Chainalysis: How Do Traditional Financial Institutions Gradually Adopt Cryptocurrencies?

TechFlow Selected TechFlow Selected

Chainalysis: How Do Traditional Financial Institutions Gradually Adopt Cryptocurrencies?

Overview of considerations for launching crypto products, enabling financial institutions to assess market opportunities while addressing regulatory and compliance requirements.

Author: Chainalysis

Translation: Felix, PANews

In recent years, cryptocurrency has become a mainstream asset class, with institutional investment serving as one of the key drivers behind global crypto adoption. In 2024, several notable developments further cemented crypto’s position within traditional finance (TradFi). Institutions such as BlackRock, Fidelity, and Grayscale launched Bitcoin and Ethereum ETPs, offering retail and institutional investors easier access to these digital assets. These financial products have drawn increased attention to comparing the investment value of cryptocurrencies against traditional securities.

Additionally, tokenization of real-world assets—such as bonds and real estate—is gaining traction, enhancing liquidity and accessibility in financial markets. Siemens' issuance of a $330 million digital bond demonstrates how traditional financial institutions (FIs) are adopting blockchain technology to improve operational efficiency. While many similar institutions have already begun integrating crypto-related technologies into their service offerings, others remain in the evaluation phase.

This article outlines key considerations for launching cryptocurrency products, enabling financial institutions to assess market opportunities while addressing regulatory and compliance requirements.

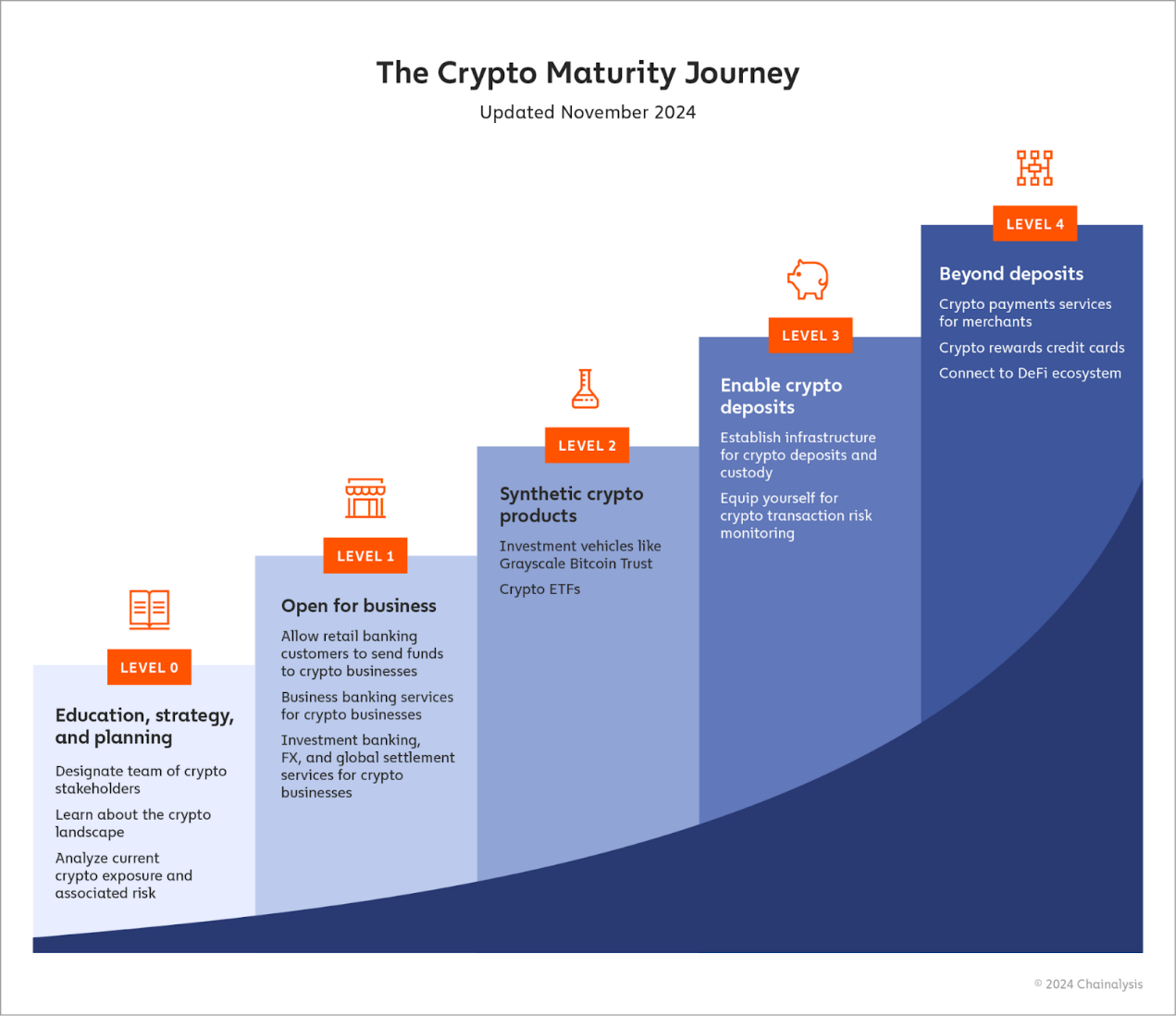

The article explores five typical stages of cryptocurrency adoption for financial institutions:

-

Level 0: Education, Strategy, and Planning

-

Level 1: Opening Business Relationships

-

Level 2: Synthetic Crypto Products

-

Level 3: Enabling Crypto Deposits

-

Level 4: Advanced Products, DeFi, and Beyond

Level 0: Education, Strategy, and Planning

Organizations considering entry into the crypto space typically begin by identifying key stakeholders across multiple departments, along with a designated leader to oversee the initiative. This individual may be hired from the crypto industry, although external recruitment can also wait until the business-opening phase, when the institution is exploring how to support crypto or launch a crypto program. Generally, these stakeholders fall into two categories:

-

Frontline professionals who directly engage with crypto or crypto businesses—such as investment bankers, commercial bankers, traders, corporate lenders, and wealth managers.

-

Enterprise risk professionals—who evaluate which crypto products are viable, including specialists in market risk, KYC, anti-money laundering / countering the financing of terrorism (AML/CFT), sanctions, financial crime, fraud, and compliance.

The above list is illustrative rather than exhaustive, but these two groups will be the primary participants in launching any crypto product. However, once such products become reality, company-wide coordination and executive sponsorship and engagement may be required.

Once an initial crypto team is established, it should be brought together to determine how entering crypto aligns with the institution’s risk appetite and to identify knowledge gaps that must be filled to properly assess risks associated with any crypto opportunity—including compliance risks. This phase includes training teams to use blockchain analysis tools.

Banks at Level 0 can also start by assessing their current exposure to cryptocurrency and measuring the resulting risks. Given current adoption levels, many banks already have some form of financial connection to the crypto industry—whether through retail banking programs, cross-border financial services, or corporate lending initiatives. During this process, banks may need to understand the specific crypto businesses they or their customers interact with and consider screening them using industry intelligence tools.

Finally, any financial institution interested in entering crypto should begin by learning as much as possible about the industry. Numerous resources are available:

-

Educational content: Industry leaders regularly publish materials that help institutions better understand the opportunities and risks within the crypto ecosystem.

-

Social media: The crypto industry is one of the most active on social platforms, with Crypto X being central. For example, Vitalik regularly shares insights on the latest industry developments, alongside a large number of insightful online journalists, commentators, and independent researchers.

-

Communities: Crypto communities enable broad real-time conversations, as nearly every project has its own Discord or Telegram channel where users gather. In an active channel, one hour of discussion can equate to hours of research. Moreover, these chats often lead to in-person meetings and networking.

-

Personalized consulting: Experts can be consulted to learn how to better use these tools and gain deeper industry insights.

Level 1: Opening Business Relationships

Once a financial institution has identified its key stakeholders, educated them about the crypto ecosystem, and established its risk appetite and compliance procedures, it can begin considering its clients. The first step is to start supporting and engaging with crypto businesses just as with any other business.

In retail banking, this means allowing customers to transact with crypto businesses that meet the institution's risk criteria. Historically, financial institutions struggled to accurately assess risk in retail banking relationships involving crypto.

Lack of standardized regulatory frameworks, reliable data sources, and transparency in crypto market activity made it difficult to effectively evaluate counterparty risk, limiting exposure. However, with tools like crypto compliance solutions, many banks have successfully adapted their processes to properly assess the risk of individual crypto businesses and safely expand their exposure to the sector in a regulated manner.

Crypto-friendly banks can also begin accepting crypto businesses as direct clients. Notably, BankProv (formerly Provident Bank), one of the oldest banks in the U.S., now offers specialized services for crypto businesses, including USD-denominated accounts and crypto-to-fiat conversion. Banks like AllyBank and Monzo allow customers to link their accounts to external crypto exchanges, reducing friction between crypto and TradFi and making it easier for users to manage both their crypto and traditional assets.

Banks can offer additional services to crypto clients. For instance, in 2018, JP Morgan Chase and Goldman Sachs advised Coinbase on its direct listing. More recently, Coinbase engaged advisory firm Architect Partners (which previously merged with crypto investment bank Emergent) for consultation on acquiring derivatives exchange FairX. Many crypto firms have now grown into global operations and require foreign exchange (FX) services and more robust global settlement mechanisms.

Architect’s acquisition of Emergent highlights another critical need: the crypto expertise required to enter this space. Fortunately, such expertise can be acquired through targeted hiring rather than full-scale acquisitions. Building one or more digital asset teams involves recruiting experienced crypto professionals in key areas such as compliance, security, and other specialized services the institution aims to provide.

Level 2: Synthetic Crypto Products

Once a bank becomes comfortable working with crypto businesses, it may want to help retail and institutional clients gain exposure to crypto markets. However, this does not require accepting crypto deposits or holding crypto assets on behalf of clients. Instead, financial institutions can offer synthetic investment products based on cryptocurrencies, allowing clients to benefit from crypto price appreciation without directly handling digital assets.

In 2024, Bitcoin ETPs emerged as breakthrough instruments for providing crypto exposure. Among the most prominent are BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin ETP (FBTC), both of which hold actual Bitcoin. Similarly, Ethereum ETPs gained momentum. Major funds such as VanEck and ArkInvest launched Ethereum ETPs in 2024, enabling investors to indirectly hold ether, the native token of the Ethereum network. Given Ethereum’s and smart contracts’ critical roles in DeFi, these ETPs offer a direct way to invest in blockchain innovation.

Looking ahead, ETPs on other blockchains such as Solana could follow. While Solana-based ETPs have not yet been approved, investors can already gain exposure through products like Grayscale’s Solana Trust (GSOL). As the Solana blockchain ecosystem continues to expand, more ETPs are likely to emerge to meet growing investor demand.

Level 3: Enabling Crypto Deposits

At Level 3, banks give customers direct access to crypto markets by allowing them to deposit digital assets—and potentially even custodying those assets on their behalf. In 2024, only a few traditional financial institutions have taken this step, but rising interest from both retail and institutional clients is pushing more banks to support crypto deposits.

Rather than building transaction monitoring tools from scratch, BNY Mellon integrated Chainalysis software, leveraging our suite of products for real-time transaction monitoring, accessing real-time risk data on crypto companies their customers may interact with, and investigating suspicious activities. This approach enabled faster deployment of crypto solutions with less upfront investment, while benefiting from native crypto expertise.

Fortunately, financial institutions do not have to navigate this space alone. Partnerships with crypto-native firms allow banks to outsource the technical complexity of holding digital assets. In 2022, BNY Mellon launched its own digital asset custody solution—but instead of building the entire platform internally, it partnered with digital asset security firm Fireblocks to obtain the necessary infrastructure.

Level 4: Advanced Products, DeFi, and Beyond

Few financial institutions currently offer services beyond custody when adopting crypto, but it is not unheard of. For example, Fidelity expanded its custody services to allow institutional clients to stake Bitcoin as collateral in DeFi-based lending, while SEBA Bank continues collaborating with DeFi-native firms like DeFi Technologies. DeFi remains one of the fastest-growing and most exciting sectors in crypto.

Payments represent another area where crypto adoption is advancing. Visa continues to lead in this domain, recently expanding its stablecoin settlement capabilities to allow USDC transactions with merchant acquirers. Similarly, PMC’s IP Coin continues facilitating commercial payment transactions, further integrating blockchain into traditional banking.

Conclusion

As cryptocurrency becomes increasingly mainstream, banks are recognizing ways they can assist their clients while driving revenue and incorporating crypto into broader strategic goals. While the journey may seem daunting at first, financial institutions can adopt crypto in a structured, step-by-step manner—allowing them to test and refine their offerings at each stage.

The key lies in identifying the right types of products and services to build at each step. The inherent transparency of crypto makes this easier. With the right tools, financial institutions can correlate blockchain-based transaction data with their own proprietary records, observe how funds move across different wallets and services, and use these insights to inform business decisions—identifying which crypto services best serve their target customer base. From there, it comes down to hiring the right talent or partnering with the right crypto-native firms to build the necessary infrastructure and compliance tools for new crypto products.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News