BTC (Re)staking Supply-Side Competition Intensifies, Wrapped BTC Projects Vie to Capture WBTC Market Share

TechFlow Selected TechFlow Selected

BTC (Re)staking Supply-Side Competition Intensifies, Wrapped BTC Projects Vie to Capture WBTC Market Share

In the BTC (re)staking space, there is currently a trend of oversupply and intense competition on the supply side, while the market size on the demand side remains uncertain.

Written by: 0xMaiaa, BeWater Research

With the launch of Babylon's mainnet Phase 1 a month ago, Pendle's listing of BTC LST, and the continuous rollout of wrapped BTC assets, market attention has been steadily refocused on BTCFi. The following content covers major recent updates in BTC (re)staking and BTC-pegged assets:

BTC (Re)staking:

-

The importance of ecosystem strategy for BTC LST

-

Pendle enters BTCFi

-

SatLayer joins the BTC restaking competition

BTC-Pegged Assets:

-

Coinbase launches cbBTC

-

WBTC expands across multiple chains

-

FBTC’s aggressive expansion

2/ Current BTC LST competitive landscape:

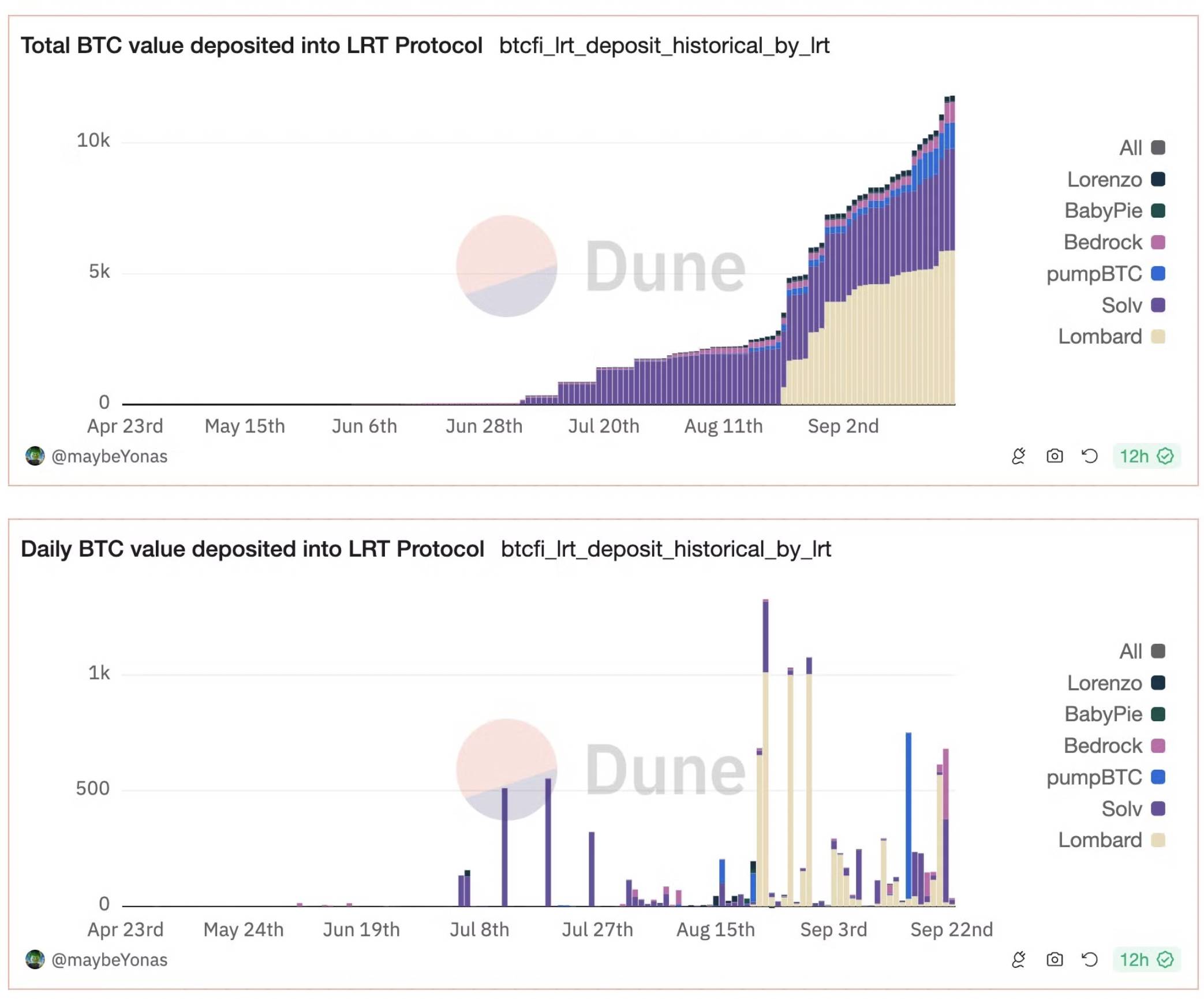

After Babylon Stage 1 quickly reached its 1,000 BTC cap, competition among BTC LSTs continues to intensify, with各方 vying for dominance as the primary staking gateway for BTC and its wrapped derivatives. Over the past 30 days, @Lombard_Finance has seen rapid growth, achieving the highest TVL with 5.9k BTC in deposits, surpassing @SolvProtocol, which had long held the leading position.

Lombard gained its current competitive edge by forming a strategic partnership with top restaking protocol @symbioticfi, offering participants richer yield opportunities from the ETH ecosystem and greater access to DeFi applications.

3/ The importance of ecosystem strategy for BTC LST:

In the BTC LST space, ecosystem strategy has become a decisive factor in the current competitive landscape. Unlike ETH LRTs, which natively benefit from Ethereum’s mature DeFi ecosystem and L2s, BTC LSTs face more complex challenges, including downstream DeFi use cases, the development stage of BTC L2s, integration with various chain-specific BTC-pegged assets, and compatibility with restaking platforms.

At this stage, choices in ecosystem strategy directly impact growth speed and early market share capture. Below is an overview of each BTC LST provider’s current approach:

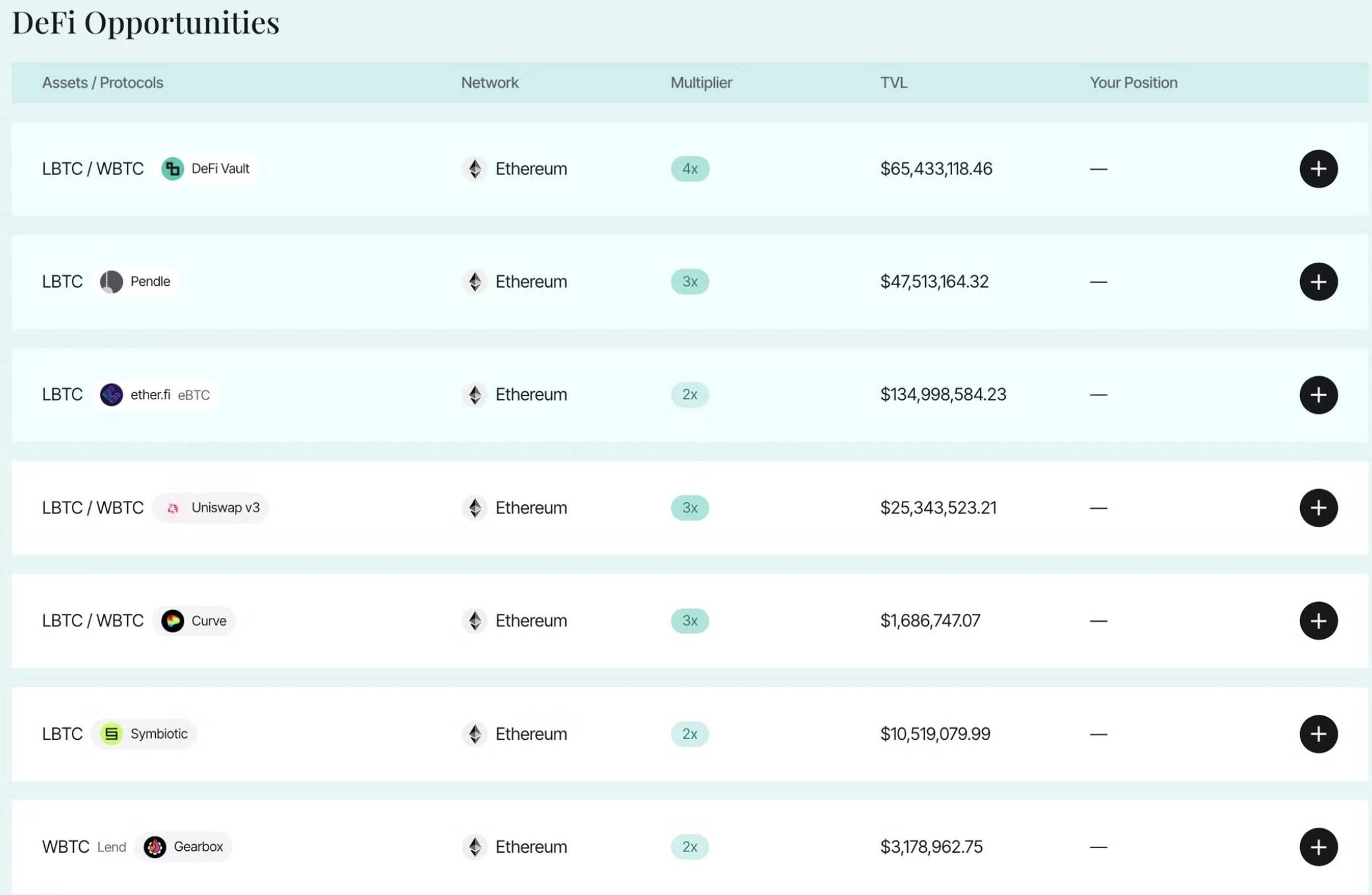

4/ Currently, @Lombard_Finance strategically focuses on the ETH ecosystem. Through partnerships with @symbioticfi and @Karak_Network, Lombard offers stakers additional external rewards beyond those provided by @babylonlabs_io. Meanwhile, $LBTC became the first BTC LST to be supported by ETH-based restaking protocols. In terms of utility, Lombard is actively promoting leveraged strategies for $LBTC on ETH, with key partners including @pendle_fi, @GearboxProtocol, and @zerolendxyz. Notably, Ether.Fi’s acceptance of $LBTC deposits means $LBTC will benefit from all future downstream applications tied to $eBTC, further strengthening its competitive advantage.

5/ In contrast to Lombard’s focused strategy, both @SolvProtocol and @Bedrock_DeFi are aggressively expanding across multiple chains, building ecosystems that span upstream deposit acceptance and downstream application development. Currently, SolvBTC.BBN and uniBTC have their primary liquidity on BNB and ETH, while also injecting BTC liquidity into other L2s. A notable aspect of Solv’s strategy is requiring users to deposit SolvBTC to convert it into SolvBTC.BBN for participation in Babylon—this drives demand for SolvBTC and reinforces Solv’s core business as a Decentralized Bitcoin Reserve.

6/ @LorenzoProtocol and @pStakeFinance, backed by @BinanceLabs, have prioritized development on the BNB chain during their initial phase. They already support $BTCB deposits and have issued their respective LSTs—$stBTC and $yBTC—on the BNB chain. Lorenzo stands out by building a yield market based on BTCFi, using a structure that separates liquid principal tokens (LPT) from yield accrual tokens (YAT), similar to Pendle’s model, thereby enabling more flexible strategies around BTC restaking yields.

7/ From another perspective, differing BTC LST ecosystem strategies—particularly in which upstream BTC derivatives they accept and how LSTs are minted—will influence the liquidity and DeFi adoption of BTC-pegged assets across various ecosystems. As the BTC LST market continues to expand, this trend will become increasingly pronounced, triggering TVL defense wars across chains.

8/ Pendle enters BTCFi:

Recently, Pendle has integrated four BTC LSTs into its points marketplace: $LBTC, $eBTC, $uniBTC, and $SolvBTC.BBN. The current liquidity and total TVL of these LSTs on Pendle are shown in the chart below. Notably, $LBTC’s actual adoption exceeds the surface-level figures in the LBTC (Corn) pool. Since 37% of $eBTC is backed by $LBTC, Pendle’s integration of $eBTC indirectly benefits Lombard, giving $LBTC holders more options to optimize their yield strategies.

9/ Aside from $eBTC, the other three LSTs are partnered with another key player, @use_corn. Corn is an emerging ETH L2 featuring veTokenomics and Hybrid Tokenized Bitcoin. Since Corn’s gas token $BTCN will be minted via a hybrid mechanism, the current collaboration suggests a possibility that trusted BTC LSTs may be accepted in the future for $BTCN minting.

The potential integration path could be: Wrap BTC → BTC LST → BTCN → DeFi. This architecture adds another layer of leverage within the BTCFi system—while enabling users to maximize yield across multiple protocols ("one fish, many meals"), it also introduces new systemic risks and the possibility that protocol point systems become over-mined, resulting in far lower-than-expected returns. For reference on Corn and Lombard’s points distribution, see: https://x.com/PendleIntern/status/1835579019515027549

10/ Points-based leverage is one of the key use cases for yield-bearing assets like ETH LRTs and BTC LSTs. As a pioneer, Pendle’s integration of BTC LSTs is likely to drive broader DeFi adoption trends. Currently, @GearboxProtocol has introduced $LBTC into its points market, and @PichiFinance has hinted at integrating BTC LSTs in the near future.

11/ SatLayer enters the BTC restaking race: @satlayer has entered the BTC restaking space, emerging as a new competitor to @Pell_Network. Both accept BTC LST restaking and use it to provide security for other protocols, similar to @eigenlayer. As an early mover in BTC restaking, Pell has accumulated $270 million in TVL and nearly integrated all major BTC derivatives across 13 networks. Meanwhile, SatLayer, after announcing a funding round led by @Hack_VC and @CastleIslandVC last month, is rapidly expanding its market presence.

12/ SatLayer is currently deployed on Ethereum and already supports WBTC, FBTC, pumpBTC, SolvBTC.BBN, uniBTC, and LBTC—more integrations are expected. As more homogeneous restaking platforms emerge, competition for liquidity of BTC and its derivative assets will intensify. While this offers participants additional layers of leveraged yield opportunities, it also signals oversupply in restaking infrastructure on the supply side.

13/ Current state of wrapped BTC tokens:

After Justin Sun’s involvement in WBTC custody sparked controversy, competition in the wrapped BTC market has intensified. Key alternative assets now include @Binance’s $BTCB (supply: 65.3k), @MerlinLayer2’s $mBTC (supply: 22.3k), @TheTNetwork’s $tBTC (supply: 3.6k), @0xMantle’s $FBTC (supply: 3k), and the various BTC LSTs mentioned earlier.

14/ Coinbase launches cbBTC:

Last week, Coinbase launched $cbBTC, a custodial wrapped asset now with a supply of 2.7k. Deployed on Base and Ethereum, $cbBTC is already supported by several major DeFi protocols including @0xfluid, and plans to expand to more chains. Additionally, BTC LST projects @Pumpbtcxyz and @SolvProtocol quickly announced collaborations with Base following $cbBTC’s launch, highlighting cbBTC’s potential in the BTCFi ecosystem.

15/ WBTC expands across multiple chains:

Despite ongoing security concerns, $WBTC still holds over 60% of the wrapped BTC market share. @BitGo recently announced deploying $WBTC on Avalanche and BNB Chain using @LayerZero_Core’s Omnichain Fungible Token (OFT) standard, aiming to solidify its market position through multi-chain expansion.

However, WBTC’s adoption continues to decline. As major DeFi protocols like @aave and @SkyEcosystem begin removing WBTC as collateral, this trend may influence other DeFi platforms’ attitudes toward WBTC.

16/ FBTC’s aggressive expansion:

$FBTC, jointly managed by Mantle, Antalpha, and Cobo, is now deployed on Ethereum, Mantle, and BNB Chain. Through its "Sparkle Campaign," @FBTC_official is actively promoting broader adoption of $FBTC in BTCFi. In the BTC (re)staking space, $FBTC is already adopted by Solv, BedRock, PumpBTC, and Pell, offering Sparks points incentives to early adopters.

17/ Currently, all wrapped BTC assets are actively competing for integration into major DeFi protocols and broad user adoption in an effort to claim the next $WBTC-scale market position. Beyond existing wrapped BTC assets, new entrants such as @ton_blockchain’s $tgBTC and @Stacks’ $sBTC are also expected to join the race soon.

18/ Amid the ongoing growth of BTCFi, BTC (re)staking and BTC-pegged assets remain two critical areas to watch.

In the BTC (re)staking space, there are clear signs of oversupply and intense competition on the supply side, while the actual size of demand remains uncertain. In this early-stage competitive environment, differentiated ecosystem strategies and unique downstream use cases are becoming key differentiators among BTC LST providers. Meanwhile, the trend of BTC-pegged assets being increasingly nested within each other introduces new systemic risks, along with the risk of protocols being over-mined, leading to minimal final returns.

For all BTC-pegged assets, trust remains paramount. Exchanges, L2s, and BTC LST providers are all pursuing different approaches to develop their own BTC-pegged assets, aiming to gain acceptance from mainstream DeFi protocols and users, and swiftly capture the market share being lost by WBTC.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News