Binance Alpha's star token BR halves instantly, echoing ZKJ's price plunge, sparking renewed skepticism over Alpha mechanism

TechFlow Selected TechFlow Selected

Binance Alpha's star token BR halves instantly, echoing ZKJ's price plunge, sparking renewed skepticism over Alpha mechanism

Blossomed many times, but BR still failed.

Author: ChandlerZ, Foresight News

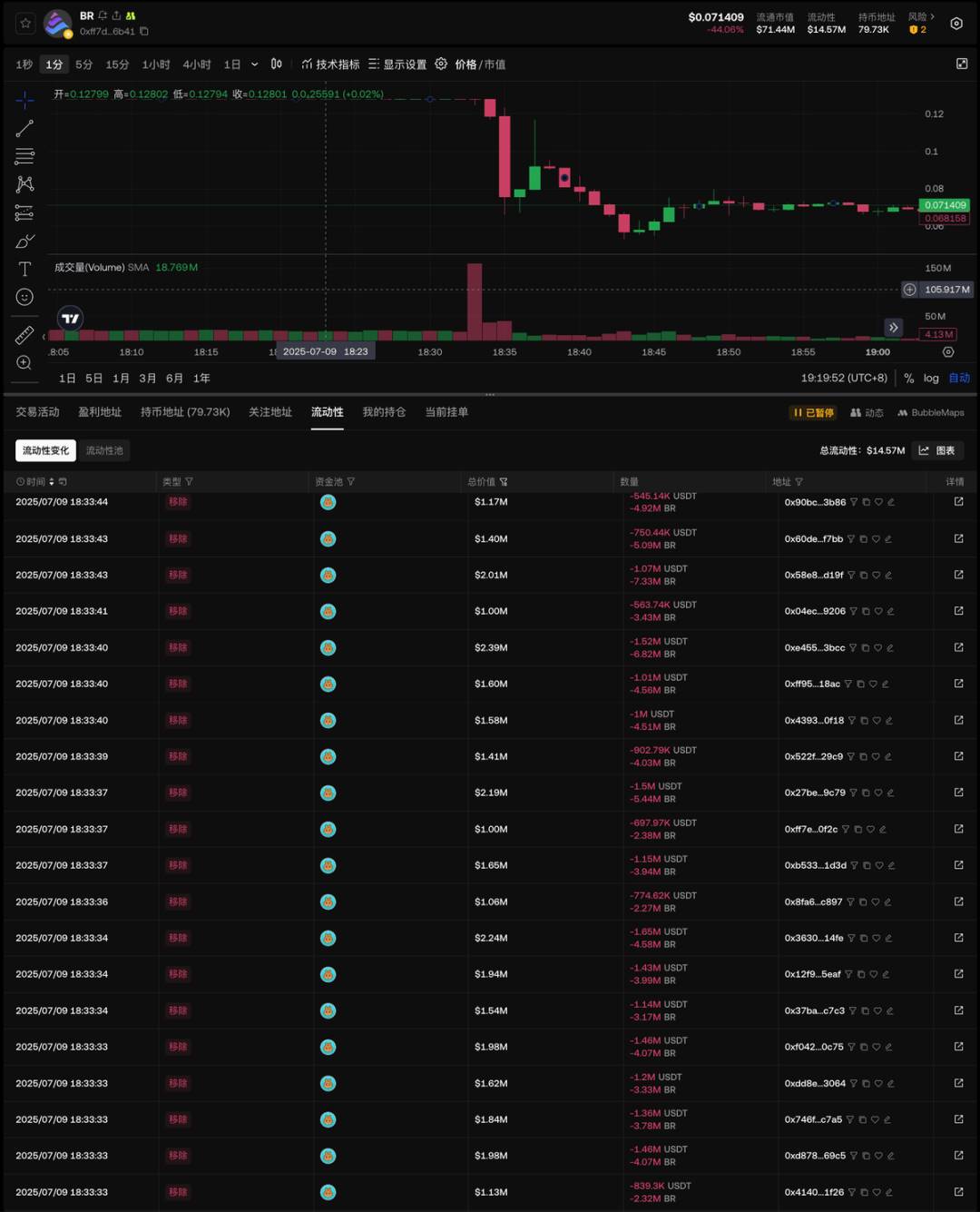

On July 9, another familiar crash unfolded among Binance Alpha projects. In less than 10 minutes, BR—the recent star token of Binance Alpha—plummeted from a high of 0.129 USDT to 0.053 USDT, effectively halving in value within seconds.

The price collapse can be described as "clean and swift." According to monitoring by @ai_9684xtpa, OKX’s liquidity data showed that prior to the crash, BR's trading pool liquidity remained stable at over $60 million. However, the critical event occurred within just 100 seconds: 26 addresses nearly simultaneously withdrew $47.59 million in liquidity. Immediately afterward, 16 addresses initiated large-scale token dumps—including three addresses selling over $1 million each and 13 others dumping $500,000 each—creating concentrated sell pressure that overwhelmed the remaining liquidity, triggering a cascading price drop. BR’s current liquidity now stands at only $14.56 million.

Below are the top 5 main dumping addresses:

-

0x00E0E2225E48e40ac7A1C5C48C3359325C7F41c3

-

0x20c375580C4BD0DA36aec0c55406fa645F964FBd

-

0x63293340bb17D9bc0f66f1956a810f7BFC7c857B

-

0x58e837F8F9C1aCfE618AdbBa95314BE2ab55d19F

-

0x31A256E01900f93831361dF928EB32F83A6Af40E

Who Is Behind the Dump?

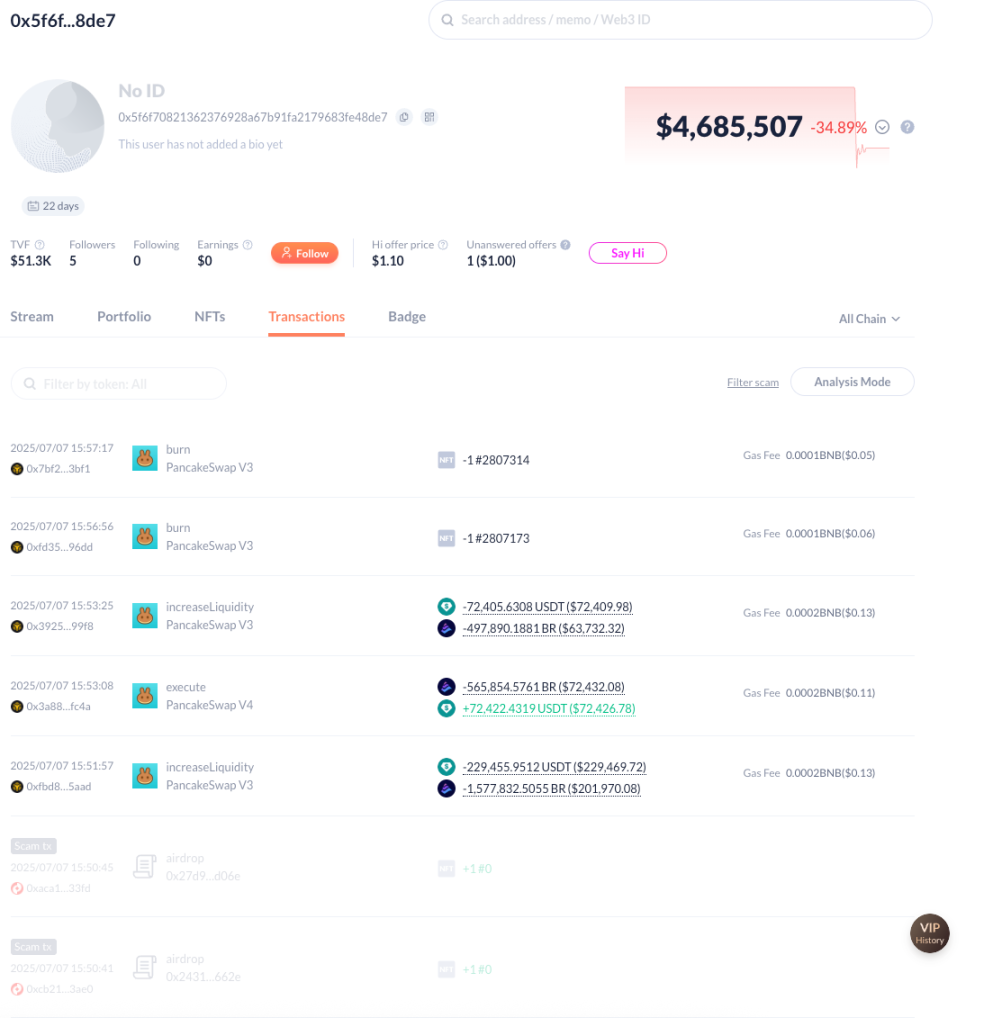

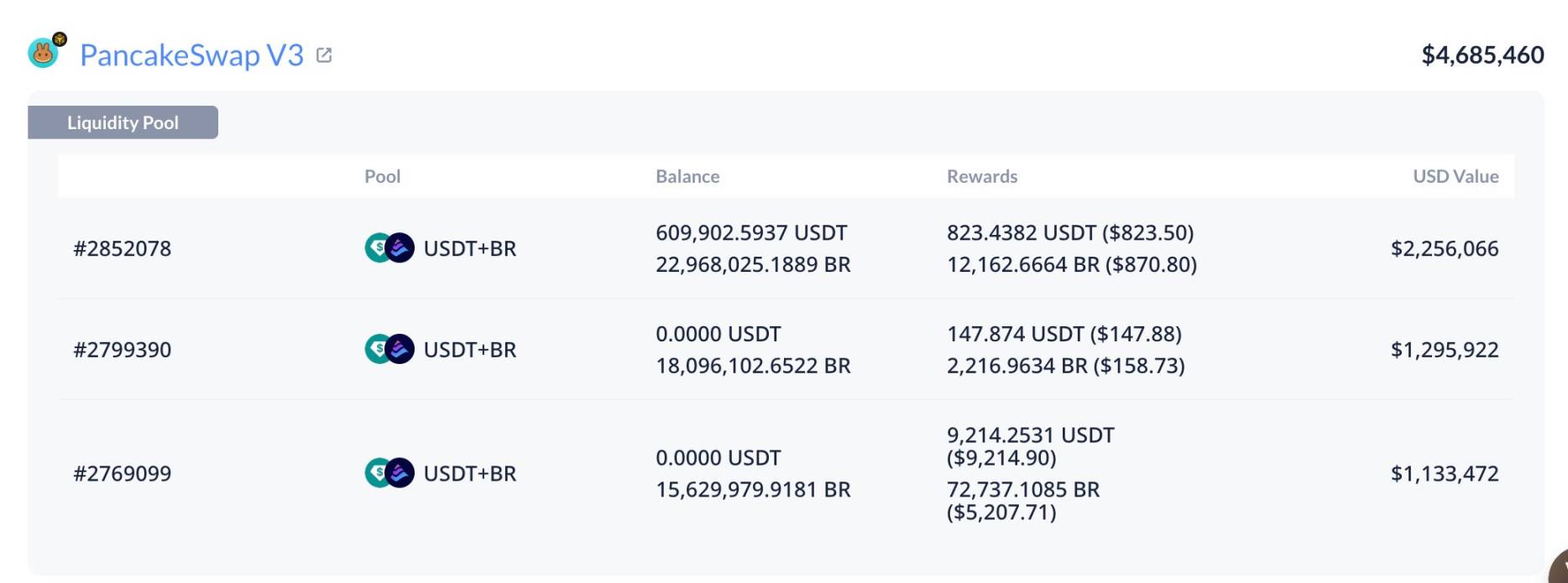

Analysis suggests this dump does not appear to be orchestrated by the project team. First, motivation: given the precedent of ZKJ’s collapse, such an overt move would be too brazen. The large-volume activity seems more likely aimed at manipulating futures or spot markets. Second, on-chain data shows the project’s primary liquidity address (0x5f6f70821362376928a67b91fa2179683fe48de7) still holds $4.685 million in liquidity, with its last transaction occurring on July 7—no activity was detected during the crash period.

The three main million-dollar-level dumping addresses were all newly created two weeks ago. Between June 24 and June 28, they withdrew funds directly from exchanges and began aggressively accumulating BR tokens—an obvious and singular funding source.

The fourth-largest dumping address, 0x58e837F8F9C1aCfE618AdbBa95314BE2ab55d19F, has more traceable history. Its earliest fund origins date back to 2017, with interactions recorded on legacy platforms like Yunbi, ZB.com, Liqui, and YoBit—clearly identifying it as a crypto OG.

The tactics mirror those used in the ZKJ crash: “instant liquidity withdrawal + coordinated large-scale dumping + multi-address synchronization.” Tracing remains difficult, however, as most key addresses exhibit single-source fund trails.

Precedent Set by ZKJ Crash

In fact, this type of manipulation has clear precedent. The ZKJ crash serves as a direct warning for BR’s recent plunge. Just under a month earlier, on June 15, ZKJ had also plunged over 80% in a short time. According to a preliminary investigation report released by Polyhedra afterward, the ZKJ crash originated from multiple addresses colluding to withdraw substantial liquidity from PancakeSwap V3 before rapidly dumping tokens. This on-chain sell-off triggered forced liquidations on centralized exchanges, further exacerbated when Wintermute transferred 3.39 million ZKJ tokens to CEX platforms within minutes—amplifying market panic and ultimately leading to nearly $94 million in forced liquidations. Notably, ZKJ’s crash also occurred under Binance Alpha’s incentive mechanism, which enabled highly concentrated, unlocked liquidity structures. These strikingly similar conditions have now almost perfectly repeated themselves in BR’s collapse.

Currently, the BR team claims it did not remove liquidity and has publicly disclosed its liquidity addresses, vowing not to withdraw in the future, urging users to remain rational. Additionally, to further support traders in the PancakeSwap BR/USDT pool, the team will launch a special airdrop program. Users who experienced significant slippage or price discrepancies due to market volatility during periods of sharp price swings will qualify for compensation. Specific airdrop rules and distribution plans will be announced and completed in the coming days.

While the project team may not have directly participated in the dump, the flaws in the underlying mechanism cannot be ignored. BR is one of the so-called "score farming" tokens within the Binance Alpha program, where teams inflate trading volume to attract retail investors to provide liquidity and compete for Alpha activity points.

On June 25, on-chain data revealed BR became the highest-volume token in the Binance Alpha program, recording $238 million in 24-hour trading volume. One of the suspected main LP addresses linked to Bedrock (starting with 0x9bd) had net deposited 50 million BR tokens (approximately $4 million) into liquidity pools since June 19. Five hours prior, this address sold 41.436 million tokens at an average price of $0.07959—worth $3.298 million—then added 9.27 million BR and 3.427 million USDT as bilateral liquidity to PancakeSwap, earning only $5,412 in fees over five hours.

Binance Alpha Liquidity Mechanism Under Fire

Community backlash against such incidents is growing stronger. Crypto OG @BroLeonAus quickly pointed out after BR’s crash that risks associated with this “volume pumping + liquidity draining” model were foreseeable. As early as when BR and AB were first launched, he observed their use of linear price charts, low trading fees, and continuous encouragement for liquidity provision—all hallmarks of typical “score farming and pool draining” behavior. Now, both projects are showing near-identical signs of collapse, confirming his warnings.

In his view, the current point-calculation rules of Binance Alpha contain obvious flaws, indirectly incentivizing projects to fabricate artificial activity to gain platform visibility and rewards. Under this design, merely creating the illusion of “deep liquidity, stable price movement, and low fees” is enough to lure retail users into becoming liquidity providers, resulting in accumulated liquidity pools. Project teams need only “bait the trap,” wait for the right moment, then swiftly withdraw liquidity and exit—leaving ordinary users holding the bag.

BroLeon revealed that last week, the Bedrock team approached him for promotional collaboration. He explicitly advised implementing third-party locking mechanisms for project liquidity to protect users. However, the team gave no clear response, and the partnership was never finalized. He emphasized that while there is currently no concrete evidence linking the BR team directly to the dump, greater responsibility lies with Binance Wallet’s team for ignoring glaring risks and loopholes in the system despite being aware of them.

The platform originally intended to benefit retail investors, but the reality has turned into a scenario where project teams exploit mechanism vulnerabilities to harvest retail funds—sparking negative sentiment toward the platform itself. This outcome clearly contradicts the original intent. In today’s DeFi landscape, any incentive mechanism that fails to define boundaries against abuse risks becoming a “cash machine” for speculators. Alpha was once seen as Binance’s proactive exploration into on-chain liquidity ecosystems, aiming to drive broader user participation in on-chain trading and enhance token circulation and decentralization through platform incentives.

But now, the initial vision appears increasingly distorted. The incentive structure is not tied to vesting schedules or genuine, sustained liquidity, enabling rampant volume manipulation. Projects or short-term profiteers can induce artificial market booms at minimal cost, eventually cashing out in an environment lacking oversight or constraints. Without structural reform, relying solely on post-event compensation or explanations will likely fail to prevent the next “flash crash.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News