KOL Debate: Do Exchange Listing Fees Exist?

TechFlow Selected TechFlow Selected

KOL Debate: Do Exchange Listing Fees Exist?

Behind the hidden corners of the industry, how many unknown transactions remain concealed.

Author: shaofaye123, Foresight News

Following Moonrock Capital CEO Simon's post complaining about exorbitant listing fees, the controversy over cryptocurrency exchange listing costs has intensified. Key opinion leaders across the industry have engaged in heated debate—Are these sky-high listing fees real? What are the hidden listing fees? How do exchanges profit? Behind the industry's shadowy corners lie countless undisclosed deals. Let's examine them one by one.

The Exorbitant Listing Fee Controversy

Since its emergence, the issue of exorbitant listing fees has drawn significant attention, prompting responses from numerous prominent figures in the industry. Besides Andre Cronje, co-founder of Sonic Labs, swiftly refuting Coinbase, TRON founder Justin Sun also voiced support, stating, "Binance did not charge us any listing fee. However, Coinbase requested we pay 500 million TRX (approximately $80 million) and deposit $250 million worth of BTC into Coinbase Custody to improve their performance."

Conflux COO Yuanjie Zhang subsequently added his support, saying, "Binance charged zero listing fee for CFX. A deposit of 150k BUSD was forfeited due to poor token performance. Since there was no security vulnerability in the Conflux network, the collateral of 5 million CFX tokens was eventually returned. When will CFX be listed on Coinbase for free? I can defend you."

Binance quickly responded positively as well. Besides a statement from Yi He on Twitter, recently released Changpeng Zhao also issued a declaration: "Bitcoin has never paid any listing fee. Focus on projects, not exchanges."

For further reading on this incident, see: Rumors Abound: Are Binance’s Sky-High Listing Fees Real?

What Are the Hidden Listing Fees?

In September this year, Yi He addressed market concerns regarding listings. Binance has a fundamental framework and strict procedures for listings, involving four stages: business development, research team review, committee assessment, and compliance audit—ensuring no suspicion of information leaks or insider trading.

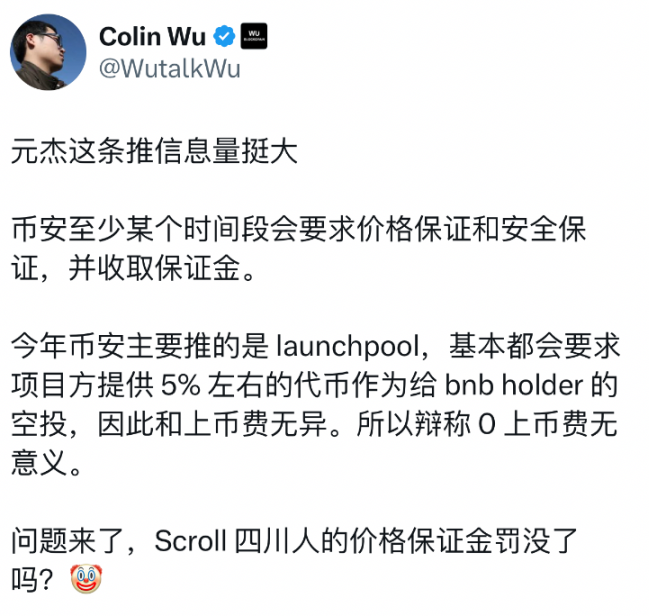

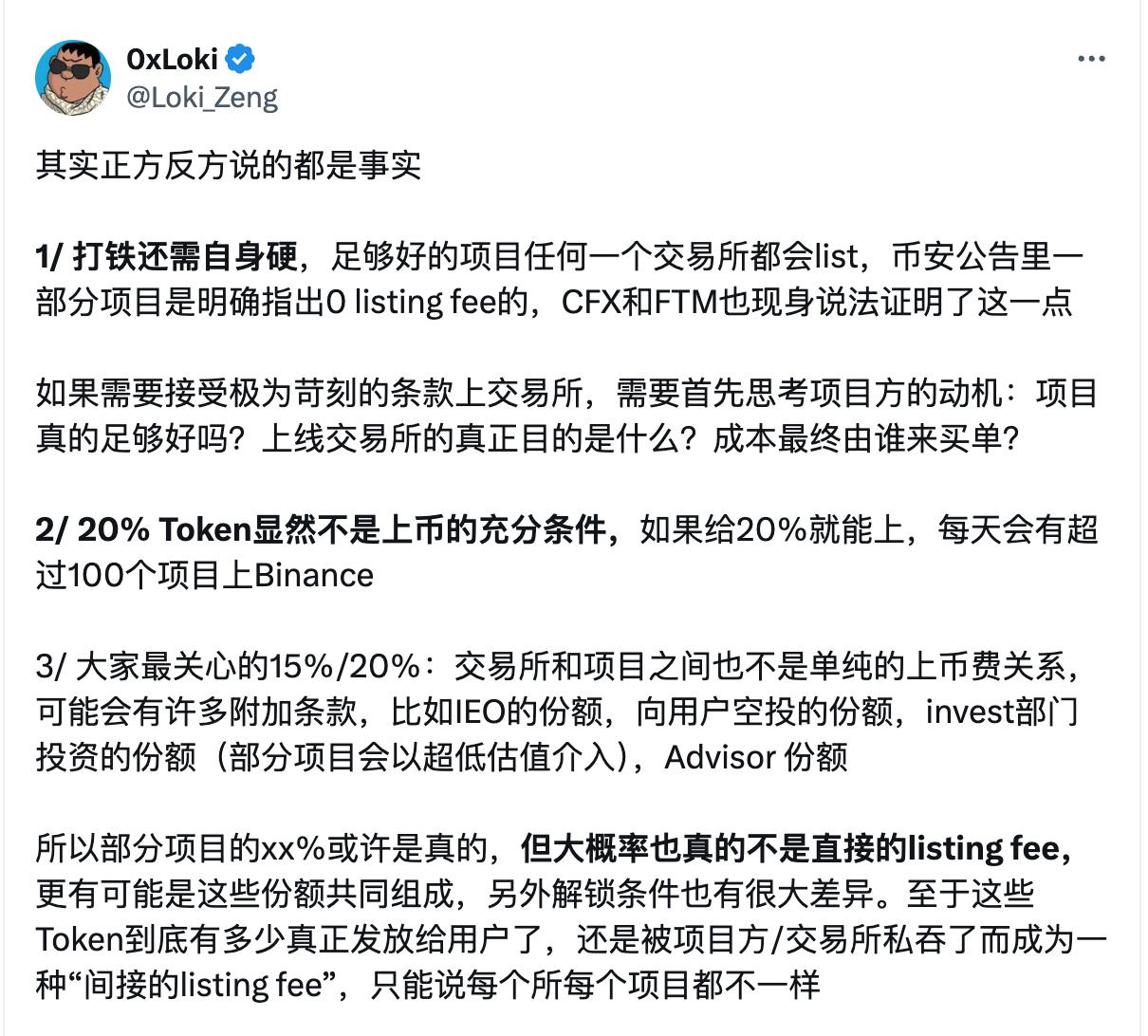

Based on disclosed information, Binance does not directly accept token allocations or stablecoins as bribes during the listing process. However, projects must allocate a certain portion (around 5%) to Binance Launchpool and may need to reserve airdrop rewards for specific users. Beyond these known costs, as seen with CFX’s listing, projects are also required to post substantial collateral to ensure price stability, which could be forfeited otherwise. Additionally, Binance's investment share, marketing budgets, and other expenses require prior agreement between the project and Binance.

Regarding these components labeled as "hidden listing fees," some argue that collateral requirements and airdrops are merely rebranded versions of high listing fees—an iceberg whose bulk remains submerged. Others contend these practices are justified and should not be conflated with hidden fees, since airdrop allocations, for example, serve as user incentives.

Concerns Surrounding Centralized Exchanges

Shady practices within the industry are not uncommon. Given the highly profitable nature of exchange operations, it is difficult to ensure complete transparency in all transactions.

Currently, aside from trading fees and yield from capital utilization, exchanges may also benefit from users' small, untradeable assets left in accounts or from front-running and arbitrage based on account data. Compared to these, many non-compliant exchanges resort to malicious tactics such as price manipulation ("pinning"), data-driven dump attacks, or rumor-based market crashes to generate profits.

Under the traditional centralized exchange model, manipulative actions like Robinhood restricting buy/sell orders during the GME event are hard to avoid. Moreover,利益 exchanges between projects, market makers, and exchanges remain opaque to retail investors. Users appear unable to occupy an equitable position under the centralized exchange model.

Negative Return Rates on Listings

Listings are meant to generate profits—whether for retail investors, exchanges, or projects. Yet, considering current listing return rates, discussions around hidden listing fees may miss the point. Perhaps greater focus should be placed on token price recovery and project development.

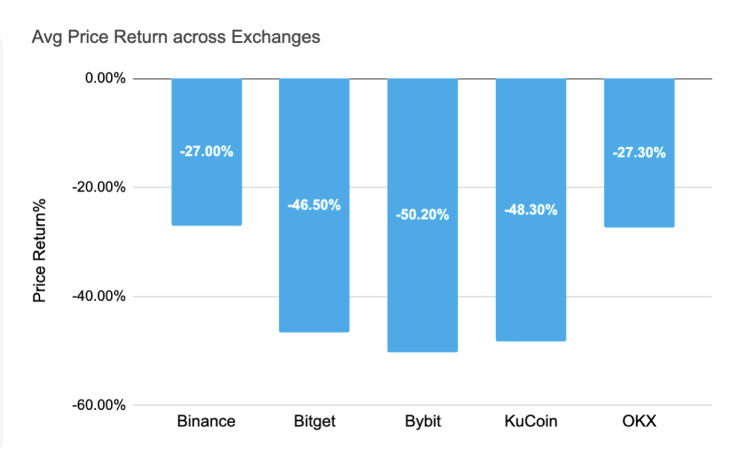

From the beginning of the year, average returns for most exchanges have been negative. Bybit saw the largest decline at -50.20%. KuCoin recorded an average return of -48.30%, while Bitget reached -46.50%. Binance and OKX also posted negative average returns at -27.00% and -27.30%, respectively. If these dark corners remain unaddressed, industry growth could be hindered.

Facing the challenges of centralized exchanges, Simon—the whistleblower behind the allegations of exorbitant listing fees—offered his perspective: "It's important to clarify: the question isn't whether Coinbase, Binance, or any other bad CEX is better. The real question is: which DEX should you use?"

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News