How did various Layer1 blockchains perform in 2024?

TechFlow Selected TechFlow Selected

How did various Layer1 blockchains perform in 2024?

Since January, Layer 1 token prices have surged by over 7000%.

Author: Prem Reginald

Translation: Baicryptowrites

Fueled by Donald Trump's presidential election victory, the cryptocurrency market in 2024 has exhibited a vertical growth trajectory. As platforms for decentralized applications (dApps) and smart contracts, demand for Layer 1 (L1) solutions has surged significantly, with major L1 blockchains fiercely competing for top-tier status. However, they face strong challenges from Layer 2 (L2) solutions that aim to enhance transaction speeds at extremely low costs, thereby competing with established blockchains like Ethereum.

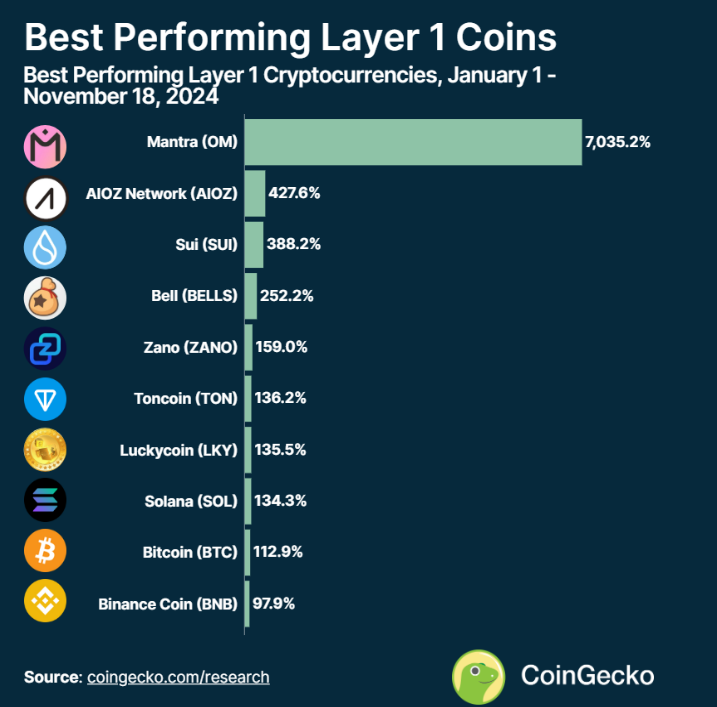

1. Which Layer 1 Tokens Performed Best?

Among the top-performing tokens, Mantra (OM) achieved unprecedented growth, surging 7,035.2% in value. This surge was partly driven by Mantra’s partnership with Zand, a UAE-based digital bank. By complying with regulations set by Dubai’s Virtual Assets Regulatory Authority (VARA), Zand enabled tokenization of real-world assets (RWA). Additionally, demand for RWA products continues to grow, as traditional financial institutions increasingly bring money market funds and bonds onto blockchains.

2. Other Top Performers

AIOZ Network (AIOZ) emerged as another standout performer, rising 427.6% year-to-date (YTD). The platform’s decentralized content delivery network has seen increasing adoption, driven by ongoing ecosystem optimizations. Completing the top three is Sui (SUI), which grew 388.2% YTD, benefiting from rapid development within its ecosystem, including innovative dApp launches leveraging its high scalability and developer-friendly features.

Other notable performers include:

-

Bellscoin (BELLS): Up 252.2%

-

Zano (ZANO): Up 159%

-

Toncoin (TON): Up 136.2%, successfully hosting dApps and launching “Tap-to-Earn” games through integration with Telegram.

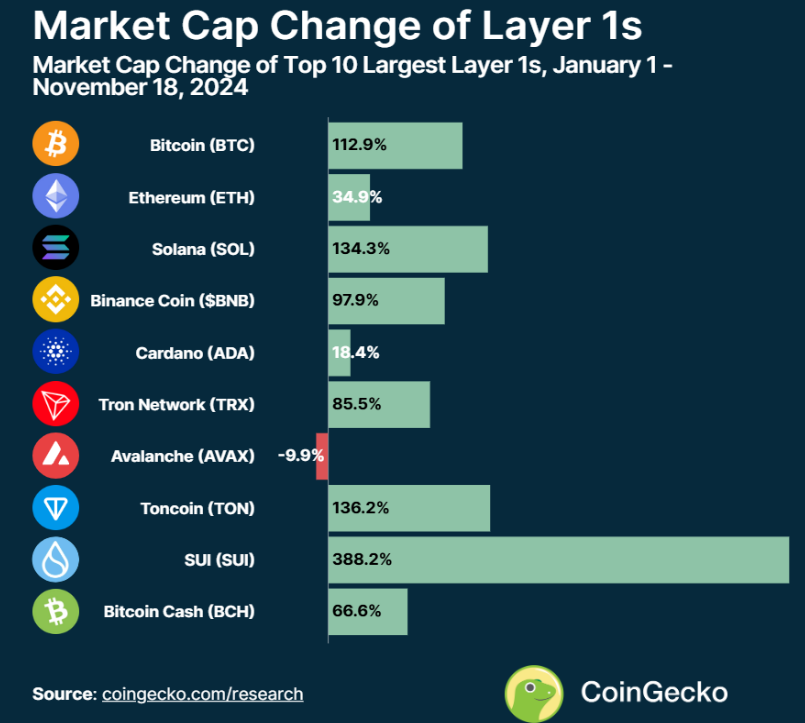

3. Top 10 Market Cap Layer 1 Tokens Show Moderate Gains

Despite the extraordinary performance of mid- and small-cap Layer 1 tokens, larger-cap tokens such as Bitcoin, Ethereum, and Solana remain solid investment choices.

Bitcoin (BTC) achieved an annual gain of 112.9%.

Ethereum (ETH) rose 34.9%, underperforming relative to peers. Ethereum’s dominance has declined year after year amid the rise of new Layer 2 solutions and competing blockchains, even following the launch of spot Ethereum ETFs in the U.S. Nevertheless, Ethereum still outperformed the S&P 500, which gained 24.8% in 2024.

Solana (SOL): Rising from the Ashes

Solana (SOL) rebounded from the shadow of FTX’s 2022 bankruptcy, growing 134.3% YTD. Much of its gains occurred in 2023, when a memecoin frenzy drove prices from $15 to $120. This trend extended to other blockchains as well—Tron Network (TRX), for example, rose 85.5% this year.

Meanwhile, Toncoin (TON) recorded an impressive 136.2% increase, primarily due to its ability to host dApps on the popular messaging app Telegram. “Tap-to-Earn” gaming models became highly popular on Telegram, further fueling its growth.

Sui: The Brightest Star

Sui delivered the most outstanding performance this year, gaining 338.2%. This surge was largely driven by increased investor interest, rising on-chain activity, and enhanced utility through significant dApp expansion. Additionally, Circle’s USDC has been integrated into the network, and a trend of capital flowing from Ethereum to Sui has been observed.

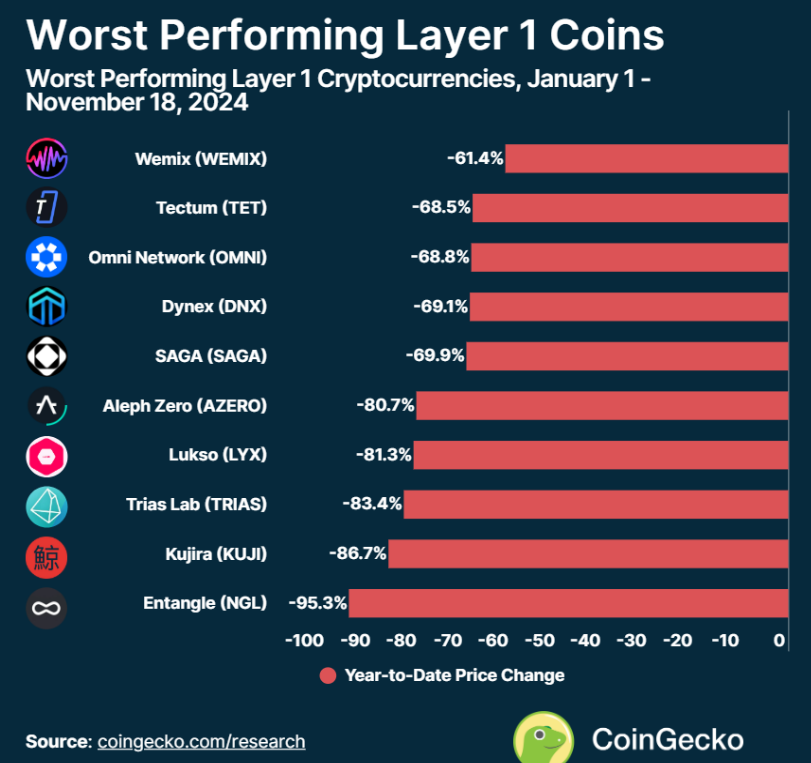

4. The Biggest Declines

On the flip side, some tokens have declined as much as -96% YTD.

Entangle (NGL) performed the worst, down -95.3% YTD.

Close behind are Kujira (KUJI) and Trias Lab (TRIAS), falling -86.7% and -83.4% respectively.

NGL launched in March 2024 at a high valuation and has since experienced continuous price depreciation. Kujira’s performance was impacted by its team’s high-risk leveraged liquidity positions, which backfired during periods of market volatility.

5. How Have Layer 1 Tokens Launched in 2024 Performed?

Various Layer 1 cryptocurrencies launched in 2024 have shown mixed results, reflecting the challenges of standing out in a competitive market.

Aleo (ALEO), launched in September, has fallen -58.1% since issuance.

Saga (SAGA), launched in April, faced similar struggles, declining -69.9% YTD.

Omni Network (OMNI), also launched in April, dropped -68.8%.

Zeta Chain (ZETA), issued in February, has fallen -57.3% to date.

Router Protocol (ROUTE) and Performance of Other New Projects

Router Protocol (ROUTE), launched in July, saw its price fall by 24.8%, while Ice Open Network (ICE), active since January, experienced a relatively smaller decline of 34.5%. Meanwhile, Kaia (KAIA), which entered the market no later than the end of October, achieved a modest positive gain of 5.2%. These outcomes reflect the volatility of new Layer 1 projects and underscore the importance of continuous innovation and user adoption for achieving market recognition.

6. Top 10 Layer 1 Projects Ranked by Price Performance

Note: YTD stands for Year-to-Date, meaning "from the beginning of the year." It typically describes the performance of a metric—such as returns, price changes, or performance—between January 1st and the current date.

7. Conclusion

In 2024, the Layer 1 blockchain landscape displayed diverse performance. Mantra led by a wide margin with a staggering 7,035% YTD gain, driven by strategic partnerships and cutting-edge blockchain use cases. Meanwhile, established players like Bitcoin, Solana, and Toncoin demonstrated steady performance, proving their resilience in an ever-changing market. At the same time, newly launched tokens faced significant headwinds, often struggling due to high initial valuations.

As competition intensifies between Layer 1 and Layer 2 solutions, focus on scalability, utility, and compliance will determine the next wave of winners—an especially critical factor in this fast-evolving crypto market.

Note: This research analyzed price returns of the top 100 cryptocurrencies categorized under Layer 1 on CoinGecko by market capitalization. The YTD return data covers performance from January 1, 2024, to November 18, 2024. These figures represent a market snapshot, highlighting performance differences among tokens within the broader market environment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News