New Trends in Bitcoin Ecosystem Development: Transitioning from Institutional Investment to Consumer Chains, How is Core Driving BTCFi?

TechFlow Selected TechFlow Selected

New Trends in Bitcoin Ecosystem Development: Transitioning from Institutional Investment to Consumer Chains, How is Core Driving BTCFi?

Institutions are at a critical turning point in adopting Bitcoin.

Author: Weilin, PANews

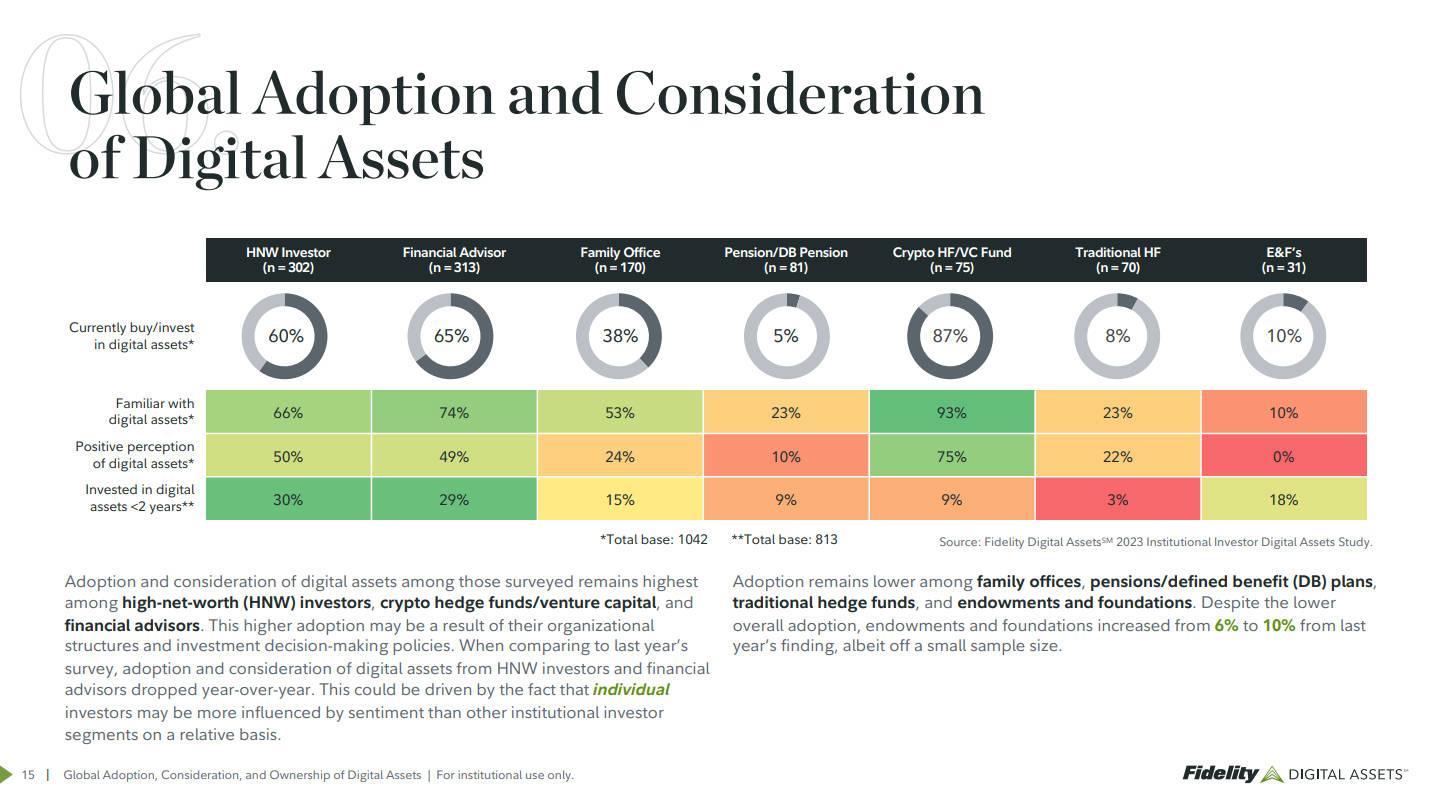

In the current cycle, institutional adoption of Bitcoin has become a highly watched trend. A survey by Fidelity indicates substantial untapped demand for Bitcoin adoption. Influenced by the approval of U.S. Bitcoin ETFs and shifts in regulatory policies, governments and large funds are beginning to view Bitcoin as a strategic reserve asset. The United States may establish a strategic Bitcoin reserve, with increasing numbers of countries and institutions potentially following suit—possibly giving rise to a new financial paradigm. Institutional Bitcoin adoption is at a critical turning point.

Through its Fusion upgrade introducing dual staking, combined with yield-generating ETPs and CoreFi strategies, TechFlow offers solutions for generating real yield on Bitcoin. Messari recently released growth metrics for TechFlow in Q4 2024, revealing a trend within the Bitcoin ecosystem toward transitioning from institutional investment to consumer chains as the user base expands. As of February 4, more than 5,700 Bitcoins have been staked on TechFlow's chain, with a total value locked exceeding $850 million.

Current State of Institutional Bitcoin Investment: Significant Untapped Demand, at a Critical Juncture

A June 2024 survey by Fidelity Digital Assets shows growing interest among institutional investors in Bitcoin. Conducted the previous year, the survey polled over 1,000 global institutional investors worldwide. In the survey, 60% of institutions reported having knowledge of digital assets, and 51% said they are currently investing in them. In 2019, only 39% of institutions were aware of digital assets, while just 22% of U.S. investors were investing in digital assets at that time.

A deeper analysis of this data reveals two types of investors. On one hand, institutionally driven individual investors—such as high-net-worth individuals, investment advisory firms, crypto hedge funds/VCs—70 to 80% of whom have already invested in digital assets. On the other hand, large institutions such as pension funds, traditional hedge funds, endowments, and foundations still show single-digit percentage adoption rates. With Bitcoin’s current market cap around $2 trillion, institutional adoption is at a pivotal moment, marked by vast unmet demand.

In 2024, well-known institutions like Strategy (formerly MicroStrategy), BlackRock, ARK Invest, and Fidelity strengthened Bitcoin’s market presence through strategic investments and innovative financial products like Bitcoin ETFs. As of January 24, Strategy held 471,107 Bitcoins at an aggregate cost of approximately $30.4 billion. Throughout 2024, the company purchased an additional 258,320 Bitcoins.

With the approval of spot Bitcoin ETFs and the Trump administration’s support for crypto assets, an increasing number of major companies and institutions are adopting Bitcoin reserve strategies. Firms such as Strategy, MARA Holdings, and Riot Platforms have incorporated Bitcoin into their treasury reserves, gradually integrating cryptocurrencies into mainstream discourse. Under the new U.S. administration, both state and federal levels are exploring plans to hold Bitcoin as a reserve asset, and anticipated regulatory reforms are expected to further accelerate institutional adoption.

From an asset perspective, Bitcoin offers high returns (9,800% return over eight years). Despite higher risk and volatility, its low correlation with traditional assets makes it an ideal tool for portfolio diversification. Compared to traditional alternative assets like real estate and art, Bitcoin holds clear advantages in liquidity, transparency, and divisibility.

How Core Enhances Real Yield Solutions: Fusion Upgrade Introduces Dual Staking, Yield-Generating ETPs, and CoreFi Strategies

Institutions invest via direct purchases, Bitcoin futures, ETFs, custody services, BTCFi, and stocks tied to Bitcoin. TechFlow provides institutions with BTCFi staking options to securely and steadily earn yield.

In April 2024, the TechFlow blockchain first integrated non-custodial Bitcoin staking, enabling users to stake Bitcoin and earn yield while retaining full control over their assets. This native mechanism generates Bitcoin yield without requiring additional trust assumptions.

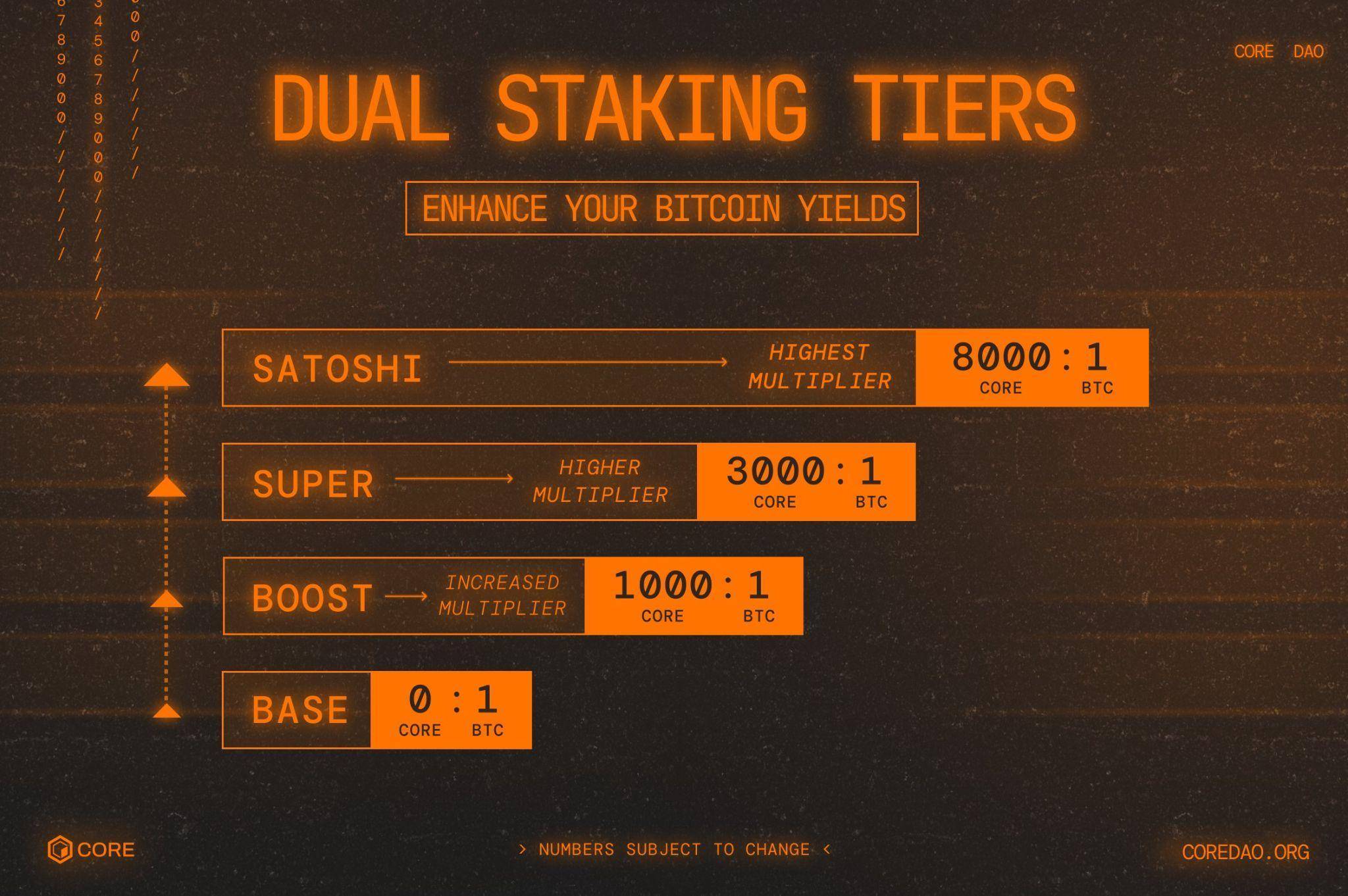

On November 19, 2024, TechFlow launched its Fusion upgrade. PANews previously highlighted how this upgrade opened new market opportunities for TechFlow within the Bitcoin ecosystem. The introduction of dual staking aims to address potential imbalances in community reward distribution caused when Bitcoin stakers, after locking their assets, claim CORE tokens through validator nodes—especially significant when institutions stake large amounts of Bitcoin, leading to increased CORE emissions. To encourage Bitcoin stakers to re-stake their received CORE rewards back into validator nodes, dual staking boosts participation by offering higher annual percentage yields (APY).

To further enhance yield generation from non-custodial Bitcoin staking, the dual staking mechanism unlocks higher reward tiers by simultaneously staking both Bitcoin and CORE tokens. Since daily CORE emissions are fixed, users who stake both Bitcoin and CORE receive elevated rewards. The reward increase scales with the amount of staked CORE tokens, encouraging deeper engagement in the TechFlow ecosystem and maximizing returns for loyal users.

Recently, TechFlow introduced its first yield-generating Bitcoin exchange-traded product (ETP), offering investors opportunities to earn yield through non-custodial Bitcoin staking. Partnering with Valour, a subsidiary of DeFi Technologies, this ETP delivers a 5.65% yield, serving as a key entry point for institutional investors into the BTCFi ecosystem.

On February 4, DeFi Technologies entered into a binding letter of intent with CoreFi Strategy and Orinswift Ventures, aiming to facilitate a reverse takeover so that the merged entity’s common stock can be listed on the Cboe Canada Exchange. The TechFlow Foundation will contribute $20 million worth of CORE tokens to strengthen CoreFi’s treasury reserves. Additionally, CoreFi plans to raise $20 million through concurrent financing to accelerate development in BTCFi technologies.

Furthermore, TechFlow has partnered with custodial service providers including Fireblocks, Copper, Cactus, and Hashnote to support dual staking. Inspired by the success of Strategy and Metaplanet, CoreFi strategies offer regulated investment vehicles enabling institutional investors to leverage Bitcoin and CORE yield.

On February 18, the TechFlow Foundation, in collaboration with Maple Finance, BitGo, Copper, and Hex Trust, announced the launch of lstBTC. lstBTC will serve as a new type of liquid, yield-bearing Bitcoin token on the TechFlow blockchain, designed specifically for institutions to generate yield from idle Bitcoin holdings. By transforming Bitcoin into a productive asset, lstBTC enables holders to convert billions of dollars into yield-generating positions while maintaining security, compliance, and liquidity.

Institutions can mint lstBTC by depositing Bitcoin into trusted custodians such as BitGo, Copper, or Hex Trust. lstBTC generates yield while remaining fully liquid—allowing institutions to trade, transfer, or use it as collateral. Upon redemption, holders receive their original Bitcoin plus proportionally calculated yield directly deposited into their custodial accounts.

Key features of lstBTC include:

Unlike other Bitcoin yield solutions, lstBTC is built specifically for institutions, eliminating the need for asset transfers or unnecessary risks.

No changes to custody arrangements—organizations can continue holding Bitcoin with existing custodians.

Real BTC yield—earn BTC-denominated returns through TechFlow’s dual staking mechanism without moving Bitcoin out of custody.

Fully liquid and scalable—lstBTC can be traded, transferred, or used as collateral while the underlying Bitcoin continues earning yield.

Built for institutional use cases—seamlessly integrates into existing and new portfolio strategies to boost returns.

Emerging Trends Based on Data: TechFlow Leading Bitcoin Adoption, Transitioning from Institutional Investment to Consumer Chains

As hype and speculation subside, the blockchain sector increasingly prioritizes practical applications and genuine user growth. TechFlow is emerging as a consumer chain for Bitcoin, driving real-world usage and sustained user expansion.

According to a third-party report by research firm Messari, in Q4 2024, TechFlow’s DeFi TVL (in USD) grew 90% quarter-over-quarter to reach $811.8 million. Avalon Labs ranked first in DeFi TVL, followed by Colend and Pell Network. Pell Network launched Bitcoin restaking functionality in August, bringing fresh momentum to the TechFlow ecosystem.

TechFlow and BTC staking (in USD) rose 31% quarter-over-quarter to $730.5 million. This growth was primarily driven by 500 Bitcoins staked via TechFlow’s non-custodial Bitcoin staking product, launched in April.

TechFlow’s average daily active addresses surged 160% quarter-over-quarter to 249,700. By the end of Q4, the cumulative number of unique wallets on TechFlow reached 34.8 million. Fees increased 97% quarter-over-quarter to $235,000.

In Q4, TechFlow released the Fusion upgrade, launching dual staking and introducing LstBTC. During the quarter, 1,298 Bitcoins and 16.5 million CORE tokens were dual-staked, representing 22% and 19% of all Bitcoin and CORE staked on the TechFlow network, respectively.

Judging from performance metrics, TechFlow has achieved authentic user growth and consistent block space demand, outpacing competitors. Looking ahead, TechFlow’s Q1 priorities will focus on further developing relationships with custodial and institutional partners.

As a consumer-chain trend emerges in the Bitcoin ecosystem, TechFlow is leading this transformation, advancing real-world application and broader adoption of Bitcoin. Through innovative staking mechanisms, yield-generating financial products, and a robust network of partners, TechFlow not only provides stable yield channels for institutional investors but also creates greater participation opportunities for everyday users. Going forward, as the regulatory landscape clarifies and technology advances, TechFlow is poised to play a pivotal role in driving Bitcoin’s evolution from an investment instrument to a consumer chain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News