Binance Research 2024–25 Summary and Outlook: AI x Crypto is a key area to watch; not all NFT projects launching tokens will succeed

TechFlow Selected TechFlow Selected

Binance Research 2024–25 Summary and Outlook: AI x Crypto is a key area to watch; not all NFT projects launching tokens will succeed

2025 is expected to be a landmark year for crypto ETFs, driven by increased capital inflows and the potential launch of new ETF products.

Author: Binance

Compiled & Translated: TechFlow

Just now, Binance Research released its 2024 Year in Review and Outlook for 2025 report, using over 100 charts to detail the performance of various crypto sectors over the past year and offering eight key outlooks for 2025.

Given the original report's length, TechFlow has condensed and refined the content, focusing on the 2024 review and 2025 outlook sections.

Key Highlights of 2024

-

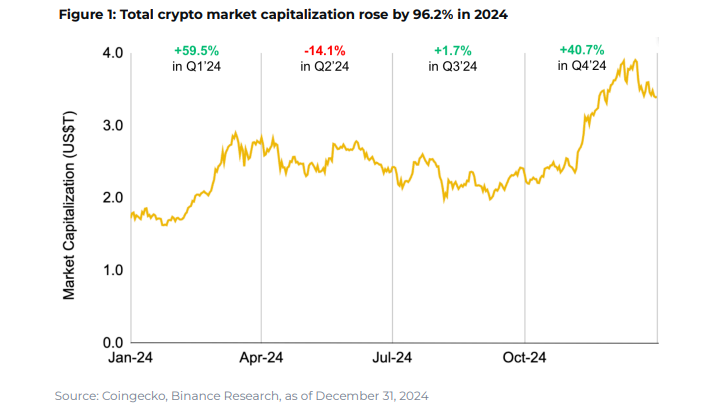

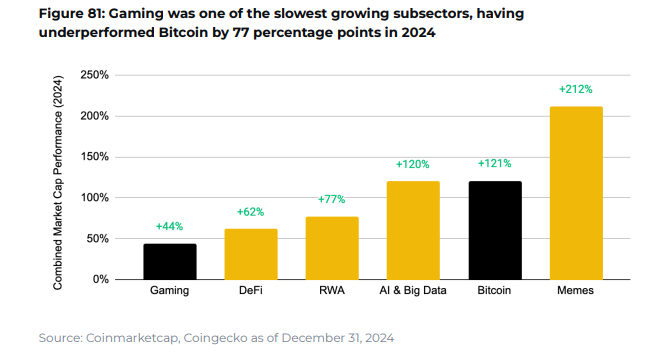

Overall Market: The cryptocurrency industry saw significant growth in 2024, driven by strong performance in Q1 and Q4, with market capitalization increasing 96.2% year-on-year. The U.S. launch of spot BTC ETFs in January marked a pivotal moment, boosting market sentiment and attracting new capital. Favorable macro conditions—including the Federal Reserve’s rate cut in September and positive regulatory expectations following the U.S. presidential election—further fueled momentum.

-

Key narratives throughout the year: points systems, restaking, memecoins, AI agents, and stablecoins.

-

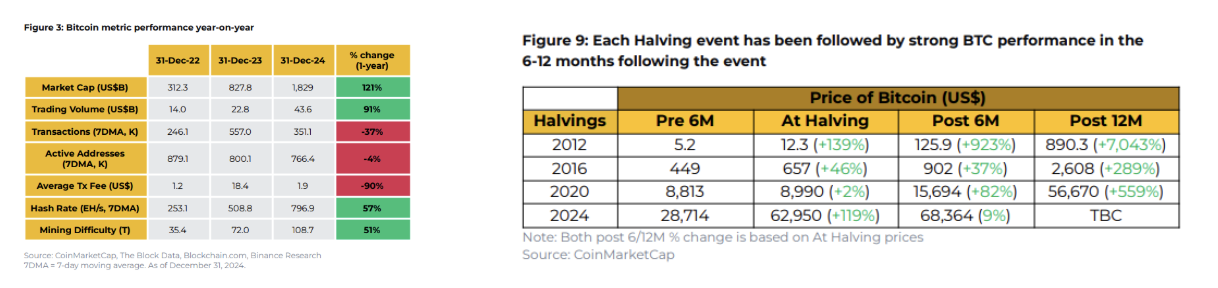

BTC: Bitcoin had an eventful 2024, including the approval of spot ETFs in the U.S. in January and breaking the long-anticipated $100,000 mark in December. The ETFs proved historically successful, attracting approximately $35B in net inflows with total assets exceeding $105B. Bitcoin’s dominance rose above 60%, the highest level since 2021. On the demand side, the fourth halving halved Bitcoin’s annual issuance, while the Bitcoin ecosystem flourished, with DeFi total value locked (TVL) growing by 6,400%.

-

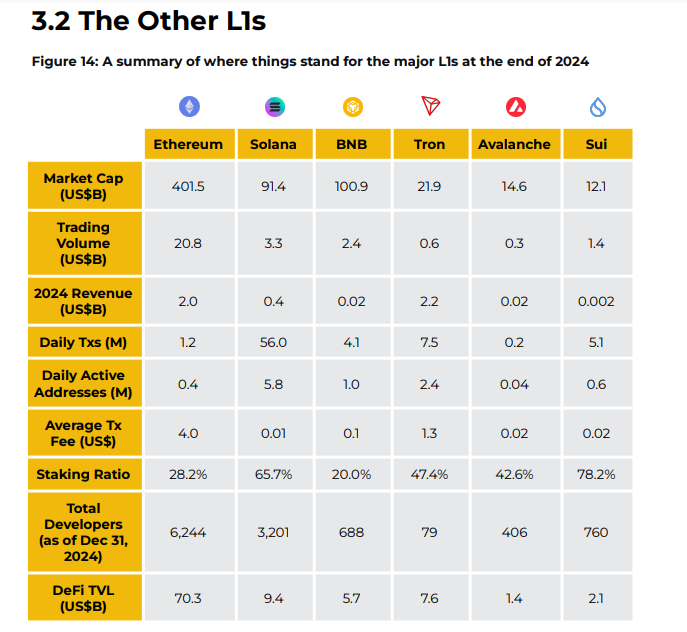

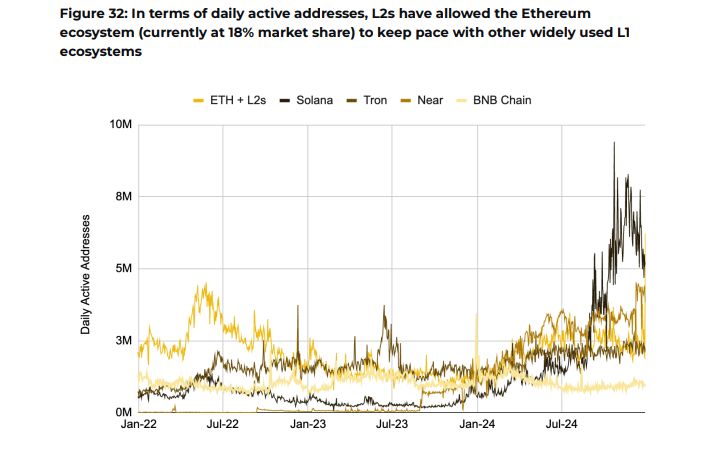

Alt L1: In 2024, Ethereum led alt-L1s in metrics such as market cap, trading volume, and DeFi TVL, while Solana dominated activity metrics like daily transactions and active addresses, also maintaining the lowest average transaction fees. For 2025, key developments include the potential U.S. Ethereum ETF, more dApps launching their own chains, the Pectra upgrade, and Ethereum’s priority dilemma. Solana repeatedly hit all-time highs in fees and DEX volume during 2024, with developer interest surging, though on-chain stablecoin usage remains relatively low.

-

BNB Chain made scalability advances with opBNB and data storage development via Greenfield. Sui outpaced Aptos in development, while Avalanche delivered its largest update to date with Avalanche9000. Tron performed strongly in stablecoin transactions (though its position faces challenges). TON slowed in the second half of 2024 but remains noteworthy alongside upcoming launches like Berachain and Monad.

-

Base L2 stole the spotlight in 2024. Despite lacking a native token, Base captured 39% of TVL and 67% of daily active users, making it the top L2 across both metrics.

-

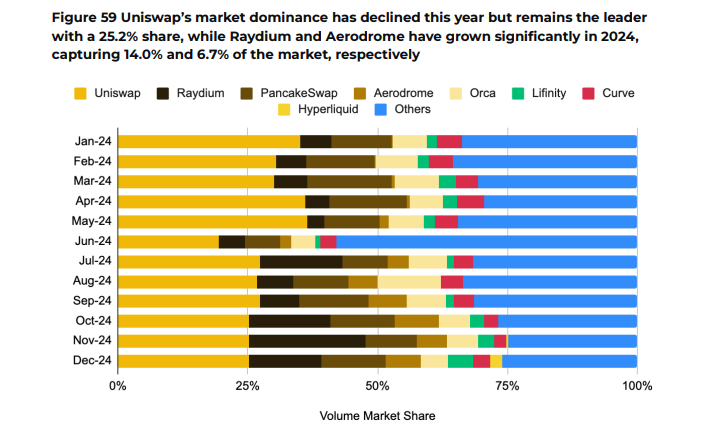

DeFi: Total value locked (TVL) grew 119.7% year-to-date, reaching $119.3B. This recovery sparked a revival across DeFi sub-sectors, with core areas like money markets and decentralized exchanges (DEXs) hitting new milestones. The year was characterized by the emergence of previously inaccessible on-chain financial primitives, narrowing the gap between DeFi and centralized exchange (CEX)-like experiences, rising adoption by consumers and institutions, and intensified protocol competition.

-

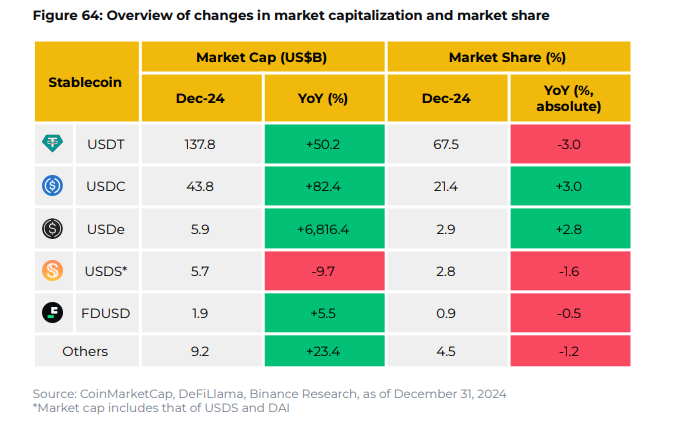

Stablecoins: The market experienced notable growth in 2024, reaching a record high market cap of $205B, slightly down to $204B by year-end, up 56.8% year-on-year. Leading stablecoin USDT grew its market cap by 50.2%, but lost some share to USDC, which surged 82.4% and gained 3 percentage points in market share. Ethena’s USDe, launched in December 2023, quickly became the third-largest stablecoin with a market cap of ~$5.9B.

-

Gaming: Token market cap grew 44%, underperforming the broader crypto market’s 96.2% year-on-year increase. Despite slower growth, the Web3 gaming sector achieved significant progress. The number of unique active wallets (UAW) interacting with games surged 580% throughout the year, surpassing 50 million by year-end.

-

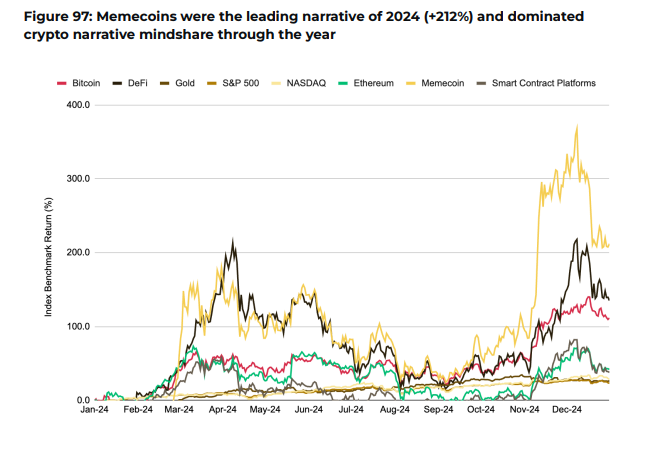

Meme: Memecoins were the best-performing asset class in 2024 (+212%) and dominated market attention. Top memecoins are split between Solana and Ethereum ecosystems, with Solana emerging as the default chain for meme trading. Pump.fun’s incredible growth was a key driver of this success.

-

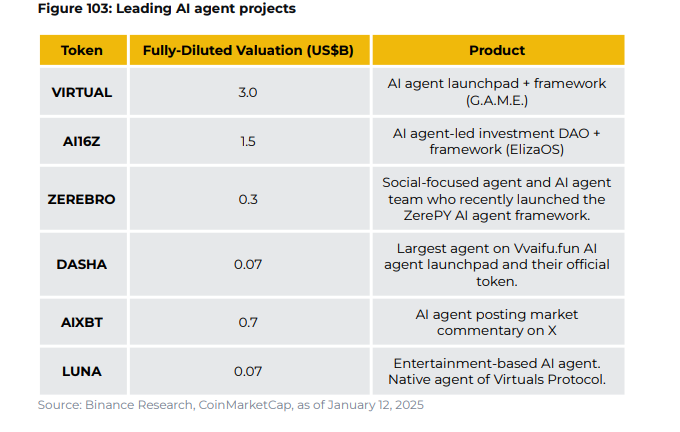

AI: Initially sparked by Truth Terminal and $GOAT, the sector captured the market from October onward and entered the mainstream. Infrastructure providers like Virtuals Protocol (GAME framework) and ai16z (ElizaOS framework) have been key players. Early agents focused on market commentary (aixbt) or entertainment (Luna, Eliza), with many more in development. Swarm intelligence (agent groups), web2 entry into AI agents, and the rapid evolution of AI x crypto are key areas to watch.

-

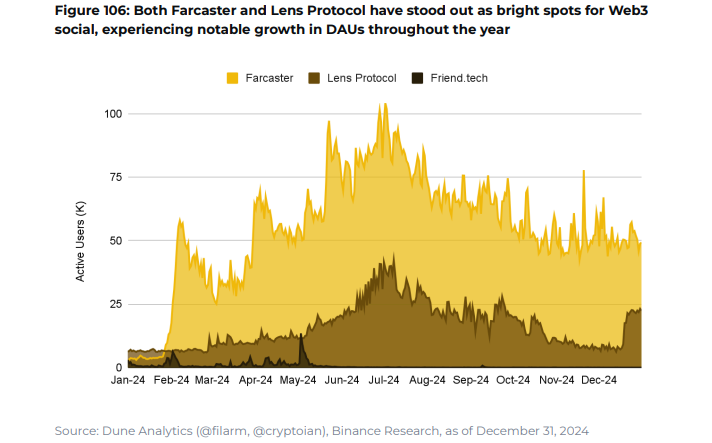

SocialFi: UAW declined from a peak of 35 million in July to 11.3 million by year-end, highlighting ongoing user retention challenges for DeSoc products. However, dApps on social networks like Farcaster showed more stable growth, standing out as bright spots in the space.

-

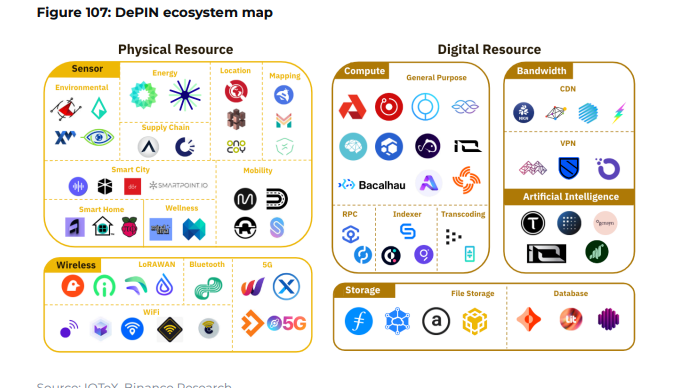

DePIN has demonstrated real-world applications in computing, telecommunications, and energy, drawing substantial interest and investment. Despite 249 projects with diverse models, some DePIN projects face challenges in generating meaningful revenue.

-

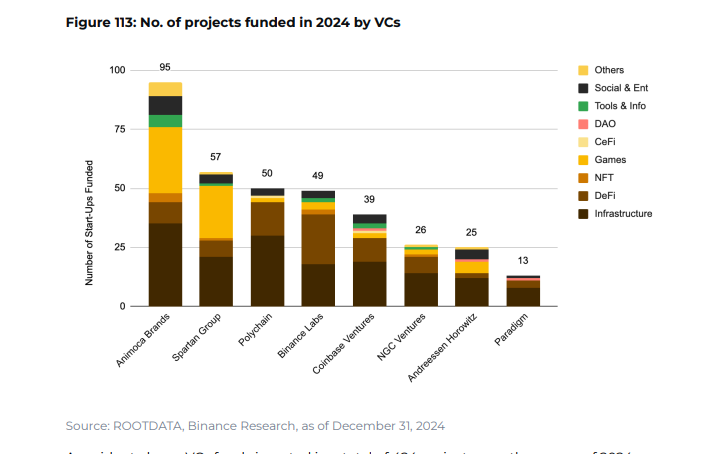

Web3 projects attracted 1,432 investments in 2024, raising a total of $9.2B. Nearly $4B went to infrastructure projects, accounting for about 44% of total funds raised. DeFi followed with $1.5B (16%) and gaming with $0.8B (9%).

8 Key Outlooks for 2025

-

Spot ETF Boom

Driven by increasing fund inflows and potential new ETF approvals, we expect 2025 to be a landmark year for crypto ETFs. As crypto prices hit new highs and gain further mainstream attention, ETF inflows are expected to surge. By 2024, BTC and ETH ETFs recorded inflows of $35.2B and $2.7B respectively—and these figures could climb even higher.

Moreover, more institutional investors—including wealth managers, corporations, and family offices—are likely to explore crypto exposure via ETFs. We also anticipate a broader range of ETFs being approved across various crypto assets, evidenced by recent filings for XRP and SOL ETFs. This trend will further cement ETFs’ role in providing accessible and diversified investment opportunities in the crypto market.

-

Shift in Token Value Models

With a more favorable U.S. regulatory environment and clearer oversight, the scope for on-chain applications to share value is expected to expand significantly. This shift may usher in a “dividend era,” where more projects distribute value to token holders via treasury funds or revenue-sharing models, enhancing the appeal of native tokens.

This trend is already evident in DeFi, where leading dApps like Ethena and Aave have initiated discussions or passed proposals to implement fee-switch mechanisms, enabling protocols to directly share revenue with users. As regulatory clarity improves and competitive pressure to accumulate value increases, even previously resistant protocols like Uniswap and Lido may reconsider their positions. If this trajectory continues, it could reshape token demand in industries like DeFi, where protocol revenues have historically not been shared with token holders.

The shift toward enhanced value accrual is also beginning to impact AI-related tokens, which traditionally lack strong mechanisms to align value with holders. Signs of change are emerging, with more projects exploring token buybacks, burns, and revenue-sharing models in 2025.

-

BTCFi Will Continue to Advance

The BTCFi narrative gained traction this cycle, fueled by Bitcoin’s strong market performance and increased institutional interest through spot BTC ETFs. These factors led to the accumulation of idle BTC holdings, creating opportunities to transform them from capital inefficient to capital efficient.

While current focus remains on staking derivatives and lending, this trend is expected to expand into other DeFi use cases. With Bitcoin DeFi TVL growing 6,400% in 2024—from $0.1B to over $6.5B—the wheels are already in motion.

Any traction gained by Bitcoin covenants or upcoming Bitcoin Improvement Proposals (BIPs) will also be key determining factors.

-

High-Yield Stablecoins Gain Momentum

Benefiting from increased Web2 corporate adoption and clearer regulation, this favorable environment is likely to lift most stablecoins. Among them, yield-generating stablecoins are expected to stand out, as demonstrated by the rapid rise of Ethena’s USDe. Demand for yield remains strong, and yield-bearing stablecoins offer holders a direct way to earn returns on their stablecoin holdings without active management or complex strategies.

However, the success of yield-bearing stablecoins will depend on more than just yield generation. To thrive, they must also ensure broad availability across platforms, simple on- and off-ramps, and deep liquidity.

-

AI x Crypto Will Be a Key Area to Watch

So far, the AI agent sub-sector has exceeded expectations and is poised for significant growth in the coming months, including potential entry by Web2 giants like OpenAI. Additionally, many top crypto-native AI teams are working on projects beyond AI agents, with new use cases gaining traction. Cryptoeconomic and artificial intelligence technologies are clearly converging, and we expect 2025 to be a meaningful year in this journey.

-

Rising Importance of L2 Abstraction

Following the Decun upgrade, L2s have grown rapidly. There are now over 120 L2s at various stages of development. As the L2 landscape matures and application-specific chains and specialized L2s gain popularity, L2 abstraction—simplifying cross-chain user experience—has become commonplace and essential.

We expect competition within the L2 ecosystem to intensify, particularly between rollup-as-a-service providers and L2 aggregators, which are becoming major brands vying to create the most widely used and diverse cross-chain ecosystems.

-

Tokenization Gains Interest from Traditional Finance (TradFi)

BlackRock and Franklin Templeton have already tokenized their money market funds, while Goldman Sachs plans to launch a crypto platform focused on tokenization within the next 12–18 months. Singapore’s Monetary Authority’s “Project Guardian” is also advancing, with financial institutions like JPMorgan, HSBC, and Deutsche Bank working to expand asset tokenization into capital markets.

-

NFT Projects Launch More Tokens, But Not All Will Succeed

Pudgy Penguins’ launch of its PENGU token pushed NFT trading volume to new highs, demonstrating the power of token launches to capture market attention. This success has also triggered speculative demand for other prominent NFT collections, as traders anticipate further token launches that could similarly boost activity and interest.

Successful token launches have the potential to attract new participants and act as a positive catalyst for the relatively stagnant NFT market.

However, sustaining long-term interest and price remains a major challenge. Projects must continuously evolve their ecosystems and enhance token value accrual to maintain momentum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News