Bonding Curve: Binance "Grasps" Retail Investors' Psychological Momentum

TechFlow Selected TechFlow Selected

Bonding Curve: Binance "Grasps" Retail Investors' Psychological Momentum

Bonding Curve does not solve the liquidity generation problem, but instead artificially increases the number of candidates to surface the most promising Meme tokens.

Author: Zuo Ye

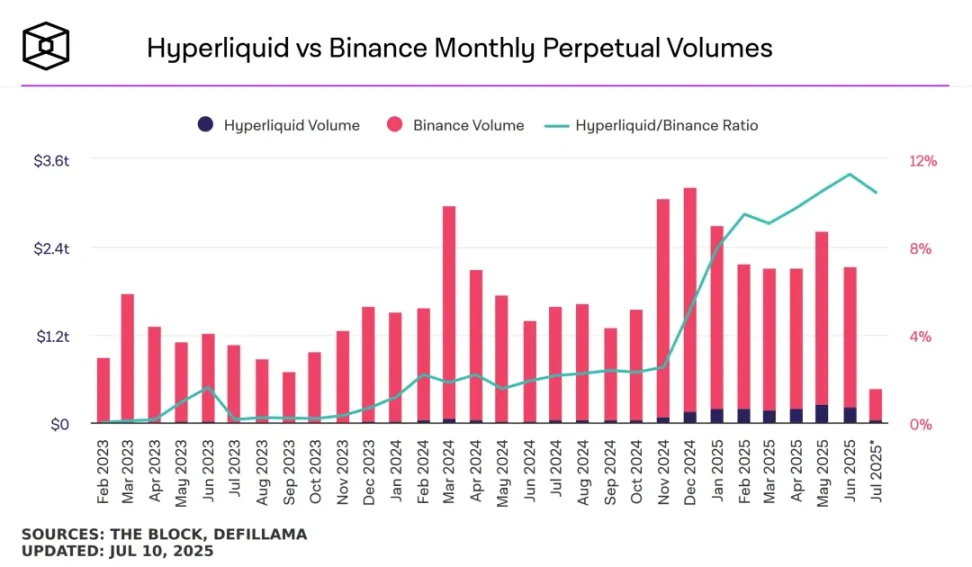

Consider one question: if Binance is destined to be unable to stop the rise of Hyperliquid, how should it maximize its benefits?

Image caption: Comparison of HyperLiquid and Binance derivatives trading volume, source: @TheBlock__

At a time when $PUMP is outperforming major CEXs on Hyperliquid, Binance—the most pressured—responds by boosting liquidity on Binance Alpha. Note, this means increasing liquidity within the Alpha market, not participants’ returns.

In the past, listing on Binance meant listing on Binance spot; now it increasingly means listing on Alpha. To avoid the disappearance of the “Binance listing effect,” traffic must be directed toward Alpha, derivatives, and BNB Chain. But an exchange that doesn’t facilitate trading seems too strange, so Alpha’s trading attributes must be enhanced.

Additionally, empowering $BNB is critical for the entire Binance -YZi- BNB Chain ecosystem. The returns owed to BNB holders represent a daily liability for Binance. Beyond economic value, more utility value—and even emotional value—must be introduced.

To summarize, there are two reasons why Binance Alpha has enabled trading:

1. Counteract Hyperliquid’s listing effect and increase Binance’s overall liquidity;

2. Enhance $BNB with greater practical utility, strengthening the stability of the Binance ecosystem.

In light of these two points, Binance’s collaboration with FourMeme to launch a Bonding Curve TGE becomes easier to understand—it also subtly rides the Meme launcher revival wave sparked by PUMP’s token issuance, especially since Bonk and MemeCore have both gained traction.

For details, refer to: Pump/Bonk/$M: Three-Way Meme Split, Two Paths for Asset Issuance

Choosing Bonding Curve to Drive Initial Liquidity

According to Binance's announcement, the token for this Bonding Curve TGE is Aptos DEX Hyperion.

We won't introduce the project here, nor will we discuss token price or similar content in this article. We only explain the logic behind Binance’s choice of Bonding Curve, to help founders consider future listing strategies.

Image caption: @hyperion_xyz/center, source: @BinanceWallet

After reading the announcement, key elements include: holding BNB, ability to resell within the Bonding Curve system upon successful subscription, and transition into the standard Alpha trading system after the event. Essentially, this encourages in-market trading—pre-market activity relative to the Alpha market.

As a result, Binance’s trading system now has at least four tiers: Bonding Curve trading → Alpha trading → derivatives trading → spot trading. It’s a selective promotion system—not all projects will necessarily advance to Binance’s main trading platform.

This conveniently masks or addresses Binance’s biggest current liquidity crisis. By creating more initial liquidity mechanisms, Binance attempts to resolve the issue. Historically, Bonding Curves haven’t truly solved liquidity generation—they artificially increase the number of candidates, hoping to discover the most promising Meme tokens through trial and error.

Looking back at DEX evolution, LP Tokens were the real tool that solved liquidity provision. AMM/order book mechanisms require them to function properly. But Binance’s situation is complicated: though not an early-stage project, it suffers from the biggest problem early projects face—shrinking liquidity and declining $BNB value capture capability.

Compare this to PumpFun, which uses in-market Bonding Curve plus off-market AMM pools. Bonding Curve itself contains a paradox: the higher the demand, the higher the price—like rising housing demand causing燕郊 properties to appreciate. Once the market inflection point hits, collapse follows instantly, with no gradual decline possible.

PumpFun doesn’t resolve this inherent paradox. Instead, it minimizes launch costs to attract more attempts: while燕郊 may fall, maybe Dubai rises. Global crypto liquidity and infinite experimentation make internal markets the cheapest launchpads—out of 1,000 internal launches, 10 might reach external DEXs, and one of those may eventually reach a CEX.

If internal markets increased to 10 million, market liquidity would surge instantly, benefiting internal markets, external DEXs, and CEXs alike—though ultimately, it would all collapse.

A prediction: Binance Alpha Bonding Curve TGE events will increase in frequency; otherwise, they won’t achieve their intended effects of generating liquidity and directing it toward the main site and $BNB.

Further, Bonding Curve is actually more akin to a rebase algorithmic stablecoin mechanism. The former relies on the logic “more demand → higher price → better liquidity,” while the latter operates on “the more bought, the stronger reserves + the more sold, the higher profit → stablecoin price stability.”

Both share similar flaws: they rely on the “normal” part under the law of large numbers, rarely accounting for extreme events. Using the 80-20 rule, they focus on the 80% case and ignore the 20% exceptions—ultimately, one died from the Luna-UST shock, the other had its liquidity drained by $TRUMP.

Studying Psychological Momentum, Waiting for a Fatal Blow

There’s a momentum phenomenon in markets: prices often rise higher than expected, or fall deeper than fair value suggests.

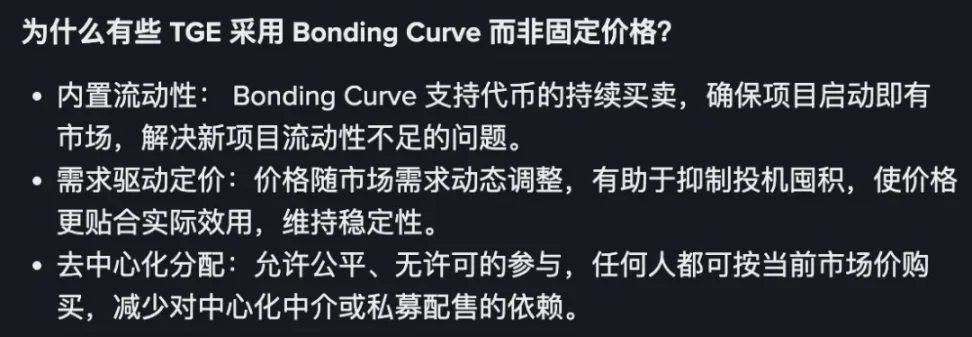

The assumptions underlying Bonding Curve are inherently unreliable—but they perfectly match Binance’s current needs:

-

Generate initial liquidity: Binance Alpha already has strong market foundations, so this isn’t about “built-in liquidity,” but rather front-loading liquidity—redirecting what would have been post-launch Alpha liquidity, as well as trading liquidity from other DEXs/CEXs, into the Bonding Curve zone;

-

Pricing expectations drive demand: just as Pre-Market trading involves pricing博弈, Bonding Curve creates博弈around pricing, stimulating demand. Users must sell tokens to avoid becoming mere watchers before the Bonding Curve collapses;

-

Absorb the listing effect: Bonding Curve enables market-driven pricing. Binance uses it to prevent weakening of the listing effect from undermining main-site liquidity, theoretically achieving fairer pricing.

Image caption: Reasons for choosing Bonding Curve, source: @BinanceWallet

So, what’s the cost?

As mentioned earlier, PumpFun-style Bonding Curves depend on a large number of internal markets to produce breakout hits. Binance Alpha still has too few listing events—even if every project in crypto joined, it wouldn’t be enough.

However, Binance Alpha will serve as a venue for initial price discovery for projects. Consider $JELLYJELLY, where Binance and OKX jointly targeted Hyperliquid. I suspect CEXs may unite against Hyperliquid—with Binance leading the charge.

The ultimate trick to stealing liquidity is price discovery. Retail investors want to buy low and sell high. If Binance directly amplifies the listing effect, it must pay a higher price. But by positioning itself as helping retail discover the earliest prices, liquidity will naturally flow in.

Then, wait for an extreme black swan event—and deliver a fatal blow to Hyperliquid. Just as Bybit was severely damaged by a hack, while CZ/Binance shrugged off a $4.2 billion fine; just as Hyperliquid’s extreme transparency led to being exploited, then Binance steps in to poke it further—just like how FTX collapsed easily, yet CZ remains the big brother.

Conclusion

Scale is Binance’s greatest advantage; agility is Hyperliquid’s offensive weapon. A war of attrition, waiting for change—that’s the rational choice. Binance chooses price signals; Hyperliquid pursues the listing effect. Liquidity is the outcome of their rivalry, not the cause.

Only pity the Alpha users: ox, ox, who are you working for? The sugar is so sweet—why do those who grow it live so hard?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News