From New York Bank to Citibank, Wall Street is entering the cryptocurrency field

TechFlow Selected TechFlow Selected

From New York Bank to Citibank, Wall Street is entering the cryptocurrency field

Some major U.S. banks are aggressively moving into cryptocurrency services for large funds, investors, and traders, leveraging the rapid regulatory easing under President Donald Trump to launch digital asset versions of businesses they have long dominated.

Article by: Yueqi Yang

Translated by: Block unicorn

Some major U.S. banks are aggressively moving into cryptocurrency services for large funds, investors, and traders, leveraging the rapid regulatory easing under President Donald Trump to launch digital versions of businesses they've long dominated.

Most of the activity so far involves custody—holding cryptocurrencies on behalf of investors. A senior executive at State Street, one of the world’s largest custodians of stocks and bonds, said the bank plans to launch digital asset custody services next year. Meanwhile, its top rival, BNY Mellon, has already launched a small-scale custody business for Bitcoin and Ethereum but plans to expand it to more types of tokens.

Citigroup, the third-largest bank in the U.S. by assets, is also exploring ways to expand cryptocurrency custody through both internal development and partnerships with external firms, according to people familiar with the bank.

"Citigroup recognizes that institutional client adoption of digital assets is accelerating," a Citigroup spokesperson said. "We're also working with clients to develop capabilities in asset tokenization and digital asset custody."

Overall, these initiatives could represent a reshuffling of power between Wall Street and crypto-focused firms, as banks expand key cryptocurrency offerings to large clients. Currently, crypto companies such as Coinbase, Anchorage Digital, and BitGo dominate cryptocurrency custody, while firms like Galaxy Digital, FalconX, and Hidden Road provide trading services for large investors and traders—effectively serving as Wall Street in the crypto world.

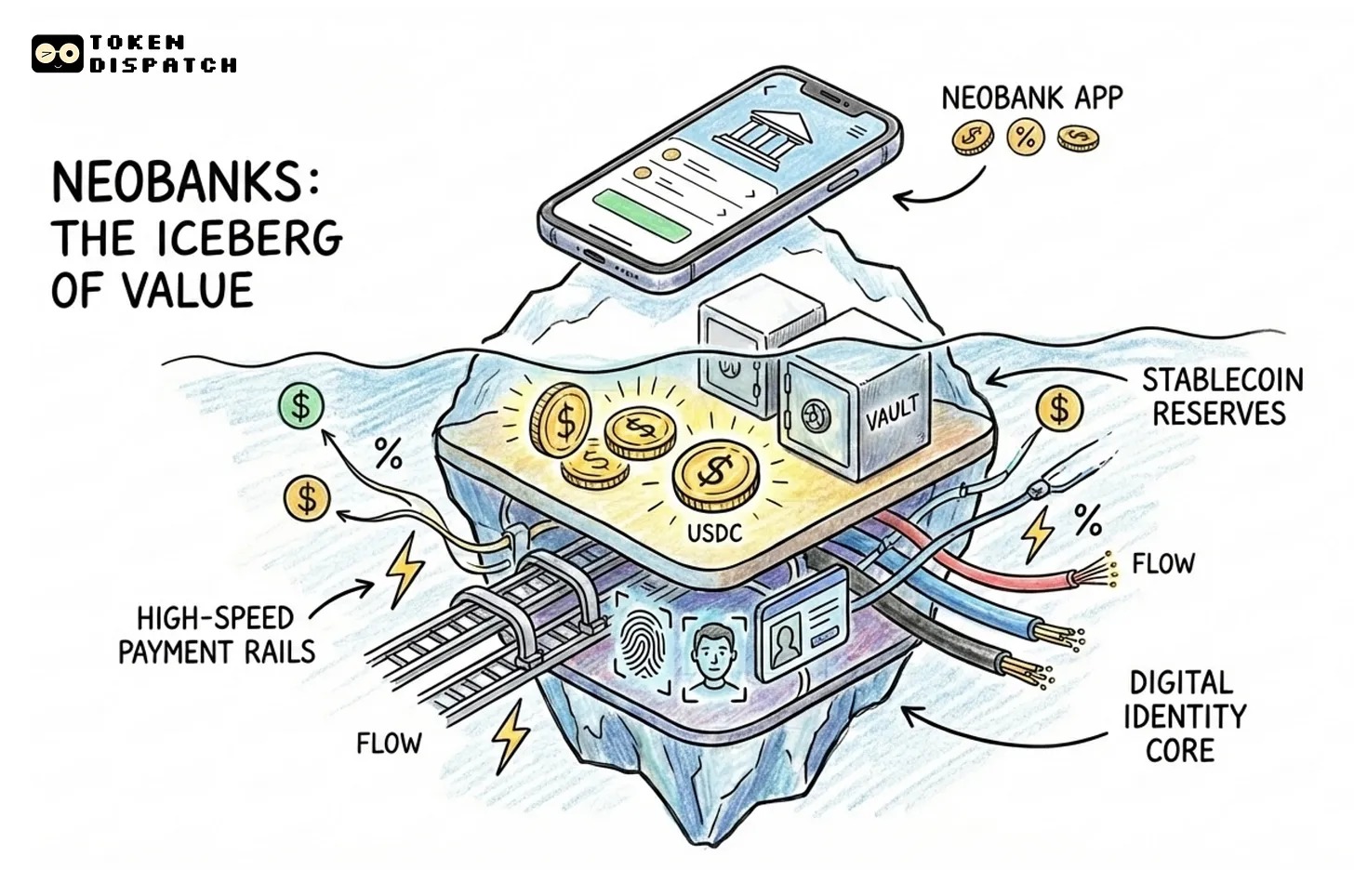

Custody is a behind-the-scenes service, but it's crucial because it serves as a springboard for banks to further enter crypto activities such as trading and lending—services central to Wall Street banks' revenue. Traditional asset managers may also prefer holding crypto assets with banks rather than crypto firms, meaning their entry into crypto depends on banks’ ability to offer custody.

Until recently, banks largely avoided direct involvement with cryptocurrencies due to regulatory hurdles and risks associated with this volatile and relatively new asset class. But during its first week in office, the Trump administration saw the Securities and Exchange Commission rescind Biden-era accounting guidance that had made holding crypto prohibitively expensive for banks.

Federal banking regulators are also overhauling their approach to cryptocurrency oversight after previously discouraging banks from engaging in the space. For example, the Federal Deposit Insurance Corporation once warned about crypto risks to the entire banking system but is now paving the way for greater bank participation in crypto activities.

The crypto industry is closely watching U.S. banks’ plans, as they could bring capital into the crypto market from large clients such as hedge funds, mutual fund firms, endowments, wealth management firms, and financial advisors—all managing trillions of dollars collectively.

This could significantly boost the overall crypto market, currently valued at around $3.2 trillion, with Bitcoin and Ethereum accounting for nearly 70% of market capitalization. As traditional firms seek to make more crypto investments, they will need places to store cryptocurrencies and firms to help them trade.

For instance, BNY Mellon has seen growing interest in crypto from endowments, wealth managers, and registered investment advisors who want to hold crypto with a bank. "We’re looking to grow our crypto custody client base in a measured way," said Caroline Butler, BNY Mellon’s global head of digital assets.

The bank is also exploring providing custody services for asset managers launching Bitcoin and other cryptocurrency exchange-traded funds (ETFs). Currently, Coinbase dominates this business. Most fund firms offering popular Bitcoin ETFs—including giants like BlackRock and Franklin Templeton—use Coinbase to safeguard billions of dollars worth of crypto.

Banks can also use custody as an entry point into another hot area of crypto: tokenization—the process of putting assets like bonds onto blockchains. BNY Mellon is considering using custody to support tokenized assets such as money market funds. "It powers all the other custody-related services," Butler said.

Likewise, State Street aims to offer custody and transfer agency services—tracking ownership of assets—for companies providing tokenized assets to investors. It could also offer services helping clients manage the process of using tokenized assets as collateral, making these blockchain-based assets more useful for traders and driving adoption.

"Our plan is to roll out these services to clients in phases starting in 2026, beginning with custody, subject to regulatory approval," said Donna Milrod, State Street’s chief product officer.

In the meantime, crypto firms are seeking ways to avoid being completely crowded out by Wall Street. They believe many banks will initially want to partner with or outsource to crypto firms to build infrastructure or deliver services.

Coinbase, the largest U.S. crypto exchange, sent a letter earlier this month to U.S. banking regulators urging them to allow banks to launch crypto custody and trading services by outsourcing parts of those operations to crypto firms. Brett Tejpal, head of Coinbase Institutional, said he was holding intensive two-day meetings this week with 10 U.S. banks.

However, many large banks’ product launches won’t happen immediately. For example, State Street still needs Federal Reserve approval to launch digital asset custody services in the U.S., Milrod said.

Trading Springboard

Once banks have crypto custody in place, it can pave the way for additional services such as crypto trading and lending, as well as prime brokerage—the suite of trading and other services offered to big clients like hedge funds. This would solidify banks’ presence in territory currently dominated by major crypto firms.

Trading giant Goldman Sachs made waves when it launched a crypto trading division in 2021, but the bank still does not directly trade cryptocurrencies. Instead, it trades crypto derivatives that are cash-settled rather than involving actual crypto, along with Bitcoin and Ethereum futures listed on CME.

Likewise, Citigroup only trades CME Bitcoin futures on an agency basis, meaning it facilitates client trades without using its own capital, according to a bank spokesperson.

But banks have a long way to go compared to custody when it comes to trading activities. Expanding into direct crypto trading, while potentially more profitable than custody, will face greater regulatory scrutiny because trading and lending typically pose higher risks for banks than simply overseeing clients’ crypto holdings.

Moreover, just because banks are allowed to do something doesn't mean they will—crypto volatility could make meeting large banks’ strict regulatory capital requirements costly, and banks must decide whether trading crypto represents the best use of their resources.

To directly trade crypto, Goldman Sachs would need approval from its primary regulator, the Federal Reserve, according to two people familiar with the bank’s digital asset plans. It would also need a BitLicense from the New York State Department of Financial Services to offer crypto services in New York.

Goldman will also assess whether entering spot crypto trading makes commercial sense, one of the people said. A Goldman Sachs spokesperson declined to comment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News