The Retail Investor Dilemma: The Stablecoin Business They Can't Access

TechFlow Selected TechFlow Selected

The Retail Investor Dilemma: The Stablecoin Business They Can't Access

Those who make money don't want to go public; those that go public may not distribute profits. "Profits" are actually irrelevant to retail investors.

By Alex Liu, Foresight News

Casino rake —— exchanges; banks that pay no interest —— stablecoins. The analogies may not be perfect, but they illustrate just how lucrative the business models are in these two hottest sectors of the crypto industry. Competition is fierce in the exchange space, leaving little room for structural opportunities, while a new wave of hype around stablecoins seems only just beginning.

Recently, Circle, the issuer of USDC, became the first publicly listed stablecoin company, drawing strong investor enthusiasm. Its stock closed at three times its IPO price on the first day, achieving a market cap exceeding $20 billion. Meanwhile, Plasma, a stablecoin payment chain backed by Tether, raised $500 million within minutes—some investors even paid tens of thousands of dollars in ETH network fees to deposit over $10 million.

Circle stock CRCL price

Why do people say stablecoins are a great business? And if so, can retail investors participate? This article aims to briefly analyze the current operational models and profitability of major stablecoins, highlight the reality that “the profitable ones don’t want to go public, while those going public may not share profits,” discuss the challenges retail investors face in this sector, and explore potential solutions.

Is the Stablecoin Business a Good One?

To start with a conclusion: whether stablecoins are a good business depends on who the players are. Currently, the most profitable player is Tether, the issuer of USDT.

Comparing all stablecoins to "banks that pay no interest" isn't entirely accurate—there are interest-bearing stablecoins like sUSDe, sUSDS, sfrxUSD, and scrvUSD, which return yields to depositors. But when it comes to Tether specifically, it’s even more extreme than such a bank—not only does it pay zero interest, but redeeming USDT for USD (i.e., cashing out) incurs a 0.1% fee, capped at $1,000 per redemption.

Unlike traditional banks, stablecoin revenue streams vary widely. Banks primarily earn by lending out deposits and capturing the spread between loan interest and deposit rates, risking losses from defaults. In contrast, major stablecoin issuers like Tether generate risk-free returns by investing fiat reserves into short-term U.S. Treasury bills (T-Bills), eliminating credit risk—an inherently superior profit model compared to a "no-interest bank."

Ethena's stablecoin protocol operates more like a complex capital management platform, mainly profiting from funding rate arbitrage via spot staking and perpetual contract hedging, albeit with higher risk. Stablecoins launched by protocols like Curve, Sky, and Aave primarily earn through lending interest, also carrying associated risks. While interest-bearing stablecoins benefit users by returning yield, they reduce the underlying business model's profitability.

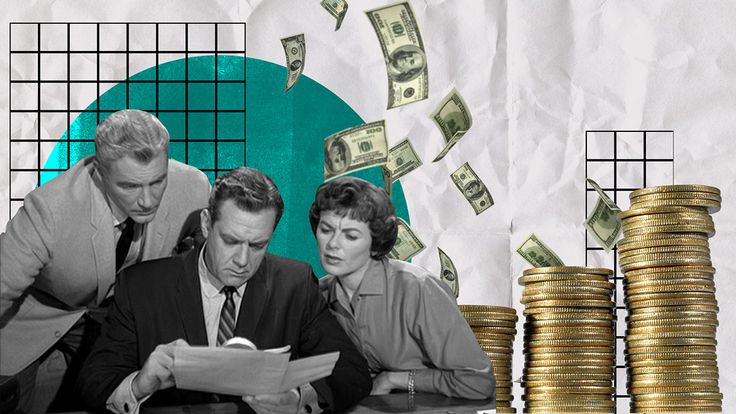

Net profits and employee counts of select companies

In this light, Tether—with its one-way inflow of capital, minimal expenses, and low risk—is truly “earning money while lying down.” As shown above, Tether earned $13 billion in profit in 2024, surpassing financial giants like Morgan Stanley and Goldman Sachs, despite having only about 100 employees—just a fraction of their workforce—demonstrating exceptional labor efficiency. Binance, an exchange with comparable profit levels, employs over 5,000 people globally, falling far behind in efficiency. CZ recently admitted on X that Binance is “far less efficient” than Tether. The reason? Tether focuses solely on its core, highly profitable USDT business, which benefits from first-mover and network effects. Demand grows organically without heavy marketing. In contrast, crypto exchanges have complex operations and intense competition, requiring constant listing of new tokens, customer support, and marketing campaigns—driving up human and financial costs.

Tether’s USDT is indeed a fantastic business. Circle, as the “number two player” in the stablecoin space, has USDC with a current market cap exceeding $60 billion—nearly 40% of USDT’s value. Surely, it must also be a “money printer,” right?

The answer, however, is no—at least not yet.

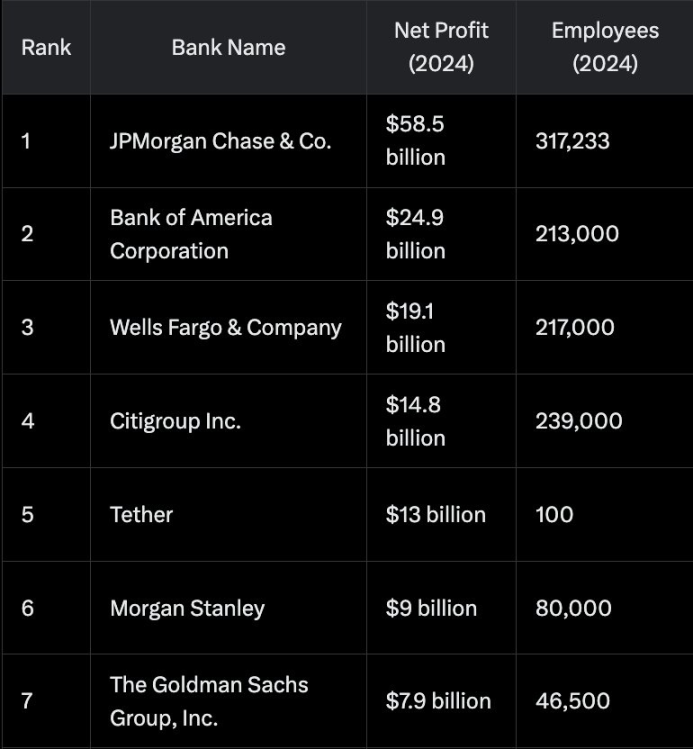

According to Circle’s financial reports, its net profit in 2024 was only $155 million (compared to Tether’s tens of billions). This is because Circle incurs over $1 billion in distribution costs, sharing most of its gross margin with partners like Coinbase and Binance to promote USDC adoption. For example, all profits generated from USDC activity on Coinbase go entirely to Coinbase (which then distributes them as interest to users), and Coinbase also receives half of the profits from USDC usage outside its own exchange.

Circle financial report table

Facing pressure from competitors—whether non-compliant ones like USDT or other compliant ones like PYUSD and FDUSD—Circle will likely maintain high distribution costs for the foreseeable future to preserve adoption advantages. In summary, Circle is full of potential, but currently struggling in a fiercely competitive environment and has yet to realize solid profitability.

The Retail Investor's Dilemma

From the above, it’s clear that Tether—the leading player in the stablecoin space—is undoubtedly a compelling investment opportunity, yet retail investors have no access to it whatsoever.

Tether CEO Paolo Ardoino retweeted a post stating, “If Tether went public, the company would be valued at $515 billion, surpassing Costco and Coca-Cola to become the world’s 19th largest company,” adding his own comment: “We currently have no IPO plans.” Given Tether’s profitability, there’s simply no need to raise external capital. If you held the exclusive license to operate a Macau casino, you’d probably prefer to run it alone rather than bring in partners.

Thus, in the stablecoin space, the most profitable players don’t want to go public.

Should retail investors consider investing in Circle, the already-public “number two player”? Few investors could buy CRCL shares near its ~$30 IPO price. Most retail investors face a stock that, based on a mere $100 million in annual profit, surged to a multi-billion-dollar valuation at launch, with a price-to-earnings ratio exceeding 100. Buying such a high-P/E stock usually means betting on future growth—a highly speculative move.

Moreover, as a high-P/E, fast-growing “internet tech company,” not paying dividends long-term is the norm. Being a shareholder won’t let you “lie down and earn money.”

The profitable ones don’t want to go public; the ones going public may not distribute profits—so ‘profits’ are effectively irrelevant to retail investors. This is the dilemma: immense profitability in the sector, yet limited access for everyday investors.

Usual’s Experiment

What retail investors may need is something like the Usual model.

Usual is a controversial stablecoin protocol that previously suffered a USD0++ depeg event, causing significant user losses and severely damaging community trust. However, the protocol’s mechanism design has notable merits—it represents a valuable attempt in terms of allocation mechanisms and tokenomics.

The stablecoin issued by Usual is called USD0, each unit fully backed by $1 worth of RWA (Real World Assets). These RWAs are actually interest-bearing stablecoins such as USYC and M, whose yields come from U.S. Treasury bills, issued by licensed and compliant RWA providers like Hashnote.

Holding USD0 directly generates no interest—the underlying Treasury yields are captured by the protocol instead. Like Tether, this is a profitable business.

But Usual is not Tether. USDT benefits from first-mover and network effects, supported by real-world use cases—trading on exchanges, serving as a shadow dollar for payments across Southeast Asia and Africa, etc.—so people willingly hold USDT. But why would anyone hold USD0, which pays no interest?

This is where another component of the Usual ecosystem, USD0++, comes into play. Its proper name is liquidity-enhanced bond, though its code includes “USD,” easily misleading people into thinking it’s a stablecoin. Users can stake USD0 to receive USD0++; each USD0++ can be redeemed for 1 USD0 after four years (i.e., in 2028). Clearly, before maturity, the value of USD0++ should be less than 1 USD0, gradually approaching parity over time.

This mirrors traditional zero-coupon bonds: buying a one-year $110 face-value bond for $100 locks in a 10% annualized return upon maturity. Similarly, such bonds approach their par value as redemption nears.

During its rapid growth phase, Usual allowed 1:1 conversion between USD0 and USD0++, intentionally or not reinforcing the misconception that USD0++ is a stablecoin—and bearing direct responsibility for the subsequent “depeg” incident. It’s not a stablecoin, so “depeg” isn’t technically accurate—but holders did suffer losses.

By staking USD0 to get USD0++, users surrender the future yield of their funds for four years. So why do it? Usual offers USUAL tokens as “enhanced yield” on USD0++, providing returns well above normal bond yields—over 100% APY at peak, still around 10% today.

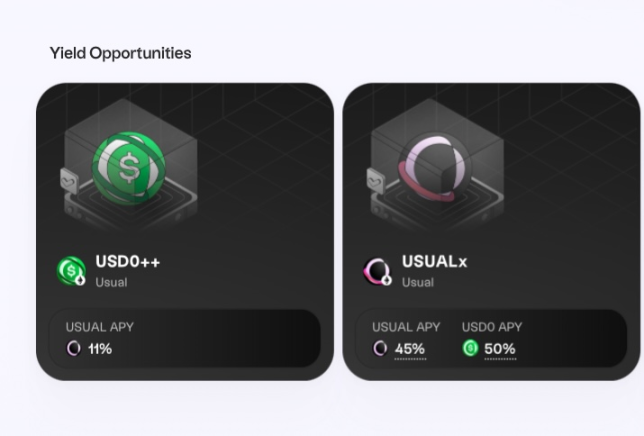

Token yields in the Usual ecosystem

This requires USUAL tokens to have value. What gives USUAL utility? The Treasury yields captured by the protocol are distributed weekly to USUAL stakers (holders of USUALx), who also receive emissions of new USUAL tokens. Currently, Usual’s TVL (total value locked) is about $630 million, distributing approximately 520,000 USD0 weekly to USUAL stakers—equivalent to roughly 50% APY.

In short: without Usual, I’d use my dollars to buy Treasuries and earn yield. With Usual, I hold USD0, the underlying dollars buy Treasuries, but I earn no yield. By staking USD0 into USD0++, I get USUAL tokens; by staking USUAL, I earn the underlying Treasury yield.

The value of USUAL tokens stems from depositor yield rights—this is a self-reinforcing flywheel game entirely driven by TVL. In theory, rising TVL increases weekly payouts, boosting USUAL’s price, which attracts more users and further increases TVL. But the flywheel can also reverse—falling prices reduce USD0++ yields, declining TVL reduces dividends, pushing prices lower still.

This model heavily relies on token emissions to sustain itself. 90% of USUAL tokens will be released over four years via airdrops and as USD0++ yield rewards. The remaining 10% is allocated to the team and investors. So what happens when emissions end? After four years, all USD0++ matures, and no further USUAL emissions are needed.

The Usual team must use this four-year window—while regulatory conditions are favorable and competition hasn’t fully entered—to build real utility for USD0, spin the flywheel using token incentives, and accumulate meaningful TVL and network effects. After four years, Usual reverts to a Tether-like model, except its profits go to USUAL stakers.

This is essentially a four-year token distribution phase.

What are the advantages of this experiment? Why might retail investors need a model like Usual?

Usual enables retail investors to gain exposure to profits similar to Tether’s model through the USUAL token. Acquiring USUAL tokens through saving, staking, or trading lowers the barrier to accessing the yield rights behind Tether-style stablecoins. The token flywheel allows retail participants to obtain early-stage tokens at low cost—USUAL acquired when TVL is low could appreciate significantly as the protocol grows. Even if the “self-mining” strategy fails and one only holds funds without buying USUAL, the worst-case outcome is merely lost interest.

The stablecoin sector is clearly still in its early stages, with Luna’s collapse still fresh in memory. Will retail investors get a slice of this pie, or will this lucrative space ultimately be dominated by Wall Street and other institutional giants? We’ll have the privilege of finding out together in the years ahead.

Disclosure: The author of this article has participated in the USUAL ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News