Now is not just a meme supercycle, but also a supercycle for attracting new users to enter

TechFlow Selected TechFlow Selected

Now is not just a meme supercycle, but also a supercycle for attracting new users to enter

Love it or hate it, memecoins are bringing a new group of users and a new social stratum to our world.

Author: TPan

Translation: TechFlow

A few weeks ago, a talk at Token2049 went viral on X, amassing over 1.4 million views and tens of thousands of interactions: Murad's Memecoin Super Cycle speech.

Notice the ratio of likes to bookmarks—absolutely insane!

Key takeaways from Murad’s talk:

-

Both old and new memecoins have outperformed all other tokens.

-

Tokens are often overvalued pre-launch due to various stakeholders (founders, VCs, angels, centralized exchanges, market makers, KOLs, etc.), ultimately leaving retail investors as exit liquidity.

-

Memecoins have proven their "utility" through DOGE, SHIB, PEPE, and WIF. I'm absolutely not a memecoin supporter, but I documented PEPE and WIF in their early stages and why they were interesting.

-

The crypto industry is essentially a token production industry disguised as a software production industry.

-

Memecoin distribution is more organic, decentralized, and fair. Poor holders become full-time unpaid promoters.

-

At the end of the day, retail investors care about making money, having fun, and belonging.

-

All tokens—whether tech-based or meme-based—are gambling tables in a casino. “Why should we play at your table when we can have our own?”

-

The memecoin supercycle also has external drivers: inflation, AI replacing jobs, income inequality, loneliness, mental health issues, increased online time, and fewer paths to “success.” This phenomenon is known as financial nihilism.

-

Altcoins aren’t primarily about technology, and memecoins aren’t primarily about memes. Both are tokenized communities that attract people through different narratives and mechanics to drive price appreciation.

-

The best memes evolve into cultures—or even small religions—with shared values, lifestyle principles, ideals, ideologies, artworks, events, hopes, and visions.

Whether you like it or not, this talk offers a useful framework for understanding why memecoins have become a major theme—and may still be far from peaking. So put aside your biases and watch it if you haven't already.

Beyond that, Murad’s rapid-fire delivery and fast-paced slides almost make you feel like you’re trading a memecoin, watching a price chart rapidly fluctuate.

Where Are Memecoins Going Next?

Untokenized memes have already established themselves as mediums of communication, cultural units, and composable content fragments. They dominate social media dynamics, create overnight celebrities (e.g., the Hawk Tuah girl who became Haliey Welch), and entered mainstream media.

Therefore, tokenizing memes is a natural evolution. After all, all kinds of content and assets are being tokenized—from written content, car ownership, government bonds/commodities, to digital collectibles and artwork.

But what else makes memecoins interesting beyond their common traits?

The Good Deeds of Memecoins

Vitalik Buterin

One strategy for gaining recognition is sending tokens to prominent figures. If a memecoin launches on Ethereum, Vitalik Buterin is usually the top target.

Yesterday, Vitalik converted several tokens he held into ETH and donated $642,000 to charities, noting that memecoins have an opportunity to play a positive role beyond enriching holders and speculation.

vitalik.eth:

I appreciate all memecoins that directly donate portions of their supply to charitable causes.

(For example, I noticed ebull donated large amounts to various groups last month.)

Any tokens sent to me will also be donated to charity (thanks moodeng! Today’s 10 billion will go toward airborne disease prevention tech), though I’d prefer you send them directly to charities—or even better, set up a DAO so your community can participate directly in decision-making and process.

I’ve said before that I think the best path forward for memecoins is maximizing positive real-world impact, so it’s great to see this actually happening!

This isn’t the first time—he donated $1 billion worth of SHIB in 2021 to support India’s COVID relief efforts.

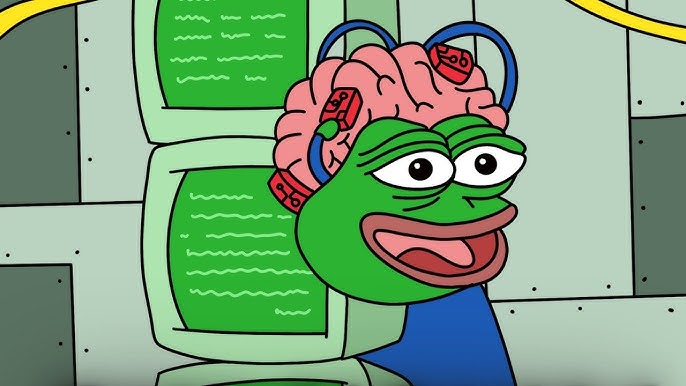

Pump.science

pump.science, developed by Molecule—a platform funding early-stage decentralized science (DeSci) research—combines memecoins with prediction market mechanisms.

Pump.science focuses on longevity research using worms (click here for more details on testing methods), employing low-cost, rapid testing approaches.

How It Works?

-

Researchers can submit drug regimens to be listed on the memecoin launch platform pump.fun

-

When the token’s market cap reaches $10,000, a livestreamed experiment begins

-

Users can speculate on the effectiveness of the tested compounds by buying and selling tokens

While pump.science hasn’t captured attention like typical memecoins, this three-week-old platform is introducing novel interactive mechanisms, drawing interest to its field, delivering clear social benefits, and potentially creating aligned incentive systems.

Memecoin Marketing and Sponsorships

Crypto is no stranger to high-profile marketing campaigns and sponsorships (mainly in sports), some of which continue today.

-

Coinbase signed a 4-year, $192 million sponsorship deal with the NBA in 2021

-

Crypto.com signed a 20-year, $700 million contract for naming rights to the Los Angeles Lakers’ arena

-

Multiple F1 teams are sponsored by various crypto companies including ApeCoin, Binance, OKX, Bybit, Sui, and Kraken

-

Prior to its collapse, FTX held naming rights to the Miami Heat arena and was an F1 sponsor

-

VeChain is the official blockchain partner of UFC, and you can’t miss their logo displayed inside the octagon during fights

These sponsorships make sense—the above examples show billion-dollar companies advertising to massive audiences. But what about a memecoin?

Earlier today, the APU memecoin community announced a partnership with Bare Knuckle Fighting Championship (BKFC), with APU (a derivative Pepe character) branding appearing at event venues and elsewhere.

Notably, an individual within the APU community personally covered the sponsorship cost, suggesting they expect significant returns from the exposure gained.

Additionally, Emily Lai pointed out that upon arriving in London, she noticed widespread adoption of guerrilla-style street marketing tactics by memecoin communities.

If you find NFT graffiti or stickers on lampposts annoying, sorry to say—it might just be the beginning (e.g., one wallet still holds $650,000 earmarked to display WIF on the Las Vegas Sphere).

What Can Non-Speculators Do About It?

Memecoins can trigger instinctive reactions among some in our industry—an irony, given that outsiders often react similarly.

The simple answer is: nothing. Take a deep breath, let it happen, and accept the reality that memes have already reached—and will continue to reach—billions, possibly trillions, in influence. Let them do their thing; there’s no need to resist or resent it.

A more nuanced answer is to be grateful. Why?

NBA Top Shot brought in massive new users—over 80,000 unique buyers in February 2021 alone. Many eventually moved into NFTs, and some became entrepreneurs, creators, or contributors within the ecosystem. I was one of those drawn in by speculation and potential gains. Over the years, I’ve met many others with similar journeys.

Love it or hate it, memecoins are bringing a new cohort of users and demographics into our world—potentially validating the memecoin super cycle hypothesis.

Some are using crypto wallets for the first time (hopefully with a better experience). Some are learning about slippage and swaps. Some will lose money and conclude crypto is indeed a scam.

And some will stay, curious about what else is happening in this wild world. That’s when the memecoin super (onboarding) cycle truly begins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News