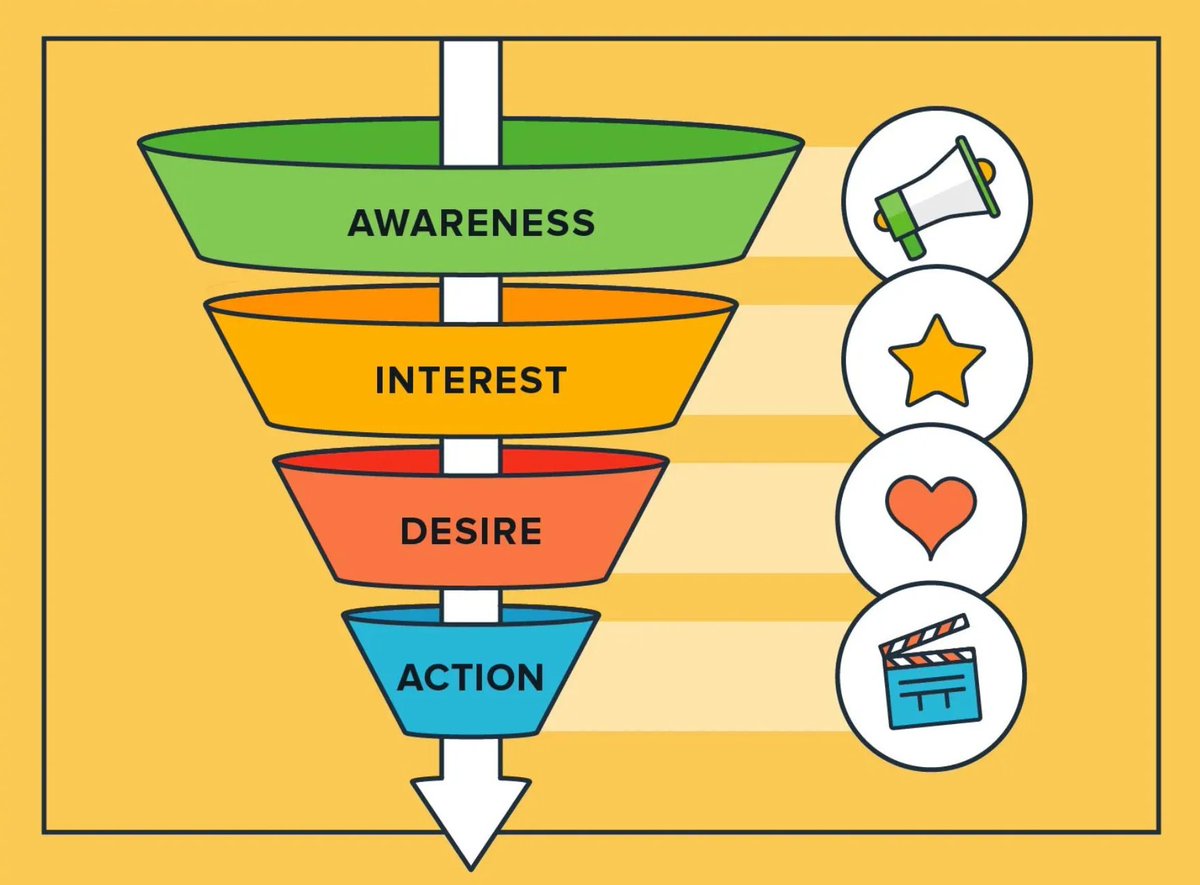

In the public chain ecosystem, chains rely on large-scale infrastructure promotion and fundraising narratives to attract dApp developers, eventually achieving user retention through application ecosystems. Meanwhile, dApps acquire users directly via real-world use cases, gradually build their own ecosystems through user migration and network effects, and ultimately evolve into a chain.

From "hype" to "reality," from "reality" to "hype"—different paths, same destination. What's the core here? It's about Distribution—who can acquire users more efficiently and retain them.

In Web2, the barrier to Distribution is much higher than the product itself, because marginal costs for most products approach zero, while distribution channel competition has extremely high barriers.

Distribution means monopoly over traffic entry points + platform network effects + data control—all forming the core competitiveness of Web2 companies.

Take TikTok as an example:

- Traffic entry monopoly: TikTok seized the short-video wave, becoming a new generation traffic gateway

- Platform network effect: Built a two-sided market of creators—viewers—advertisers; as content supply grows, user stickiness strengthens continuously

- Data monopoly: Massive user data trains recommendation algorithms, constantly improving distribution accuracy, forming a strong data moat

Why did we invest in Hooked back then? We always called it a web2.5 product—because tap-to-earn is actually a long-proven effective user acquisition model capable of bringing in massive external traffic. But one thing was ultimately disproven: users acquired via airdrops have low quality and poor conversion rates. Even with efficient traffic acquisition, retention fails. This is why we later passed on all Telegram tap-to-earn projects—same model, different channel, still low-quality users.

Back to business fundamentals, the logic of Distribution exists in web3 too—only the user acquisition methods differ.

In the past, Generic Public Chains lacked mature products, couldn’t rely on product to gain traffic, let alone achieve monopoly effects. Therefore, their way of gaining awareness mainly relied on:

- Tech pioneer appeal: attracting early developers and tech enthusiasts

- Founder charisma and cultural uniqueness: building identity and community

- Fundraising and token incentives: driving short-term user growth

However, the success or failure of this model entirely depends on "strength of consensus"—when strong, it builds ecosystem moats; when weak, a shift in market sentiment causes traffic to collapse.

Now, App-Specific Chains are multiplying, indicating Web3 is gradually returning to Web2 business models—using real applications as drivers, achieving efficient conversion and long-term retention through market segmentation and private traffic operation.

I tend to believe this model follows healthier growth logic and better aligns with the evolution of real-world commerce.

What lies ahead?

The coexistence of these two paths reflects the industry’s early stage—no single model has achieved absolute dominance, and a paradigmatic shift has yet to occur.

All investments are essentially bets on "momentum." Where are we now? Generic Public Chains haven’t been disproven, but as demand for mainstream adoption rises sharply, relying solely on technical or fundraising narratives can no longer generate sufficient consensus. At the same time, the paradigm shift from building super dApps to building chains hasn’t been proven either. This isn’t just a switch between product and infrastructure—it’s a leap from PMF-driven product thinking to the ability to shape culture and build ecosystems. Founders capable of such transformative evolution are extremely rare.

Both paths have opportunities and challenges. The true divide lies in—entirely different demands on founder capabilities. At its core, venture capital is about betting on market pricing based on judgment of "momentum," "endeavor," and "people"—placing wagers amid extreme uncertainty, accepting failure risk, in pursuit of exceptional risk-adjusted returns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News