"Super Boost" rule arrives, where is the annual Web3 blockbuster Binance Alpha heading?

TechFlow Selected TechFlow Selected

"Super Boost" rule arrives, where is the annual Web3 blockbuster Binance Alpha heading?

Alpha is increasingly becoming a platform that tests user loyalty—when low-scoring users consider leaving, where will Alpha go next?

Author: Luoluo

Recently, many users contributing trading volume on Binance Alpha for airdrops are once again saying they're ready to "quit." The reason is that the point thresholds for two new asset airdrops in late August hit record highs, pushing the "priority claim" and "first-come, first-served" airdrop point requirements up to 260 and 230 respectively.

This surge in points and user backlash mirrors the market sentiment seen in May and June this year. It wasn't until Binance introduced the "point consumption" and "tiered point distribution" rules that active Alpha users stabilized in July, driving Binance Alpha's trading volume to $10 billion.

Now, with high trading volumes and elevated claim thresholds returning, Alpha is increasingly becoming a platform testing user loyalty. As low-point users consider leaving, where will Alpha go next?

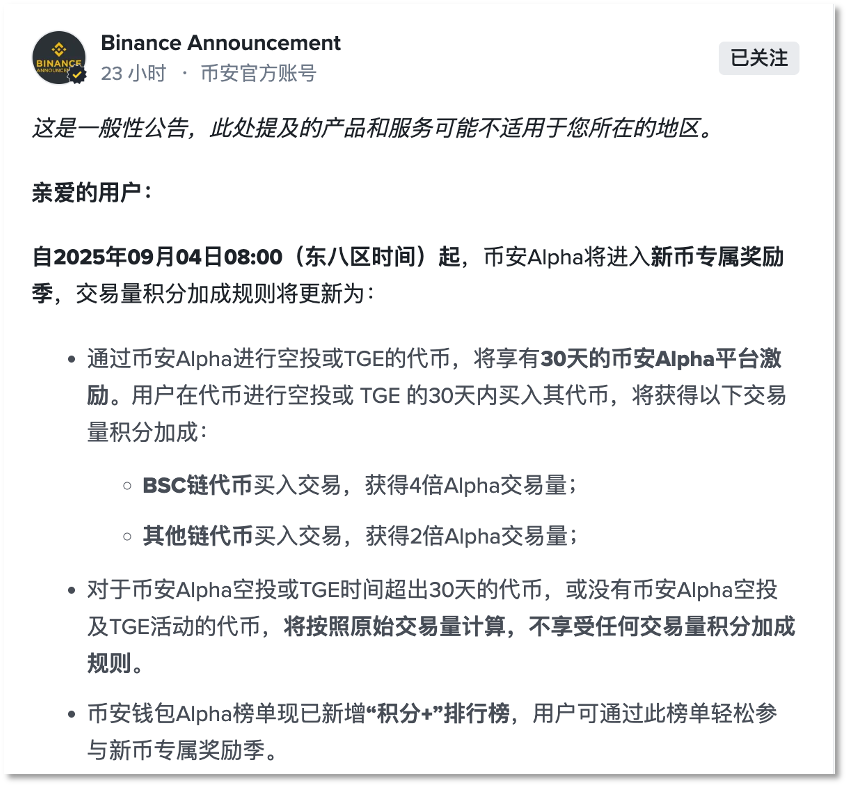

On September 4, the Alpha points system was upgraded again. New projects launching via airdrop/TGE will now enjoy a 30-day "newcomer support period," during which users buying these tokens receive "supercharged" trading volume multipliers toward their points—4x trading volume weight for tokens on the BSC chain and 2x for other chains. This rule increases users' point returns from trading, though users should also be mindful of the volatility risks associated with new tokens.

The differentiated treatment between BSC and other chains further signals Binance’s strategic support for Alpha as a Web3 marketplace.

In just over half a year, Binance Alpha has hosted over 100 airdrop campaigns. The resulting surge in trading volume and liquidity has made the platform appear even more attractive than Binance’s main site—a veritable mini altcoin market.

As Binance’s testing ground for new listings, Alpha evaluates various Web3 projects through real-market transactions. Looking at the performance of Alpha airdropped tokens over the past three months, 3–4 projects each month have shown breakout potential after listing on Binance’s main exchange, reversing the earlier trend of project tokens peaking immediately upon Binance listing.

Binance’s recently launched Alpha2.0 market maker program further indicates that this Web3 Wallet-based segment is aiming to expand Alpha into a much larger opportunity.

Why the “Super-Size” Boost to Alpha Points?

On August 28, DOLO and BLUM were the two projects that pushed Alpha airdrop point thresholds higher.

DOLO, using a phased point claim model, set its "priority claim" threshold at 260 points—the highest since Alpha airdrops began. The second-phase "first-come, first-served" threshold also rose sharply, increasing by 30 points from its previous stable level of 200 over 11 consecutive rounds.

Users who waited for high-point holders to claim DOLO before dropping down to claim the BLUM airdrop were shocked when BLUM’s single-round "first-come, first-served" threshold also climbed to 230 points.

While some users took to social media declaring it "unplayable" or quitting altogether, others successfully claimed DOLO and BLUM airdrops worth $48 and $28 respectively.

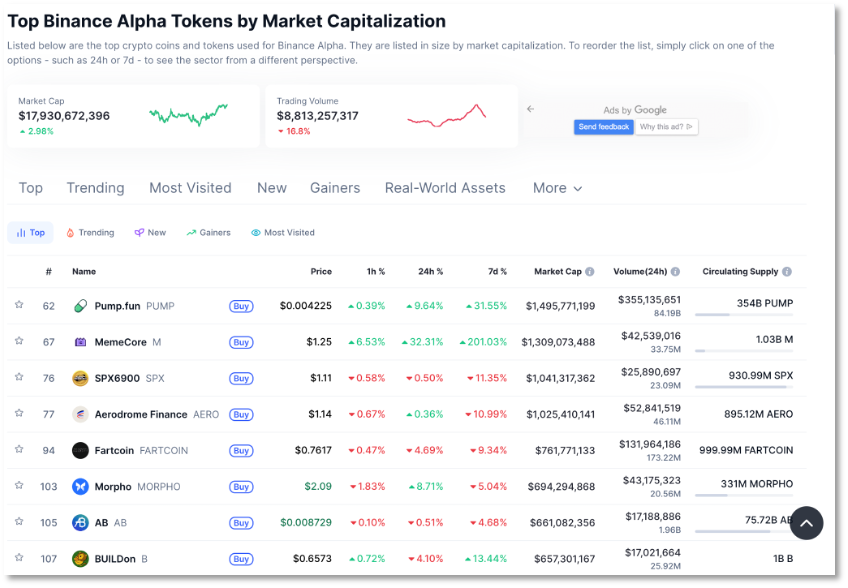

These rising airdrop thresholds suggest Alpha’s trading activity remains strong. According to CoinMarketCap data, two weeks ago, Binance Alpha tokens had a total market cap of $17.4 billion and trading volume of $8.83 billion. With new token listings, the segment’s trading volume rose to $10.015 billion the following week, maintaining a market cap around $17.1 billion. As of September 4, its trading volume stood at $8.813 billion, with a market cap of $17.93 billion.

As of September 4, Binance Alpha’s trading volume reached $8.813 billion

High points, yet traders and point farmers remain—just as occurred during Alpha’s peak in May and June—accompanied by two months of dynamic adjustments by Binance.

Fundamentally, Alpha Points are designed to reward users actively engaging with the Binance ecosystem. Officially launched on April 25, the system allows users to accumulate points based on both balance and trading volume, qualifying them for new airdropped tokens. Before this, early adopters had already capitalized on opportunities, earning substantial airdrops with minimal trading, quietly accumulating tens of thousands in profits within a month—nearly $1,000 per day.

On the day the points system launched, Binance Wallet’s active users surged over 58%—from 44,967 to 71,228—and trading volume doubled within 24 hours, jumping from $48.46 million to $118 million.

The rat race had begun. Binance has continuously iterated its points rules to dynamically balance reward distribution among participants while strengthening risk controls to prevent cheating and maintain fairness.

In May, as Alpha airdrop claim thresholds climbed from double digits in April to nearly 200, Binance Alpha upgraded its points system on May 13 by introducing a "consumption mechanism"—requiring users to spend 15 actual points when confirming participation in Alpha or TGE events.

By consuming points to lower thresholds, Binance aimed to make rewards more accessible and inclusive, curbing excessive point accumulation and allowing latecomers to join. However, it took about half a month—roughly equivalent to the 15-day point accumulation cycle—for thresholds to drop back to around 200.

User @Mingo shared his earnings online: 24 Alpha and TGE airdrops earned him $1,795 in one month. After deducting $133.5 in trading costs, his monthly income exceeded 10,000 RMB, with individual airdrop gains as low as $70. The standout project NXPC (MapleStory) admitted users at a 187-point threshold, pushing individual account earnings to $600 or even over $1,000, setting a historical record for Alpha airdrop profits and becoming @Mingo’s highest "daily income" that month.

Image from Binance user @Mingo Mingge’s social media post

Undoubtedly, early high Alpha airdrop returns have been a major draw. However, organized teams have long been viewed by regular users as undermining fairness. Photos of dozens of phones grabbing Alpha airdrops and job postings seeking full-time airdrop hunters have circulated widely online.

In response, Binance cracked down. In early June, Binance detected certain groups using bots for Alpha activities, clearly stating that any use of automation tools—including scripts or non-manual methods—would be considered "violations." The company upgraded its risk control systems to better detect and penalize such behavior, revoking Alpha participation rights for flagged accounts.

On Binance’s in-app social forum "Plaza," many users reported receiving violation alerts, with mixed results from appeals.

Yet, weekly active users numbering in the hundreds of thousands still drove the direct claim threshold up to between 210 and 251 in June.

Starting June 19, Binance updated the points rules again, introducing a two-stage distribution model: a high-point priority claim phase within a limited time window, followed by a lower-threshold, first-come-first-served phase for qualified users.

After the tiered points system launched, many users noticed they now faced bot detection tests when claiming airdrops—beyond facial recognition, they encountered CAPTCHA-style slider verification to prove human identity.

Binance significantly enhanced its bot detection capabilities. July saw relatively stable Alpha points. Across 31 Alpha airdrops (excluding TGEs), the highest "priority claim" score was 234—seen only in the PEAQ airdrop—with individual payouts around $45. The lowest was 210, occurring in BGSC at the start of the month and RCADE on July 10, both yielding around $40. The "first-come, first-served" threshold fluctuated between 120 and 190 before stabilizing at 200.

One user reported that after accumulating a high score of 240, he claimed five airdrops in July, netting about $240 after costs—averaging $48 per airdrop—"clearly far lower than the previous two months."

In August, the previously stable ~200-point "first-come, first-served" threshold began breaking upward, with end-of-month levels hitting 230. Competition in Alpha airdrops continues to intensify. Meanwhile, Dune data shows weekly active users on Binance Wallet rose from over 120,000 at the start of the month to over 180,000 by month-end.

September 4: Alpha updates trading volume rules

Finally, on September 4, Alpha adjusted its points rules again, introducing a "Points Plus" mechanism. For new airdrop/TGE tokens, trading volume will be "super-multiplied" for 30 days, effectively acting as an accelerator for users aiming to accumulate points and claim airdrops, boosting their point returns.

KOL @BitHappyX views the "30-day boosted trading volume" rule as "a reallocation of resources and benefits"—curbing team farming while directing traffic and incentives toward genuine participants and new projects.

He explains that since existing tokens retain only 1x trading volume weighting, this cuts off teams’ ability to farm points via large-scale purchases of stagnant old tokens, shrinking their arbitrage space. While new tokens enjoy point boosts, they typically experience significant price volatility in their first month (within 30 days). Although regular users face risks too, teams chasing high points with heavy positions would bear substantially higher financial risk.

He predicts that given reduced advantages on old tokens and increased risk on new ones, some teams will be forced to abandon "fake activity" and may exit Alpha entirely.

As Winson Liu, Global Head of Binance Wallet, emphasized: "Through incentivized participation, we’re offering truly loyal Alpha users a fairer way to engage, while enabling Binance Alpha to support more high-quality Web3 projects."

Is the 'Selection Pool' Working for Binance Listings?

After eight months of operation, Binance Alpha has distributed over 100 airdrops. When its trading volume surpassed $10 billion, the sustained surge signaled strong user interest, establishing Alpha as an independent momentum cycle apart from traditional altcoin markets—using trading as a hard metric to continuously validate projects for Binance.

In fact, when Binance announced Alpha’s launch last December, it intended for this wallet-based on-chain DEX to serve as a pre-listing selection pool for the main exchange—not guaranteeing all Alpha tokens would list, but early cases of exclusive TGE (Token Generation Event) projects on Binance Wallet later listing on the main site strengthened perceptions of Alpha as a "listing candidate zone."

At the time, Binance was grappling with criticism over "poor listing quality" and "friend coins," prompting co-founder He Yi to repeatedly defend and clarify strict listing standards. Binance also introduced a "vote-to-list/delist" mechanism.

Although Binance later slowed its listing pace, most new assets still followed a "peak at launch" downward trend with little improvement.

It was against this backdrop that Binance Alpha officially entered real-world testing. The result proved that no amount of promises can match turning user demand into tangible products and experiences—a strength Binance excels at.

On March 18, Binance Alpha 2.0 launched by integrating directly into the main site, blurring the lines between centralized exchanges (CEX) and Web3 wallets, allowing CEX users to directly purchase early-stage on-chain project tokens using USDT, USDC, and other assets from within the platform.

Winson Liu stated clearly: "The Binance Alpha platform serves as a pre-listing token selection pool, aiming to enhance transparency in Binance’s listing process. By publicly featuring curated early projects, Alpha strengthens community trust and offers insights into tokens with future potential within the Binance ecosystem."

As the number of Alpha tokens grows, so does the pool of candidates. Has Binance’s main exchange seen a surge in listings driven by new token momentum? Have Alpha-vetted projects improved Binance’s listing quality?

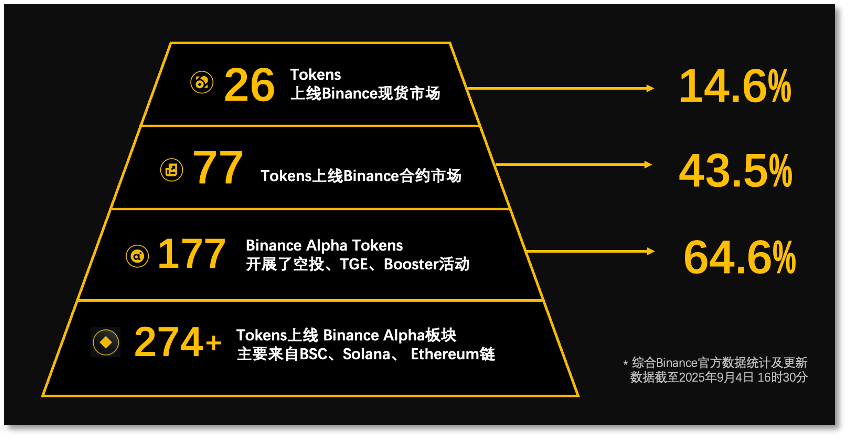

As of September 4, CoinMarketCap listed 274 token projects that had launched and traded on Binance Alpha. Combined with Binance’s official data from August 18 and subsequent updates, 177 of these projects conducted TGE/airdrop/Booster campaigns (64.6%), of which 26 were listed on Binance’s spot market (14.6%) and 77 on futures markets (43.5%).

Spot market conversion rate for Alpha airdropped tokens: 14.6%

DWF Labs’ June statistics showed that out of over 190 tokens on Binance Alpha, 18 were listed on Binance’s spot market—about 9.5%. Two months later, only 26 of 274 Alpha tokens had reached the spot market, keeping the conversion rate at 9.48%.

Clearly, even with Alpha as a preliminary filter, Binance maintains nearly unchanged conversion rates under its "strict selection" criteria.

Looking at Alpha tokens that made it to Binance’s main exchange, nearly all participated in TGE/airdrop/Booster campaigns, with airdrops being the most frequent channel and leading to the highest number of spot and futures listings.

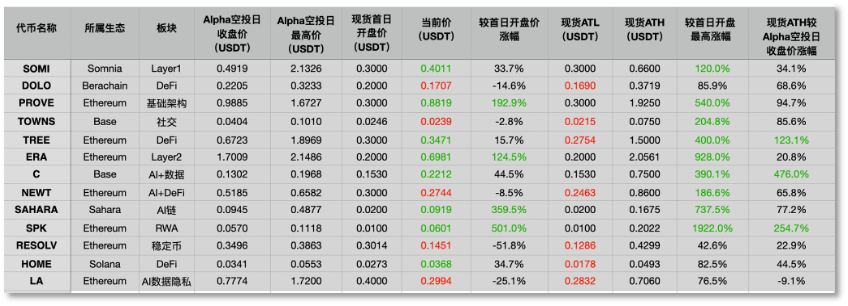

TechFlow analyzed 107 airdropped tokens launched by Binance Alpha from June to September. Of these, 13 were listed on Binance’s spot and futures markets, while 19 were listed solely on futures markets.

Performance of Alpha airdropped tokens after listing on Binance spot

(Data as of September 4, 16:30)

Among these 13 tokens listed on Binance’s spot market, as of September 4, eight fluctuated with broader market corrections amid a declining crypto environment. Yet PROVE, ERA, SAHARA, and SPK held firm, showing 1–5x gains from opening prices, with SPK surging 501%. Only three dropped significantly (over 10% below opening), with RESOLV performing worst, falling 51.8% from issuance.

Of the 13 projects, nine achieved ATHs (all-time highs) over 100% above opening prices, with minimum gains exceeding 40%. PROVE, SAHARA, ERA, and SPK saw ATHs rise 540%, 737%, 928%, and 1,922% respectively from their Binance spot opening prices.

If measured from Alpha airdrop closing prices, all but the earliest-listed LA (-9.1%) achieved at least 20% gains from airdrop close to spot ATH. TREE, SPK, and C saw spot ATHs rise 123%, 476%, and 245% respectively from their Alpha airdrop closing prices—clear evidence of Binance’s ecosystem uplift effect on project tokens.

Such performance greatly surpasses Binance’s new listings from late last year, breaking the frequent post-listing decline pattern. Clearly, the combined Alpha plus "airdrop listing" strategy is delivering real "selection" value.

Accelerating Toward the Core Web3 Market

With growing numbers of projects, the "peak at launch" phenomenon is now appearing within the Alpha trading zone—fitting for Alpha’s nature as a Web3 on-chain emerging board: early-stage projects with suboptimal on-chain liquidity.

But Binance plans to change this.

The September 4 Alpha points update focuses more on newly listed projects, potentially bringing them genuine trading volume and amplifying Binance’s "multi-use" advantage.

Under the new rules, BSC—already dominant among Alpha token issuance chains—remains a key focus for Binance support. The "4x trading volume" incentive (up from unlimited 2x) drives traffic and strengthens BNBChain, likely boosting on-chain activity and fee revenue. Trading efficiency and price performance of new tokens in the Alpha zone could also improve as user engagement rises.

Beyond improving new token performance through traffic, on August 28, Binance announced the Alpha 2.0 limit order market maker program, inviting experienced DEX traders to participate with zero trading fees on limit orders and access to Alpha-exclusive APIs.

Leveraging its deep CEX expertise, Binance is addressing Alpha’s liquidity短板 (shortcoming) as a core Web3 market, while its strengths have become increasingly evident over the past six months.

Alpha has already attracted massive trading participation through airdrops and trading competitions. Compared to other wallets, Binance Wallet ranks among the top-tier globally in terms of active Web3 wallet users. Moreover, most tokens listed on Binance Alpha originate from the BNBChain, with 77% of June–August airdropped tokens built on BNBChain.

Messari’s latest BNBChain Q2 2025 report shows BNBChain maintained strong growth in Q2, setting new highs in user activity and on-chain transactions. Daily active addresses and transaction volume surged, DeFi activity remained solid, and BNBChain led all chains in DEX volume, stablecoin transaction count, and active users, cementing its leadership in the Web3 ecosystem.

In terms of market cap and investor confidence, BNB’s market cap grew 7.5% quarter-over-quarter to $92.6 billion. On-chain metrics saw fees drop 90% to 0.1gwei, daily transaction volume jump 101.9% to 9.9 million, and daily active addresses grow 33.2% to 1.6 million. May alone added 17 million new addresses. In DEX performance, BNBChain ranked first in trading volume with a daily average of $3.3 billion in Q2, with PancakeSwap—handling much of Alpha’s trading volume—capturing 85.1% market share.

Rising user activity, surging traffic, and growing DEX volumes are attracting more projects to build on BNBChain. One crypto OG openly advised innovative projects in a community chat to deploy directly on BNBChain: "Low fees and high traffic are exactly what early-stage projects need most. BNBChain meets nearly all those needs today, and your token might even enter Alpha or receive Binance support. Why wouldn’t you?"

Winson Liu, Global Head of Binance Wallet, believes the trading volume surge reflects a shift in how users interact with Web3: "Binance Alpha is redefining how users discover early projects and earn real rewards—we’re setting a new standard for early participation in Web3."

From a DEX feature within Binance Web3 Wallet gradually evolving into a core component of the main platform, Alpha is clearly moving toward becoming a central Web3 product—evident even in interface design.

Initially, Alpha appeared alongside Binance’s spot and futures trading sections on mobile. Then, with the introduction of points, it gained a dedicated airdrop interface similar to Launchpool. Later, this interface expanded to include one-click access to trading contests, wealth management, TGE, and Booster tasks—effectively consolidating the most popular features of Binance Web3 Wallet into a single, refined hub.

Today, users no longer need third-party sites to input wallet addresses and calculate accumulated trading volume and points—Alpha now provides a built-in estimated points preview.

Now, launching on Alpha is approaching the impact of listing on Binance’s main site—delivering maximum visibility, tapping top-tier platform traffic, and securing effective market liquidity. Binance Alpha is increasingly taking shape as a core Web3 marketplace. The new rule doubling trading volume for user points also means new listings will continue. As this pie grows, "airdrops" may truly become a sustainable benefit for users.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News