How to position for the final leg of the bull market after BTC breaks through $90,000?

TechFlow Selected TechFlow Selected

How to position for the final leg of the bull market after BTC breaks through $90,000?

The window of opportunity to exit may last only a few months, so it's important to seize it.

Author: Duo Nine⚡YCC

Translation: TechFlow

The wait is finally over.

Your efforts are about to be handsomely rewarded.

In this newsletter, everything you learn will converge into a complete cycle over the coming months.

This period is crucial for your success now and in the future. It’s your moment to shine and apply what you've learned. Congratulations on making it this far.

Now, let’s dive in. A brief summary is provided at the end.

We have just entered the final phase of a four-year cycle. This is the most exciting and challenging time. Market volatility is intense—prices can swing double digits overnight and keep breaking records.

What's your exit strategy? To succeed, you need one. We’ll explore that in detail shortly.

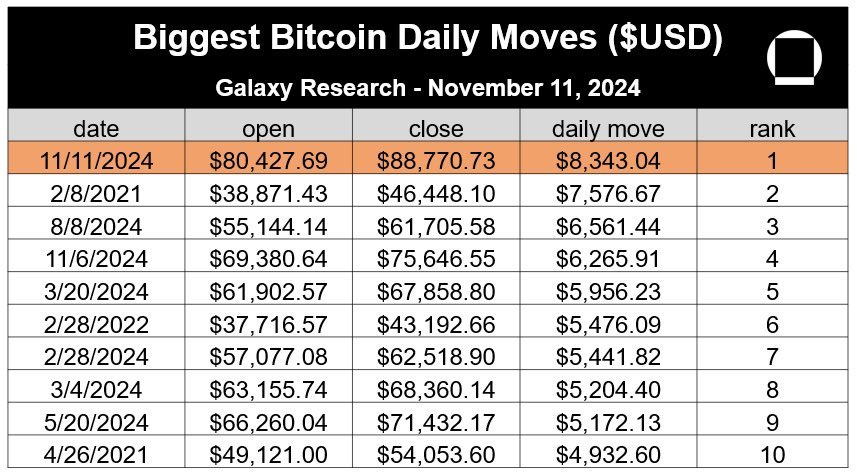

Just this week, Bitcoin hit a new high of $90,000. This isn’t just a new price record—it was also the day with the largest nominal gain in 24 hours. Bitcoin surged over $8,300 in a single day. See the chart below.

Daily swings of $10,000 will soon become normal. Even writing this feels crazy, but there’s already an 83% chance it will happen. No wonder, in my previous alpha post, I advised keeping things simple and just buying one coin.

That coin is Bitcoin.

At the time, the price was $70,000. Since then, Bitcoin has risen nearly 30%! Many people are chasing opportunities in altcoins, while the biggest opportunity stands right in front of them every day.

Bitcoin offers the best risk/reward ratio in crypto. When factoring in risk and volatility, no other investment compares to its potential returns. Keep this in mind when looking at emerging coins that carry higher risk.

However, altcoins are surging too. For example, since early November, DOGE has nearly tripled in price. I’ve been recommending it for months—back when it was around 10 cents, now it’s around 40 cents. This is the stage of the cycle where everyone can easily make money.

This is the time when anyone can profit easily.

But this won’t last long. This phase is typically the shortest in a cycle—the final leg before it ends. The faster and higher prices rise, the closer we may be to the peak. If this momentum continues for several weeks, we could reach the top very quickly.

Here’s the most optimistic scenario:

-

Bitcoin reaches $300,000 by April 2025—just five months away.

Could this happen? I have good news—keep reading.

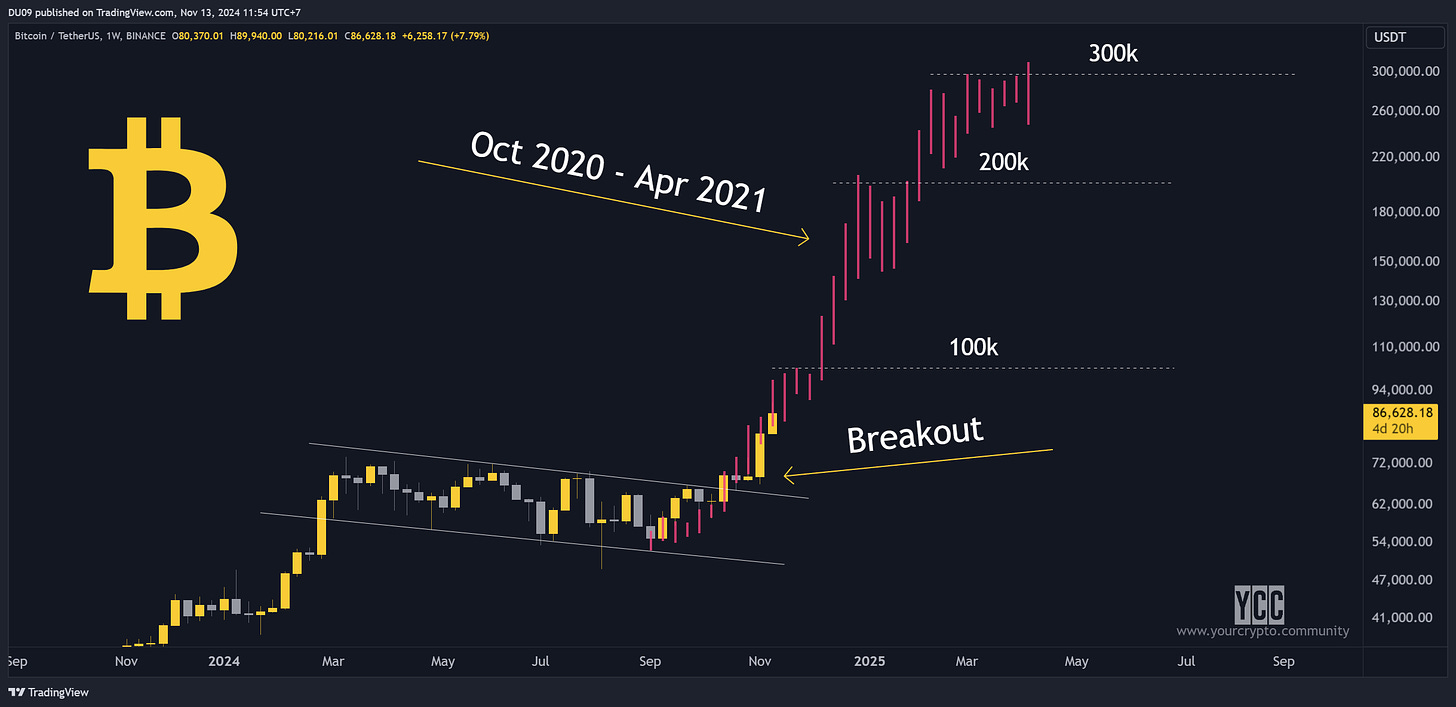

If current momentum mirrors the pink section above—the most aggressive bull run from the previous cycle (October 2020 to April 2021)—Bitcoin could surge another 4x after its breakout point. We’ve just experienced a similar breakout in this cycle.

If you examine the projections, past price movements reflect resistance levels at $100k, $200k, and $300k. That seems like a strange coincidence. What will happen next remains to be seen, but there’s reason to stay optimistic.

Rumors suggest some nations are entering the Bitcoin market due to fear of missing out.

Additionally, institutional investors have confirmed they’re allocating part of their capital to Bitcoin, sending the message: “You must get exposure.” The launch of Bitcoin ETFs this year is a positive development, as it now allows anyone to buy in.

What should you do?

If you’ve followed me for a while, you should already know that this isn’t actually the time to gain market exposure—you’re late. You gain exposure during bear markets or periods of market calm (or stagnation). Right now, we’re in the opposite environment. Market sentiment is high, and FOMO is starting to emerge.

The final stage of this cycle is about selling and locking in profits. This doesn’t mean you can’t continue buying and profiting—you can—but the risks are much higher now.

Bitcoin has entered a price discovery phase.

This means Bitcoin has broken through its previous all-time highs, and no one knows how high it can go or where it will peak. Prices will be highly volatile and uncertain.

Buyers and sellers will test each other while searching for the top. This is a dangerous process—when the market suddenly reverses, you don’t want to be the last one holding the bag. Pay special attention to your use of leverage, as market volatility will be extreme.

Therefore, your goal should be to exit while the market is active. According to the charts above, the market may peak in activity by early 2025. That will be your best window to exit. Don’t obsess over exact price points—focus on exiting within that timeframe. I’ll share more guidance in the sections below.

1. Sell all altcoins when the market is most active

A good way to determine when to sell altcoins is by watching Ethereum and Solana. If they hit new all-time highs, it’s a strong signal that you should start taking profits as altcoins rally.

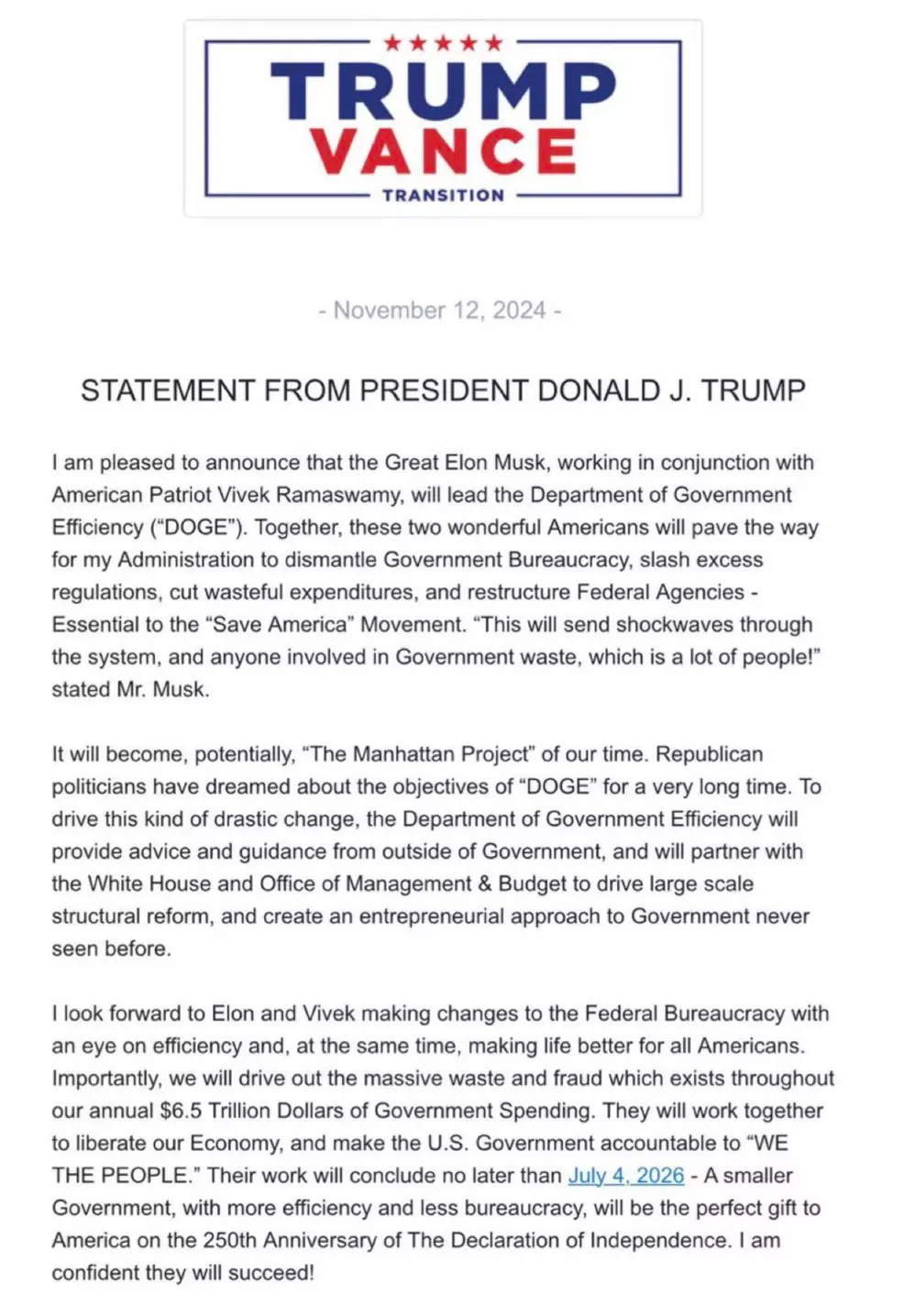

Note that most altcoins, such as DOGE, have their own market cycles and may rise earlier or later due to other factors. In the case of this internet-culture-driven cryptocurrency, it’s being pushed constantly by Elon Musk and President Trump.

Trump’s recent statements are big news for DOGE holders. Given the exposure it will receive from this newly established Department of Government Efficiency (i.e., DOGE), its price could rise to $1.

Crucially, sell off all your altcoins as Bitcoin approaches its peak. Don’t get stuck holding them when the next bear market hits.

2. Do not sell Bitcoin unless absolutely necessary

I don’t recommend selling Bitcoin, because in the long term, it will continue to perform well—projected to potentially reach $1 million by 2030 or beyond. Whether you want to sell is ultimately your choice.

If you decide to sell, start gradually above $100,000, selling no more than 10% at a time. You want to sell incrementally during the rise, ideally near the top. A similar approach can be applied to altcoins.

If you hold less than one Bitcoin, focus on accumulating as much as possible, or prepare funds to buy more during the next bear market. If you hold more than one, consider selling a portion at the peak to secure capital for future purchases. Either way, use profits from altcoins to buy more Bitcoin during the next bear market.

Never risk losing your Bitcoin. It is a key asset for achieving financial freedom. Focus on the long-term vision. However, if this money is critically important to you, carefully consider your reasons for selling. If it’s for buying property, ensure that property will appreciate into the millions. Remember, Bitcoin is the hardest asset in the world!

3. Control your fear of missing out (FOMO), or you may suffer losses

A common mistake is selling, then seeing the price keep rising and rushing back in. This often leads to re-entering at market peaks and suffering losses.

This is a common trap that many fall into. Therefore, you need a clear, actionable exit plan. After selling, store your profits somewhere hard to access—like a hardware wallet, or invest in gold (e.g., PAXG)—and leave it untouched for at least a year.

When panic hits and the market enters so-called “death mode” (when media declares Bitcoin dead), that’s when you can return with your profits. Buy as much Bitcoin as possible. I’ll be here to help—don’t worry.

Share your exit strategy in the comments, and let me know your target price for Bitcoin below.

Summary & Recommendations

-

We are in the most exciting phase of this crypto cycle—the final stretch;

-

This is your time to sell and lock in massive gains, with the goal of fully exiting altcoins;

-

The end of the cycle brings great opportunities—but also extremely high risks;

-

Have a clear exit plan and execute it without being driven by fear of missing out (FOMO);

-

The exit window may only last a few months—make the most of it;

-

Your ultimate goal should be accumulating more Bitcoin—think long-term!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News