Will the Fed's rate cut signal an upcoming market turning point?

TechFlow Selected TechFlow Selected

Will the Fed's rate cut signal an upcoming market turning point?

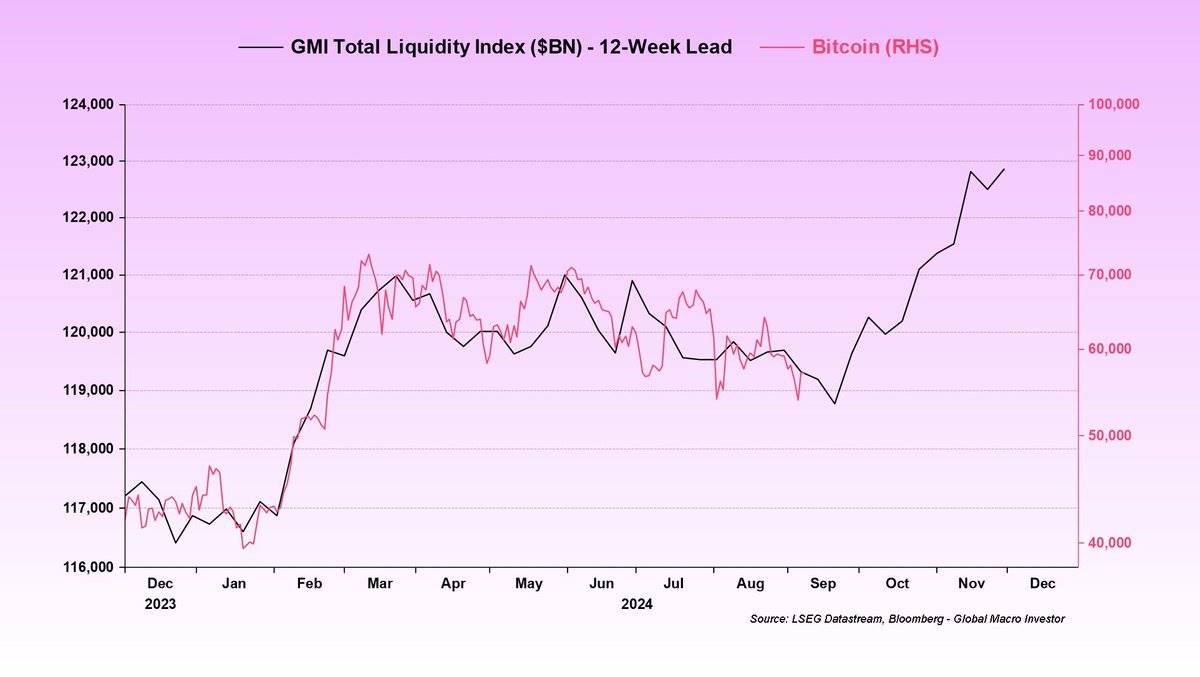

Liquidity is growing rapidly, but the crypto market is still waiting for sentiment to shift from risk aversion to risk appetite.

Author: Crypto, Distilled

Translation: TechFlow

Global M2 money supply has reached an all-time high, yet BTC prices remain subdued.

Liquidity is not flowing into the crypto market, as investors favor safe-haven assets like gold.

Will this situation change? (Thanks to @BittelJulien)

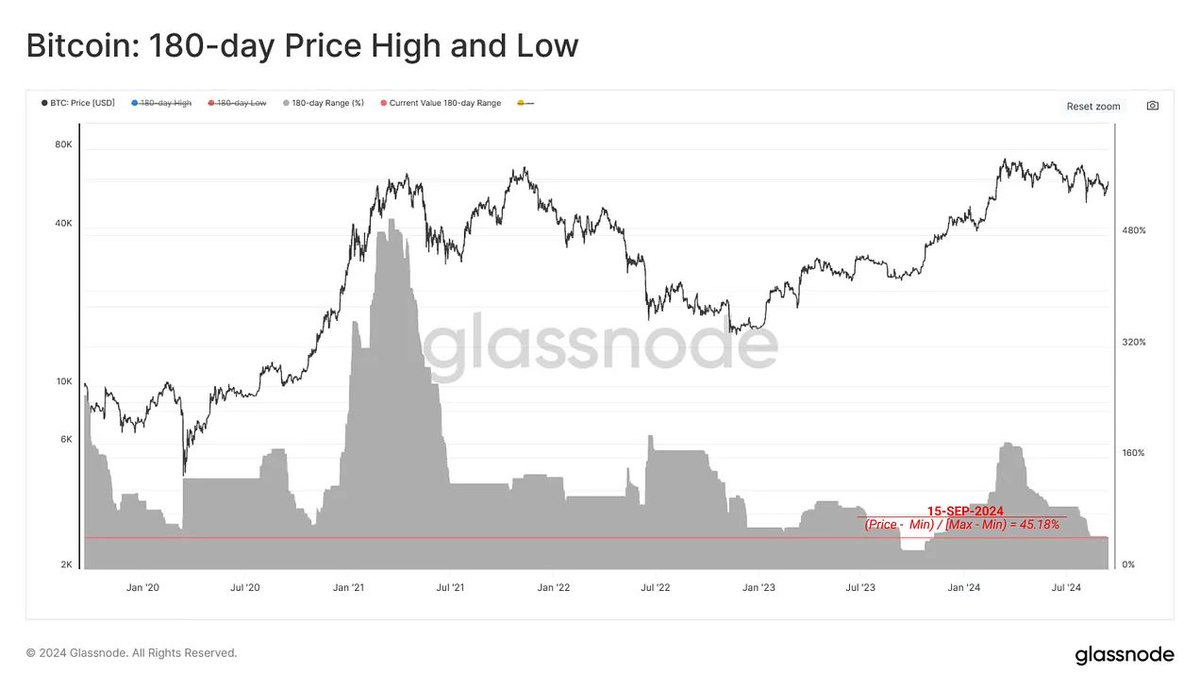

BTC is currently trading within a clear range for the sixth consecutive month.

Volatility is contracting, resembling a tightly coiled spring.

In fact, only August 2023 and May 2016 saw tighter BTC price ranges sustained over 180 days.

(Thanks to @glassnode)

Since August, stablecoin dominance has been rising, reflecting this risk-off sentiment.

Investors are seeking safe-haven assets amid macro uncertainty.

Stablecoins dominate trading pairs, serving as a proxy for investor demand.

Total stablecoin supply is nearing its all-time high of $160.4 billion.

This indicates accumulation of dollar-denominated capital within the crypto ecosystem.

However, this capital has not yet flowed into risk assets, signaling ongoing investor caution.

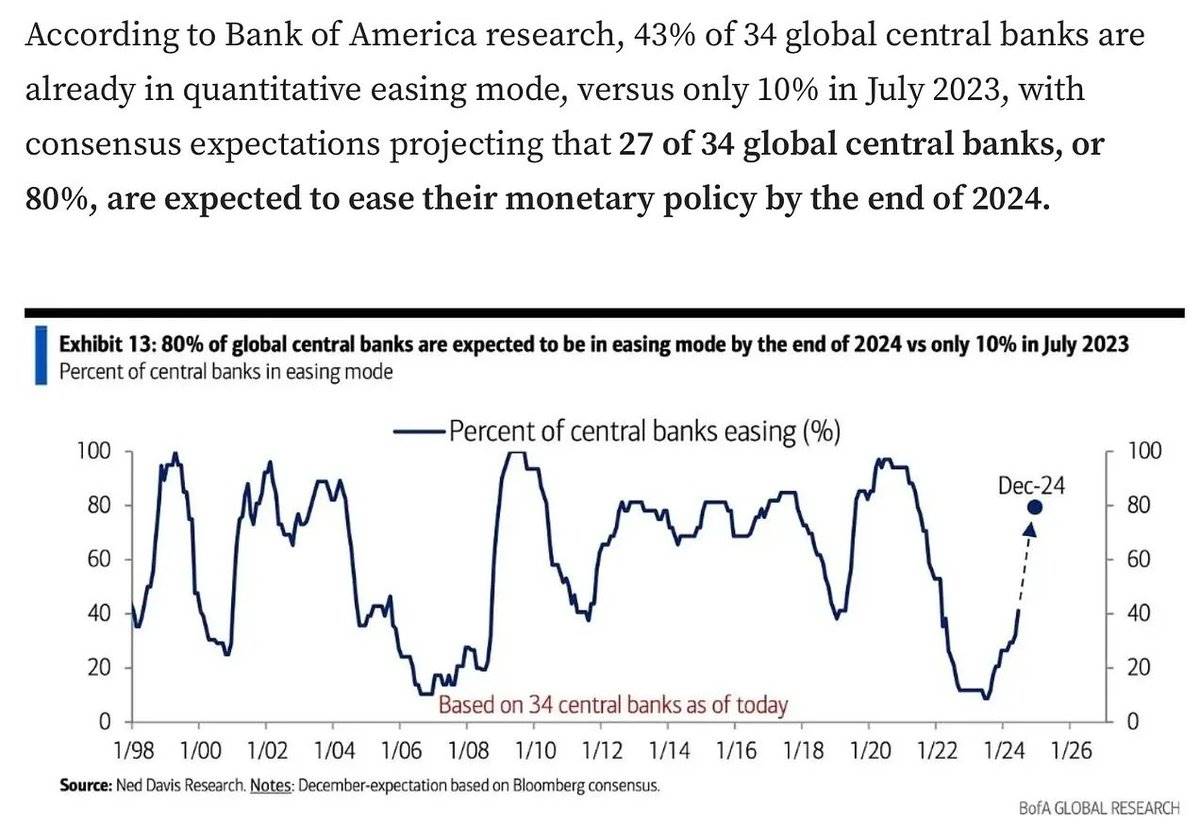

This caution may gradually ease as central banks lower interest rates.

A shift toward risk-on sentiment could prompt capital to flow from stablecoins into altcoins.

This would inject liquidity into the crypto market and potentially drive price appreciation.

Such a shift could reignite trading activity.

In the meantime, gold shows a strong correlation with M2, reinforcing its role as a hedge against economic downturns.

As money supply increases, so does demand for gold, strengthening its status as a safe-haven asset.

In August, gold rose on recession fears, while risk assets underperformed.

Interestingly, BTC and gold often alternate in their movements—when one rises, the other tends to consolidate.

This month, gold prices have increased by over 5%.

When gold's upward trend pauses, it may signal a shift in risk appetite, potentially triggering a BTC rally.

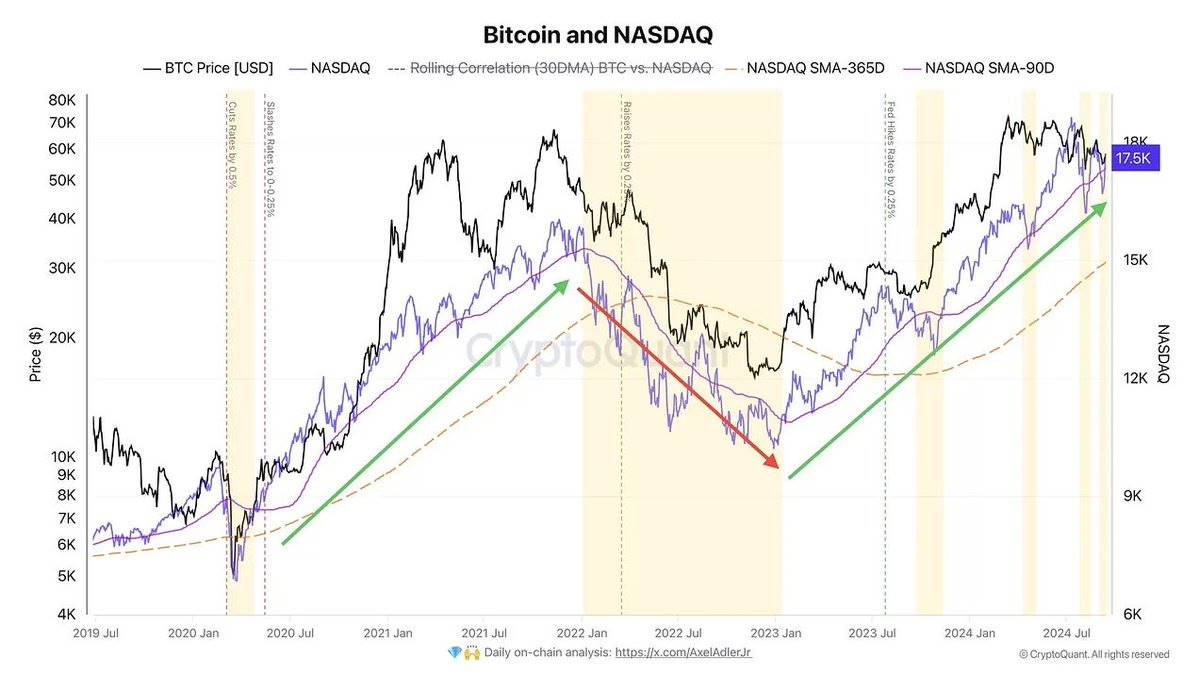

Despite being commonly referred to as "digital gold," BTC's price behavior aligns more closely with $NDX.

Its movement resembles that of high-risk technology stocks.

The correlation between BTC and $NDX has remained strong and has recently strengthened.

(Thanks to @AxelAdlerJr)

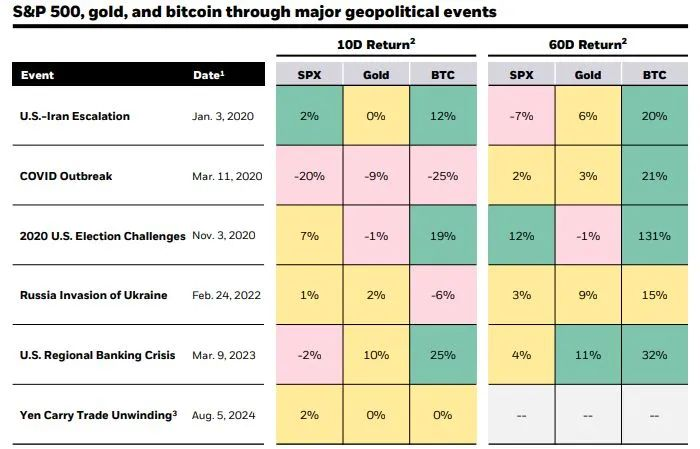

However, a recent report from BlackRock offers a different perspective.

During major events, BTC typically reacts negatively to short-term uncertainty.

Yet, even when gold and the S&P 500 perform poorly, BTC’s 60-day returns remain positive.

Despite short-term volatility, BTC may demonstrate resilience over longer timeframes.

However, due to its relatively short history as an institutional asset, more data is needed.

Further analysis is required to fully assess BTC’s performance during periods of uncertainty.

Nonetheless, BTC has consistently followed liquidity—rising with monetary easing.

43% of central banks have already begun loosening policy, and liquidity is increasing.

This could soon drive investment into risk assets like BTC.

Summary

Liquidity is growing rapidly, but the crypto market is still awaiting a shift in sentiment from risk-off to risk-on.

Central bank policies could trigger this change, channeling idle capital into the crypto market.

A rally could be swift, though recession concerns persist (not financial advice).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News