IOSG | Binance Listing Path Research: Full Breakdown of Alpha, IDO, Futures, and Spot

TechFlow Selected TechFlow Selected

IOSG | Binance Listing Path Research: Full Breakdown of Alpha, IDO, Futures, and Spot

Project teams should select appropriate channels based on their own valuation stage to align with liquidity expectations and market timing.

TL;DR:

This study analyzes the lifecycle performance of tokens listed through Binance's four major channels—Alpha, IDO, Futures, and Spot—and tracks their subsequent listings on Bitget, Bybit, Coinbase, and Upbit, focusing on return performance, listing rhythm, sector preferences, and FDV ranges.

Performance Overview

-

The median 14-day FDV across most channels is negative, indicating that for most projects, listing marks a valuation peak;

-

Binance Alpha shows the strongest explosive potential (mean +220%) but with high volatility;

-

Binance IDO offers balanced short-term gains and higher conversion rates to Futures and Spot;

-

Binance Spot performs weakest in the short term, likely serving as an exit point for early investors;

-

Bitget and Coinbase stand out in secondary market performance, while Bybit and Upbit are more moderate.

Selecting Platforms by FDV Range

-

Binance Spot favors large-cap projects (>$500M);

-

Alpha primarily supports early-stage projects <$200M, ideal for testing;

-

IDO focuses on mid-sized projects in the $70M–$200M range;

-

Bitget / Bybit have flexible ranges but lean toward projects with growth momentum or large caps;

-

Coinbase / Upbit prefer compliant, high-valuation projects.

Listing Time Expectations

-

Alpha → Spot: average ~60 days;

-

IDO → Spot: average ~17 days;

-

Futures → Spot: average only 14 days;

-

Futures may be the fastest pathway.

Sector Preferences

-

Alpha: prefers Meme, AI;

-

IDO: prefers Infra, AI;

-

Spot: covers Infra, Meme, AI;

-

Futures: broader coverage,主打 Infra, AI, Meme;

-

Projects can choose the appropriate listing method based on their narrative direction.

Advanced Listing Pathways

-

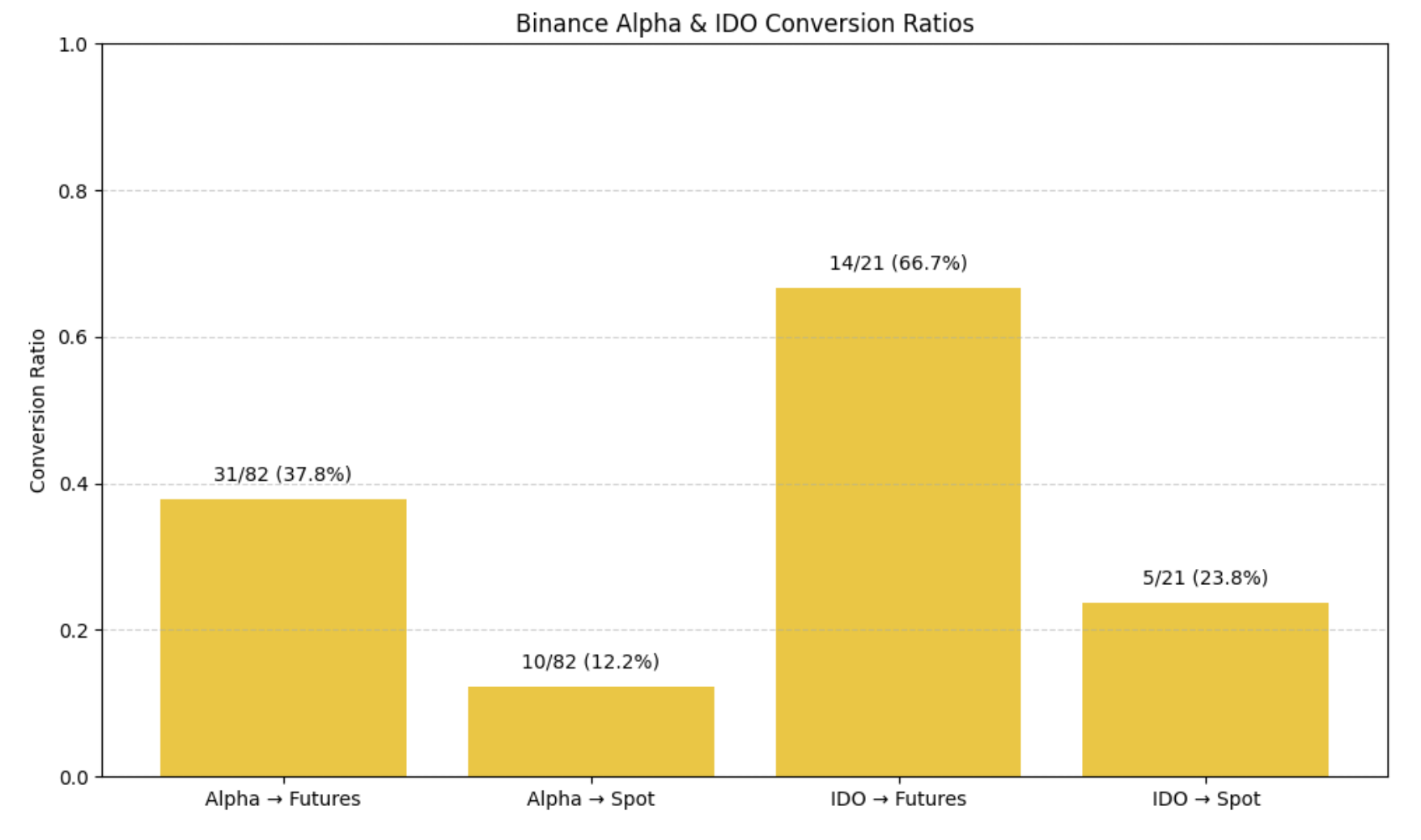

Alpha → Futures: conversion rate 37.8%

-

Alpha → Spot: conversion rate 12.2%

-

IDO → Futures: conversion rate 66.7%

-

IDO → Spot: conversion rate 23.8%

-

Around 40% FDV increase is a common characteristic before advancing to the next platform.

Alternative Platform Performance

-

Bitget has the strongest承接 capacity among other CEXs, especially friendly to Alpha/IDO projects;

-

Bybit also shows strong willingness to list IDO projects;

-

Coinbase / Upbit list very few projects, with strict reviews and long cycles.

This research focuses on the lifecycle performance of tokens listed via Binance’s channels (Alpha, community-commonly referred to as IDO Exclusive TGE, Futures, and Spot), and tracks their subsequent listing paths on centralized exchanges (CEX) such as Bitget, Bybit, Upbit, and Coinbase. The analysis covers token returns, timing, sector preferences, and valuation distribution (FDV dynamics), aiming to provide strategic listing path recommendations for project teams and establish a data-driven framework for price discovery and trading strategy evaluation for investors.

Glossary: What do Binance Spot / Futures / IDO / Alpha listings mean?

Binance Spot is the most basic trading platform on Binance, where users can buy or sell tokens at current market prices, with assets settled immediately upon trade execution, allowing free holding, transfer, or sale.

Binance Futures provides crypto derivatives trading services, enabling users to go long or short and use leverage to amplify gains or losses.

Binance IDO is a public offering channel for retail users who participate in new token issuances on the BNB Chain by staking BNB or completing Alpha Quest tasks set by the Binance team, typically occurring before the token lists on other platforms.

Binance Alpha is Binance's project discovery platform integrating Pancakeswap and other DEXs on BNB Chain, supporting early-stage projects with growth potential, emphasizing experimentation and token diversity.

Scope of Study

Exchange Selection: This study tracks projects initially launched on Binance channels and evaluates their subsequent performance on Bitget, Bybit, Coinbase, and Upbit—these being the most common CEXs following Binance.

Timeframe: Only listing events after February 2025 are included. This cutoff filters outdated market logic and better reflects current listing dynamics.

Understanding listing pathways is crucial for both project teams and investors:

-

For project teams, different platform performances directly affect resource allocation and listing schedule planning;

-

For investors, token performance across platforms informs position management and decisions on whether to chase price surges.

Price Discovery

Returns

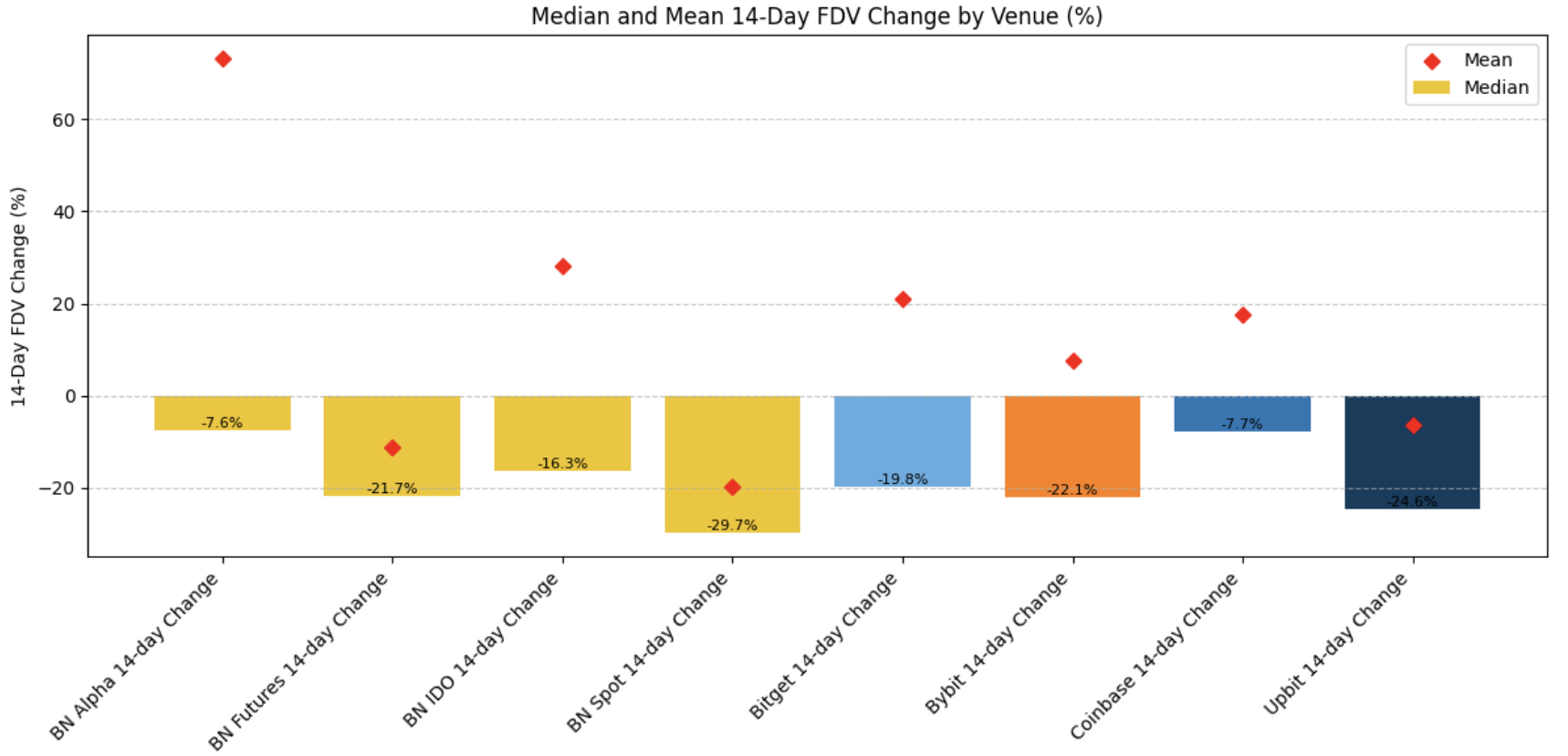

Metric Definition: In this section, we measure the percentage change in FDV within 14 days post-listing to assess short-term price discovery capabilities across platforms. We use the FDV corresponding to the closing price on the first day as the baseline and compare it with the highest FDV within 14 days.

Overall, the 14-day FDV median is negative across all platforms, indicating that in the current cycle, most projects reach their valuation peak at listing.

-

Binance Alpha: mean ~+77%, median -7.6%. Most projects deliver limited returns, but a few experience extreme rallies, reflecting Alpha’s high volatility. Despite divergent outcomes, downside risks are limited—offering exposure for projects and asymmetric upside for investors.

-

Binance IDO and Futures: medians at -16.3% and -21.7%, means at +28% and -20%. Most perform modestly, but a few outliers pull up averages. Futures underperform mainly because most projects are added after significant price movements have already occurred.

-

Binance Spot: median -29.7%, mean -20%. As the most prestigious platform, Spot listing may serve as an exit point for early investors, creating downward price pressure.

-

Bitget and Coinbase: show solid performance, with Bitget median -19.8%, mean ~21%; Coinbase median -7.7%, mean ~18%. Both demonstrate strong ability to capture momentum post-Binance listing.

-

Bybit and Upbit: perform moderately, with Bybit median -22.1%, mean 8.9%; Upbit median -24.6%, mean -5%. Upbit listings often come late, after hype has faded, resulting in weaker performance.

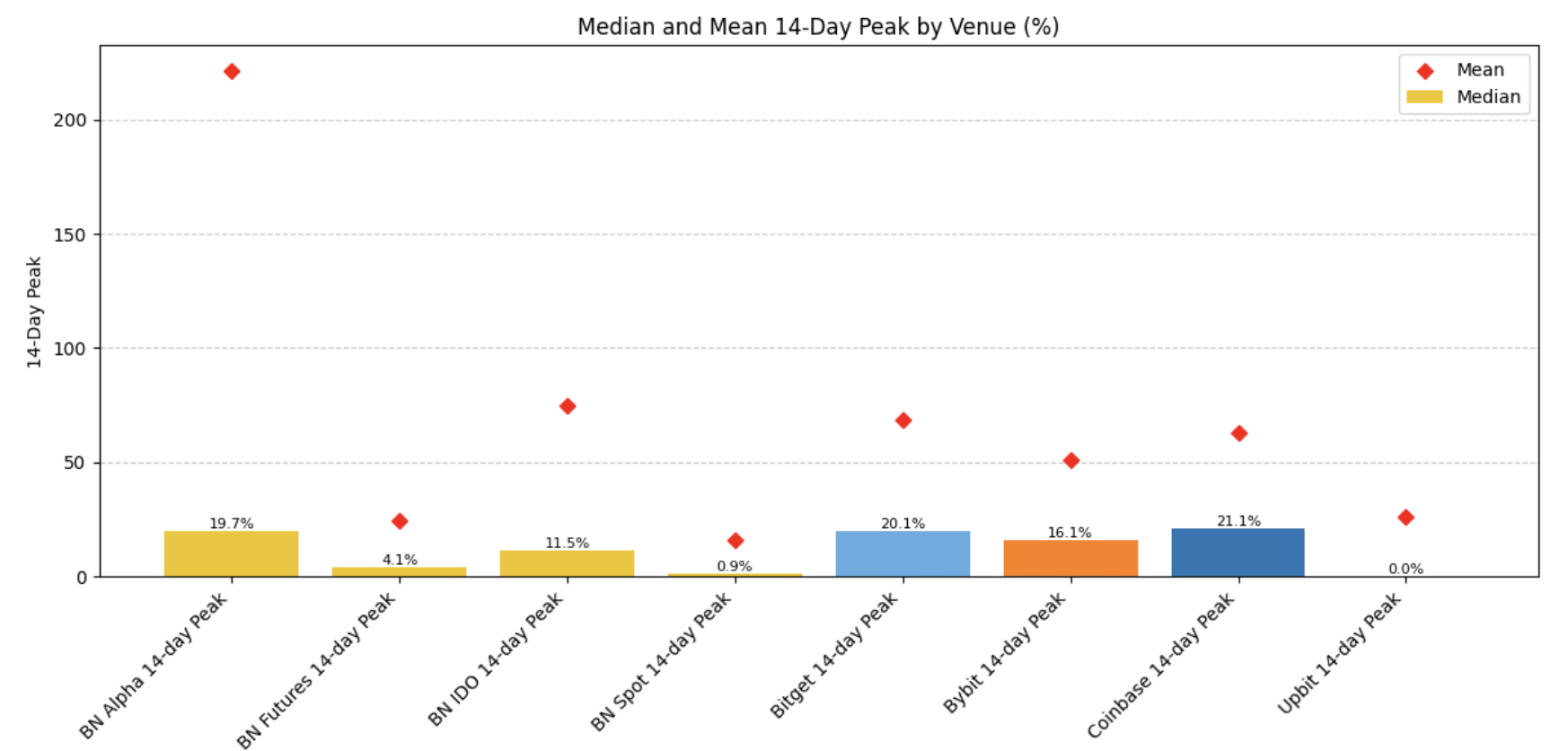

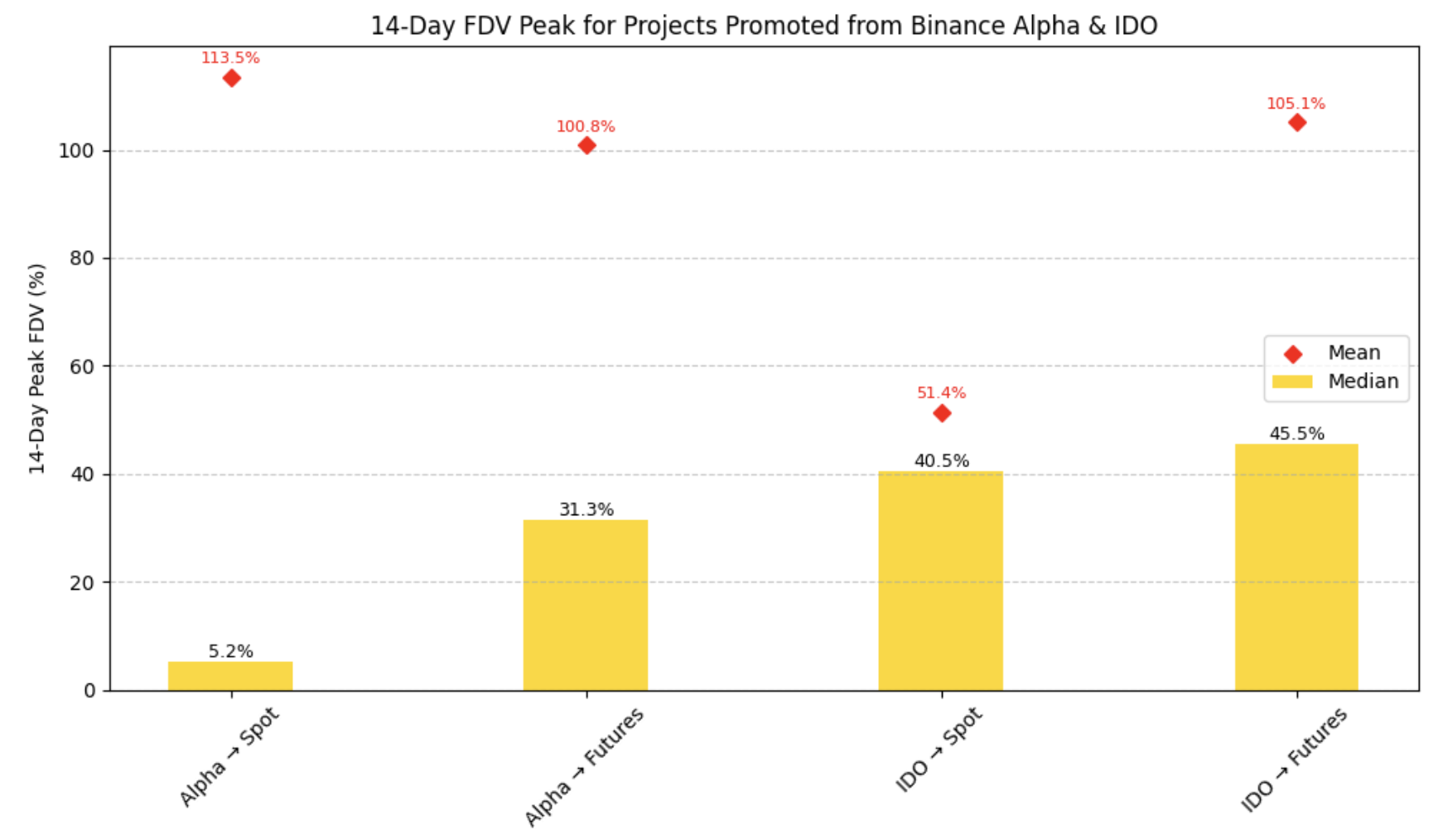

Peak Surge Magnitude

Metric Definition: This section measures the ratio between the highest FDV within 14 days post-listing and the initial listing FDV, assessing short-term upward potential across platforms.

This metric helps investors judge a token’s initial upside potential and assists project teams in understanding market demand, selling pressure, and each platform’s price discovery strength.

-

Binance Alpha: average surge reaches 220%, median 19.7%. While some projects see minimal movement, many experience sharp rallies, showcasing Alpha’s strong short-term speculation and price discovery power—the highest upside potential among all platforms.

-

Binance IDO: average surge ~75%, median 11.5%. Most projects enjoy decent hype post-launch.

-

Binance Futures: average surge 27%, median just 4.1%. Provides some traffic and modest price impact, serving well as a supplementary exposure channel.

-

Binance Spot: underwhelming performance, average surge only 15%, median 0.9%. Strong sell-off pressure hits immediately due to fulfilled market expectations.

-

Coinbase: average surge 60%, median 21.1%. Delivers the strongest catalytic effect among CEXs, benefiting from its U.S. user base, though listing frequency is low.

-

Bybit / Bitget: average surge 70–80%, medians around 20%, showing strong speculative sentiment and notable short-term volatility—excellent listing choices for quick momentum.

-

Upbit: average surge 35%, median 0%. Shallow liquidity and relatively weak user enthusiasm.

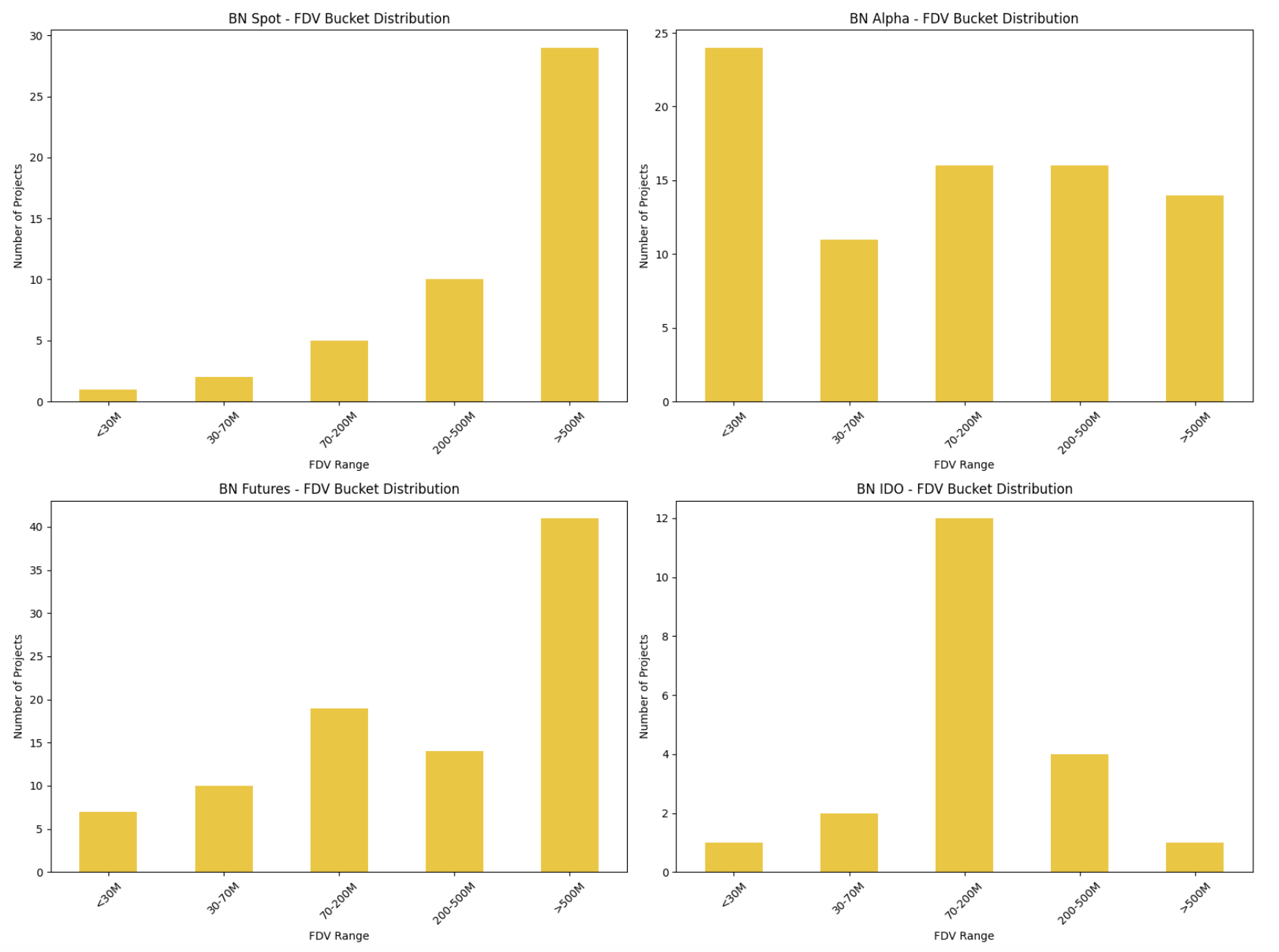

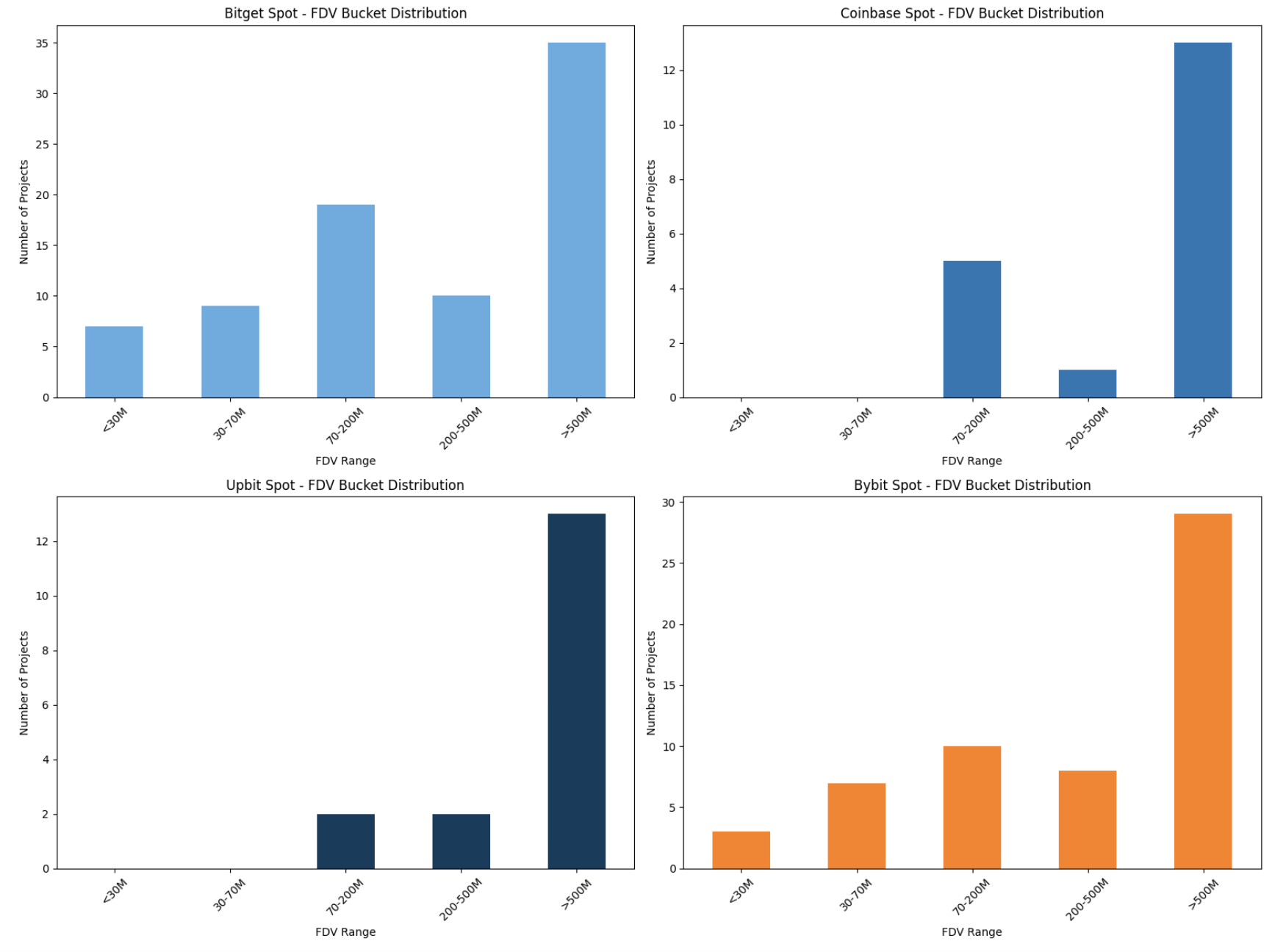

FDV Distribution at Listing

This section examines the FDV distribution of projects at listing across platforms, offering guidance for project teams. Different valuation-stage projects suit different channels; understanding each platform’s preferred FDV range helps teams align listing timing and strategy more precisely.

-

Binance Spot: over 60% of projects have FDV above $500 million, clearly favoring large-cap projects. The platform demands strong project scale and institutional backing, best suited for mature, high-valuation projects.

-

Binance Alpha: wide coverage, mostly under $200 million. Aligns with Alpha’s “testing ground” positioning, ideal for early-stage, high-potential projects.

-

Binance Futures: over half of projects exceed $500 million FDV, with decent presence in the $70M–$500M range. Functions more as a follow-up channel for already-listed projects, suitable for those with stabilized valuations.

-

Binance IDO: concentrated in the $70M–$200M range, indicating preference for mid-cap projects. Ideal for public launches after thorough product, community, and strategic preparation.

-

Bitget: spans full valuation spectrum from below $30M to over $500M, with clusters in $70M–$200M and above $500M. Shows high acceptance but leans toward mid-to-large cap projects with existing traction or institutional support.

-

Bybit: nearly half of projects above $500M FDV, with solid coverage in $70M–$200M. Capable of capturing short-term hype and driving mid-cap projects.

-

Coinbase: almost all projects exceed $500M FDV, reflecting high compliance barriers and large-cap focus, better suited for mature, compliant projects.

-

Upbit: all listed projects above $200M, most exceeding $500M. Indicates high market-cap requirements in Korea, better positioned as a later-stage supplementary channel.

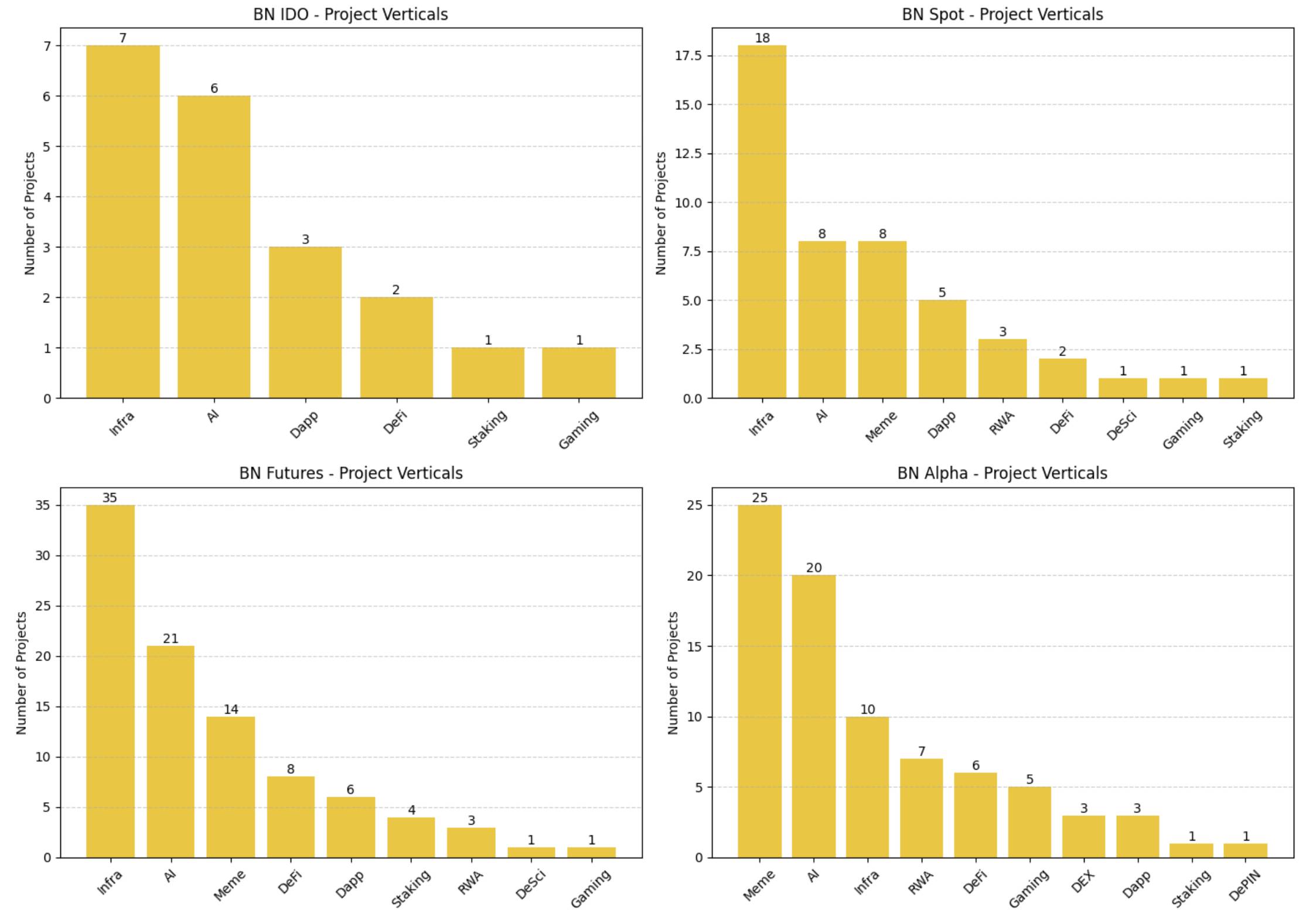

Platform Sector Preferences

Project teams need to understand differences in sector preferences across platforms. The following analysis focuses solely on sector distribution across Binance’s four channels.

In addition, the total number of listed projects per channel reflects listing difficulty—fewer projects usually indicate stricter selection criteria.

-

Binance Spot: ~50 projects listed

-

Binance Futures: ~90 projects listed

-

Binance Alpha: ~80 projects listed

-

Binance IDO: ~20 projects listed

Binance IDO:

-

Favors Infra (7) and AI (6).

-

Niche distribution, covering only 6 sectors.

-

Clearly focused on technical infrastructure and emerging applications, prioritizing Infra and AI projects.

Binance Spot:

-

Favors Infra (18), Meme (8), and AI (8).

-

Also covers DeFi, RWA, GameFi, Dapps, and other subcategories.

-

Most balanced vertical distribution, though infrastructure remains dominant.

Binance Futures:

-

Largest number of listed projects, including 35 Infra and 21 AI.

-

Significant share of Meme (14) and DeFi (8).

-

Broadest sector coverage, favoring market-active, narrative-driven projects.

Binance Alpha:

-

Primarily Meme (25) and AI (20), highlighting speculative narratives and experimental themes.

-

Infra projects: 10, plus RWA (5), DeFi (4), GameFi, etc.

-

Alpha serves as a testing ground for hype-driven and concept-based projects.

Summary:

-

Project teams should tailor product positioning and market narratives to each platform’s vertical preferences.

-

AI projects are a hot sector supported across all four channels.

-

Meme projects dominate on Alpha, with solid presence on Spot and Futures.

-

Infra projects are the most inclusive core sector outside of Alpha.

Listing Pathway Analysis

A key question for many project teams: Can Alpha or IDO serve as a stepping stone to Binance Spot? Let the data speak:

-

Alpha → Futures: 37.8% conversion rate (31/82), a relatively effective precursor channel.

-

Alpha → Spot: only 12.2% (10/82), overall low.

-

IDO → Futures: highest conversion rate at 66.7% (14/21).

-

IDO → Spot: 23.8% (5/21), better than Alpha.

Alpha works better as an early testing channel—over 30% successfully enter Futures—but promotion to Spot still requires strong fundamentals and market performance. In contrast, IDO projects have stronger brand recognition and community foundation, giving them higher promotion potential. Teams should view Alpha and IDO as entry points into the Binance ecosystem, not endpoints.

Performance Threshold

How did projects that successfully advanced from Alpha/IDO to Binance Spot perform earlier? Are there observable patterns?

-

Alpha → Spot: 14-day surge median just 5.2%, far below the 30–50% seen in other paths, yet mean reaches 113.5%—highest among all paths. This indicates extreme divergence: a few projects show massive breakout potential, but most see limited gains. Binance Spot listing depends less on market hype and more on hard metrics like product quality and user data.

-

Alpha → Futures and both IDO paths (→ Spot and → Futures) show more concentrated 14-day surge medians (~30–45%), with means between 51%–105%, indicating stable performance.

Overall, if a project achieves around 40–50% FDV surge within two weeks of its initial listing, it stands a better chance of gaining further attention from Futures or Spot. This can serve as a benchmark for teams evaluating future listing potential.

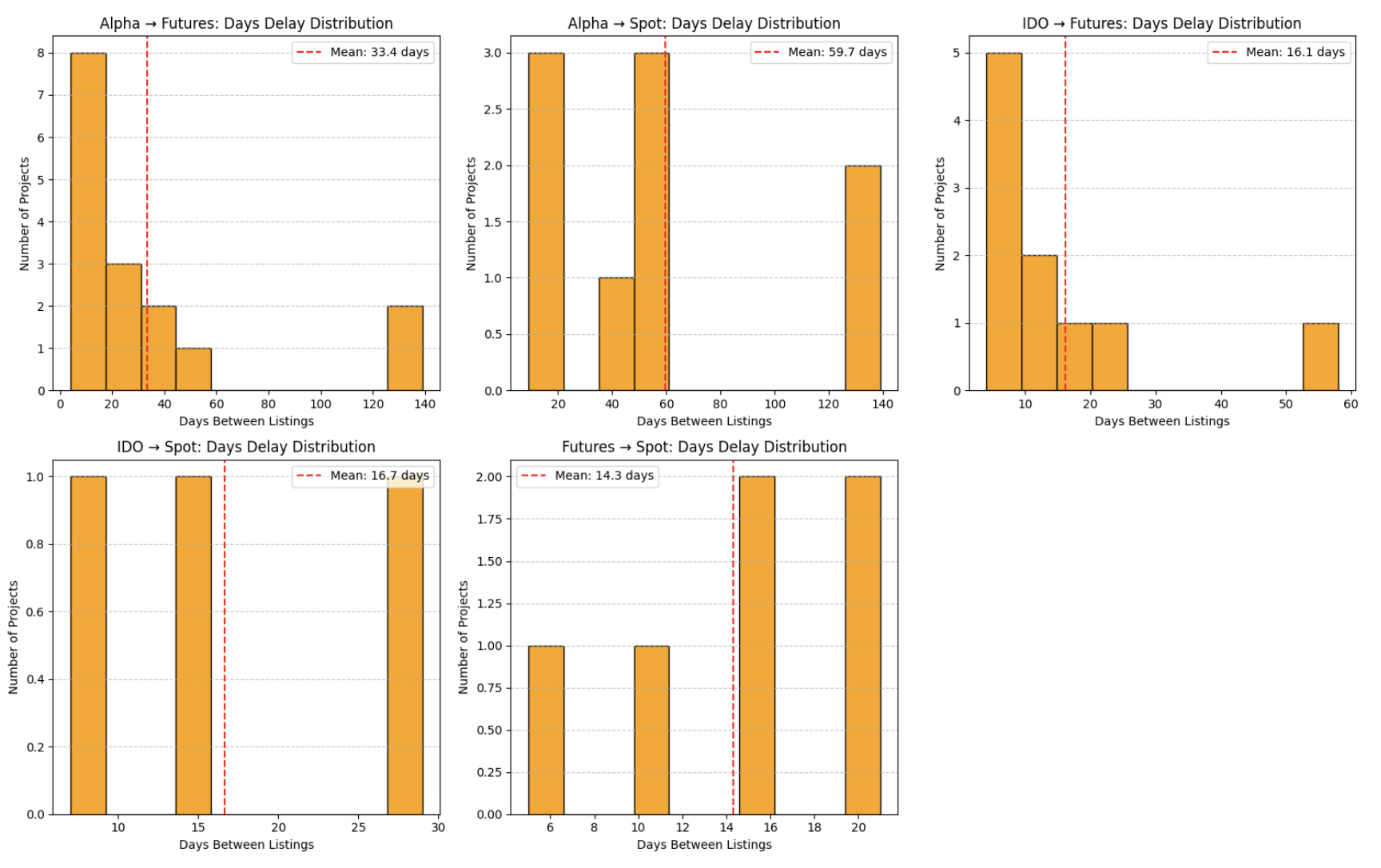

Waiting Time

Teams must set realistic expectations: how long does it typically take to go from Alpha or IDO to Binance Spot? Without clear timelines, teams risk missing market windows or losing community interest.

-

Alpha → Spot: average wait ~60 days, some exceeding 120 days. Wide distribution suggests this path lacks predictability, making Alpha better suited for exploration rather than a direct route to Spot.

-

Alpha → Futures: average only 30 days, significantly faster than Spot, demonstrating stronger market responsiveness.

-

IDO → Spot and IDO → Futures: both average 17 days, with most completed within one month post-launch. Thanks to strong community mobilization and coordinated scheduling, IDO projects enjoy more predictable progression.

-

Futures → Spot: the fastest path, averaging just 14 days, with highly concentrated timing.

If a team aims for rapid Binance Spot listing, Futures currently appears the most reliable intermediate pathway.

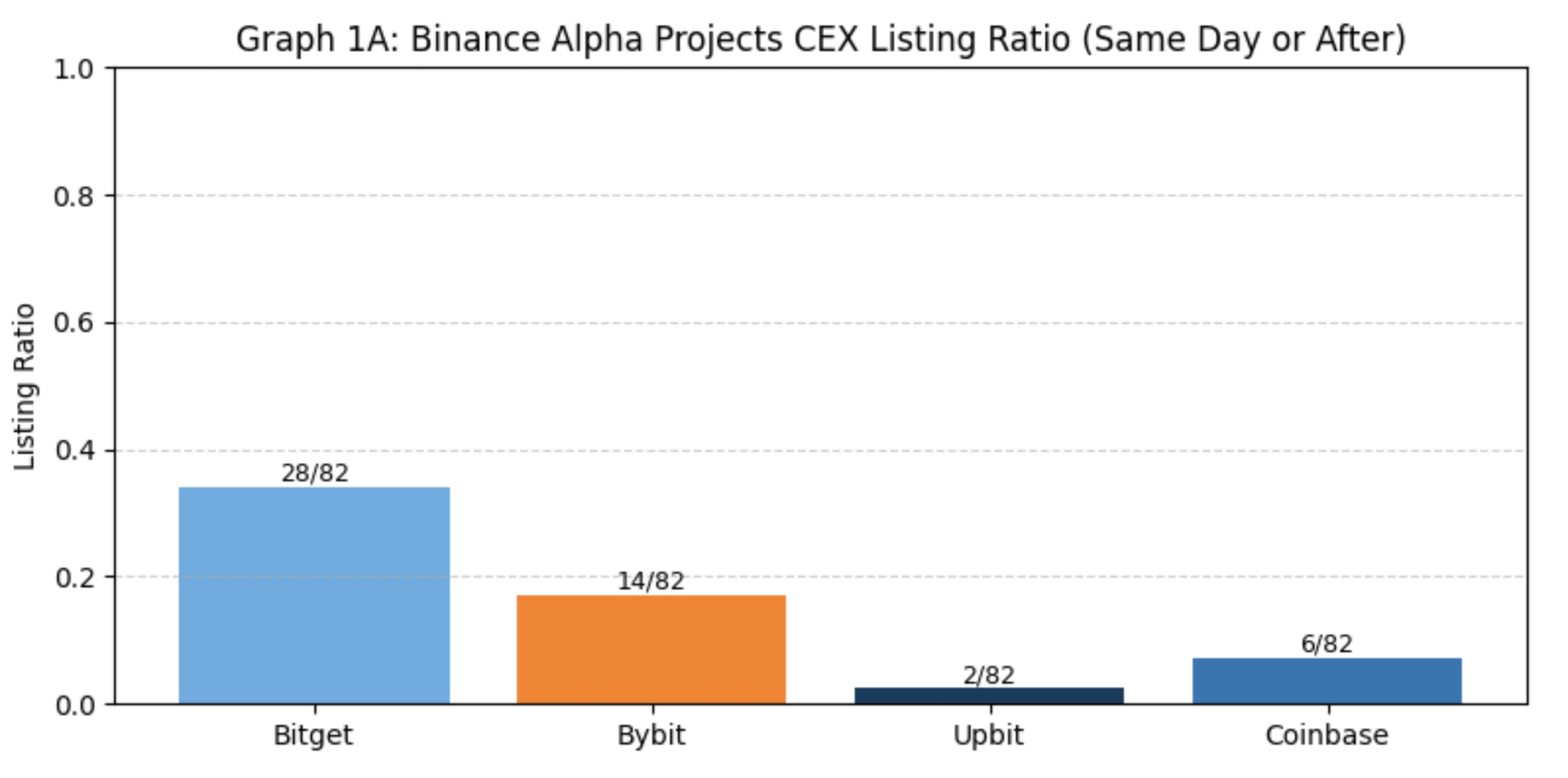

Alternative Paths: Expanding to Other CEXs

Not all projects treat Binance Spot as the sole goal. Increasingly, projects move to Bitget, Bybit, Coinbase, or Upbit after Alpha or IDO. Some platforms offer fast response times and strong liquidity, becoming viable alternatives.

Listing Volume

After launching on Alpha or IDO, how many projects successfully list on other major CEXs?

-

Alpha → Bitget: listing rate 34.1% (28/82), far ahead. Bybit: 17.1% (14/82), Coinbase: 6% (6/82), Upbit listed only 2 related projects.

Bitget shows the highest acceptance for Alpha projects, possibly due to its openness to emerging projects and flexible listing criteria. Bybit also demonstrates notable interest in Alpha projects.

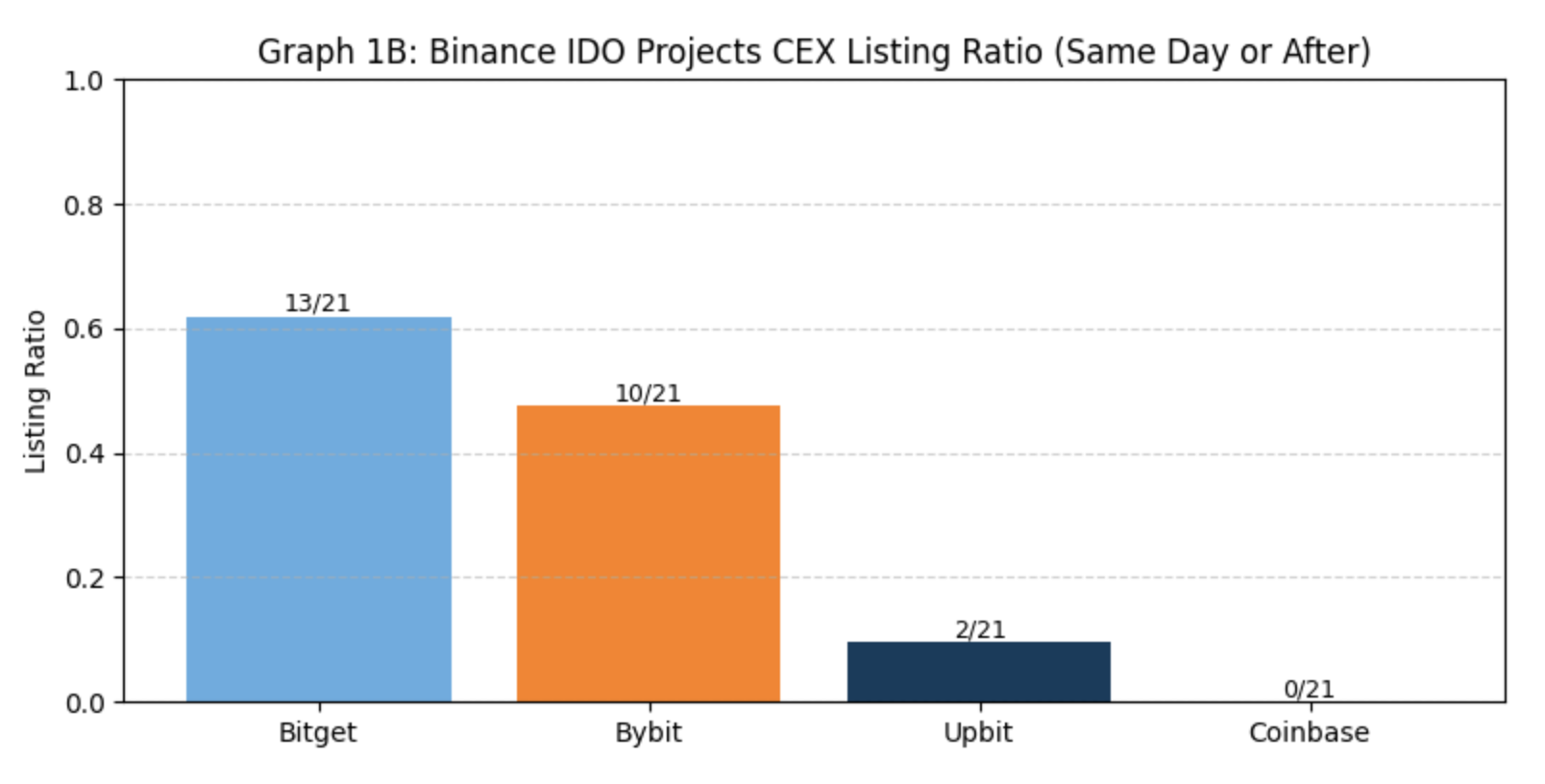

-

IDO → Bitget and Bybit: listing rates 61.9% (13/21) and 47.6% (10/21), Upbit 9%, Coinbase no record.

Compared to Alpha, IDO projects are more attractive on other platforms, likely due to stronger branding and community momentum. Bitget and Bybit also show greater capacity for IDO projects, making them key extension paths worth considering.

Listing Wait Time

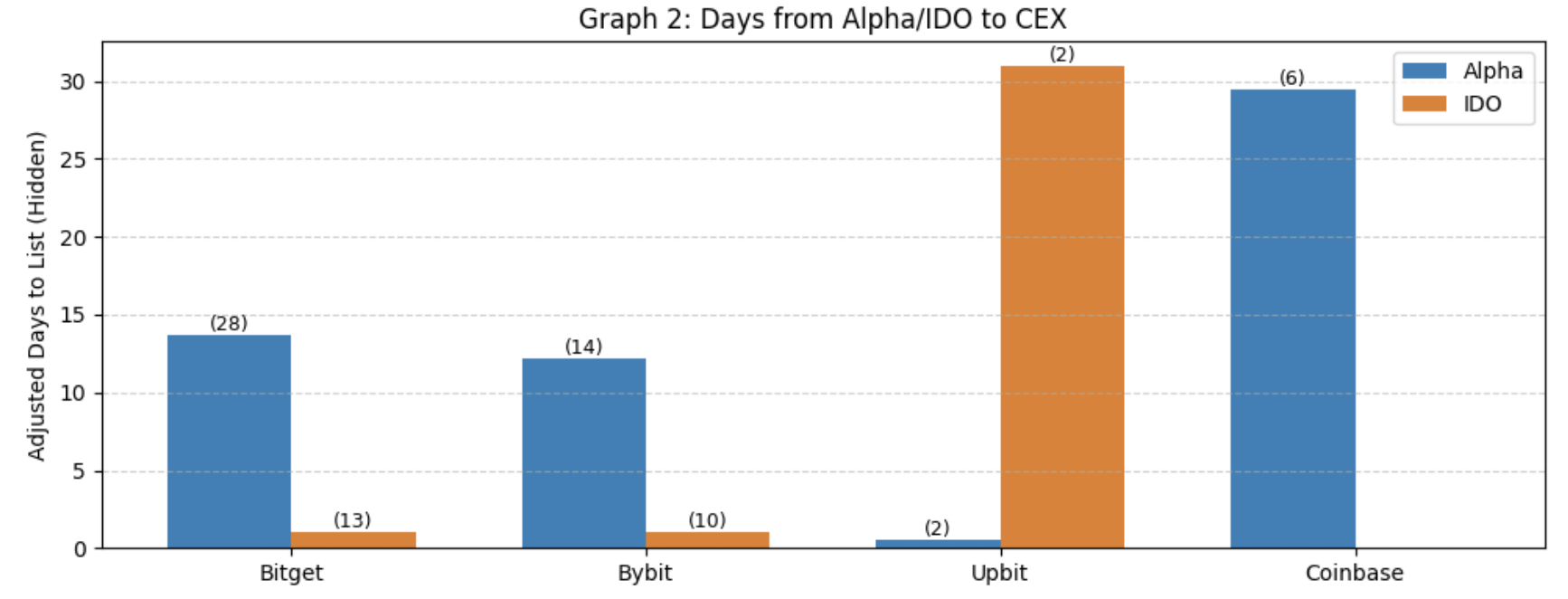

How long after Alpha or IDO listing on Binance do projects typically get listed on other mainstream CEXs?

-

Bitget: Alpha projects average ~14 days, IDO even faster at 13 days, with many launching on TGE day.

-

Bybit: Alpha projects ~13 days, IDO also same-day TGE listing.

-

Coinbase: only lists Alpha projects, average ~29 days.

-

Upbit: only lists IDO projects, average ~31 days.

Bitget and Bybit operate at a faster pace, suitable for rapid deployment; Coinbase and Upbit are slower, requiring alignment with local compliance and community rhythms.

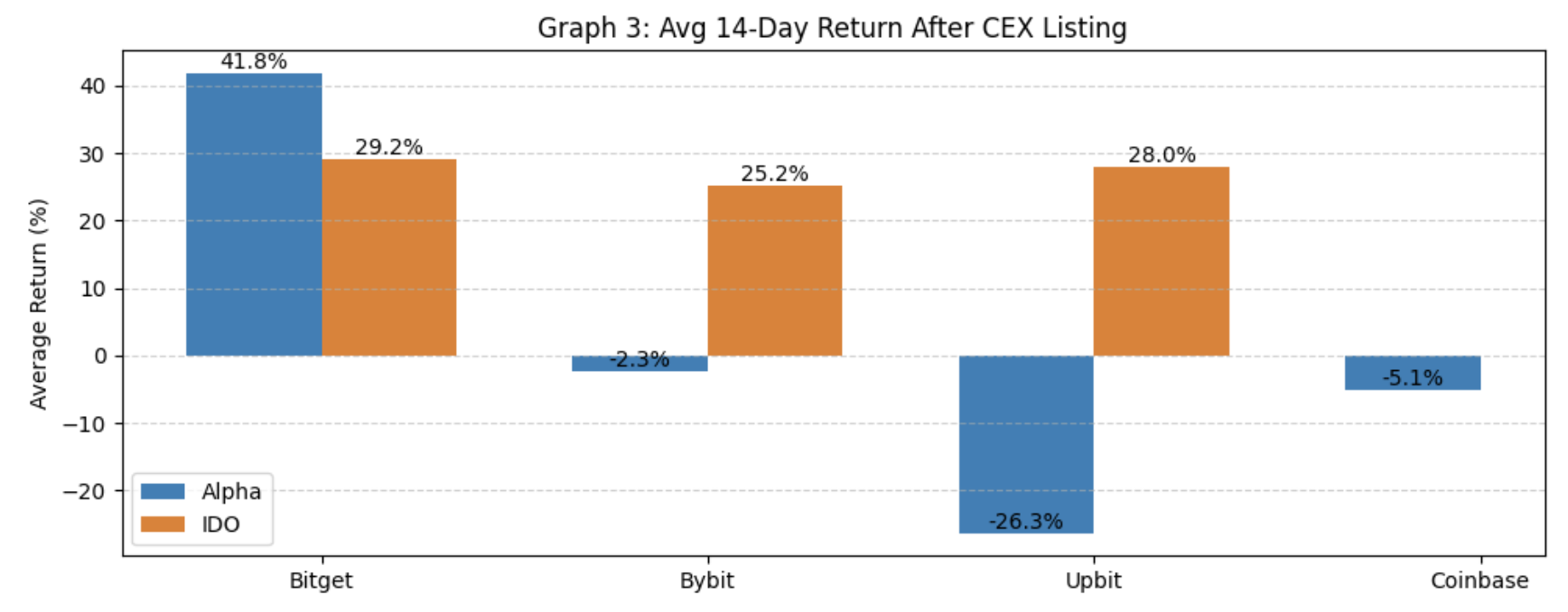

Price Discovery on Other CEXs

The chart below shows the average 14-day returns for Alpha and IDO projects after listing on various CEXs:

-

Bitget: Alpha projects return 41.8%, IDO 29.2%—best performer.

-

Bybit: Alpha projects -2.3%, IDO projects 25.2%—shows stronger preference for IDO.

-

Coinbase and Upbit: only 6 and 4 sample projects respectively, too small for representative statistics.

Bitget and Bybit consistently perform well in listing Binance-originated projects, making them important considerations when planning TGE strategies.

Conclusion

Overall, Binance Alpha and IDO serve as effective entry points within Binance’s ecosystem:

-

Alpha functions more like an experimental playground—low barrier to entry, ideal for early project exposure;

-

IDO carries stronger brand endorsement and higher conversion rates to Futures and Spot.

However, conversion to Spot remains scarce: only about 12% of Alpha projects eventually upgrade, and 24% for IDO. Project teams must manage pacing carefully:

-

Alpha → Spot averages ~60 days,

-

IDO → Spot takes ~17 days,

-

Futures → Spot is fastest, only 14 days.

Additionally, platform preferences for project FDV send critical signals:

-

Spot favors large-cap projects valued above $500M;

-

Alpha mainly accepts early-stage projects under $200M;

-

IDO targets mid-sized projects in the $70M–$200M range, suitable for well-prepared launches.

Project teams should select appropriate channels based on their valuation stage to align with liquidity expectations and market timing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News