What are the requirements for a project to move from Binance Alpha to Binance Spot?

TechFlow Selected TechFlow Selected

What are the requirements for a project to move from Binance Alpha to Binance Spot?

Are all the ones launching spot trading "brand-new regular forces"?

By: Cookie

One month ago, we reviewed projects on Binance Alpha that conducted "points airdrops," analyzing market preferences for different concept tokens based on their price performance after these airdrops.

This time, we're taking a new angle—projects listed on Binance Alpha that have subsequently been listed on Binance Spot. Can we uncover useful insights and interesting conclusions by examining these projects from multiple data perspectives?

Is Binance Alpha still a "forward base" for listing on Binance Spot?

The original Binance Alpha served as a "forward base" for Binance Spot listings. However, after Binance announced the upgrade to Binance Alpha 2.0 in March this year, the correlation between being listed on Binance Alpha and eventually being listed on Binance Spot has significantly weakened.

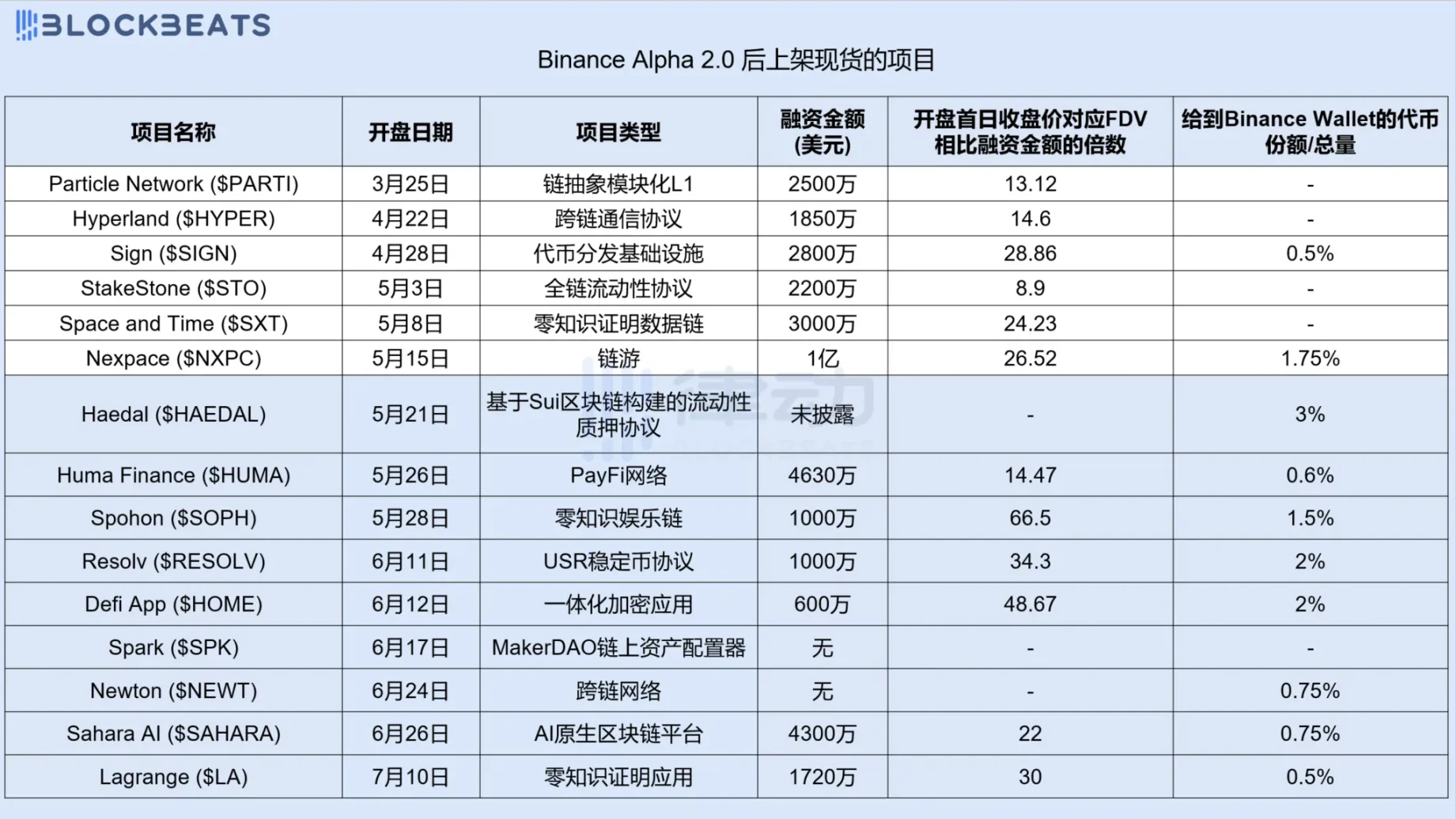

Since the Binance Alpha 2.0 update, there have been 88 projects listed and 71 projects that conducted "points airdrops." Ultimately, only 15 projects have been listed on Binance Spot, accounting for about 17% of all listed projects and approximately 21% of those that conducted points airdrops.

Are all Spot-listed projects "brand-new regulars"?

Of the 15 projects listed on Binance Spot after the Binance Alpha 2.0 update, 13 secured funding. According to disclosed figures, the highest-funded project is the blockchain game "MapleStory Universe" $NXPC with $100 million raised, while the lowest-funded is DeFi app $HOME with $6 million raised. Excluding Haedal, whose funding amount was not disclosed, the remaining 12 projects raised a total of $356 million.

The two projects without disclosed funding are no small players either. Spark $SPK originates from MakerDAO, and Newton $NEWT comes from Polygon Labs.

Does Binance show preference toward projects invested in by Binance Labs/Yzi Labs? Not really. Among these projects, only StakeStone, Sign, Sophon, and Sahara AI—four in total—received investment from Binance Labs/Yzi Labs.

In terms of project types, Binance also shows no particular bias, covering a wide range including modular blockchains, chain abstraction, PayFi, blockchain gaming, omnichain liquidity protocols, zero-knowledge proofs, and more—all typically requiring substantial funding for development.

It's fair to say that in the Binance Alpha 2.0 era, the path to Binance Spot is dominated entirely by "regulars"—we rarely see organic, community-driven projects like $AIXBT anymore.

These aren't just "regulars," but rather "brand-new regulars"—most launched their TGE, opened airdrop claims, and were listed on Binance Spot almost simultaneously. The exception is Lagrange, which was listed on Binance Spot over a month after its Binance Alpha listing and TGE. Judging solely by their connection to Binance Alpha airdrop activities, 10 of these projects conducted "points airdrops." The token allocations given to Binance Wallet varied across these 10 projects: Haedal gave the largest share at 3% of its total supply, while Sign and Lagrange gave the smallest at 0.5% each.

Compared to their funding amounts, how successful were these new tokens?

Using the fully diluted market cap corresponding to the closing price on the first trading day, among the 12 projects that disclosed specific funding amounts, only 4 had a maximum fully diluted market cap less than 15 times their funding. The lowest among them was StakeStone, which still reached approximately 8.9 times its funding amount.

The remaining 8 projects all had opening-day fully diluted market caps exceeding 20 times their funding. Sophon saw the highest multiple at around 66.5x, while Sahara AI had the lowest among this group at about 22x.

This doesn't appear directly tied to project type; instead, it's influenced by prevailing market conditions, individual project execution, and market perception. For example, despite relatively low market attention and optimism toward blockchain gaming, "MapleStory Universe" still achieved roughly 26.52x, likely due to its strong game IP and high expectations within the blockchain gaming space.

Conclusion

Overall, the trend suggests that for projects listed on Binance Alpha aiming to progress to Binance Spot, Binance's bar remains quite high. Having a compelling narrative and securing funding have become standard requirements, although project types aren't limited to currently popular market themes.

Among the projects we were able to analyze, over 75% achieved a fully diluted market cap on their first trading day that exceeded 20 times their funding amount—this threshold has effectively become a new project's "passing grade."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News