100,000 Users Exit: Those Who Lost Money in Binance Alpha

TechFlow Selected TechFlow Selected

100,000 Users Exit: Those Who Lost Money in Binance Alpha

Will you continue to farm points?

Author: shushu, BlockBeats

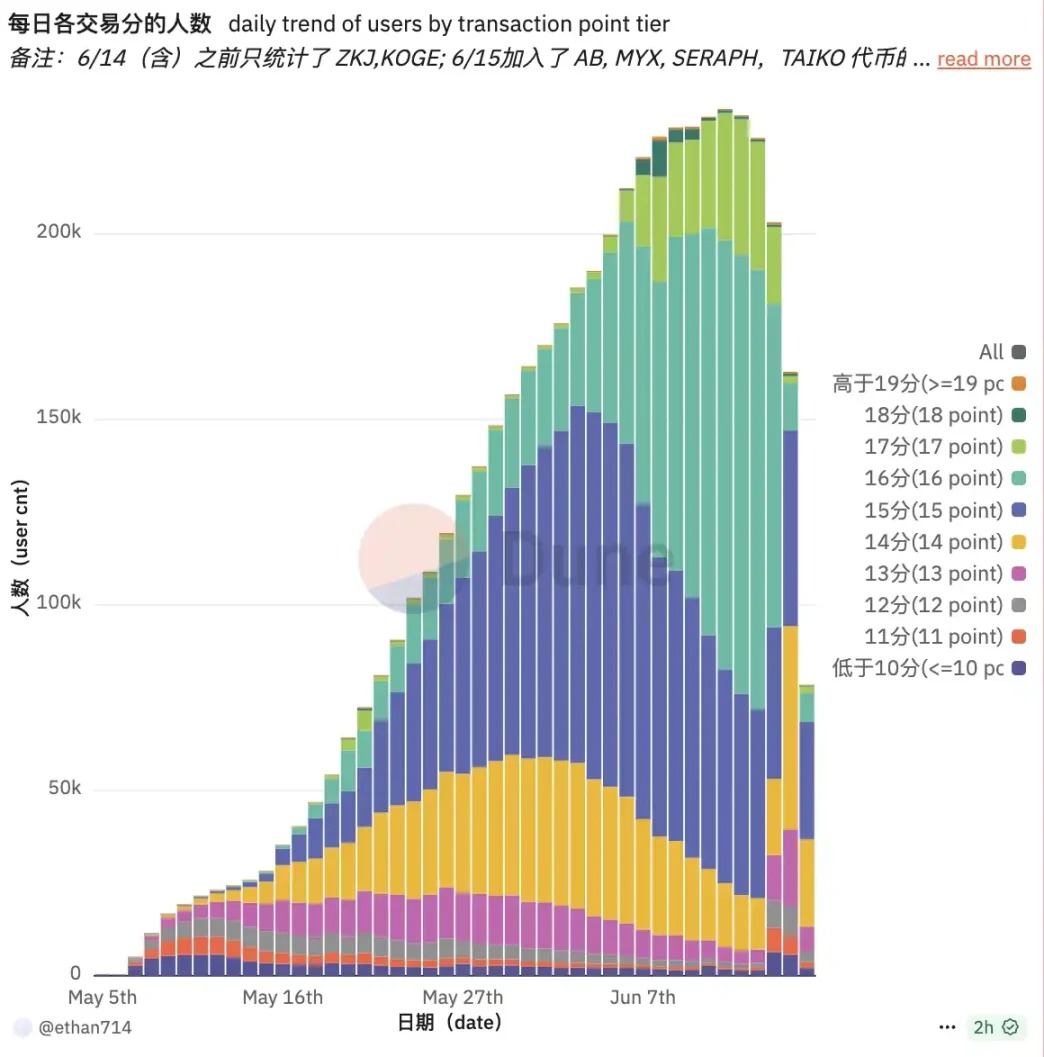

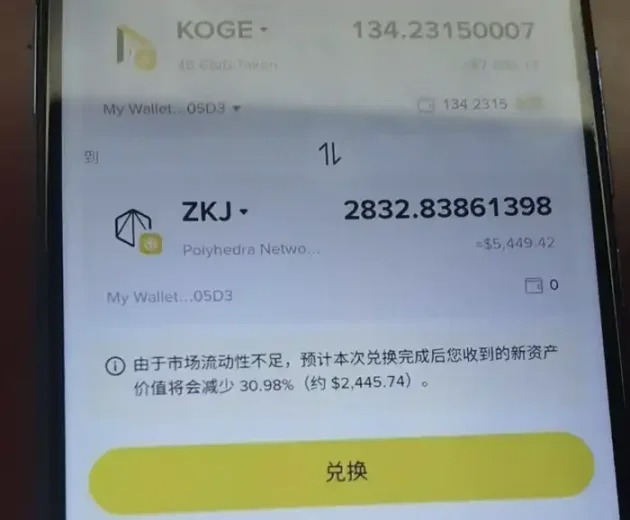

Following the crashes of $ZKJ and $KOGE, Binance Alpha's activity has noticeably declined. According to Dune data, the number of trading users on Alpha dropped sharply from a peak of 233,000 on June 12 to 195,000 on June 15—a loss of nearly 40,000 users in just three days. As of today, the number of users actively trading on the platform has further shrunk to only 70,000, reflecting a cliff-like drop in user enthusiasm and participation. At the same time, the marginal cost of score farming has significantly increased, and the cost-effectiveness of the Alpha game is rapidly deteriorating.

Meanwhile, recently launched projects on Binance Alpha are showing signs of "dump upon listing."

BlockBeats calculated the profitability of VELO, the latest points distribution project on Binance Alpha. Under normal circumstances (with a principal of $1,000), Alpha users are currently achieving minimal profits. By trading between Alpha tokens, daily trading wear-and-tear reaches $4, with an expected 30-day profit of $224, an expected cost of $120, resulting in a net 30-day profit of $104—about $3.5 per day.

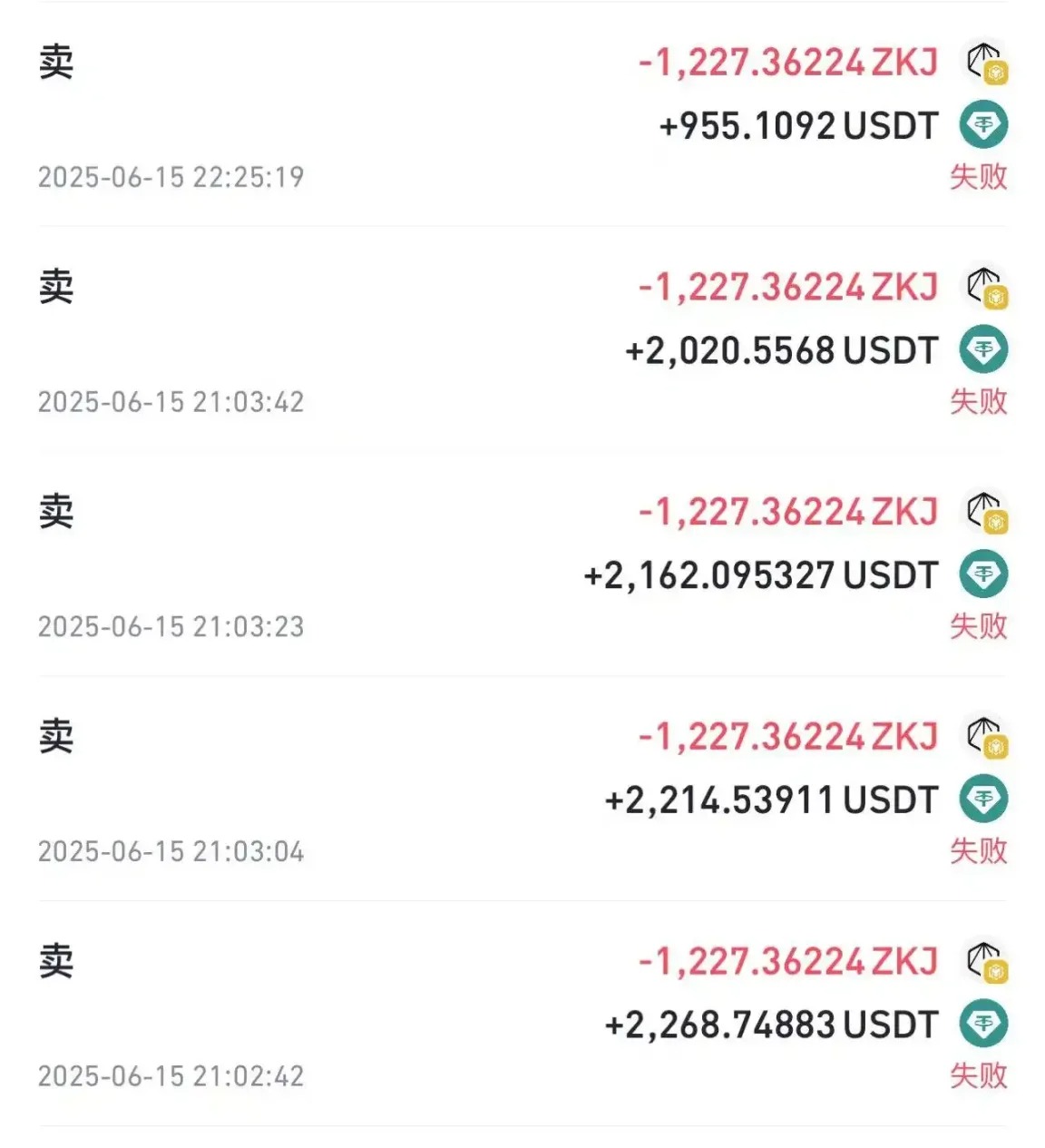

Starting from 00:00 UTC on June 17, 2025, Binance Alpha officially implemented new rules: trading volume between Alpha tokens will no longer count toward Alpha Points. This means that previous farming strategies relying on pools like ZKJ/KOGE for point farming are now ineffective. Users now face higher barriers to earning points and a more complex liquidity structure.

As expected, impacted by the $ZKJ crash, Binance Alpha’s incentive model has entered a period of adjustment. The direct consequence of this mechanism shift is that a large number of users who were once active within the Alpha ecosystem are choosing to exit. Some left after suffering losses in the $ZKJ/$KOGE dual-token pool, while others found that the marginal returns from farming no longer outweigh transaction costs and are no longer willing to invest effort.

In this exclusive interview, BlockBeats spoke with multiple Alpha users—including LP providers who incurred real losses during this downturn, as well as regular participants who attempted "score-farming arbitrage" but saw lower-than-expected returns. Some have decided to completely leave the Alpha game, while others remain uncertain about whether to keep seeking new opportunities. Through their stories, we reconstruct the real emotions and thoughts behind this "cliff-like exodus."

Those Who Gave Up

"Early-stage returns were truly high, fees were low, especially when we caught the Adventure Island launch. By late May, I had gradually scaled up to 20 accounts. Because frequent facial verification was required, I handed over account management to the owners themselves, maintaining around $16,000 in actual daily trading volume for farming."

However, Jiangjiu said he sensed something was off by mid-June as competition intensified due to rising participation: "On the 14th, I noticed something strange—one or two accounts suffered unusually large losses totaling $160. That was too abnormal. But because I was struggling to adjust my strategy, I ignored the risk that might be approaching—or perhaps I just didn’t want to admit it—and still held onto excessive expectations."

More tragically, during the ZKJ crash, a friend of Jiangjiu misinterpreted his casual message "Done farming?" as a prompt to buy in, hastily increased his position in ZKJ, and ultimately suffered a 60% loss. Jiangjiu recalled he originally intended to wait for a reply before warning his friend not to continue farming and to observe the situation first. But his friend misunderstood his intent and immediately executed trades. After buying, he couldn't sell smoothly and turned to Jiangjiu for help. By then, Jiangjiu hadn't had time to explain how to place a low-price order to quickly exit, leaving his friend to watch helplessly as the price plummeted. He admitted the core issue wasn’t luck, but rather information assessment and communication costs.

When asked if he tried reaching out to the project team, Jiangjiu said he did not seek feedback: "This kind of thing is too common in crypto. Unless the exchange takes the lead, retail losses are just losses—you can’t appeal anywhere. You have to stay cautious yourself."

He added that since losing access to low-fee farming pools like ZKJ and KOGE, farming costs have significantly increased. Rewards per cycle have dropped to around $50–60, while point thresholds keep rising. He is now on the verge of giving up: "But I still want to struggle a bit and see how the next few rounds perform. If they don’t meet expectations, I’ll have no choice but to quit."

Unlike Jiangjiu, Mosquito operated four accounts and had accumulated approximately $5,000 in total profits before the crash. He noticed unusual volatility in ZKJ the day before the crash but, seeing a temporary rebound in price, allowed侥幸 psychology to take hold.

"I noticed ZKJ fluctuating the previous day. I stubbornly held for an hour and saw it recover, even making $5. When the crash happened the next day, I saw sharp wicks and assumed it would rebound like the day before."

This侥幸 mindset led Mosquito to enter again after losing $30 on his first account: "I thought it would bounce back normally, just like the previous day, so I kept the first account unchanged and used the second one to complete tasks with $1,800. Then the second account also started crashing."

Ultimately, Mosquito decided to cut his losses when the token price fell to 0.8, suffering a total loss exceeding $2,000: "I simply didn’t take risk seriously enough. I should’ve paid more attention to pool size—indeed, there was massive withdrawal from the pool that day."

Mosquito believes the Alpha project is nearing its end: "Input and output are no longer proportional. Get sandwiched a few times and all your work is wasted. Today, I claimed the basic rewards from all my accounts and withdrew."

Mosquito isn’t alone—in interviews with BlockBeats, many participants mentioned declining ROI in current Binance Alpha activities, and numerous users have abandoned multi-account strategies.

The Alpha golden window may be closing.

Continuing to Farm Amid Sunk Costs

Jiege is a community builder in the BSC ecosystem who has participated in Alpha activities since the early Shell IDO days. As an information hub within his community, he too couldn’t escape this systemic risk.

"I could feel it—the moment 'stablecoins' stopped being stable, price swings became intense. I actually sensed the gray rhino approaching. But managing accounts and spending time on trading had already consumed much of my personal life, so I couldn’t react in time," Jiege said.

During the crash, Jiege promptly stopped losses and alerted group members, yet still faced significant losses. He believes this loss cannot be entirely blamed on bad luck: "You could say we’re just paying tuition to the market again. There were indeed ways to avoid this. It’s just that I happened to be doing large-scale cross-trading at that exact moment, with two accounts farming simultaneously—making it impossible to avoid getting halved on the spot."

This experience prompted Jiege to reflect on his risk control strategy, especially the importance of on-chain monitoring tools. He feels he needs to incorporate such tools going forward: "If you can detect immediately that the token price is dropping and the pool size shrinking, you know greater volatility is coming."

Nonetheless, Jiege says he will continue participating in Alpha: "As long as there’s profit, it’s worth continuing. Of course, I also hope Alpha introduces more innovative and fair launch models."

"Initial strategy: 33 times at the 60k tier, then 66 times at the 130k tier. Haven’t calculated exact earnings yet," Siner explained. This high-frequency, high-volume trading strategy brought substantial returns during stable periods but also exposed greater operational risks.

His biggest losses didn’t come from market movements, but human error: "Most losses were due to my own mistakes—the biggest one was forgetting to sell Koge on the 16th. Also, going for the 130k tier was too aggressive. The account I forgot to sell has now dropped from $1,000 to $400."

Managing large numbers of accounts also created efficiency challenges: "I usually finish farming all accounts in 1–2 hours, but the 170k tier workload was too heavy—I ended up farming continuously for four or five days, leading to empty farming (no effective points earned)."

Unlike most users exiting the market, Siner remains confident about Alpha’s future. When asked if he’d continue farming Alpha, he replied: "Of course I must continue—I’ve already found a no-loss method." This indicates he will keep seeking speculative farming opportunities within the Alpha ecosystem, even after rule changes.

For Tiange, who didn’t suffer losses during the ZKJ crash, exiting Alpha would mean writing off prior sunk costs: "I already have two hundred points in sunk costs. If I give up now, all that effort goes to waste. And if a good project launches on Alpha later, one round could let me break even."

Tiange summarized the mindset of participating in Alpha projects: "Farming points and grabbing freebies—all these are garbage projects. Don’t get emotionally attached."

Conclusion

Jiangjiu admits Alpha farming returns can no longer cover operational costs: "Rewards are now only $50–60, point thresholds are high, slippage keeps increasing—maybe you earn $3–4 a day." The collapse of ZKJ/KOGE didn’t just wipe out principal; it eliminated a low-cost arbitrage pathway. Once Alpha removed the rule counting inter-token trading volume toward points, users now face higher transaction wear-and-tear and a more complex points-grinding landscape.

Binance Alpha was once seen as an innovative mechanism to revive on-chain activity and user engagement. Yet the current points model clearly overestimated the long-term effectiveness of incentivizing trading volume and liquidity provision, while underestimating structural bank runs.

With Binance’s new rules in effect, Alpha is transitioning from a simple farming and arbitrage tool into an incentive system increasingly focused on genuine interaction and value capture. This means points allocation will no longer rely solely on trading volume or LP amounts, but will lean more toward holding duration, depth of interaction, and real demand.

Yet for many users who relied on low-cost farming tactics, this shift forces them to reevaluate the purpose of participation. For Alpha to restart its growth engine in the future, it must find a new balance between fair distribution and risk control mechanisms.

For users still exploring within the Alpha ecosystem, we recommend strengthening risk management awareness, closely monitoring indicators such as pool structure, token fundamentals, and LP concentration, and avoiding becoming the bagholder in the next systemic risk event. After all, in this constantly iterating Web3 world, arbitrage windows will always exist—but the cost of stepping on a mine has never been lower.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News