DeFi Beginner's Guide (2): After Binance Ends USDC Subsidies, How Can Off-Circle Office Workers Steadily Earn 10% APR on Stablecoins?

TechFlow Selected TechFlow Selected

DeFi Beginner's Guide (2): After Binance Ends USDC Subsidies, How Can Off-Circle Office Workers Steadily Earn 10% APR on Stablecoins?

Recommend some 10% stablecoin yield scenarios suitable for DeFi beginners.

Author: @Web3Mario

Summary: This week, Binance's promotional campaign for USDC flexible savings has ended. Such low-risk financial products—offering instant withdrawals and accessible yields—are ideal for DeFi beginners, especially non-crypto-savvy office workers looking to allocate assets, with nearly 12% returns being highly competitive across Web3. Therefore, many users are likely now searching urgently for alternative low-risk stablecoin yield options. In this article, I will outline the best principles for DeFi newcomers—particularly non-crypto office workers—to participate in DeFi, and analyze several stablecoin yield opportunities with comparable returns and low risk suitable for these users.

Seven Principles for "Non-Crypto Office Workers" Participating in Stablecoin Yield

First, let me describe a scenario: if you find this appealing, then the content of this article will be useful to you:

By performing simple on-chain operations to allocate your assets, you can earn a 10% annualized USD-denominated yield, with funds freely depositable and withdrawable at any time, no lock-up required, extremely low principal risk, and without needing to frequently check your dashboard.

This kind of scenario is relatively rare in traditional finance. To earn more than the current short-term U.S. Treasury yield of 3.7%, you'd typically need to learn complex hedging or arbitrage strategies, research fundamentals of junk bonds, or take on risks like P2P platform collapses. However, in the DeFi world, due to differing market maturity and evolving stablecoin regulatory environments, there are numerous stablecoin issuers and lending protocols. In such a competitive landscape, platforms often offer additional subsidies to drive product adoption—similar to generous vouchers during food delivery wars. Thus, at this stage of the market, it’s still possible to find stablecoin yield opportunities that offer attractive returns with manageable risk.

These stablecoin yield scenarios are ideal for individuals who aren’t crypto believers but seek steady returns—especially middle-class office workers outside the crypto space. You don’t need to bet on crypto price movements; instead, you benefit from the premium paid by speculators or degens chasing alpha. Moreover, asset allocation requires minimal learning or time investment. Hence, during a rate-cutting cycle, if you still wish to maintain exposure to USD stablecoins, you should pay extra attention to stablecoin yield opportunities.

Below are key principles I recommend for such users when selecting stablecoin yield options:

1. Keep it simple: Avoid complex on-chain interactions: For DeFi beginners, remember—more complex on-chain actions mean greater exposure to risk and higher usage costs. You might accidentally interact with a phishing site and authorize malicious addresses to access your funds, or incorrectly enter a recipient address when bridging assets. Therefore, beginners should prioritize simple yield scenarios to avoid unnecessary losses.

2. Stick to mature platforms and control greed: New protocols often offer higher rewards. When faced with ultra-high yields, exercise caution. Many DeFi projects are developed by anonymous teams. If something goes wrong—like a hack—you may only receive a farewell letter and a pile of worthless tokens from a recovery plan. Additionally, new protocols face threats from hidden hackers in the on-chain dark forest—their resilience is uncertain. Therefore, I advise beginners to start only with established platforms and remain cautious toward stablecoin yield opportunities exceeding 10%.

3. Understand the yield structure and avoid "tokenomics" traps: Pay close attention to the APR advertised on project websites. Study how the yield is composed and under what conditions you can realize it. Many projects design tokenomics to reduce selling pressure on their token price—for example, rewards might not be immediately sellable on secondary markets and could require a long vesting period before they’re claimable. This introduces significant uncertainty, as you cannot predict how the reward token’s price will change during the vesting period, greatly affecting your actual realized return. Therefore, prioritize yield opportunities where rewards are easy to obtain.

4. Not all "stablecoins" are stable: Since DeFi Summer, stablecoins have remained a major area of innovation. Recall the algorithmic stablecoin boom led by Luna—a vibrant era of rapid experimentation. Today, however, only fully collateralized stablecoins offer relative stability. Yet collateral management varies widely. For instance, Ethena’s USDe uses a delta-neutral perpetual futures funding rate arbitrage portfolio as collateral, while Falcon’s USDf has an even more complex mechanism. We won’t dive deeper here. My advice: if you don’t want to worry about depeg risks during work hours, stick to payment stablecoins backed by reputable institutions with high-liquidity reserves (e.g., USDT, USDC), or over-collateralized decentralized stablecoins backed by blue-chip assets (e.g., USDS, GHO, crvUSD).

5. Understand yield dynamics and choose wisely: Be aware that the yield you see today may not last. You should assess how long an attractive yield is likely to persist. For example, seeing a 15%+ supply rate for USDC in a lending protocol usually means the pool utilization exceeds 95%, forcing borrowers to pay over 20% interest—clearly unsustainable. Don’t assume you can exit in time; automated arbitrage bots constantly scan for such anomalies and quickly eliminate them. Once familiar with basic DeFi logic, explore fixed-rate products like Pendle.

6. Interact during low network congestion to minimize costs: A commonly overlooked detail: timing matters. Interact with DeFi during periods of low network activity. Before transacting, check Etherscan to gauge current gas levels. Currently, sub-0.2 GWEI indicates relatively low congestion. Always review fee costs in MetaMask before confirming—otherwise, you might spend $120 in gas to claim $100 in rewards.

7. Don’t ignore exchange rate risk in the new cycle: Finally, if you're a non-USD investor, pay attention to currency risk. Macroeconomic trends increasingly point to USD depreciation. Over the past month alone, the RMB has appreciated by about 1%. Factor in exchange rate fluctuations when making investment decisions.

Recommended ~10% Stablecoin Yield Opportunities for DeFi Beginners

After outlining these principles, I’d like to recommend two stablecoin yield opportunities well-suited for DeFi beginners as alternatives to Binance’s USDC flexible savings.

The first is supplying RLUSD on Ethereum Aave V3, which offers a sustained ~11% APR. RLUSD is a fiat-backed stablecoin pegged 1:1 to the USD, launched by Ripple Labs. Its reserves primarily consist of USD and short-term Treasuries—highly liquid assets—and it operates under strict oversight within New York State trust company regulations, ensuring stability and security. RLUSD’s circulating supply has surpassed $700M, with over $50M liquidity on Curve, meaning low slippage for user entry.

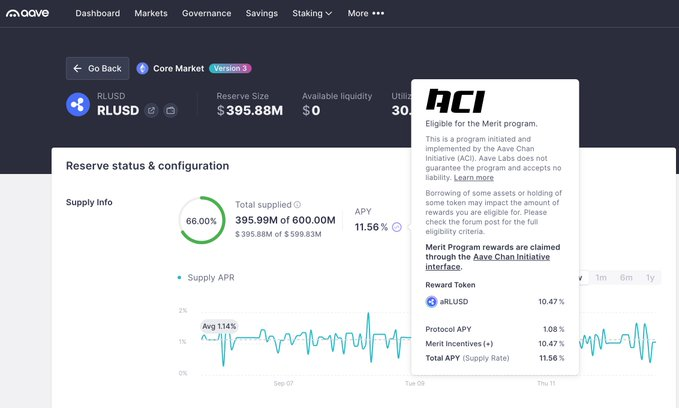

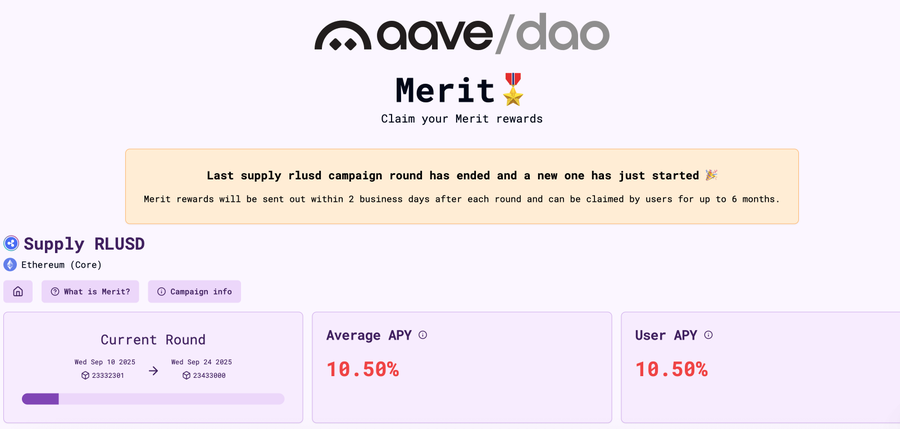

On Ethereum Aave V3, supplying RLUSD currently yields 11.56% APR: 1.08% comes from borrower interest, automatically compounded into your principal, while 10.47% comes from Ripple’s subsidy program. These subsidies are distributed via the Merit Program every two weeks, and users can manually claim them through the Aave Chan Initiative Dashboard. Based on my observation, these subsidies have continued for several months, indicating sustained yield. Participation is straightforward: simply swap for RLUSD on Curve and supply it to Aave.

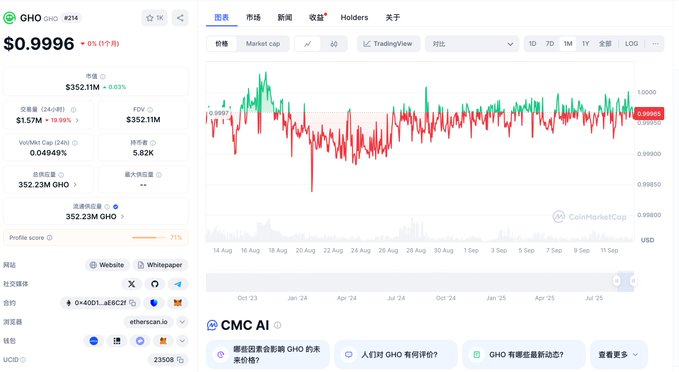

The second option is supplying GHO stablecoin on Avalanche Aave V3, offering a consistent 11.8% APR. GHO is Aave’s official over-collateralized decentralized stablecoin. Its mechanics were detailed in previous articles, so we’ll skip the explanation here. GHO is backed by blue-chip crypto assets approved by Aave and secured by Aave’s liquidation engine, ensuring price stability.

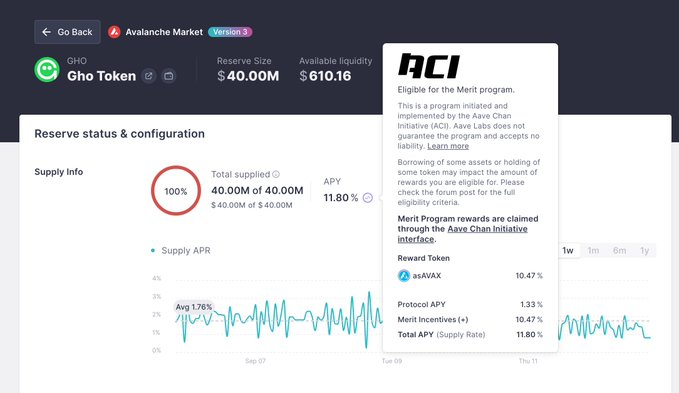

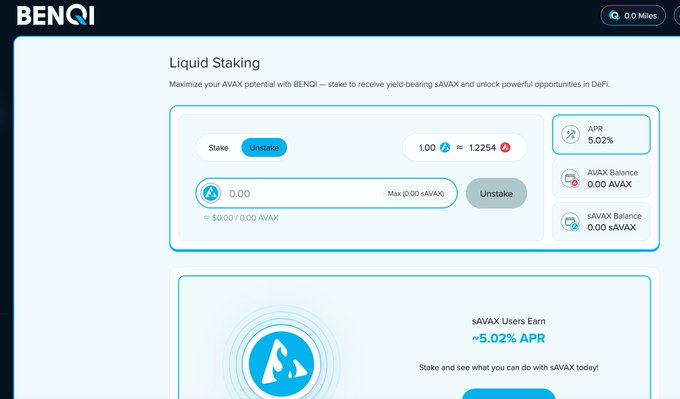

Avalanche is a high-performance L1 chain. Though its ecosystem development has lagged recently, it possesses strong compliance resources. Similar to RLUSD, the 11.8% APR on Avalanche Aave V3 consists of 1.33% borrowing interest and a 10.47% subsidy from AVAX. This subsidy is also distributed via the Merit Program every two weeks through the Aave Chan Initiative Dashboard. The subsidy has been ongoing for a considerable time. Note: rewards are paid in asAVAX form. asAVAX is the deposit receipt for sAVAX in Aave, and sAVAX is the staking receipt from BENQI, Avalanche’s leading Liquid Staking protocol. To convert these rewards into other tokens, you must unstake via BENQI, which involves a 15-day cool-down period. However, asAVAX itself is a yield-bearing asset, earning around 5% staking yield.

I believe both of these stablecoin yield opportunities are suitable for DeFi beginners and non-crypto office workers. Please participate with careful consideration.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News