How will retail investors in the crypto market lose money?

TechFlow Selected TechFlow Selected

How will retail investors in the crypto market lose money?

Half comes from poor timing of entry, and the other half from information asymmetry.

Author: Bay Edition, BayFamily

Bitcoin and altcoins are surging. Markets always experience peaks, followed by crashes. Yet each time, retail investors lose their money following a consistent pattern. Recently, I came across an academic paper describing exactly how retail investors lose money during booms and busts.

The paper is titled "Wealth Redistribution in the Process of Bubbles and Crashes."

The historical event studied in this paper is the 2014 A-share bubble in China.

From July 2014 to December 2015—a period of 18 months—China's stock market went on a rollercoaster ride: the Shanghai Composite Index rose over 150% from early July 2014, peaking at 5166.35 on June 12, 2015 (including moderate gains from July to October 2014 and a rapid rebound from October 2014 to June 2015), then plunged 40% by the end of December 2015.

The authors obtained all user trading data from the Shanghai and Shenzhen exchanges during that period and analyzed why retail investors lost money. Let’s state the conclusion first.

The wealthiest households—the top 0.5%—gained more than 250 billion RMB in profits, while the bottom 85% of households collectively lost 30% of that same amount. Throughout this process, money was transferred from the pockets of the poor to those of the rich.

In other words, as commonly said, money moves from those who need it most to those who need it least.

Why does this happen? The main reason is that during the early stages of the bubble, the top 0.5% increased their market exposure, while households in the bottom 85% did the opposite. During the late bubble phase, mid-tier investors failed to cut losses decisively.

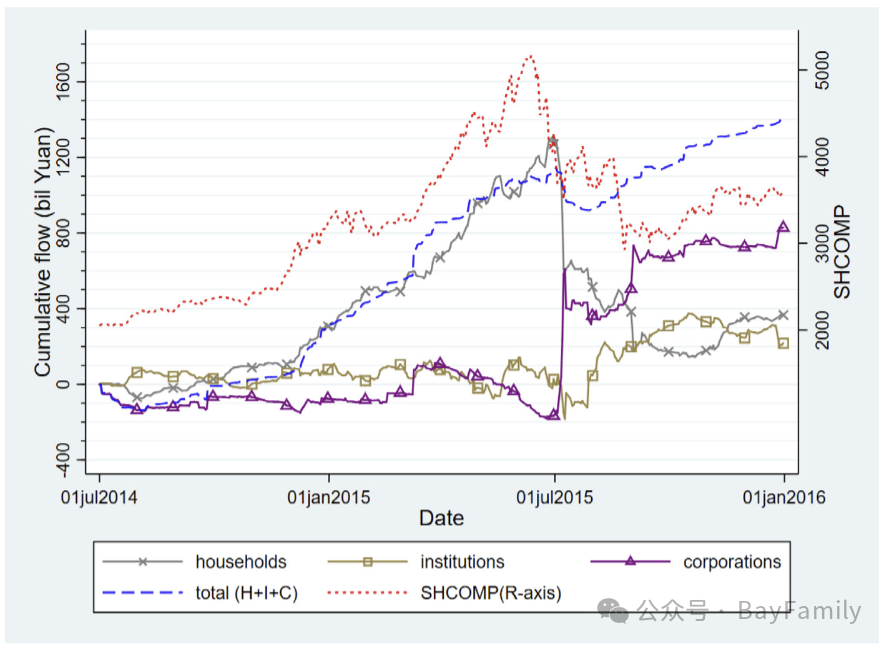

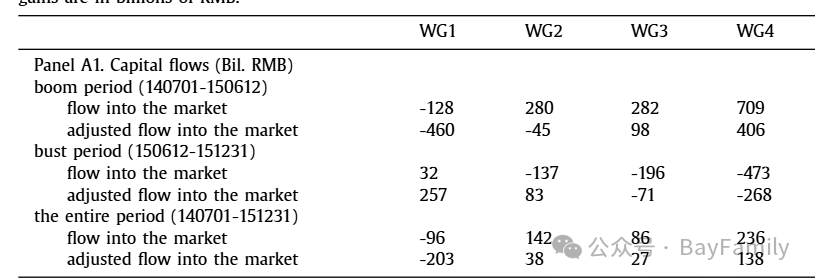

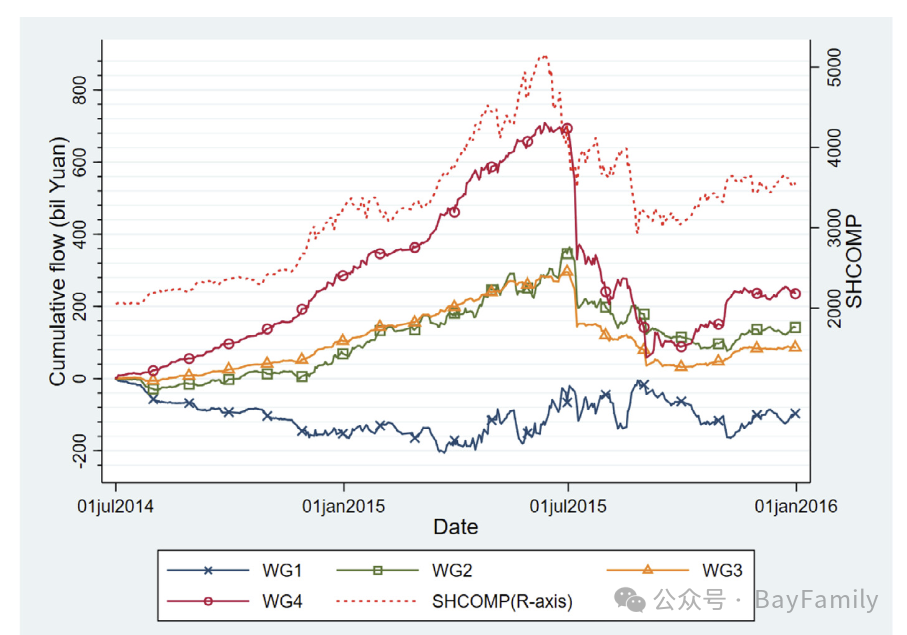

Let’s first look at capital inflows. The authors categorized all accounts into three types: household, institutional, and corporate-owned accounts. (Account type and ownership information can be directly observed in their administrative data.) Household accounts were further divided into four groups based on account value (defined as the sum of stocks held on the Shanghai and Shenzhen stock exchanges plus cash in the account), with the following thresholds: below 500k RMB (WG1), 500k to 3 million RMB (WG2), 3 million to 10 million RMB (WG3), and above 10 million RMB (WG4).

The authors then plotted daily capital inflows for each group against the Shanghai Composite Index.

From July 1, 2014, to June 12, 2015, the household sector saw a cumulative inflow of 1.1 trillion RMB, while the other two sectors recorded cumulative inflows of 80 billion and -130 billion RMB respectively. By June 29, 2015, household inflows continued rising, peaking at 1.3 trillion RMB. Shortly after, the household sector began selling shares to corporations—mainly government-backed investment vehicles. These government-related entities were directed by regulators to “stabilize” the market following one of the worst crashes in Chinese stock market history. By the end of December 2015, relative to the market peak on June 12, corporations had accumulated 950 billion RMB in inflows, while the household sector experienced 800 billion RMB in outflows.

In this bubble-and-crash episode, large investors profited while small investors suffered losses. Specifically, from July 2014 to December 2015, the bottom 85% of households lost 250 billion RMB due to active trading (i.e., compared to a buy-and-hold strategy), while the top 0.5% of households gained 254 billion RMB over these 18 months.

About 100 billion RMB of this wealth redistribution can be attributed to gains and losses at the market level. The remaining 150 billion RMB redistribution resulted from heterogeneous portfolio choices—differences in stock selection. Large investors may have had access to superior information channels.

To put these numbers in perspective, by the end of June 2014, the total holding value of the bottom household group was 880 billion RMB, meaning their cumulative loss over these 18 months equated to 28% of their initial stock wealth. Meanwhile, the wealthiest household group had a total holding value of 808 billion RMB at the start of the sample, representing a 31% increase.

There are two primary reasons why small retail investors lose money:

1. Retail investors, especially the poorest ones, make the biggest mistake of being risk-averse. In the early bull market phase, they hesitate to deploy significant capital, instead adding funds gradually as prices rise. As shown in the chart below, WG1 (the least wealthy retail investors) even showed net capital outflows during the initial bull phase.

2. Mid-tier retail investors fail to exit decisively when prices fall. Large investors (WG4) quickly and decisively exit the market after price declines. Small retail investors hesitate and often add more funds trying to catch a falling knife.

3. When retail investors enter the market, they go straight for high-risk stocks (high beta), hoping for overnight riches. They chase cheap-looking stocks and end up trapped.

The paper's original description of these phenomena is as follows:

"Our analysis shows that during the early phase of the bubble, the largest household accounts—those in the top 0.5% of stock wealth distribution—actively increased their market exposure by flowing into the stock market and tilting toward high-beta stocks. Then, shortly after the market peaked, they rapidly reduced their market exposure. Households below the 85th percentile exhibited precisely the opposite trading behavior. Over these 18 months, the top 0.5% of households earned over 250 billion RMB in gains, while the bottom 85% lost over 250 billion RMB—approximately 30% of any group’s initial account value. In sharp contrast, during the two and a half years prior to June 2014, when the market was relatively calm, the gains and losses experienced by these four household wealth groups were an order of magnitude smaller. Through the lens of a stylized portfolio choice model, we show that this wealth redistribution is unlikely driven by investor rebalancing or trend-chasing trades, but rather reflects heterogeneous investment skills among households."

"The fact that the top 0.5% households earn significantly more than the bottom 85% during boom-bust cycles has policy implications. It is widely believed that greater participation in the stock market is a path toward prosperity and equality, especially in developing countries where financial literacy and market participation are generally low. However, if the poor and financially less sophisticated individuals end up actively investing in financial markets prone to bubbles and crashes, such participation could actually harm their wealth. Given recent research showing that salient early experiences can have lasting effects on personal economic decisions decades later, this is particularly concerning. Therefore, while greater stock market participation may improve welfare, it is crucial to emphasize that active investing may lead to precisely the opposite outcome."

The crypto market resembles the early stage of China’s A-share market—dominated by retail investors, with major players manipulating prices. Reading this paper carefully may help inform your own investment decisions. Half of retail investors’ losses come from poor timing, the other half from information asymmetry and poor stock selection.

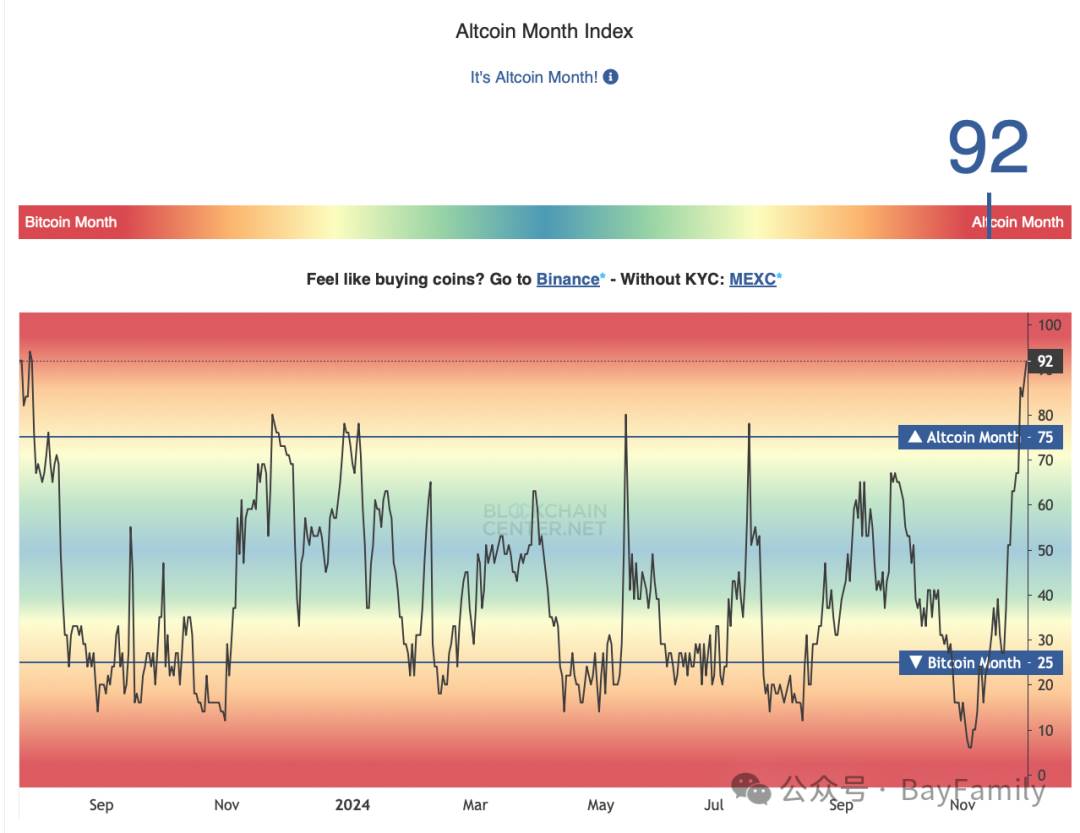

Current market characteristics align closely with the above analysis. In March 2024, a large number of so-called "zombie coins" were revived.

Altcoin indices have been sharply lifted.

All signs indicate retail investors are rushing into the market. Sector rotation is often a signal that the market has entered its mid-to-late stage.

Binance has two hundred million users. Its backend data could clearly reveal the current market phase. Unfortunately, it won’t release this data—it only benefits select groups.

The conclusion boils down to two sentences:

1. Don’t chase a rising market. 2. Don’t touch altcoins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News