BTC's New Journey After Breaking $100K: 10 Reasons to Hit $150,000 in 2025

TechFlow Selected TechFlow Selected

BTC's New Journey After Breaking $100K: 10 Reasons to Hit $150,000 in 2025

This article will conduct an in-depth analysis from four dimensions: timing cycle, macroeconomics, market demand, and on-chain data.

Written by: Miles Deutscher, Crypto Analyst

Translated by: Yuliya, PANews

The market is undergoing a pivotal turning point. After Bitcoin surpassed the $100,000 mark this week, investors are now shifting their focus to the next price target. Based on comprehensive data analysis, multiple indicators suggest that Bitcoin is poised to reach a new high of $150,000 by 2025.

This report will conduct an in-depth analysis through 10 key metrics across four dimensions:

-

Time-cycle Analysis

-

Macroeconomic Factors

-

Market Demand Dynamics

-

On-chain Data Indicators

Time-Cycle Analysis

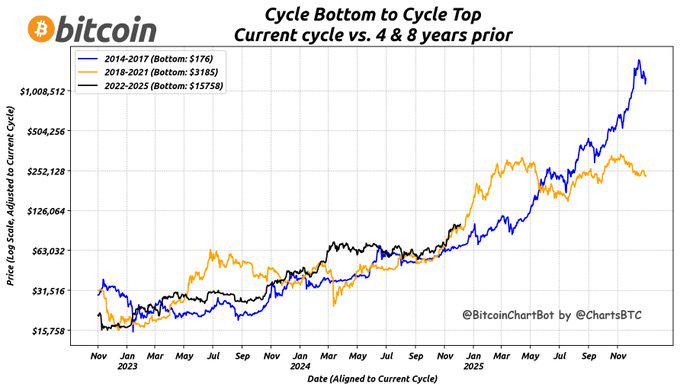

1. The current Bitcoin price trajectory closely resembles previous cycles.

2. The market has entered its most explosive phase—the period when prices accelerate the fastest.

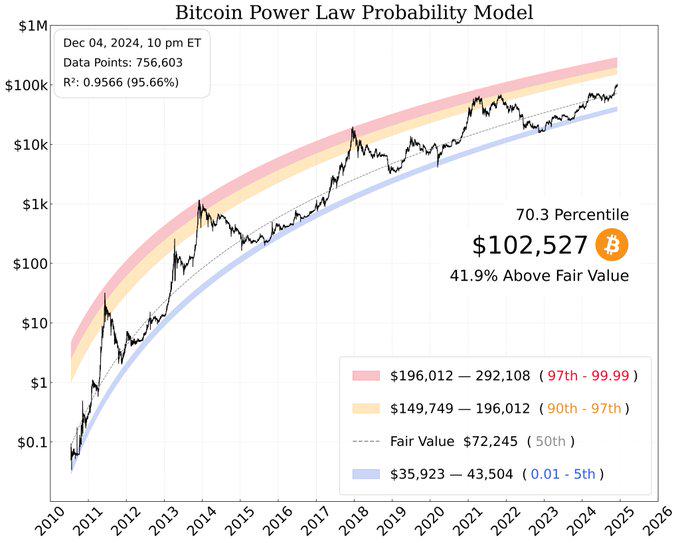

3. Historically, Bitcoin consistently enters the red zone (97th percentile) of the power law probability model. If this cycle follows the same pattern, Bitcoin’s price could surpass $196,000.

Macroeconomic Factors

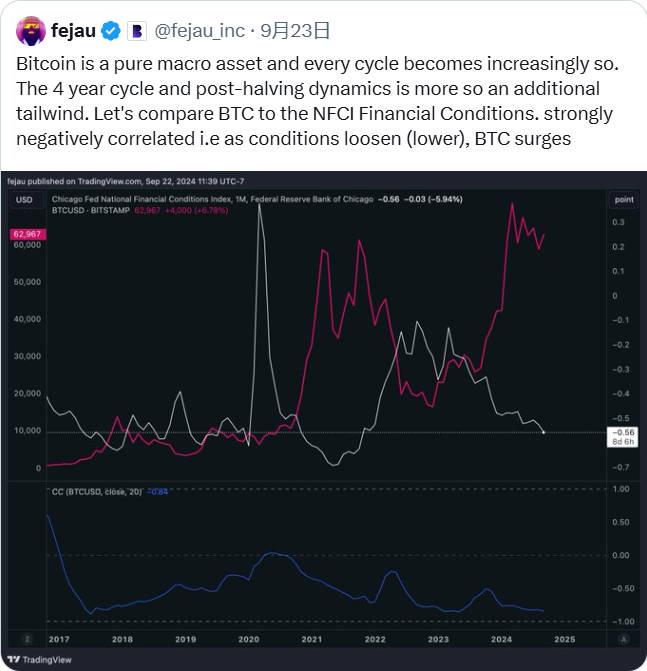

4. The current macroeconomic environment is the most favorable since 2021. Bitcoin is highly sensitive to changes in monetary policy and global liquidity.

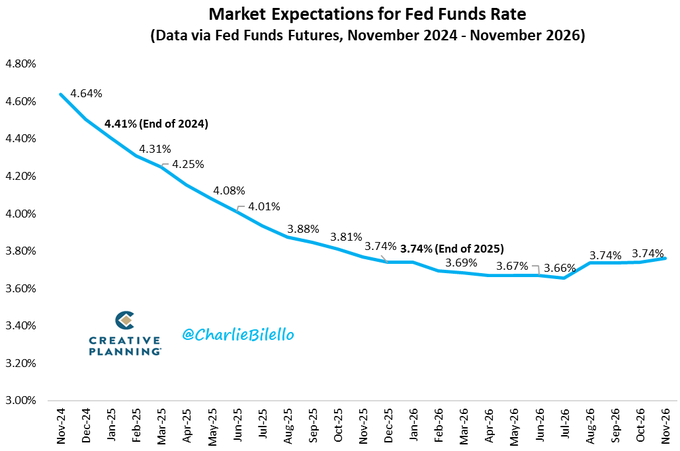

5. Continued rate cuts are expected throughout 2025, providing strong macro support for risk assets.

Market Demand Dynamics

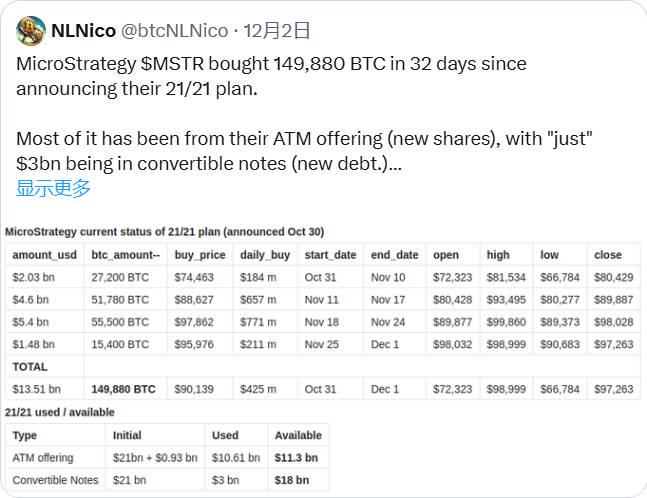

6. MicroStrategy continues purchasing under its 21/21 plan (targeting 21% of Bitcoin's total supply, with $29.3 billion remaining to invest).

This impacts Bitcoin demand in two ways:

-

Sustained and aggressive buying pressure from MicroStrategy

-

Speculative capital positioning early in anticipation of future buying pressure

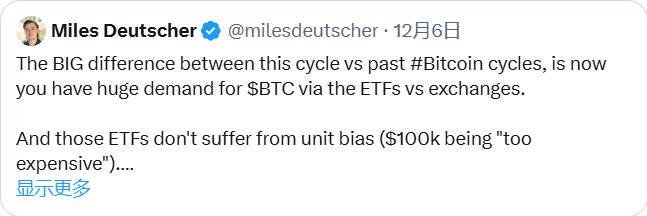

7. U.S. spot ETF holdings have exceeded 1.1 million Bitcoins—surpassing the amount believed to be held by Satoshi Nakamoto. This creates persistent buying pressure. Additionally, spot ETFs generate a powerful "unit bias" effect.

On-Chain Data Indicators

8. Retail demand for Bitcoin has surged to the highest level since 2020.

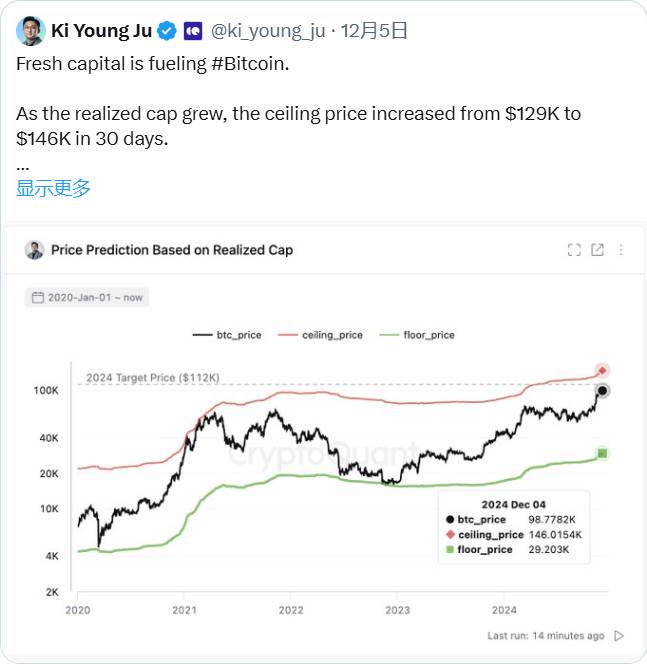

9. New inflows are driving the current price movement. "Even at $102,000, we are far from bubble territory—prices would need to rise another 43% to reach typical bubble thresholds."

10. Even at $100,000, profit-taking pressure is weakening, indicating declining selling pressure.

Market Outlook

Multiple factors currently align, signaling that the upward trend will continue. Under this backdrop, Bitcoin breaking past $150,000 will inject strong momentum into the entire cryptocurrency market.

Increased market liquidity is bound to drive even larger price rallies, especially for the altcoin market. Over the coming weeks, we will continue tracking and sharing promising altcoin investment opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News