The Block x Morph Report Quick Read: Catalysts for Consumer Crypto Ecosystem — Building Decentralized Applications for Everyday Users

TechFlow Selected TechFlow Selected

The Block x Morph Report Quick Read: Catalysts for Consumer Crypto Ecosystem — Building Decentralized Applications for Everyday Users

The success of consumer-grade crypto largely depends on its ability to摆脱 technical complexity and deliver intuitive, value-added experiences to users.

Authors: Morph & The Block Pro

As blockchain technology continues to evolve and mainstream adoption increases, a growing number of use cases are emerging at an explosive rate—particularly in media, sports, entertainment, and gaming—giving rise to a new and distinct sector: the consumer crypto ecosystem.

Recently, Morph, a global consumer-focused public blockchain, commissioned The Block Pro (a division of The Block) to conduct research on the consumer crypto space, resulting in a comprehensive 50,000-word industry report (read full report: English version, Chinese version). The report aims to uncover future industry trends and provide critical insights for crypto investors, startups, developers, and regulators, helping stakeholders understand and explore the consumer crypto ecosystem.

Morph is a global consumer-oriented public blockchain that leverages optimistic rollups and zkRollup technologies to enhance accessibility, efficiency, and usability for developers and consumer-facing blockchain applications. It has received backing from top-tier investors including Dragonfly, Pantera, Bitget, Spartan Ventures, and Foresight Ventures. As a resource distribution hub, Morph supports developers throughout their journey—from project inception to large-scale market expansion.

Key Highlights from the Report

The report first defines the "consumer crypto space" as blockchain-supported platforms, use cases, and services designed for public use to facilitate everyday activities. This includes tokenized loyalty programs, crypto collectibles, blockchain-based games, and decentralized social media platforms. On-chain consumer products aim to fundamentally reshape how users interact with and experience products and services by creating more efficient, transparent, and user-centric solutions that disrupt traditional consumer industry practices.

The report focuses primarily on on-chain consumer products centered around daily utility and engagement—not speculative, finance-driven ecosystems. Therefore, DeFi, GameFi, and NFTFi are excluded from the scope of discussion.

1. Market Landscape by Subsector

The report examines the current state of the consumer crypto ecosystem and traditional consumer brand initiatives, systematically categorizing the space into two main layers: application layer and infrastructure layer.

The application layer includes: community/brand engagement, decentralized social, gaming, media, and communications. The infrastructure layer includes: wallets, payments, DePIN, metaverse, on-chain analytics, and identity management. For each subsector, the report highlights notable projects and venture capital trends. Details are outlined below:

(1) Community & Brand Engagement

Community and brand engagement refers to applications designed to strengthen internal community ties and relationships between brands and their audiences. Use cases include loyalty reward programs, social and fan tokens, NFTs and digital collectibles, and subscription or membership products. These tools aim to boost user engagement, encourage sustained interaction, and foster brand loyalty. Representative projects include:

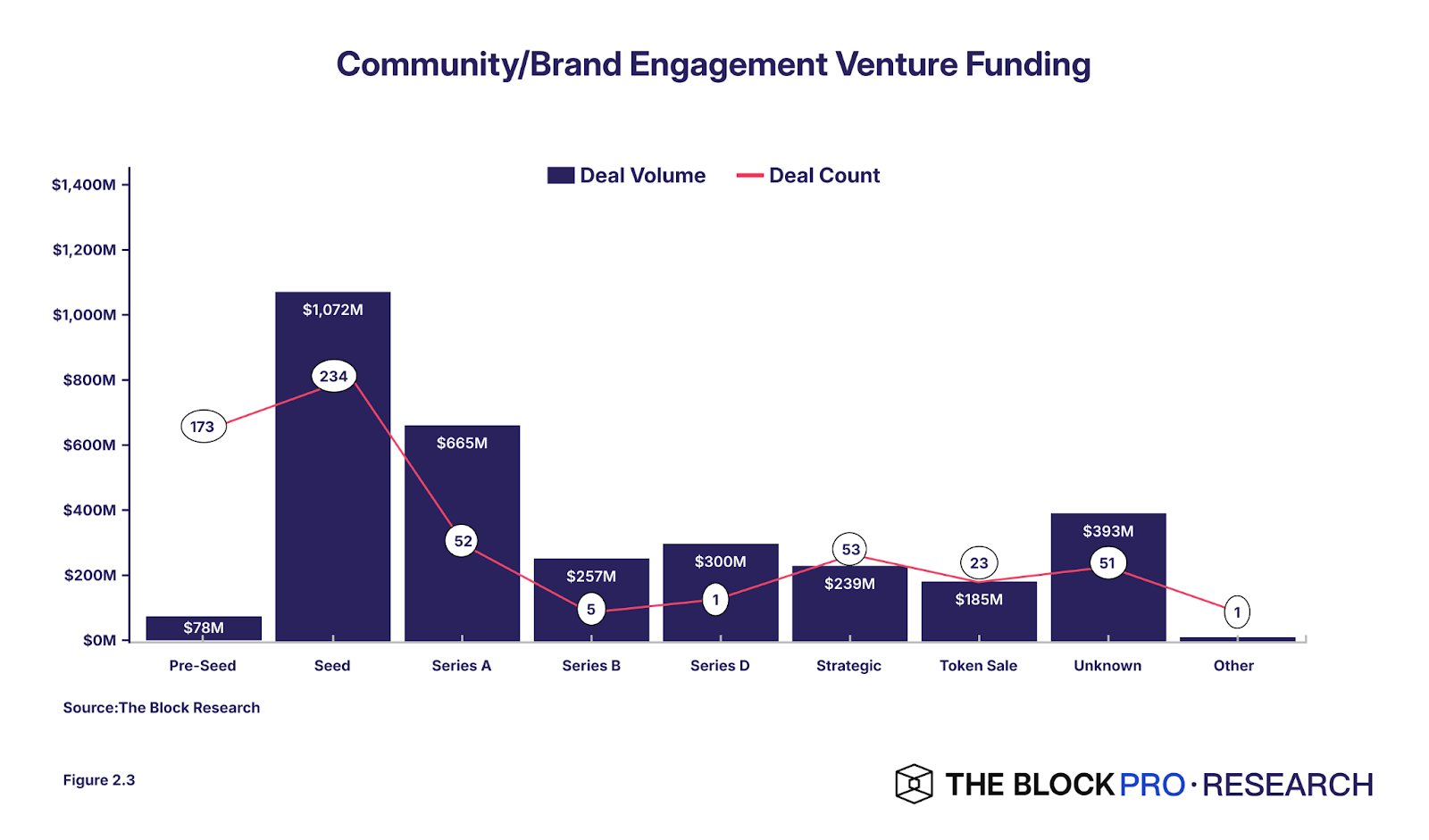

According to The Block data, the "community and brand engagement" subsector raised approximately $3.2 billion across 593 deals between 2019 and 2023. Funding was concentrated in early stages—Series A, seed, and pre-seed rounds accounted for 57% of total funding volume and 77% of deal count—typical of an emerging industry. As shown below:

(2) Decentralized Social (DeSo)

The decentralized social (DeSo) subsector encompasses blockchain-powered social networking apps that allow users to create, share, and exchange information and content in a decentralized manner. DeSo represents a shift in how users interact, share content, and participate in online communities. Core features include censorship resistance, user ownership and control over data and content, and incentive mechanisms powered by tokens. Representative projects include:

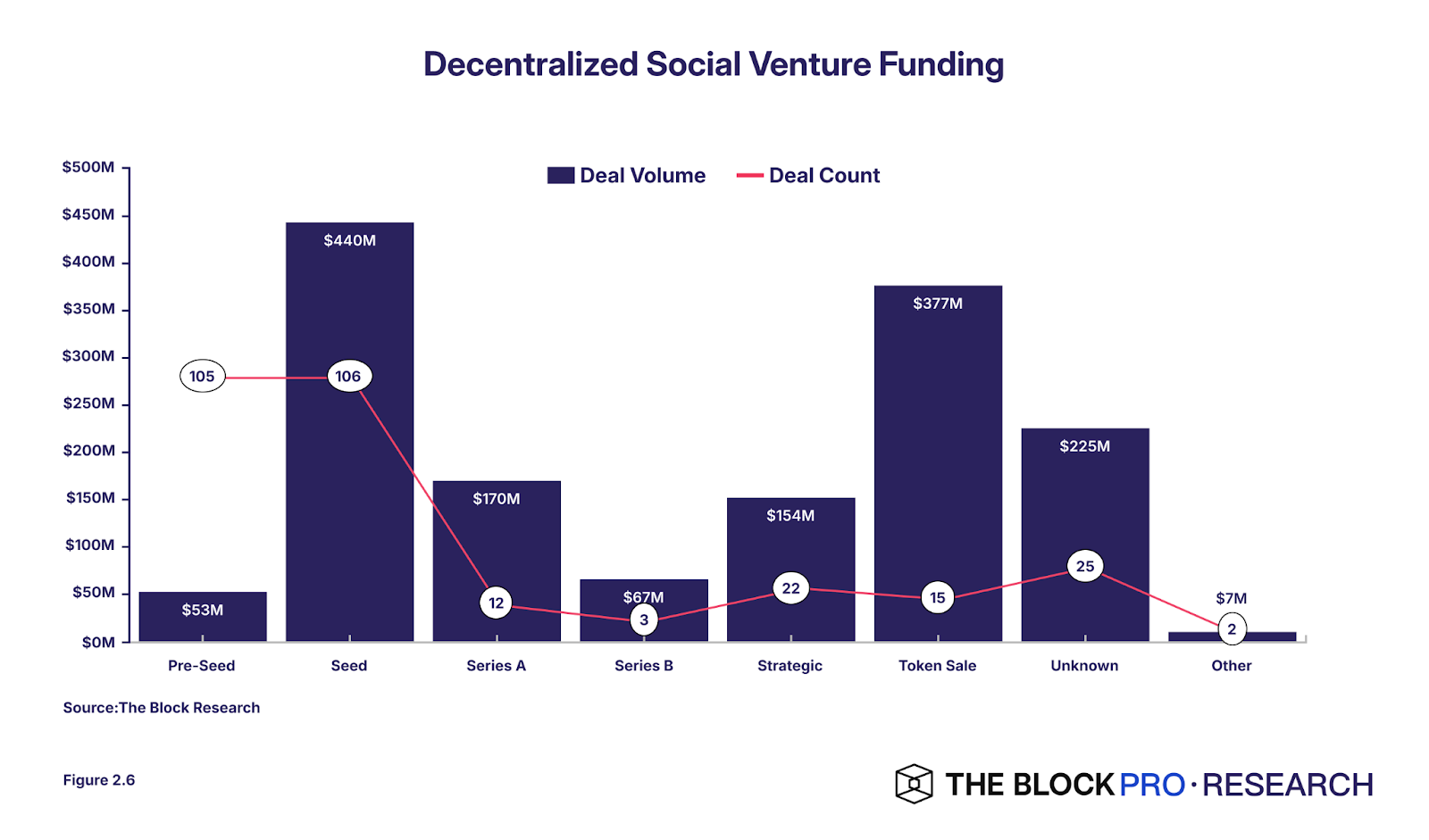

Data from The Block shows that between 2019 and 2023, the DeSo subsector saw around 290 transactions and raised approximately $1.5 billion. As shown in the chart below, the top three funding rounds by transaction volume were seed, token sale, and Series A, collectively accounting for nearly two-thirds of total funding.

(3) Gaming

On-chain gaming is transforming the traditional gaming industry by redefining relationships among players, developers, and in-game assets through blockchain technology. On-chain games create unique, player-driven economies where users can truly own, sell, and trade their digital assets—addressing limitations of traditional gaming models. Additionally, the open-source nature of on-chain games fosters permissionless innovation, enabling developers to create mods, plugins, and custom game modes that interoperate with the core game. Representative projects include:

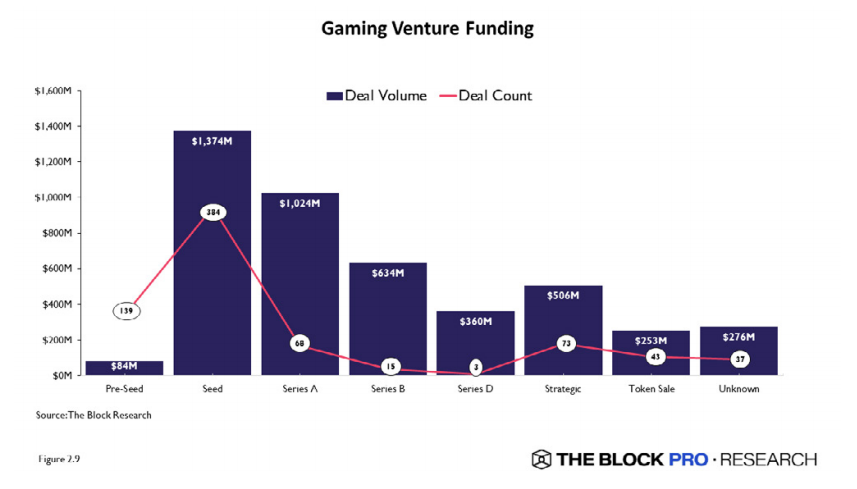

Based on data from The Block’s transaction dashboard, the on-chain gaming subsector raised approximately $4.5 billion across 762 transactions between 2019 and 2023. As shown below, funding was primarily concentrated in seed and Series A rounds, which together accounted for 53% of funding volume and 59% of deal count.

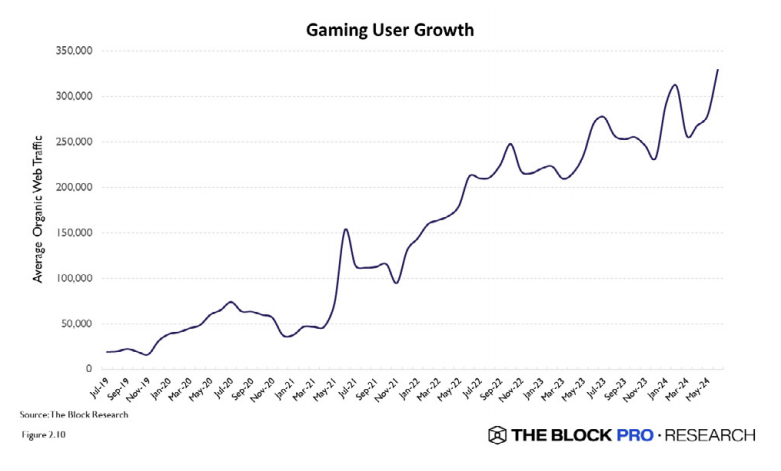

The surge in investment from 2019 to 2023 coincided with significant growth in user activity within the on-chain gaming space. The chart below shows that user activity in this subsector experienced a particularly pronounced upward trend compared to others, indicating strong momentum in this emerging industry. Moreover, user activity growth remained relatively stable, suggesting potentially higher user retention rates than other consumer crypto subsectors.

(4) Media

On-chain media applications leverage the immutable and transparent nature of blockchain to authenticate and establish ownership of digital content. By turning media assets into NFTs or other blockchain-based tokens, creators can prove authorship and retain control over distribution and monetization. Smart contracts enable automated royalty payments, ensuring creators receive a fair share of revenue whenever content is consumed or resold—reducing reliance on intermediaries. Representative projects include:

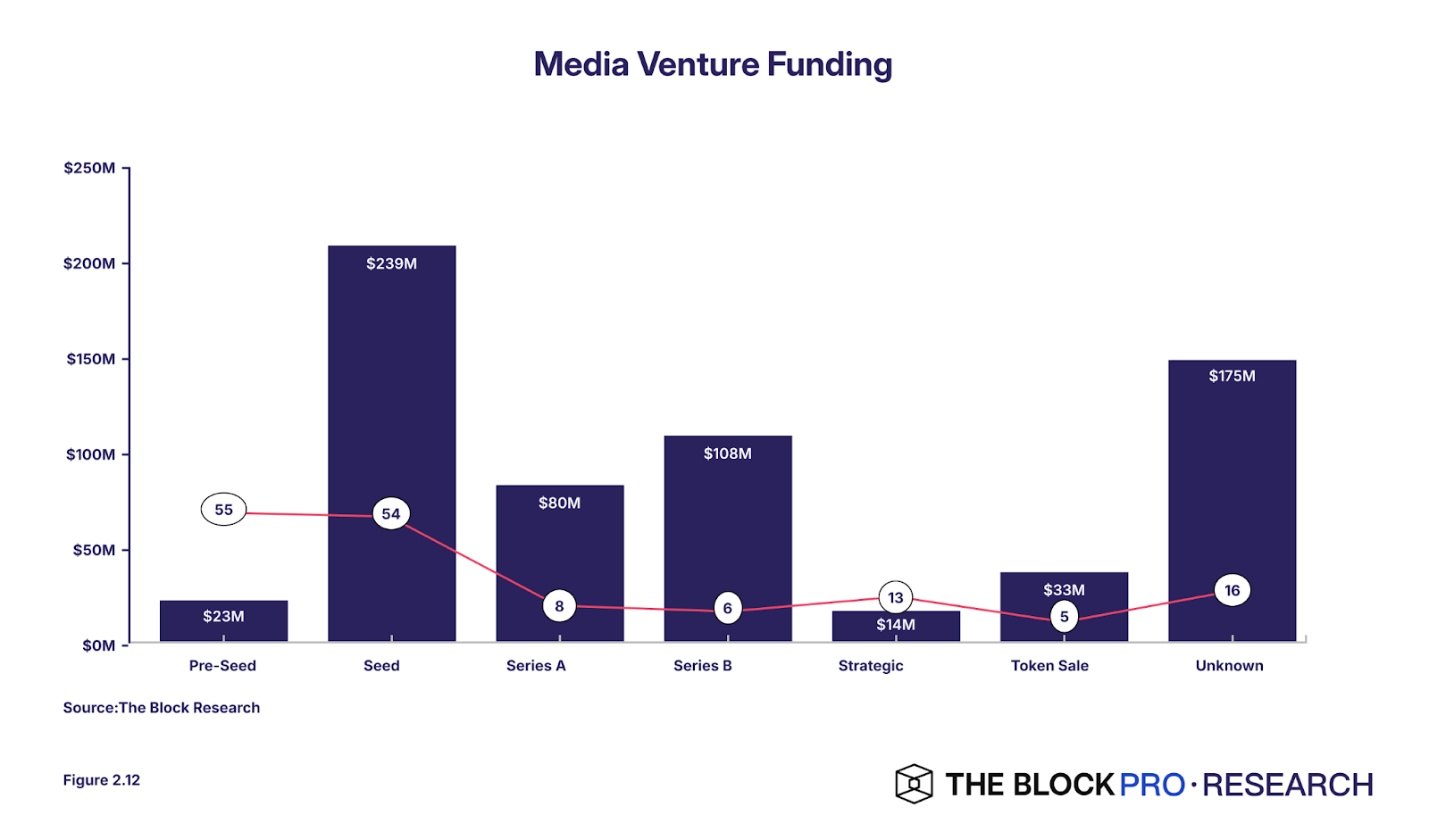

According to The Block, the decentralized media subsector raised approximately $672 million across 157 transactions between 2019 and 2023. As shown below, funding was primarily focused in early stages—Series A, seed, and pre-seed rounds accounted for 51% of funding volume and 75% of deal count. Over 80% of Series B deals occurred in 2021 or later, indicating increasing maturity as projects progress beyond initial funding phases.

(5) Communications

On-chain communication protocols aim to overcome the limitations of centralized messaging platforms. In on-chain communications, messages are exchanged directly between wallet addresses, eliminating the need for centralized intermediaries. Messages are encrypted and stored on decentralized networks such as IPFS or blockchain. This decentralized approach ensures no single entity controls the data, reducing risks of data breaches, unauthorized access, and potential misuse of personal information. Representative projects include:

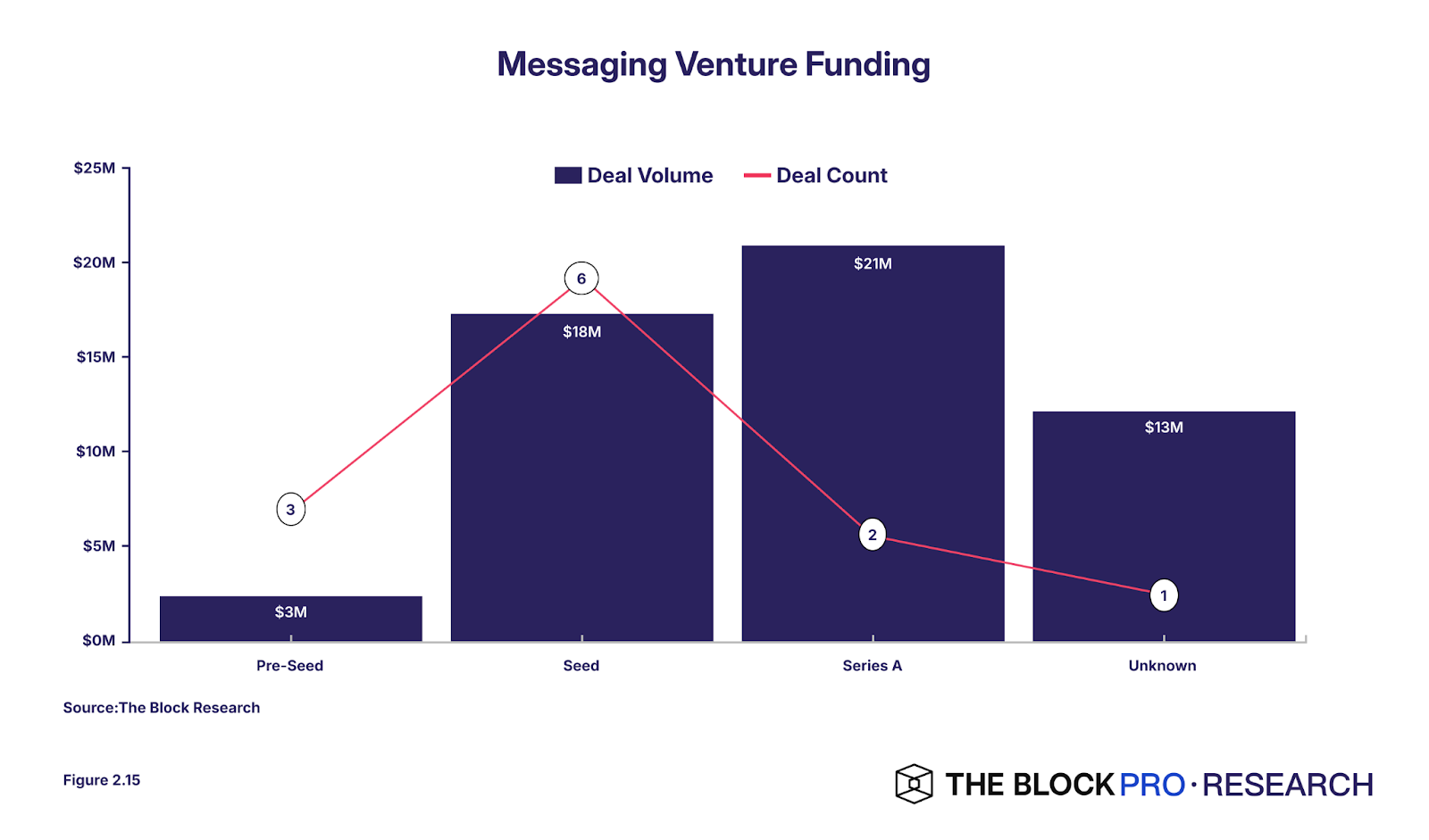

According to The Block, the on-chain communications subsector raised approximately $54 million across 12 transactions between 2019 and 2023. As shown below, all fundraising occurred at Series A stage or earlier. This pattern may reflect the absence of a breakout application capable of attracting later-stage investment. The focus on early-stage funding suggests that while interest and potential exist, the sector remains in its infancy.

(6) Wallets

Wallets serve as the key entry point for users to interact with decentralized applications and manage digital assets. Cryptocurrency wallets are software programs that allow users to store, send, and receive digital currencies and interact with blockchain networks. Early wallet solutions often featured complex onboarding processes, required private key management, and had clunky user interfaces. Improving wallet user experience has become a critical priority for driving mainstream adoption of on-chain products. Innovations like account abstraction and embedded wallets simplify the user experience and lower barriers to consumer participation. Representative projects include:

(7) Payments

In the world of digital assets, on-chain payment infrastructure plays a vital role in two key functions: facilitating conversion between traditional finance and cryptocurrency, and enabling transactions within the Web3 ecosystem. On-ramping and off-ramping solutions allow users to convert fiat currency into crypto and vice versa, making it easier for individuals to enter and exit the crypto space. On-chain payment infrastructure streamlines how consumers manage cryptocurrencies and enhances the practical utility of their on-chain funds. Representative projects include:

(8) Networks

The network subsector within the infrastructure layer refers to the foundational systems and protocols that support the secure and efficient transfer of digital assets, execution of smart contracts, and data storage. This category includes both base-layer blockchain networks and those built atop existing consensus layers. These infrastructures form the backbone of the crypto ecosystem, providing the foundation for decentralized applications and services. The emergence of new blockchain networks such as Solana, Base, and Flow has brought significant improvements to the network infrastructure layer. These networks prioritize faster transaction speeds, low latency, and cost-efficiency, making them better suited for consumer-facing use cases. Representative projects include:

(9) Identity Management

Identity management refers to systems and protocols that allow users to manage their digital identities in a decentralized and self-sovereign manner. These solutions empower users to control their personal data, selectively share information with third parties, and maintain privacy and security. On-chain identity management addresses the limitations of traditional, centralized identity systems. Representative projects include:

(10) Metaverse

The metaverse refers to a collective virtual shared space and serves as a critical infrastructure component in the consumer crypto space. Within this digital environment, users can interact with digital assets and decentralized applications in a more immersive way. Metaverse platforms offer a user-friendly and intuitive interface for consumers to access and engage with various on-chain products and services. These platforms enable a wide range of consumer use cases and create new opportunities for brands and businesses to connect with consumers. Representative projects include:

(11) Analytics

Web3 advertising and growth analytics platforms play a crucial role in the consumer crypto ecosystem. They provide projects and developers with essential tools and analytical insights to attract target audiences. Their solutions support user acquisition, advertising, and growth optimization. By aggregating data from various sources and analyzing user behavior across different touchpoints, these platforms enable data-driven decision-making, help measure marketing effectiveness, and ultimately drive adoption and growth. Representative projects include:

(12) DePIN

DePIN is an emerging category of crypto networks that use token incentives to deploy location-dependent hardware devices and generate non-replaceable, consumable resources. These networks play a crucial role in the consumer crypto ecosystem by monetizing unique real-world data assets to support a variety of consumer-facing applications and services. Representative projects include:

The report also forecasts development directions for certain subsectors. For example, decentralized social media platforms may offer customizable content filtering algorithms. The future of on-chain gaming will expand to include diverse game types, platforms, and economic models catering to varied player preferences. In the media subsector, blockchain technology could enable dynamic, interactive media assets such as art or music. In communications, we may see more sophisticated and feature-rich platforms leveraging blockchain's unique properties for secure, private, and censorship-resistant communication. In community and brand engagement, next-generation "digital-physical NFT" (digi-physical NFT) platforms will become more immersive and interactive, using advanced technologies to enable dynamic, context-aware interactions between NFTs and the physical world.

In addition, the report explores the potential of emerging subsectors such as on-chain AI agents and tokenized personal data markets.

2. Fortune 100 Companies’ Adoption of Crypto Initiatives

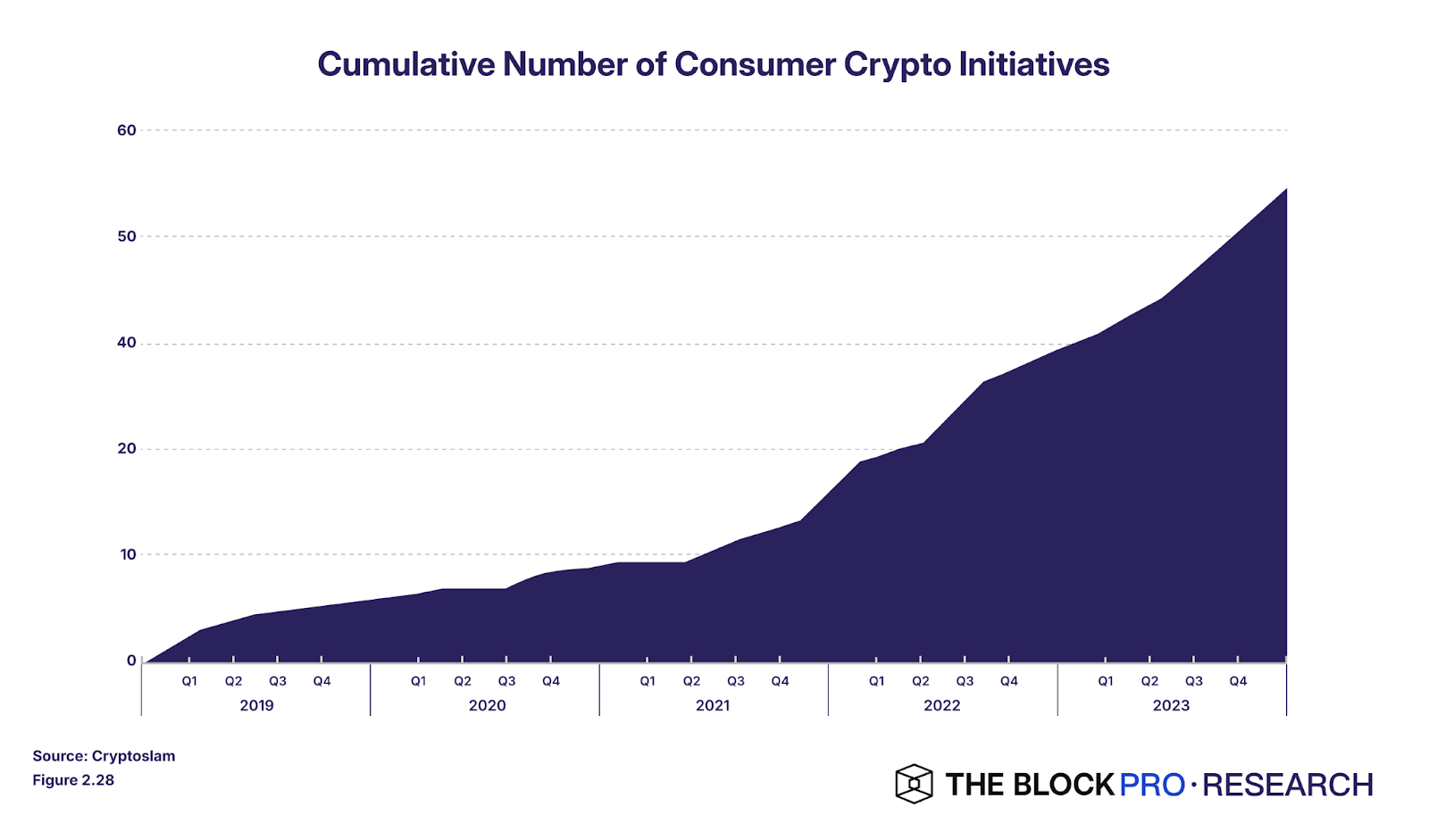

The report also analyzes data from the Fortune 100 companies to assess the adoption of consumer crypto initiatives among traditional consumer brands.

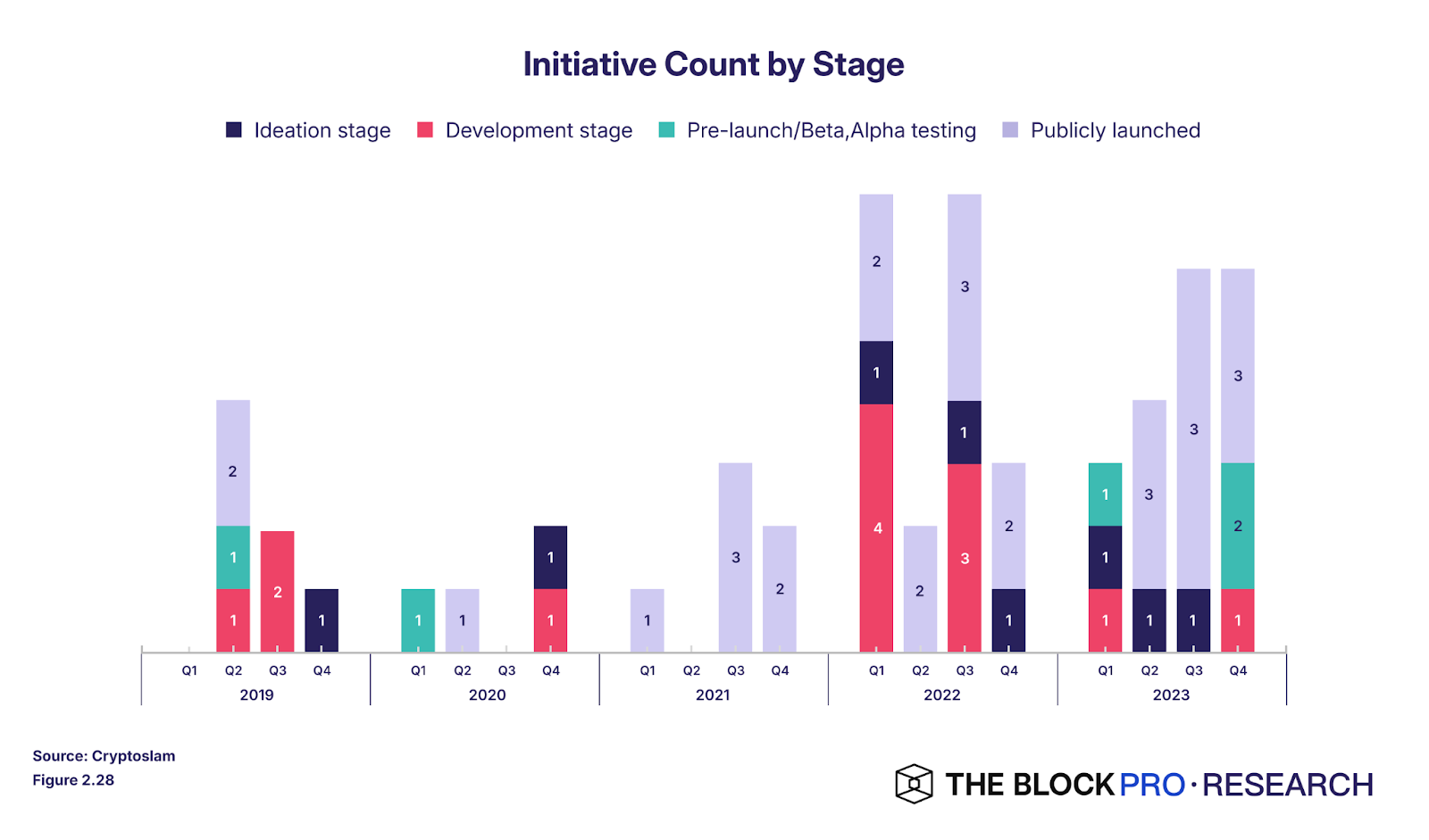

Data shows that nearly one-third (27 companies) have launched at least one consumer crypto initiative at some stage. These 27 companies initiated a total of 55 crypto projects between 2019 and 2023. As shown below, the number of initiatives increased from 7 in 2019 to 19 in both 2022 and 2023—a more than twofold increase.

If initiatives are categorized into four maturity stages—concept, development, pre-launch/testing, and public launch—the data reveals improving maturity. The proportion of initiatives in the concept phase dropped from 43% in 2019 to 37% in 2022 and 11% in 2023. Meanwhile, publicly launched initiatives rose from 29% in 2019 to 47% in 2022 and 58% in 2023. This trend indicates that companies are moving beyond initial ideation and actively developing and refining their consumer crypto projects.

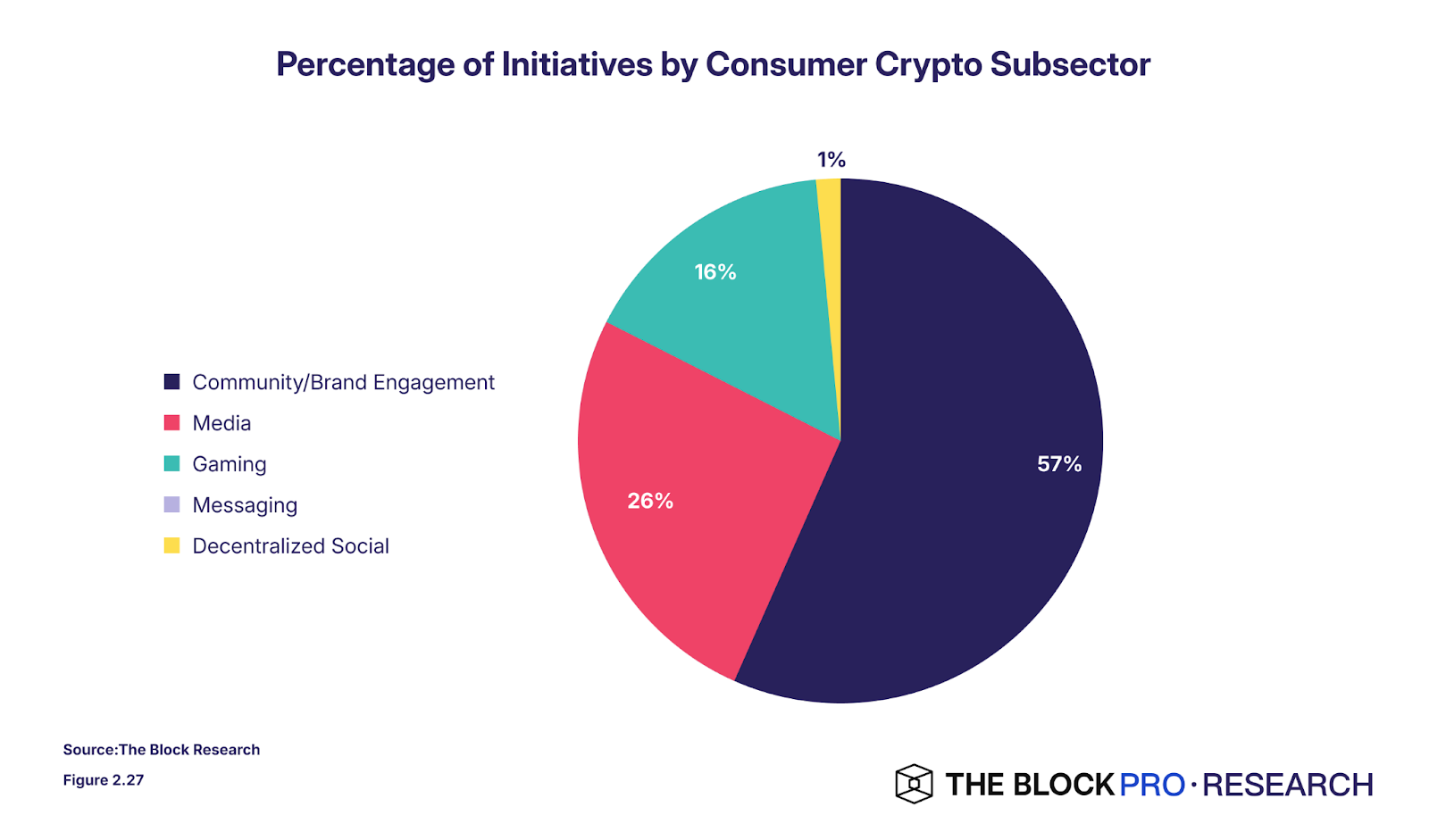

Initiatives are highly concentrated in three key subsectors: community and brand engagement, media, and gaming, which together account for 99% of all initiatives—specifically 57%, 26%, and 16% respectively. The primary reason is that these areas enable brands to build direct connections with their target audiences. Moreover, the applications and tools in these subsectors are relatively more mature and popular, and align clearly with traditional marketing strategies already familiar to consumer brands.

Across different industries within the traditional consumer sector, there are variations in the level of consumer crypto penetration. Technology, retail, and food & beverage industries are clear leaders, collectively accounting for 65% of all initiatives—27%, 20%, and 18% respectively. The other six sectors show more moderate levels of penetration, each representing less than 10% of total initiatives.

3. Barriers to Mainstream Adoption and Regulatory Outlook

The report notes that the consumer crypto space remains in its early stages and identifies key barriers to mainstream adoption: high transaction fees, complex user experiences, negative public perception, and regulatory uncertainty—offering corresponding recommendations:

-

User Experience: Consumer-facing on-chain products must prioritize intuitive UI/UX design. Developers should leverage key infrastructure components such as wallet and key management solutions, various abstraction layers and middleware, and interoperable identity systems.

-

Public Perception: Reduce the use of crypto-specific jargon to lower cognitive barriers; improve product offerings and service quality to enhance user experience and public sentiment; increase transparency of information.

-

Regulatory Uncertainty: Lack of standardization across jurisdictions further complicates the regulatory landscape for on-chain projects. Legal risks and uncertainties surrounding on-chain products may limit partnerships with mainstream brands and enterprises.

The report also examines the regulatory direction for consumer crypto by analyzing past enforcement actions and their potential implications. It provides an overview of the regulatory landscape in major markets including North America, Europe, and Asia (China, Singapore).

Finally, the report summarizes several prominent trends and developments in the consumer crypto space:

-

Potential for Mainstream Adoption: Nearly one-third of Fortune 100 companies are developing consumer crypto initiatives, signaling growing recognition of blockchain’s potential in consumer applications. Furthermore, certain on-chain consumer products are showing signs of product-market fit.

-

Infrastructure Development: The emergence of user-friendly wallets, efficient payment systems, and robust identity management solutions is laying the foundation for more accessible consumer crypto experiences.

-

Regulatory Competition: The diverse global regulatory environment is creating a “natural experiment” for consumer crypto development. This divergence may spur unexpected innovation in less-regulated markets, potentially forcing stricter jurisdictions to reconsider their approaches to remain competitive.

-

Emerging Use Cases: The rise of on-chain AI agents and tokenized personal data markets could transform how consumers interact with digital services and manage their personal information.

-

User Experience as Key Driver: The success of consumer crypto will largely depend on its ability to move beyond technical complexity and deliver intuitive, value-added experiences to users.

Consumer crypto represents a growing intersection between blockchain technology and the consumer sector. While still in its early stages, the space holds significant potential to reshape how individuals interact and transact in their daily lives. The future of consumer crypto is promising.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News