The Bridge to the BTCFi Era: The Synergy and Market Prospects of RGB++ and Fiber

TechFlow Selected TechFlow Selected

The Bridge to the BTCFi Era: The Synergy and Market Prospects of RGB++ and Fiber

The deep integration of the two in asset issuance, circulation, payments, and ecosystem applications has brought unprecedented market potential to the Bitcoin ecosystem.

By Alex Liu, Foresight News

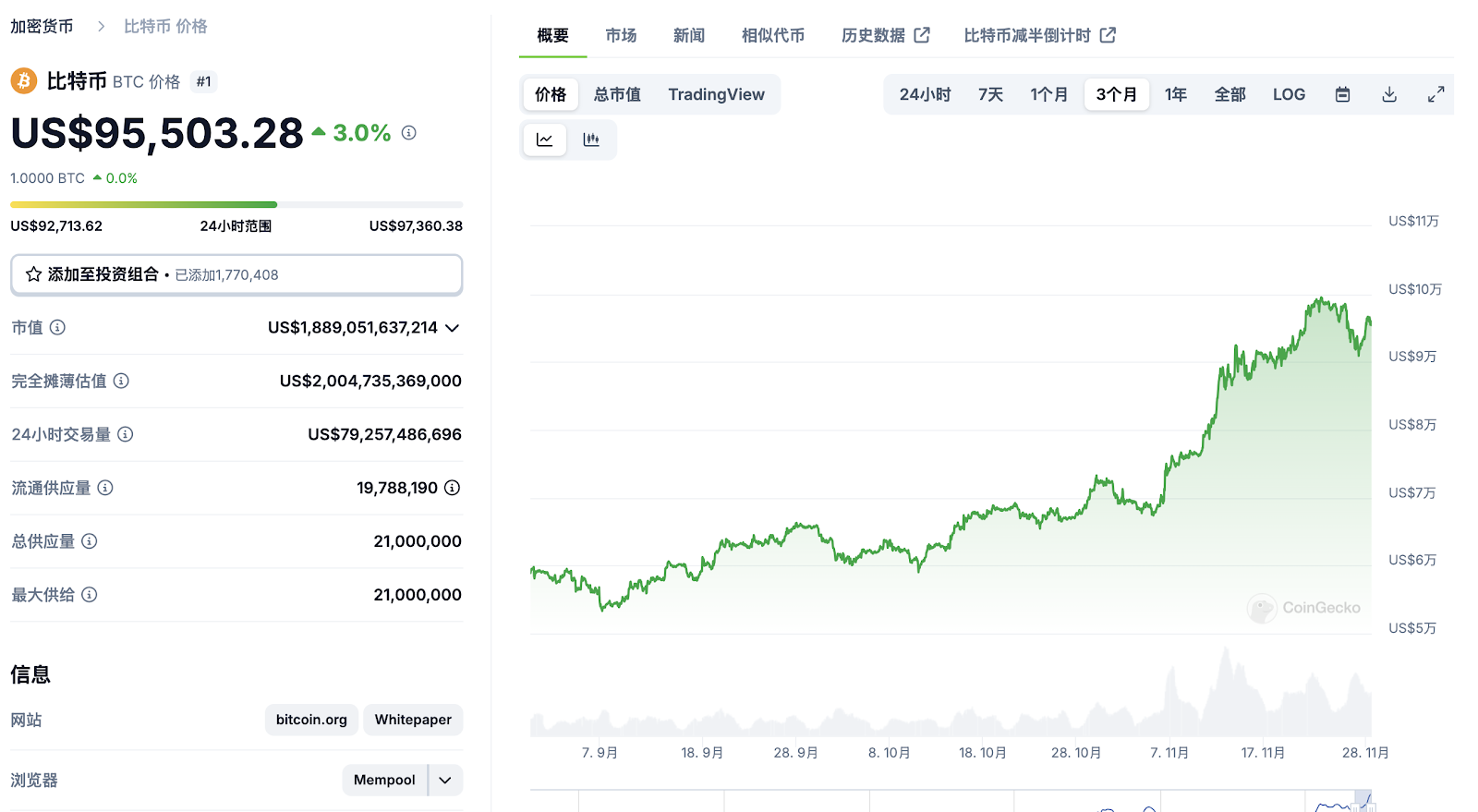

As Bitcoin (BTC) price breaks through $90,000 this year and briefly challenges $100,000, market enthusiasm continues to rise. Bitcoin is no longer just synonymous with digital gold—it is becoming a key engine driving innovation in blockchain technology and the expansion of industrial ecosystems. In this context, scaling solutions, asset issuance, and ecosystem development around Bitcoin have become industry focal points. Among these, the CKB project, its RGB++ protocol, and the upcoming Fiber network are playing a pivotal role in advancing the Bitcoin financial ecosystem (BTCFi) into a new phase. This article explores how RGB++ and Fiber unlock a fresh wave of growth opportunities for BTCFi from technical, market potential, and industry impact perspectives.

The "Spillover Effect" of Bitcoin Ecosystem and the Rise of BTCFi

In the history of Bitcoin's ecosystem expansion, asset issuance has always been a challenging proposition. Bitcoin’s foundational architecture, due to its non-Turing-complete design, inherently lacks support for smart contracts. This limitation creates functional bottlenecks for many innovative asset protocols. However, as Bitcoin’s price repeatedly hits new highs, demand for Bitcoin-based assets and financial services becomes increasingly evident—creating what can be broadly termed a "spillover effect."

Insights from the Inscription Boom and Asset Issuance Demand

In early 2023, the emergence of Bitcoin inscriptions (Ordinals) demonstrated strong market demand for on-chain asset issuance. The Ordinals protocol allows users to permanently record data on the Bitcoin blockchain, sparking a boom in digital art, NFTs, and limited asset issuance. However, the inscription protocol only stores data and cannot fulfill more complex asset functionality needs. For example, while the BRC20 protocol attempts to mimic Ethereum’s ERC20 standard, its tokens lack transfer and minting capabilities, making them unsuitable for mainstream asset issuance scenarios.

In contrast, the RGB++ protocol, with its design that combines native Bitcoin integration and flexibility, has emerged as a highly anticipated solution. By introducing isomorphic binding and Leap bridgeless cross-chain technology, RGB++ enables native cross-chain functionality and flexible operations for Bitcoin assets, laying the foundation for further development of the BTCFi ecosystem.

RGB++: Redefining Bitcoin Asset Issuance

The core innovation of RGB++ lies in overcoming the limitations of the traditional RGB protocol—not only solving the programmability challenge of Bitcoin assets but also significantly enhancing issuance efficiency and liquidity.

Isomorphic Binding: Convenience of Native Assets

The traditional RGB protocol uses off-chain verification, requiring users to run clients to manage their assets—a setup prone to data silos and limiting the protocol’s applicability in decentralized finance (DeFi). RGB++’s isomorphic binding feature allows users to directly manage and operate assets using Bitcoin accounts, simplifying interaction while ensuring data transparency and interoperability.

Leap Technology: Breakthrough in Bridgeless Cross-Chain

Leap is another core component of RGB++. By deeply integrating assets with Bitcoin’s UTXO (Unspent Transaction Output) model, Leap enables seamless movement of assets between Bitcoin’s L1 mainchain and CKB’s L2 blockchain. This bridgeless cross-chain approach reduces technical complexity, transaction costs, and associated risks.

RGB++'s architectural design introduces a new paradigm for asset issuance and circulation within the Bitcoin ecosystem. Its flexibility and efficiency have already been validated by the market and attracted attention and support from multiple key players in the Bitcoin space.

Fiber: Igniting the Spark for BTCFi Markets

The Fiber network, developed by the CKB team, is the next-generation public lightning network tailored for payment demands in the Bitcoin ecosystem. It enables fast, low-cost, and decentralized multi-currency payments and peer-to-peer transactions for RGB++ assets. Scheduled to launch in mid-December, Fiber will not only meet high-speed payment needs for Bitcoin assets but also provide critical infrastructure for decentralized applications (DApps).

High-Performance Payment Network

Fiber introduces more efficient off-chain channels supporting multi-currency payments and P2P transactions, dramatically improving transaction throughput and cost-efficiency for RGB++ assets. This capability strongly supports DeFi applications and NFT (in RGB++, called DOB) trading within the Bitcoin ecosystem, enabling rapid circulation of RGB++ assets on the Fiber network.

Decentralization and Scalability

Unlike traditional on-chain scaling solutions, Fiber adopts a decentralized architecture whose scalability can accommodate growing future transaction volumes. Additionally, Fiber is compatible with Bitcoin’s Lightning Network, allowing RGB++ assets to integrate seamlessly into Bitcoin’s existing payment ecosystem and expand their application scope.

CKB's Advantages in the Global BTCFi Race

In the global competition for BTCFi dominance, Eastern and Western approaches each have strengths—and notable weaknesses:

-

Eastern solutions like Runes and Ordinals innovate rapidly but lack robust infrastructure and mature ecosystems.

-

Western protocols such as RGB and Taproot started earlier but have progressed slowly, lacking effective market adoption.

In contrast, CKB demonstrates comprehensive competitive advantages across technology, ecosystem maturity, and real-world market deployment:

-

Technological Leadership: Through innovations like Leap and isomorphic binding, the RGB++ protocol fills a critical gap in cross-chain asset issuance within the Bitcoin ecosystem. Its technological edge gives it strong potential to unify and expand the broader Bitcoin ecosystem.

-

Ecosystem Maturity: The launch of the Fiber network provides solid infrastructure for RGB++. Meanwhile, compliant stablecoin USDI, decentralized over-collateralized stablecoin RUSD, DEX UTXO Swap, and liquid staking platform UTXO Stack enrich the ecosystem’s functional modules.

-

Market Recognition: The CKB project has long focused on the Bitcoin ecosystem, attracting investments from top-tier global institutions including CMB International, Sequoia China, and Polychain Capital. It is supported by well-known miners such as Bitmain and Broadeng, and major mining pools like F2Pool and Binance Pool now support CKB mining.

The Blue Ocean of BTCFi: Market Potential and Wealth Effects

Positive Feedback Loop in the Bitcoin Ecosystem

Rapid increases in Bitcoin’s price attract large numbers of new users who demand more sophisticated assets and services within the ecosystem. However, Bitcoin’s base layer has limited capacity, causing user transaction demand to spill over to Layer 2 solutions and related ecosystem projects. This spillover effect not only drives the growth of BTCFi initiatives but also provides natural market traffic for RGB++ and Fiber.

The Synergy of RGB++ and Fiber: An Engine Driving BTCFi Innovation

The combination of RGB++ and Fiber addresses technical challenges while unlocking unprecedented market opportunities for BTCFi. Their synergistic effects span asset issuance, circulation, payments, and ecosystem applications, injecting new vitality into the Bitcoin ecosystem. Let’s explore their joint value from multiple dimensions.

1. Enhancing Asset Circulation Efficiency: Integration of Technology and Network

RGB++ introduces a new model for asset issuance in the Bitcoin ecosystem, enabling flexible operations and cross-chain mobility for native assets. However, protocol-level support alone isn’t enough—real-world asset circulation requires an efficient and secure payment network. This is where Fiber plays a crucial role.

-

Support for High-Speed Peer-to-Peer Transactions

Fiber offers virtually unlimited transaction throughput, capable of handling large-scale circulation of RGB++ assets, especially in DeFi and NFT trading. For instance, a user issuing an on-chain asset via RGB++ can use Fiber to make quick, low-fee payments or transfers without waiting for lengthy block confirmations on Bitcoin’s mainchain. Moreover, Fiber’s high-throughput, low-latency, low-cost characteristics align perfectly with RWA (Real World Assets) issued via RGB++ and tokenized traditional financial assets.

-

Seamless Cross-Chain Connectivity

RGB++’s Leap technology enables bridgeless cross-chain functionality, while Fiber seamlessly integrates with networks like Bitcoin’s Lightning Network and Cardano’s Hydra. Through deep integration of RGB++ and Fiber, CKB achieves low-latency, high-reliability asset transfers from Bitcoin’s mainchain to various L2 systems (such as CKB blockchain, Lightning Network, Dogecoin, etc.). This bridgeless approach is particularly suited for financial and payment use cases, minimizing cross-chain operational risks.

2. Supporting the Flourishing of Diverse Assets

RGB++’s flexible design supports various types of on-chain assets, including stablecoins, tokens, NFTs, and other innovative assets. Fiber provides robust underlying support for the payment and circulation of these assets.

-

Integration of Stablecoins and Payments

The Stable++ Protocol built on RGB++ introduces a new over-collateralization model, allowing users to mint the stablecoin RUSD using Bitcoin and CKB. Furthermore, IPN (Interstellar Payment Network) announced plans to build a native payment network on Bitcoin’s mainchain using the RGB++ protocol, launching USDI—the first programmable, compliant stablecoin—to drive mass adoption of BTCFi and Lightning Network applications. USDI will be 1:1 pegged to fiat currencies and backed 100% by high-credit, highly liquid reserves. IPN will strictly comply with AML (Anti-Money Laundering), CFT (Counter-Terrorist Financing), and KYC regulations, encouraging institutional participation in BTCFi. USDI and RUSD will provide native stablecoin support across all UTXO-based blockchains, including BTC, CKB, DOGE, and BCH.

Fiber’s high-performance transaction capabilities make stablecoins like USDI and RUSD more attractive options for payments within the Bitcoin ecosystem, reducing costs and enhancing their circulation within BTCFi.

-

Expanding the Potential of NFT Markets

Current NFT markets are primarily concentrated in ecosystems like Ethereum and Solana. The integration of RGB++ and Fiber opens new possibilities for Bitcoin-native NFTs. For example, Fiber enables RGB++ NFTs to be displayed and traded across multiple chains, allowing users to purchase NFTs with native Bitcoin assets and quickly transfer them across different blockchains.

-

Empowering Meme Assets

RGB++ supports meme token issuance within the Bitcoin ecosystem, with Fiber enabling low-cost distribution and trading. During meme-driven bull markets, this model could attract significant interest from young retail investors. Currently, CKB.Fi—a meme launchpad based on CKB and RGB++—has already launched, and a Bitcoin-native “pump.fun” powered by BTC and RGB++ is reportedly coming soon.

3. Enhanced Asset Privacy and Security

Transaction privacy remains a key concern in traditional blockchain networks, and RGB++ and Fiber complement each other effectively in this regard.

-

RGB++’s Client-Side Validation Model

RGB++ allows users to run their own clients to validate and manage assets directly, eliminating reliance on third-party nodes and enhancing both security and privacy at the source.

-

Fiber’s Decentralized Architecture

Ensures censorship resistance and data security, giving users dual benefits of speed and privacy.

This enhanced level of privacy and security not only strengthens institutional and high-net-worth investor trust in BTCFi but also lays the groundwork for building more sophisticated financial applications.

4. Amplifying Network Effects Across the Ecosystem

The convergence of RGB++ and Fiber generates stronger network effects throughout the entire Bitcoin ecosystem. Their deep technical integration translates into amplified synergy in ecosystem development.

-

Accelerated Ecosystem Development

Fiber will offer developers a complete SDK and toolset, making it easier to build lightning network applications on RGB++. Developers can rapidly create DApps for lending, payments, insurance, and asset management, further diversifying BTCFi.

-

Win-Win for Node Providers and Users

The payment functionality of Fiber and the asset issuance power of RGB++ foster a virtuous cycle between node providers and users. Node operators earn higher fees by supporting RGB++ and Fiber, while users enjoy faster and more efficient transaction services.

-

On- and Off-Chain Traffic Influx

Fiber can also bring in off-chain traffic beyond the Bitcoin ecosystem through cross-chain payments and asset transfers, attracting more users and capital to BTCFi. For example, off-chain payment giants and traditional financial institutions could connect to Bitcoin asset payments via Fiber, expanding use case boundaries.

5. Activating Positive Wealth Effects

The synergy between RGB++ and Fiber brings not only technical and application-level innovation but also injects renewed imagination into capital markets. Driven by the Bitcoin bull market, the narrative around RGB++ and Fiber has become a key factor attracting investor attention.

-

Asset Appreciation Expectations

The flexibility of RGB++ and the high performance of Fiber directly boost market confidence in these assets. Once Fiber launches and achieves scale, RGB++ assets could experience explosive price growth.

-

User Growth and Ecosystem Prosperity

RGB++ and Fiber together attract more participants to the BTCFi ecosystem. Increased user activity enhances asset liquidity and creates greater network value for the Bitcoin ecosystem. This positive feedback loop will maximize the combined value of RGB++ and Fiber.

Fiber Network’s First Supported Assets: Pushing BTCFi Toward Practical Utility

As a major extension of RGB++, Fiber Network will initially support liquidity networks and staking yield mechanisms for four RGB++ assets, injecting fresh momentum into native Bitcoin financial services (BTCFi).

The initial supported assets on Fiber Network include:

-

$CKB (Nervos native token): Provides foundational value and fuel for the Fiber network, connecting BTCFi with the Nervos ecosystem.

-

$USDI (compliant stablecoin): Offers stable on-chain payment and DeFi solutions via RGB++.

-

$ccBTC (1:1 Bitcoin-reserve-backed token): Enables decentralized liquidity and lending on Fiber, expanding BTC’s financial utility.

-

$Seal (leading RGB++ asset): With strong community backing and protocol advantages, Seal stands as an innovator in Bitcoin meme economy and BTCFi applications.

Seal’s Market Momentum and Future Potential

As the flagship RGB++ asset among Fiber’s first supported tokens, Seal has shown exceptional strength—surging 430% over the past week. This surge is driven not only by the rapid development of the RGB++ ecosystem but also by market anticipation surrounding the Fiber Network mainnet launch.

Liquid Staking Rewards: Unlocking New Bitcoin Asset Yield Opportunities

To accelerate widespread adoption of the lightning network, UTXO Stack in the CKB ecosystem will introduce a decentralized liquid staking layer based on the lightning network. Users can hold and stake RGB++ assets (including $Seal, $USDI, etc.) to earn additional rewards on the Fiber network.

-

Technical Highlights:

UTXO Stack leverages the high throughput of the lightning network and the flexibility of the RGB++ protocol to enable trustless staking and reward distribution.

The UTXO model ensures transparent and secure asset management.

-

Use Case Value:

For users, holding assets becomes more than just an investment—it enables participation in deeper layers of BTCFi financial activities, generating continuous passive income.

Outlook: Core Drivers Behind the Rise of BTCFi

The synergy between RGB++ and Fiber represents more than just a fusion of technological innovations—it is a key catalyst propelling the BTCFi ecosystem toward maturity. Their deep integration across asset issuance, circulation, payments, and application development unlocks unprecedented market potential. Through initial supported assets and liquid staking reward mechanisms, they are directly driving practical adoption and expanding real-world use cases for BTCFi. As the Fiber network goes live, this synergistic effect will become even more pronounced, potentially serving as the central driving force behind the rise of BTCFi.

On this new golden track of BTCFi, RGB++ and Fiber are already positioned at the forefront of a transformative era—one that every market participant should closely watch.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News