Binance Alpha heats up, how to participate in the competition with better strategies?

TechFlow Selected TechFlow Selected

Binance Alpha heats up, how to participate in the competition with better strategies?

Advantages emerge from the details.

Written by: TechFlow

Binance Alpha's points airdrop model has been live for a month, and the reputation of the Alpha campaign—"guaranteed base rewards"—has gradually taken shape amid ongoing market discussions. The frequent weekly "money drops" have drawn in initially skeptical observers and brought a wave of new users attracted by the returns.

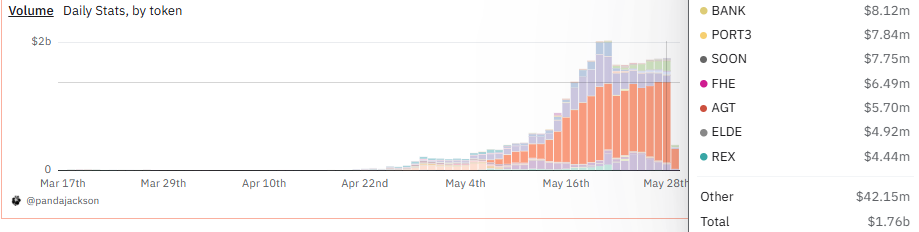

As of May 29, Binance Alpha’s daily trading volume reached $1.76 billion.

Data source: Dune – Exclusive and accurate Binance Alpha 2.0 data, author: @pandajackson42

As market enthusiasm for Binance Alpha continues to grow, Alpha points have surged accordingly. According to statistics from Twitter user @litangsongyx, in the latest Alpha campaign, the number of participants with ≥195 points is approaching 80,000, signaling that the Alpha race is heating up.

Well begun is half done. In the current high-difficulty environment, whether you're just starting or already actively involved, having a solid participation strategy is essential.

Based on the current Binance Alpha rules and market participation trends, we’ve compiled a version-appropriate strategy guide for your reference.

Minimize Trading Slippage Costs

Some users effortlessly earn hundreds of dollars monthly through point farming, while others struggle only to find their airdrop rewards barely cover transaction costs—or worse, end up at a net loss. Beyond differences in entry timing, a key factor behind this disparity is how well each individual manages slippage and gas expenses.

How can you use the current rules to minimize daily trading costs? Read the guide below ↓↓↓↓

-

Prioritize trading BSC assets: Currently, trading Alpha assets on the BSC chain earns double points. Unless participating in specific Alpha trading competitions (e.g., Sonic or Sui chain assets), prioritize BSC assets when farming points. Compared to other chains, BSC assets yield more points per unit of trading volume (cost), and due to increased liquidity attracted by this rule, BSC token trading typically incurs lower slippage.

-

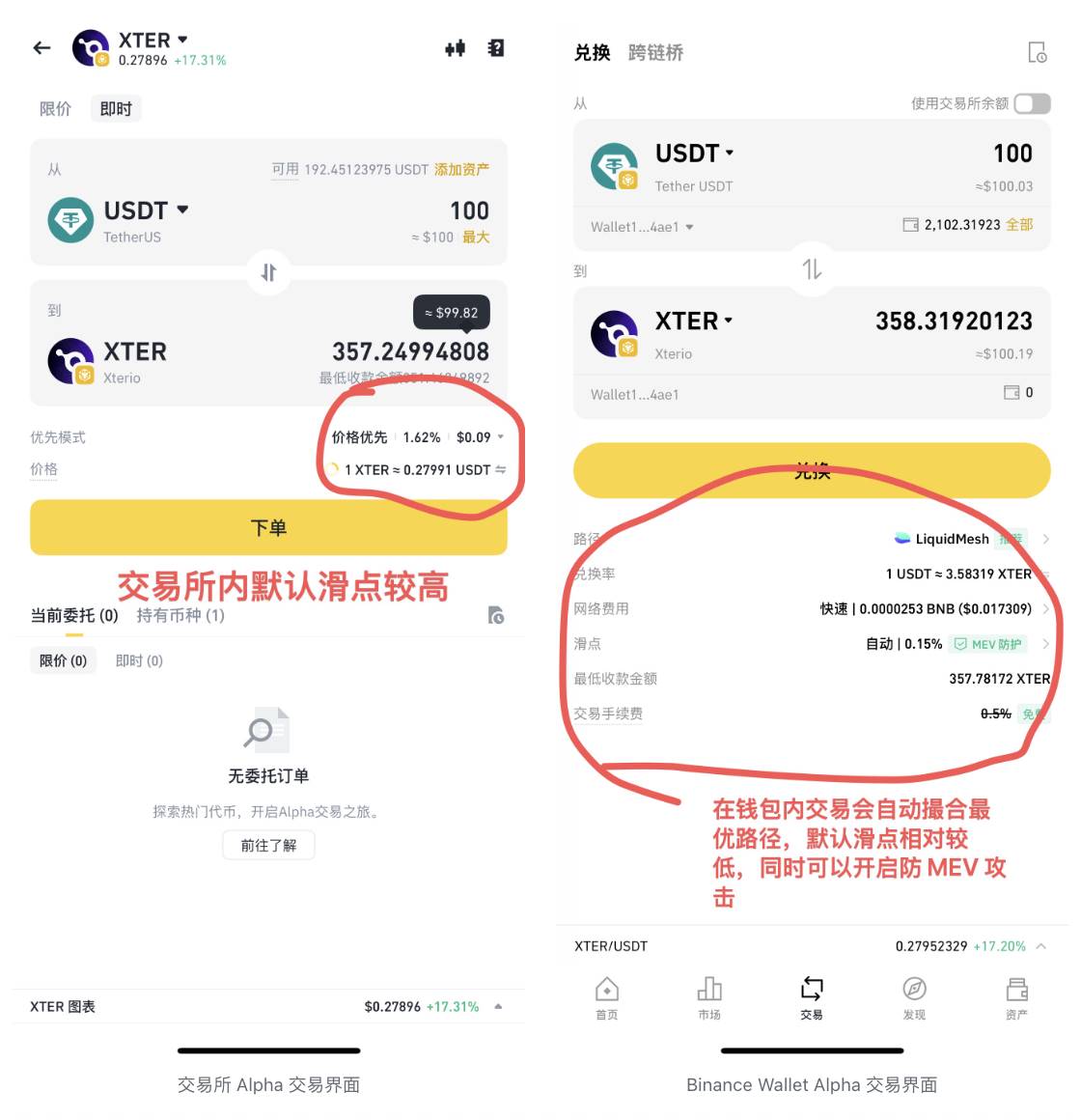

Manually set slippage: Binance offers two methods for Alpha trading—exchange-based interface and wallet swap. The exchange-integrated Alpha tool streamlines the process, ideal for beginners, but requires manual adjustment of slippage and gas per trade, which if ignored, may lead to higher costs. In contrast, trading via Binance Wallet automatically routes through optimal paths to minimize slippage. Users need only set custom slippage once per token and can optionally enable MEV protection.

-

Choose different trading pairs: BSC assets aren't limited to USDT pairs. Try BNB pairs or even "Alpha asset / Alpha asset" pairs—they might offer better slippage outcomes.

-

Favor range-bound or uptrending tokens: Since most accounts trade within ~10-minute windows daily, when selecting tokens, consider not only trading volume and liquidity depth but also price trends. Based on our testing, under otherwise identical conditions, trading tokens in minor uptrends (1–5 minute timeframe) minimizes slippage (often under 0.05%, sometimes zero). PS: Minor trends are volatile; use this method with real-time monitoring and swift execution to avoid losses from sudden downturns.

How many points should you farm daily?

The Alpha campaign uses a 15-day rolling points system, making each cycle 15 days long. Under current rules, how many points per day are needed over 15 days to achieve decent returns?

Looking at the participation thresholds of the last 10 Alpha airdrops/TGEs, even broadly distributed "everyone-gets-something" airdrops now require around 190 points—meaning participants must average at least 13 points per day. According to the scoring rules, most users need “account balance ≥ $100 (1 pt) + daily net buy ≥ $4,096 (12 pts)” to meet this threshold.

Earning just 13 points per day only qualifies you for one airdrop/TGE per cycle. Given current single airdrop payouts hover around $100, completing 15 days of farming for just one reward clearly fails to offset time and trading costs.

Assuming average trading cost of ~0.05% per trade, for most small-capital users, the following strategies strike a reasonable balance between capital requirements and operational frequency over two cycles (30 days):

-

Keep $200 reserved in account; farm volume using BNB/BSC token pairs with daily net buys exceeding $8,192. Earn 14 (volume points) + 1 (asset points) = 15 points daily. Over 15 days: 225 points total. On average, receive 4–6 airdrops every two cycles.

-

Keep $1,200 reserved; farm volume using BNB/BSC token pairs with daily net buys exceeding $16,384. Earn 15 (volume points) + 2 (asset points) = 17 points daily. Over 15 days: 255 points total. On average, receive 8–10 airdrops every two cycles.

-

If deposit ≥ $10,000, earn an additional 1 point on top, totaling 18 points daily. Over 15 days: 270 points. On average, receive 10–12 airdrops every two cycles.

How to best use your points?

Just as farming points requires strategy, so does wisely using them.

Leverage system mechanics

Alpha campaigns launch approximately 4–6 projects per week, occasionally two on the same day.

Since airdrop claims expire after 24 hours, a near-BUG behavior emerges depending on *when* you claim: Suppose today (May 29) your score is 195, and the day’s threshold is 194. If you claim on May 29, your score drops to 195–15 = 180 by May 30. If the next day’s threshold is 190, you won’t qualify.

However, by exploiting this “BUG” (claiming on the second day), on May 30 you can claim both May 29 and May 30’s airdrops using your full 195 points. By May 31, your score becomes 195–30 = 165. This lets you claim an extra airdrop under identical conditions—and if two Alpha events launch on May 30, potentially gain two extra claims.

Twitter user @litangsongyx built a historical Alpha activity dashboard: https://litangdingzhen.me/, which details each Alpha project’s distribution and claim records on-chain, plus predictions for potential token reissues.

Join Subsidy Campaigns

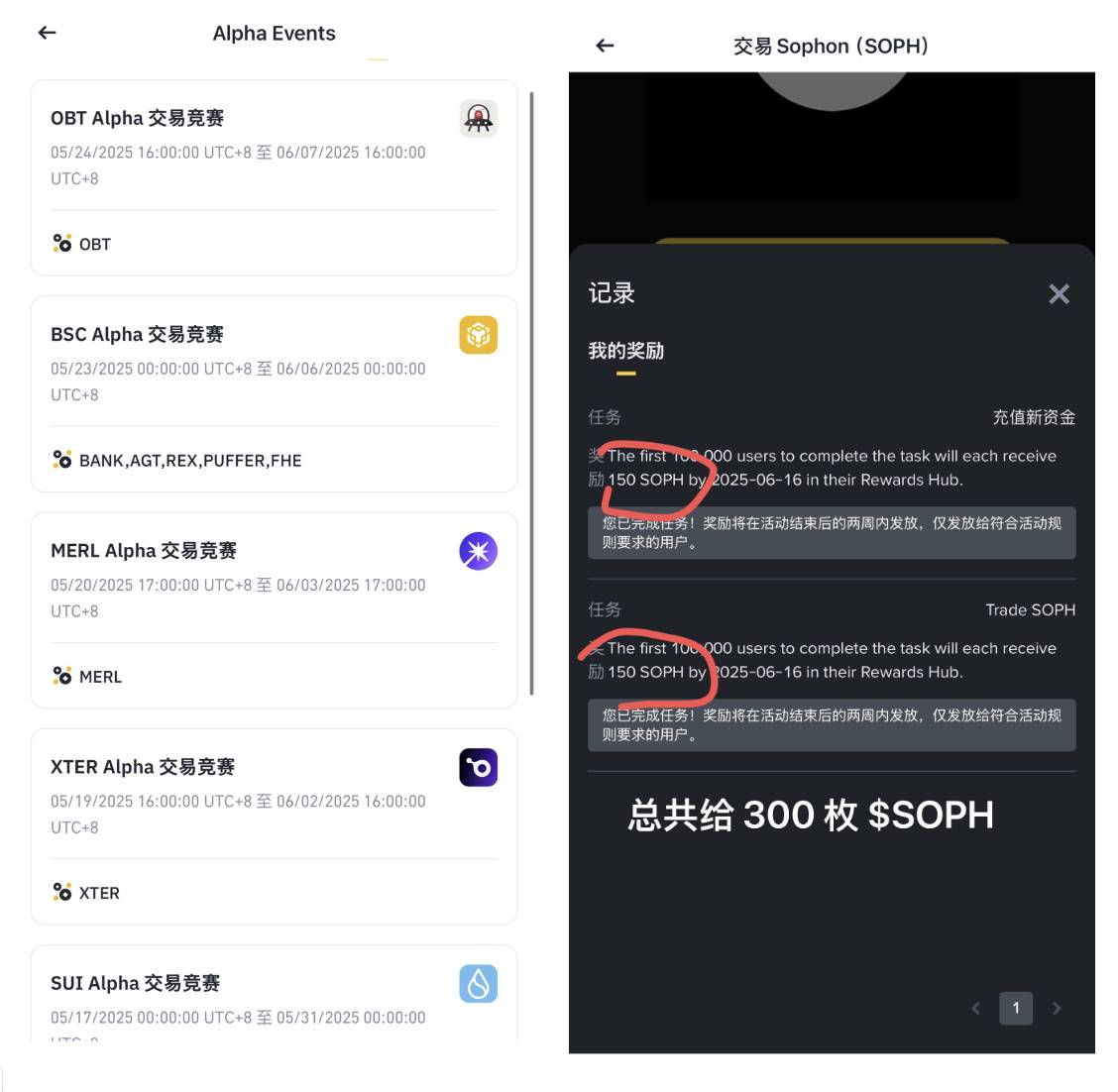

To boost Alpha engagement and support newly launched projects, Binance runs trading competitions. Achieve a certain trading volume rank for specific tokens within a set period (varies per token) and earn corresponding token rewards.

Our testing shows that with moderate daily participation, achieving qualifying ranks isn’t overly difficult. For example, in the $AIOT trading competition, finishing with 230 $AIOT (~$70) covered most trading costs.

Besides trading contests, there are single-token promotional events with simpler thresholds. For instance, the $SOPH campaign launched on May 28 took just minutes to complete: Enter “SOPH” in the Binance chat support → register for the event → buy $100 worth of $SOPH in BN Wallet → withdraw $SOPH from wallet to exchange (rewards 150 $SOPH) → sell $SOPH on spot market (rewards another 150 $SOPH). Completing these steps earns 300 $SOPH, worth ~$20 at current prices.

Markets change fast—adapt your strategy dynamically

As of May 29, current Alpha campaign payouts average $100–$150 per round, with participation thresholds fluctuating between 190 and 205 points. As more users join, the clear trend is rising thresholds and potentially declining rewards per event. As individual participants, while diligently farming points, also adjust your strategies accordingly—balancing cost, time investment, and return expectations.

While the rewards are valuable, remain mindful of systemic and non-systemic risks amid active participation. DYOR.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News