The Contract Algorithm Scythe: A Financial Philosophy Battle Between Binance and OKX in Perpetual Contracts

TechFlow Selected TechFlow Selected

The Contract Algorithm Scythe: A Financial Philosophy Battle Between Binance and OKX in Perpetual Contracts

OKX and Binance are like two philosophers, respectively interpreting Heraclitus's "everything flows" and Plato's "rational order"; one struggles within chaos, the other strategizes within structure.

Author: danny

Have you ever wondered why your positions on OKX tend to get liquidated before those on Binance? Or why your trades on Binance seem less profitable than on OKX? Or perhaps why OKX is so slow in launching new perpetual contract pairs—have they given up? This long-read will clear up all your confusion.

Revealed: Why doesn't OKX list many new coins for perpetual trading, while Binance keeps rolling them out? — It's not about business strategy or compliance. It’s actually a battle of underlying algorithms.

Introduction

Have you noticed that for the same perpetual contract pair,

Binance allows leverage up to 75x (though if you go that high, position size may be limited to $5,000), while OKX only offers up to 20x?

The prices at the same moment differ between the two exchanges? And their funding rate mechanisms vary too?

Is it because you're such a threat that capital is conspiring specifically against you? Does OKX target your account with precision strikes? Does Binance skim profits off your trades?

Come on, kid. You’re overthinking it. None of that is true. It's all due to differences in underlying algorithms.

1. What Is Perpetual Contract Trading?

We first need to understand the key factors determining perpetual contract trading:

1. Index Price

2. Mark Price

3. Funding Rate Algorithm

The relationship among these three elements can be summarized as follows:

Mark Price + Index Price = Core algorithm mechanism determining "contract price"

Funding Rate Algorithm = Mechanism determining whether and how much you should pay others.

Now, let me explain the differences in how Binance and OKX implement these three components.

What?! You don’t want to dive into details? Just here for the conclusion?

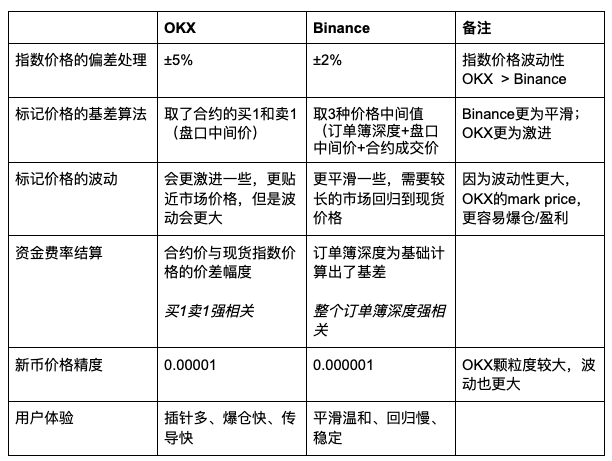

Fine. Here’s a simple comparison table:

Summary:

OKX's algorithm (mark price based on bid/ask midpoint) inherently makes its contracts more volatile than Binance’s. Combined with coarser price granularity, this further amplifies volatility.

2. The Devil Is in the Details

Below comes the dry (but crucial) technical breakdown. If you're bored, feel free to skip ahead:

Index Price

The index price refers to the weighted average spot market price across multiple major exchanges.

To prevent distortions caused by technical glitches or liquidity issues on any single exchange, systems apply “smoothing”:

- Binance: ±2%

- OKX: ±5%

Thus, under extreme market conditions, OKX’s index price fluctuates more than Binance’s—higher risk/reward and faster market response.

Mark Price

This is the most critical price in futures trading—it directly determines whether your position gets liquidated.

The design philosophy behind mark price is to create a more “reasonable” mid-price by adding a basis component to the spot index price, which reflects some futures pricing factors, used for calculating PnL and liquidation.

Formula:

Mark Price = Index Price + Basis

The “basis” is the price difference between spot and futures, smoothed using moving averages to avoid being disrupted by “spike” events.

In other words, volatility in the spot price is your biggest enemy when it comes to liquidation—not some mysterious “exchange manipulation.”

Differences in Mark Price Algorithms: OKX vs Binance

OKX's Approach:

Only uses the top-of-book “bid 1” and “ask 1” prices—the taker midpoint. Ignores order book depth, leading to higher volatility (prone to spiking), but prices are closer to real-time market action. When discrepancies arise between spot and futures, convergence happens faster—but you’re also more likely to get liquidated—or make big gains quickly.

Under OKX’s model, the mark price closely tracks the spot price and reverts faster when deviations occur.

Binance's Approach:

More conservative. Calculates three different prices:

- A weighted price strongly tied to spot index and funding rates (considering order book depth)

- The OKX-style bid/ask midpoint

- The actual contract trade price

Then takes the median of the three as the mark price. Results in lower volatility, greater stability, but slower spot-futures convergence.

Why can spot and futures prices differ?

This is normal in derivatives markets. Algorithms do not force convergence. Hence, platforms introduce a balancing mechanism: the funding rate.

Arbitrageurs use “long/short pairs” to push prices back together—but there’s a flaw in this system, which we’ll discuss shortly.

How Is Funding Rate Settled?

The sign (positive/negative) of the funding rate simply reflects market behavior. Its function is to gradually pull contract prices back toward spot via cost transfers.

Your open position incurs funding fees at regular intervals. For example:

- You open a 10x long with $100 (notional value: $1,000)

- Current funding rate is 0.1%

- You pay: $1,000 × 0.1% = $1 this period

- Positive rate: longs → pay shorts

- Negative rate: shorts → pay longs

OKX Funding Rate Algorithm:

Roughly: (Contract Order Book Midpoint − Spot Index Price) / Spot Index Price, then smoothed with moving average. Capped within ±1.5%.

Moreover, OKX sets borrowing interest at zero—meaning the platform largely ignores the actual cost of borrowing assets.

Binance Funding Rate Algorithm:

More complex. Builds upon OKX’s method (with cap ±2%) and adds two key enhancements:

① Borrowing Interest ≠ 0

Binance defaults borrowing interest to 0.01%, meaning even when spot and futures prices align, a minimum funding fee of 0.01% still applies.

② Premium Index + Impact Bid/Ask

This is where it shines. Binance doesn’t just rely on the surface-level bid-ask midpoint; instead, it considers full order book depth, though renamed as “Impact Bid/Ask.”

For instance:

- “Impact Ask”: Where would the price land if someone placed a $1 million market buy order?

- “Impact Bid”: Conversely, where would the price drop on a large sell?

This deeper consideration makes Binance’s funding rate better reflect real supply-demand dynamics rather than superficial quotes.

Precision Design

- OKX precision: 0.0001 → larger minimum order units → combined with bid/ask-only logic → faster price jumps

- Binance precision: 0.000001 → observes full order depth → finer-grained price changes

Combined with OKX’s reliance solely on top-of-book data, this leads to: fast volatility, aggressive liquidations, rapid pace—ideal for short-term scalpers. Binance, in contrast, remains stable like an old hen—better suited for large-capital, steady-position trading.

A real-world example showing where funding rates fail:

When contract price < spot price (negative funding rate), arbitrageurs should theoretically:

Short spot + Long futures → Push futures price up

But here’s the problem: If the token is controlled by whales and cannot be borrowed, arbitrageurs can’t execute this trade. Even if lending is available, borrowing costs might exceed funding rates—rendering arbitrage unprofitable.

As a result, futures prices stay depressed relative to spot, funding fees keep settling, “longs collect free money,” yet prices never recover.

This explains why tokens like Alpaca/TRB can sustain such wild behavior—even after Binance repeatedly adjusts funding frequency and caps, it still fails to cool down speculative frenzy.

An interesting case of “ethical behavior” by exchanges:

Some “slightly ethical” exchanges, aiming to stabilize prices, reportedly mint small amounts of tokens themselves, sell them on spot markets, and simultaneously go long on futures to hedge.

Why call this “ethical”? Because they could’ve just dumped the newly minted coins for profit, but instead chose to balance the market—in capitalist terms, that’s almost Buddhist. Still, they faced community backlash once the exploit was discovered.

If you’ve followed this far, you’ve likely grasped several key truths:

- Mark Price determines your PnL and liquidation status

- Funding rate mechanism acts as the bridge between spot and futures prices

- Different exchange algorithms affect liquidation timing, capital flows, and even trading strategies

- Sometimes, price divergence persists not because arbitrageurs missed the opportunity, but because they lack funds, tokens, or borrowing access

3. Above Algorithms, Beneath Human Nature — Different Trading Styles and Tactics

Different algorithms give rise to distinct trading styles and listing strategies (assuming control over spot supply):

Trading on OKX:

- Easier to spike prices: Since OKX’s mark price relies only on bid/ask levels and has coarser tick sizes, even moderate taker orders can cause sharp price swings—making “spike-based liquidations” easy to engineer.

- Higher volatility, lower manipulation cost: Smaller capital can move markets and trigger opponent liquidations faster.

- Ideal for quick schemes and tight control: Suited for short-term wash trades, triggering stop-losses and rapidly reversing—perfect for scalp-and-reverse tactics.

- More aggressive arbitrage: Faster price convergence enables frequent execution of spot-futures arbitrage, dual-sided hedging, etc.

Trading on Binance:

- Harder to move prices: Due to deep order book integration, spiking requires eating through many limit orders—higher manipulation cost. Also, the visible book depth lets us detect potential whale activity.

- Suitable for gradual positioning and stable control: Large players may prefer this “hen-like market”—less prone to sudden liquidations, allowing steady price pushes up or down.

- Arbitrage opportunities rarer but longer-lasting: Once they appear, they persist—e.g., prolonged squeeze-driven funding events—which forces Binance to frequently tweak settlement schedules.

If this were *Honor of Kings*:

OKX suits assassins like Han Xin—excels at liquidation games,震荡洗盘—with high mobility, jungle penetration, and last-second escapes.

Ideal for traders who thrive on volatility—fast-strike, high-frequency combatants.

Binance fits strategists like Zhuge Liang—a master of trend control, capital management, and systemic arbitrage—calculated, patient, triggering harvests passively.

Binance’s algorithm emphasizes order book depth, impact pricing, and balanced funding costs—like Zhuge Liang using wisdom and institutional design to outmaneuver opponents via kiting tactics (funding rates), draining adversaries slowly—prioritizing stability and macro control. (This is why most funding rate wars happen on Binance.)

4. Do Algorithms Influence New Coin Listings for Perpetual Contracts?

Absolutely—and profoundly so—especially in today’s environment of severely constrained overall market liquidity, where new coins face immediate pressure upon launch. How exchanges manage price volatility and liquidation risk has become a literal “life-or-death line” for launching perpetuals.

From a design perspective, Binance is better suited for listing new perpetuals. First, its relatively smoother pricing mechanism—using the median of spot index, order book depth, and trade price to construct mark price—makes it less prone to violent “pump-and-dump” moves during early stages, even amid wild liquidity swings. This reduces forced liquidation risks and protects the exchange from bearing losses.

Second, its depth-driven funding rate algorithm goes beyond simple bid-ask spreads. By simulating large taker orders to compute “impact bids/asks,” it builds a more realistic basis. This effectively dampens extreme gains/losses from liquidations, encouraging market makers and projects to participate in price stabilization.

In contrast, OKX faces significantly higher risks when listing new perpetuals. Its algorithm produces coarser ticks and sharper volatility. Combined with funding rates based purely on order book midpoints and no borrowing cost constraints, it’s like throwing a new coin into a sensitive, high-pressure detonator.

With insufficient liquidity, even minor aggressive trades can cause price spikes, triggering mass liquidations. Post-liquidation slippage and lack of counterparty liquidity can lead to under-collateralization—resulting in exchange losses. The $OM listing serves as a classic example: high volatility, spiking, under-collateralization—ultimately a lose-lose outcome for everyone.

Therefore, from an algorithmic philosophy standpoint, Binance’s robust framework better supports a “large-cap trend + systemic arbitrage” strategy, making it easier to collaborate commercially with projects and market makers. OKX’s high-volatility model, while attractive to aggressive manipulators, can backfire if liquidity isn’t properly prepared at launch.

This isn’t merely a commercial strategy gap—it’s an inevitable outcome shaped by foundational design philosophies.

5. Different Underlying Algorithms Reflect Different Financial Philosophies

You can view this algorithmic duel as a clash of worldviews: one champions systematic smoothness and stability—that’s Binance; the other believes in the invisible hand, volatility, and the ultimate game of human nature—that’s OKX. Your choice of platform doesn’t just shape your trading strategy—it reveals your belief about financial markets.

OKX: Behavioral Finance + Market Structuralism

OKX embodies a “volatility-centric” trading worldview. Its core premise: Markets aren’t rational—they’re arenas driven by human psychology and tactical maneuvering.

Algorithmically, OKX uses bid/ask midpoint as the foundation for mark price, with coarser precision and direct order book responsiveness. This makes prices more “jumpy,” quickly triggering liquidations or windfalls. It’s practically a lab experiment for behavioral finance: prices driven by emotion, irrational decisions, and herd effects causing exaggerated reactions.

On OKX, strategies aren’t built on assumptions of long-term equilibrium, but on exploiting “temporary structural imbalances.” It encourages—or tacitly permits—traders to harvest profits via microstructure advantages (slippage, low liquidity, order book placement). This is the essence of “structuralist trading philosophy”: designing instability to generate volatility and capture excess returns.

It attracts rhythm fighters and bold gamblers—those who don’t need stability, but crave “intense volatility.”

Binance: Efficient Market Hypothesis + Quantitative Finance

In stark contrast, Binance represents another financial ideology: While markets may deviate short-term, they eventually revert to equilibrium. The mission of mechanism design is to steer markets toward stability and rationality.

Binance constructs mark price using the median of spot index, order book, and trade price. Its funding rate incorporates borrowing costs and impact pricing. This system essentially creates a structured arbitrage equilibrium—every price deviation is corrected via rational arbitrage paths. This perfectly aligns with the **Efficient Market Hypothesis (EMH)**: Prices reflect all information; excess returns come only from bearing more risk or executing systemic arbitrage.

Binance operates on “market control.” It depends on a low-volatility, high-trust, transparent-cost environment. This philosophy gives rise to quantitative finance and systematic trading theories: mastering markets with mathematical models, hedging risk with portfolio strategies, seeking probabilistic edges within certainty.

It doesn’t ask you to fight knife battles in volatility, but to gradually bring the market into your logical framework using arbitrage formulas.

OKX is human-centric—it believes markets are irrational, and “emotion, volatility, manipulation” are the eternal protagonists. Binance is structure-centric—it believes markets can be modeled, predicted, and managed; volatility is a deviation, not destiny. This isn’t just a product rivalry—it’s the timeless debate between behavioral finance and quant finance, chaotic markets and rational order.

Final Thoughts

Beneath this seemingly cold algorithmic contest lies humanity’s two fundamental interpretations of the “market”—a fictional construct: Is it a battlefield charged with human emotion,欲望, and博弈, where chaos runs free? Or is it an orderly system that can be tamed by reason, models, and institutions?

OKX and Binance resemble two philosophers—one echoing Heraclitus’ “everything flows,” the other Plato’s “rational order.” One fights in chaos, the other maneuvers within frameworks. Traders entering this arena aren’t just betting on prices—they’re choosing systems. Perhaps true mastery in trading isn’t just understanding algorithms, but perceiving and navigating the tension between human nature and structural order.

The market never sleeps, and neither does its philosophy.

May we always maintain reverence for the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News