From "Water Bull" to "Value Bull": Why This Crypto Cycle Is the Toughest Yet Golden Era for Retail Investors?

TechFlow Selected TechFlow Selected

From "Water Bull" to "Value Bull": Why This Crypto Cycle Is the Toughest Yet Golden Era for Retail Investors?

Institutional capital entering the market, Bitcoin halving, and the emergence of real-world applications have created opportunities for long-term investors.

By Luke, Mars Finance

For crypto investors who lived through the roaring bull market of 2020–2021, today’s market is undoubtedly confusing and painfully trying. That was an era of狂欢 fueled by unprecedented monetary easing from central banks worldwide—liquidity flooded everywhere, everything surged, and it seemed that blindly buying any project could yield astonishing returns. However, those days are gone for good. Now, global financial markets balance on a delicate edge: one side marked by unexpectedly strong U.S. economic data, the other by the Federal Reserve’s unwavering hawkish stance. A historically high interest rate environment looms like a mountain over all risk assets.

This paradigm shift, driven by macroeconomic forces, has made the current crypto cycle “the most difficult era” for retail investors. The old model—relying purely on liquidity-driven momentum and emotional speculation—is now obsolete. In its place emerges a new bull market rooted in intrinsic value, clear narratives, and fundamental drivers: a true "value bull" market.

Yet, difficulty often conceals opportunity. When the tide recedes, genuine value investors enter their golden age. Precisely under these conditions do institutional adoption, algorithmic deflation mechanisms, and real-world applications integrated with the physical economy reveal their authentic, cycle-defying worth. This article aims to deeply unpack this profound transformation and explain why an era so challenging for speculators is, in fact, laying out a golden path for prepared investors.

I. The Most Difficult Era: When the Liquidity Tide Retreats

The root of this cycle's difficulty lies in a fundamental reversal of monetary policy. Compared to the last bull run’s ultra-friendly environment of “zero rates + infinite quantitative easing,” today’s market faces the toughest macro headwinds in decades. To combat the worst inflation in forty years, the Federal Reserve launched an unprecedented tightening cycle, delivering a dual blow to the crypto market and completely ending the era of easy profits.

1. The Macroeconomic Puzzle: Why Rate Cuts Remain Distant

The key to understanding today’s market困境 lies in grasping why the Fed remains so reluctant to pivot toward easing. The answer resides in recent macroeconomic data—data that appears “strong” but is actually “bad news” for those hoping for rate cuts.

Stubborn Inflation and the Hawkish Dot Plot: Although inflation has retreated from its peak, it remains far stickier than expected. The latest data shows that the U.S. May CPI annual rate slightly undershot forecasts, yet core inflation stubbornly holds at 2.8%. This is still significantly above the Fed’s 2% target. This persistence is clearly reflected in the Fed’s latest Summary of Economic Projections (SEP) and the closely watched “dot plot.” After the June FOMC meeting, Fed officials sharply downgraded their rate cut expectations, reducing the median forecast for cuts this year from three to just one. This hawkish pivot dealt a heavy blow to market optimism. As Powell stated in his post-meeting press conference: “We need to see more good data to strengthen our confidence that inflation is sustainably moving toward 2%.” In short, the bar for rate cuts has been set extremely high.

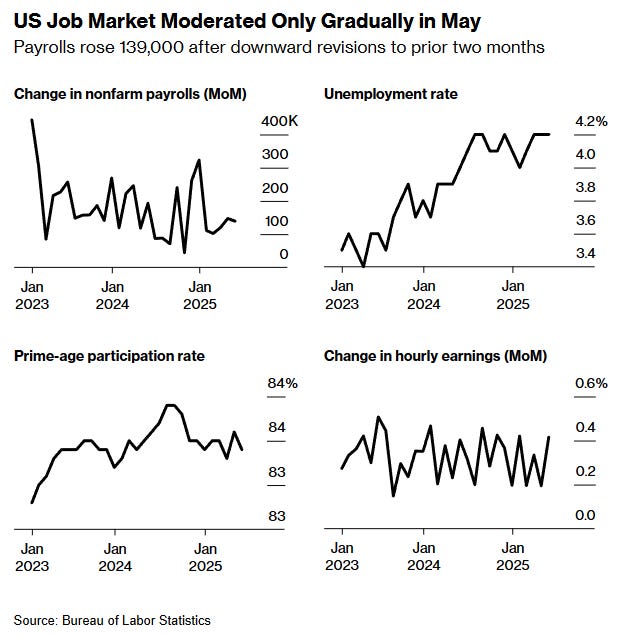

A Resilient Labor Market: At the same time, the U.S. labor market continues to show remarkable strength. May’s nonfarm payrolls report revealed 139,000 new jobs—beating expectations—with the unemployment rate holding steady at 4.2%. A robust labor market supports consumer spending, which in turn sustains upward pressure on inflation, making the Fed even more hesitant to ease policy.

Powell’s “Historical Script”: As Nicholas Colas, co-founder of DataTrek Research, points out, Chair Powell is following in the footsteps of his predecessors—adopting a hawkish tone late in his term to cement his legacy of successfully taming inflation. This concern for personal and institutional reputation means that unless economic data collapses abruptly, policy shifts will be extremely cautious and slow.

2. The “Gravity” of High Rates: The Crypto Market’s “Bloodletting” Effect

This macro backdrop directly creates harsh conditions for the crypto market:

Liquidity Drought: High interest rates mean less “hot money” circulating. For the crypto market—especially altcoins—which heavily depends on fresh capital inflows to drive price appreciation, tighter liquidity is the most lethal blow. The previous era of “everything rising together” has given way in this cycle to sector rotation or even structural rallies concentrated in only a few niches.

Soaring Opportunity Cost: When investors can easily earn over 5% risk-free returns from U.S. Treasuries, the opportunity cost of holding volatile, non-income-producing assets like Bitcoin rises dramatically. This drives large amounts of capital seeking stable returns out of crypto, further intensifying the market’s “bloodletting” effect.

For retail investors accustomed to chasing trends amid abundant liquidity, this shift is brutal. Strategies lacking deep research and relying solely on herd mentality are highly vulnerable to losses in this cycle—this is the essence of its “difficulty.”

II. The Golden Era: From Hype to Value, New Opportunities Emerge

Yet, on the flip side of crisis lies transformation. Macroeconomic headwinds act like a stress test, purging market froth and filtering out core assets and narratives with genuine long-term value—ushering in an unprecedented golden age for prepared investors. The resilience of this cycle stems precisely from several powerful internal drivers independent of monetary policy.

1. The Golden Bridge: Spot ETFs Usher in the Institutional Year

In early 2024, the U.S. Securities and Exchange Commission (SEC) made history by approving spot Bitcoin ETFs. This was not merely a product launch—it was a revolution for the crypto world. It opened a “golden door” for hundreds of billions, even trillions, of dollars from traditional finance to invest in Bitcoin in a compliant and accessible manner.

A Steady Flow of Fresh Capital: By Q2 2025, just two ETFs—BlackRock’s IBIT and Fidelity’s FBTC—had amassed total assets under management exceeding tens of billions of dollars, with consistent daily net inflows providing strong buying power. This “new blood” from Wall Street has significantly offset the liquidity squeeze caused by high interest rates.

An Anchor of Confidence: BlackRock CEO Larry Fink hailed the success of Bitcoin ETFs as “a revolution in capital markets” and said this marks only the “first step in asset tokenization.” Such endorsement from the world’s largest asset manager has greatly boosted market confidence and provided retail investors with a clear signal: follow institutions into long-term value investing.

2. Code-Based Faith: Hard-Core Support from the Halving Narrative

Bitcoin’s fourth “halving” in April 2024 reduced its daily new supply from 900 BTC to 450 BTC. This predictable, code-enforced supply contraction is what sets Bitcoin apart from all traditional financial assets. With demand—especially from ETFs—stable or growing, the halving provides a solid, mathematically grounded floor for Bitcoin’s price. Historical data shows that within 12–18 months after each of the prior three halvings, Bitcoin reached new all-time highs. For value investors, this is not a short-term gimmick, but a trustworthy, cycle-spanning long-term thesis.

3. Narrative Revolution: When Web3 Solves Real-World Problems

Macroeconomic headwinds have forced market participants to shift from pure speculation to uncovering intrinsic project value. The focal points of this cycle are no longer baseless memes like Dogecoin, but innovative narratives aiming to solve real-world challenges:

-

Artificial Intelligence (AI) + Crypto: Combining AI’s computational power with blockchain’s incentive mechanisms and data ownership models to create new decentralized intelligent applications.

-

Real-World Asset (RWA) Tokenization: Bringing physical assets like real estate, bonds, and art onto blockchains to unlock liquidity and bridge traditional and digital finance.

-

Decentralized Physical Infrastructure Networks (DePIN): Using token incentives to enable global users to collectively build and operate physical infrastructure networks such as 5G towers and sensor grids.

The rise of these narratives marks a fundamental shift in the crypto industry—from “speculating on air” to “investing in value.” Crypto venture giant a16z Crypto emphasized in its annual report the potential of “AI+Crypto” as the next innovation engine. For retail investors, this means opportunities to discover value through deep research have vastly increased. Knowledge and insight now matter more than mere courage and luck.

III. Survival Rules for the New Cycle: Patient Positioning Between Finale and Overture

We stand at a historical inflection point. The Fed’s “hawkish finale” is playing out, while the “easing overture” has yet to begin. For retail investors, understanding and adapting to the new rules of the game is key to navigating cycles and seizing golden opportunities.

1. A Fundamental Shift in Investment Paradigm

-

From Chasing Trends to Value Investing: Abandon the fantasy of finding the “next 100x coin.” Focus instead on project fundamentals—technology, team, economic model, and competitive landscape.

-

From Short-Term Speculation to Long-Term Holding: In a “value bull” market, real returns go to those who identify core assets and hold them through volatility—not to frequent traders.

-

Building a Differentiated Portfolio: In this new cycle, different assets play distinct roles. **Bitcoin (BTC)**, recognized by institutions as “digital gold,” serves as the portfolio’s “ballast”; **Ethereum (ETH)**, with its robust ecosystem and ETF prospects, functions as a core asset combining store-of-value and productive utility; high-growth altcoins should be small, research-backed “rocket boosters,” focused on frontier sectors like AI and DePIN with genuine potential.

2. Stay Patient, Position Early

DataTrek’s research reveals an intriguing pattern: during the final 12 months of the tenures of the past three Fed chairs, the S&P 500 rose an average of 16%, even as rates remained high. This suggests that once the market believes the tightening cycle is truly over, risk appetite may rebound—even before actual rate cuts begin.

A similar “front-running” rally could unfold in crypto. While most investors fixate on the short-term question of “when will cuts happen?”, true visionaries are already positioning for which assets and sectors will be best placed when the easing overture finally plays—amplified by the convergence of favorable macro winds and industrial cycles.

Conclusion

This crypto cycle is undoubtedly an extreme test of retail investors’ knowledge and mindset. The era of easy gains powered by boldness and luck—the “liquidity-fueled bull”—has ended. A new era demanding deep research, independent thinking, and long-term patience—the “value bull”—has arrived. This is precisely what makes it “difficult.”

Yet, it is also in this very era that institutional capital is flooding in at an unprecedented scale, establishing a solid market floor; where the value propositions of core assets grow increasingly clear; and where real, value-creating applications are beginning to take root. For retail investors willing to learn, embrace change, and treat investing as a journey of cognitive arbitrage, this is undeniably a “golden era”—one where they can compete alongside the sharpest minds and share in the industry’s long-term growth. History doesn’t repeat itself, but it often rhymes. Between the finale and the overture, patience and foresight will be the sole path to success.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News