Absurd BTCFi lacks interpretability

TechFlow Selected TechFlow Selected

Absurd BTCFi lacks interpretability

The demand for BTC is the demand for BTC itself.

Author: Zuoye

EigenLayer demonstrates the need for Ethereum's security space, but ≠ monetization of Ethereum’s security space. Babylon’s real competitor is actually BTC Spot ETFs—the promises of security and yield fall short when moved off-chain.

After a year of intense hype and sudden collapse, we’ve finally reached consensus: demand for BTC is purely demand for BTC itself. It cannot be extended to BTC staking assets, BTC L2s, or BTC-based DeFi.

Replicating Ethereum’s Successes and Failures

Babylon isn’t a new project—it just failed to secure funding for a long time, remaining stuck in academic research.

Solv wasn’t the original startup direction either. It emerged opportunistically after multiple pivots, then rapidly rose to prominence on Binance.

Are Bitlayer/BEVM/Merlin and other BTC L2s truly new projects? At best, there’s a 50% chance. Most were founded around the same time as WBTC. The evidence is clear: paths that previously failed don’t magically succeed on second attempt.

Even Runes failed to replicate the miraculous success of Ordinals inscriptions—eventually cooling enthusiasm, leaving only a sigh: “What a cool autumn.”

Image caption: BTC ETF, Image source: @sosovalue

In Q1 2025 reports, only BTC Spot ETFs succeeded. Beyond Bitcoin itself, ETFs are the most reliable investment vehicle—sharply contrasting with ETH ETFs. While Ethereum’s on-chain ecosystem thrives with diversity, BTC sees its fiercest activity off-chain.

We must admit: BTC doesn’t need redundant reinventions like L2s or staking. The lack of smart contracts isn’t a market gap for Babylon—it’s a deliberate choice for robustness.

Though Vitalik and Ethereum now face mockery, nearly all innovation from BTC and Solana consists of imitation and adaptation. Solana takes DeFi and Memes; BTC adopts staking architectures and yield-bearing use cases, playing at being digital gold RWA.

Solana has achieved at least temporary success, while BTC itself remains strong—$80K corrections barely register. But SOL struggles even above $100, and worse still are the now-discredited BTCFi projects.

Ethereum L2s aren’t failures—they’ve produced successors like Base. Price underperformance doesn't mean lack of utility. In contrast, BTCFi staking layers, L2s, and DeFi have seen only failure upon deeper failure.

In short, BTCFi hasn’t replicated Ethereum’s successes—it has instead inherited all of Ethereum’s failures.

The Tragedy of Monetizing Native Security

As mentioned, EigenLayer aims to monetize Ethereum’s security space by partitioning and leasing it to projects needing security. But EigenLayer doesn’t generate security—it merely relocates existing security.

Why can’t this model be replicated on other blockchains?

Features like LSD/LRT, Memes, and DEXs have been widely adopted across chains without friction. Why can’t BTC replicate this?

In reality, every chain favors one model: asset issuance products—whether wrapped as L2s or staking/re-staking systems.

If you’re bullish on the SVM L2 narrative, consider this prediction: a $100B Solana cannot sustain suburban economics. Beijing needs satellite cities—Tongliao clearly does not.

BTC is similar. The trillion-dollar Bitcoin ecosystem has only one product: BTC itself. Leveraging BTC for marginal arbitrage—like WBTC or ETFs—strengthens BTC’s market cap and earns market approval.

But step beyond that boundary—attempting to transfer BTC’s value onto your own token—and you face an ancient riddle: How do you convince people to swap their BTC for your token? It’s 100 levels harder than getting people to swap USDT for USDD via Sun God.

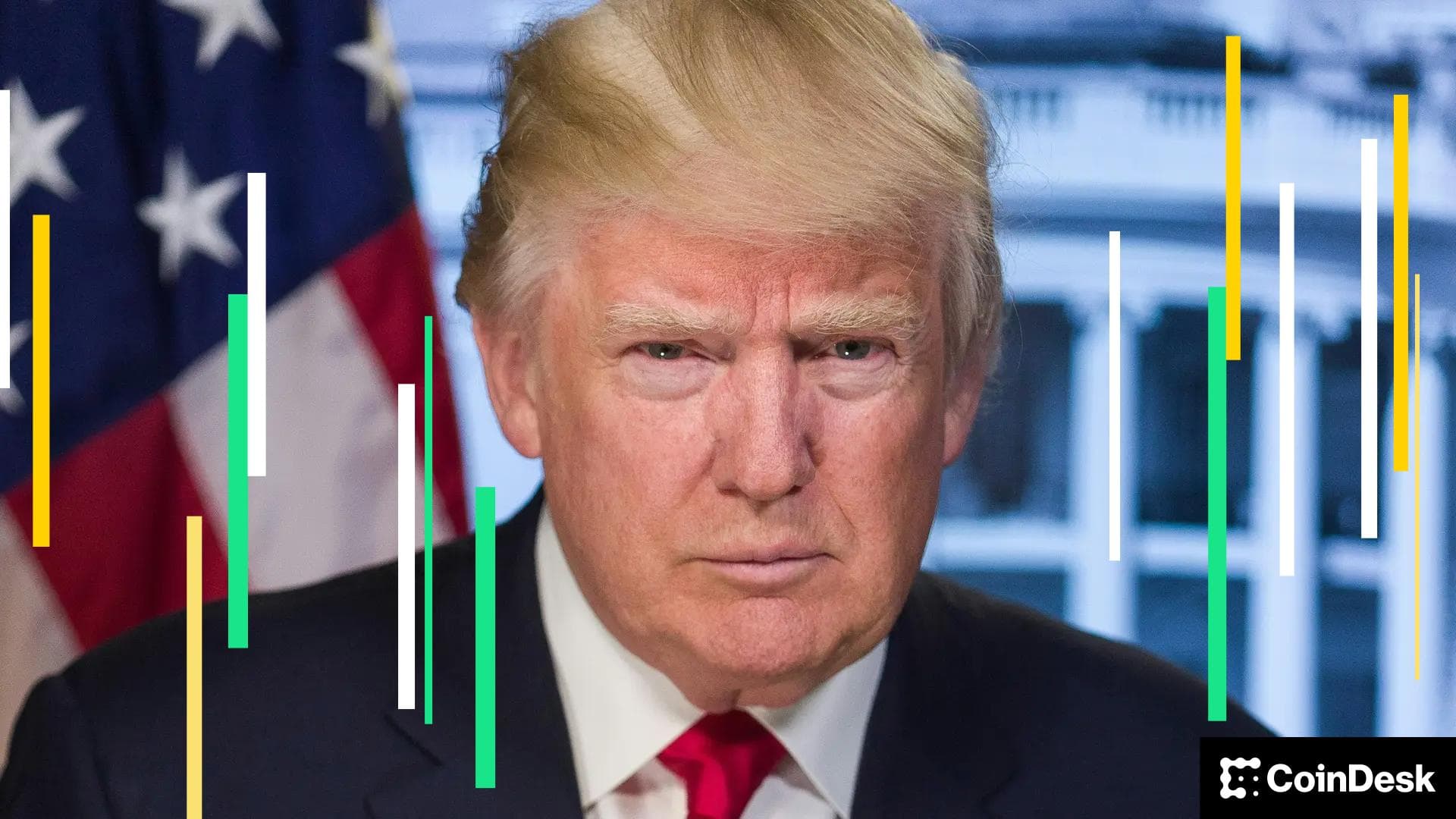

Image caption: BTC Holder Distribution, Image source: River.com

BTC staking protocols may seem booming, but the majority of global BTC is held by exchanges and asset managers. On-chain BTC staking is more a term than a reality.

Ultimately, a staking system can never match the sense of security derived from simply holding BTC. If staking fails to take root, then BTC L2s and BTC DeFi cannot stand either.

Two Dragons Cannot Coexist

ETH L1 became congested, prompting massive L2 infrastructure development—only for Pump Fun to raid the house. That’s the entire story of crypto over the past six months.

Recently, if not for BTC L2s beginning pre-token launch hype, fast-moving crypto natives might’ve already forgotten this ancient memory. In my view, the only winner has been Merlin Chain—fast token launch plus sustained operations.

Image caption: History of BTC L2 Development, Image source: Galaxy Research

Launch too early and you lose goodwill; launch too late and you lose control. If retail anger is inevitable anyway, you might as well choose the path with higher profits—that’s the entire story of BTC L2s over the past year.

Compare this: Ethereum L1 needs L2s to relieve traffic. Current dynamics are merely fiscal adjustments in a central-local relationship. EVM ecosystem fatigue isn’t caused by L2s—even if Ethereum taxed L2s more heavily, retail users wouldn’t return.

SVM L2s follow the same pattern. As Pump Fun nears the end of its profit curve, its survival tactic is seizing cash flow from AMM DEXs. On Ethereum, this would likely result in a Pump Fun Chain.

BTC L2s are most awkward. Unlike Vitalik and the Ethereum Foundation’s supportive guidance, BTC L2 technical approaches are chaotic: some clumsily imitate ZK/OP rollup models; others obsess over patching existing opcodes; still others radicalize by attempting to fully extend Bitcoin’s scripting capabilities.

Compared to the decentralized nature of SVM L2s, BTC L2s feel more like setups orchestrated by project teams and VCs. Ironically, while Anatoly and the Solana Foundation maintain a "no support, no opposition, no encouragement, no rejection" stance toward SVM L2s, Solana—long mocked as a data-center chain—is ironically the true OG upholding decentralization.

So life goes on for 365 days, until entering the post-VC, post-market-maker listing phase. Amidst public confusion and shock, BTC L2s one by one announce their airdrop plans and tokenomics.

Yet BTC itself remains indifferent to these dramas—whether $80,000 or $1, whether digital gold or savior of U.S. bonds—none of it moves the needle.

Conclusion

Since BTC’s inception, industries like wallets, mining, and wrapped assets have flourished, laying the foundation for Ethereum’s ecosystem—even Vitalik himself was nurtured through Bitcoin Magazine.

But BTC is too unique. Unlike competitors grappling with mass adoption and externalities, Bitcoin has no central figurehead, avoiding the political maneuvering required by newer projects like Movement.

Like AI’s internal mechanisms, this absurd world lacks explainability. BTC chooses not to explain. BTCFi seeks new paths, yet proves again that the old road remains the most robust.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News