Unveiling Binance Alpha's Points Illusion: 95% of Wallets with Zero Net Position Behind $3 Billion Trading Volume?

TechFlow Selected TechFlow Selected

Unveiling Binance Alpha's Points Illusion: 95% of Wallets with Zero Net Position Behind $3 Billion Trading Volume?

Revealing market anomalies generated under Binance Alpha's incentive mechanism, particularly the nature of Bedrock $BR's $30 billion trading volume.

Author: Ltrd

Translation: Tim, PANews

"Show me the incentive and I'll show you the outcome" — a famous quote by Charlie Munger. Incentives are equally evident in markets. Exchanges can favor specific market participants through tailored fee models, indirectly influencing spreads and liquidity. They may also offer loans proportional to liquidity provided, incentivizing market makers to supply more depth. The possibilities are endless, but the key lies in understanding which incentives are needed to attract attention and achieve objectives.

After Hiperliquid's massive airdrop, traders are reluctant to miss out on opportunities — a trend clearly reflected in Binance Alpha 2.0’s upgrade. As Binance’s pre-listing segment, Binance Alpha incubates promising tokens that haven’t yet met the main exchange’s listing criteria. The newly launched 2.0 version breaks new ground by introducing an auction trading model, offering early-stage projects unprecedented access to liquidity.

Today, however, we’re not here to discuss Binance Alpha’s auction features or other functionalities. Instead, I want to tell a small story — one about incentives, FOMO psychology, and potential future gains fueling bizarre anomalies in the market.

The Binance Alpha Points system — the central element of this discussion — rewards users for trading activity on the Binance Alpha platform. Users earn points by generating trading volume or holding tokens, though trading volume appears to be the dominant factor. These points grant eligibility to participate in various Alpha initiatives (such as airdrops or TGEs). Historical data shows that tokens linked to Binance Launchpad often perform exceptionally well, making such projects highly attractive. With the scale of potential rewards still unknown, many traders rush to accumulate points in hopes of substantial returns.

Now comes the crux. The mechanism is simple: generate trading volume to earn points. As a result, we observe a dramatic surge in trading volume across most tokens associated with Binance Alpha. Simultaneously, the market exhibits volatility patterns extremely rare under normal conditions.

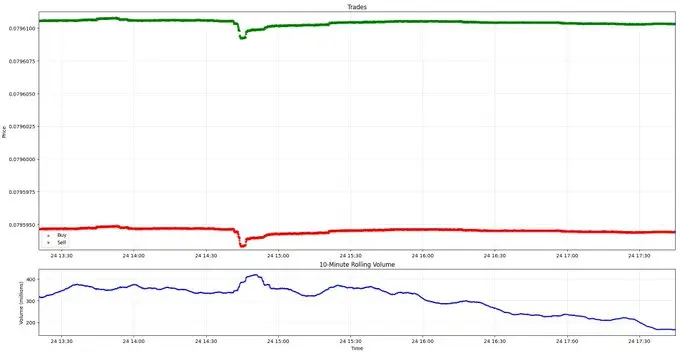

Take Bedrock ($BR), currently the hottest token on PancakeSwap, with over $3 billion in trading volume in the past 24 hours. Its chart reveals intense simultaneous buying and selling activity, generating massive turnover (as shown in the rolling 10-minute trading volume below).

This indicates that despite approximately $3 billion in total trading volume, the net difference in USDT value traded between buys and sells is nearly zero. This suggests the presence of market participants executing hedging strategies, whose trading activities carry almost no net position risk.

When interpreting data, especially without additional context (on-chain data often provides more clues, while centralized exchanges only disclose user-visible information), you must scrutinize every detail: trade amounts, frequency, outliers, distribution of market impact, order sizes, etc. When full data held exclusively by exchanges is unavailable, attention to detail becomes critical. Let’s focus on order size analysis.

This histogram does not follow a normal distribution at all. Typically, trading volumes exhibit exponential distributions — but not here. Most trades cluster tightly within the 12k–14k range, a high-volume bracket by conventional standards. Such concentration should raise red flags and warrant deeper investigation. For comparison, consider referencing trading volume data of other assets on the BASE chain.

Digging deeper into on-chain data particularly reveals underlying issues. Clearly, something unusual is happening. It's highly likely people are trying to quickly earn points to qualify for future Binance airdrops. Let’s test whether this hypothesis holds.

How is this strategy executed? Simply conduct two-way trades, minimize losses, and accumulate as many points as possible. It's actually quite clever. If this strategy is widespread, we should observe that most wallets buy and sell nearly identical quantities of tokens. Let’s pull a small sample of on-chain data for analysis.

As seen, the net token flow for most wallets indeed approaches zero. Now let’s quantify how many wallets fall into this near-zero net position range.

To be honest, the result is even more striking than I expected. Over 95% of wallets participating in trading this token have net positions close to zero — meaning their purchase and sale volumes are almost perfectly balanced during this period. Clearly, the goal is to generate points while avoiding any exposure risk.

I also wondered: how many points are these wallets aiming for? They likely followed a calculated strategy, studied Binance Alpha documentation, and identified specific point thresholds worth targeting. Let’s examine the data.

According to my dataset, excluding five outliers, every wallet generated exactly between 14 and 20 Alpha points — no more, no less. This likely reflects the absence of a “more points = bigger airdrop” rule; instead, traders only need to reach a certain threshold.

I was also curious: what’s the cost per Alpha point? Given they frequently execute both sides of trades within the same or adjacent blocks, some loss is inevitable — but how much?

The average cost per Alpha point ranges from $0.05 to $0.10 — relatively low, though the ultimate return remains uncertain.

My point is this: people will always try to "game" the system, seeking maximum returns with minimal effort. Whether you're running an exchange, designing a DeFi protocol, or managing a team, it's your responsibility to create sound incentive structures. I hope this example clearly illustrates that fundamental truth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News