Top KOL Ansem's Latest Interview: This Is the Best Cycle Since I Joined the Industry

TechFlow Selected TechFlow Selected

Top KOL Ansem's Latest Interview: This Is the Best Cycle Since I Joined the Industry

EVM-based L2s are meaningless, and meme coins are the primitive form of SocialFi.

Guest: Ansem, renowned trader

Translation: zhouzhou, Ismay, BlockBeats

Editor's Note: In this episode, renowned trader Ansem explains his recent bearish outlook on the market and shares insights into how he discovered and became bullish on Solana, his trading strategies within the Solana ecosystem, and his views on the current state and future of memecoins. He also discusses the NFT market. Additionally, Ansem offers unique perspectives on the decline of crypto celebrities, investment opportunities in cryptocurrency, and the relationship between crypto and sports betting, diving deep into future trends in the crypto industry.

In this podcast, Threadguy and Ansem raise and explore several key questions:

-

What stage of the cycle are we currently in? Are we still in a bull market?

-

You recently went public with a bearish stance—what was your reasoning, and what are your main holdings now?

-

How do you see SocialFi evolving next? Did Pump.fun "kill" memecoins? Will any memecoin surpass Doge’s all-time high this cycle?

-

Is focusing solely on memecoin trading a wise choice? How can one stay grounded during a bear market, lock into Solana, and maintain conviction?

-

Discuss the Neiro incident and your thoughts on celebrity involvement in crypto?

TL;DR

Cycle Overview: Ansem believes we’re in the early stages of the second or third quarter of the current cycle, expecting increased crypto adoption and explosive emergence of unprecedented innovations.

Why He Turned Bearish: Despite a surge in the probability of Ethereum ETF approval, the market showed little movement.

L2 Token Underperformance: Ansem argues that if you want a blockchain more efficient than Ethereum L1, you shouldn’t stick to EVM. He also emphasizes the underappreciated shift from CEX to DEX.

Bullish on Solana: Ansem has long followed Solana’s ecosystem and understands its full evolution, drawn by its faster speeds and lower costs.

Below is the edited transcript of the conversation (for readability, some content has been condensed and restructured):

Cycle Discussion: Anticipating the Explosion of New Things

Threadguy: How’s your mindset lately?

Ansem: I’m feeling great. This is probably my third cycle, and trading has been going very well. My followers have grown from 100k last December to around 500k now.

Threadguy: Do you think your follower count reflects how many new people are entering the space?

Ansem: I think so. I gained about 400k followers over six months, but then growth started slowing down weekly. When it slowed in March and April, I thought maybe the market was consolidating. But recently, growth has picked up again, which is actually a solid retail sentiment indicator. Looking back at the last cycle, major accounts also saw insane follower growth. When their growth stalls, you know not many new people are coming in anymore.

Threadguy: Where do you think we are in this cycle? Are we still in a bull market?

Ansem: Probably second or third quarter—still very early. The reason is that not much significant has happened yet. In previous cycles, we’d see broad altcoin rotations across sectors, but now we haven’t seen widespread rallies. Sure, Solana and some memecoins have gone crazy, and there’s some AI activity, but DeFi is quiet, and L2s haven’t moved much.

This cycle’s mainstream awareness phase is different. Major institutions are loudly promoting crypto and emphasizing its future. With passive inflows from ETFs, I expect market attention to remain more stable.

Threadguy: How do you see crypto adoption changing this cycle?

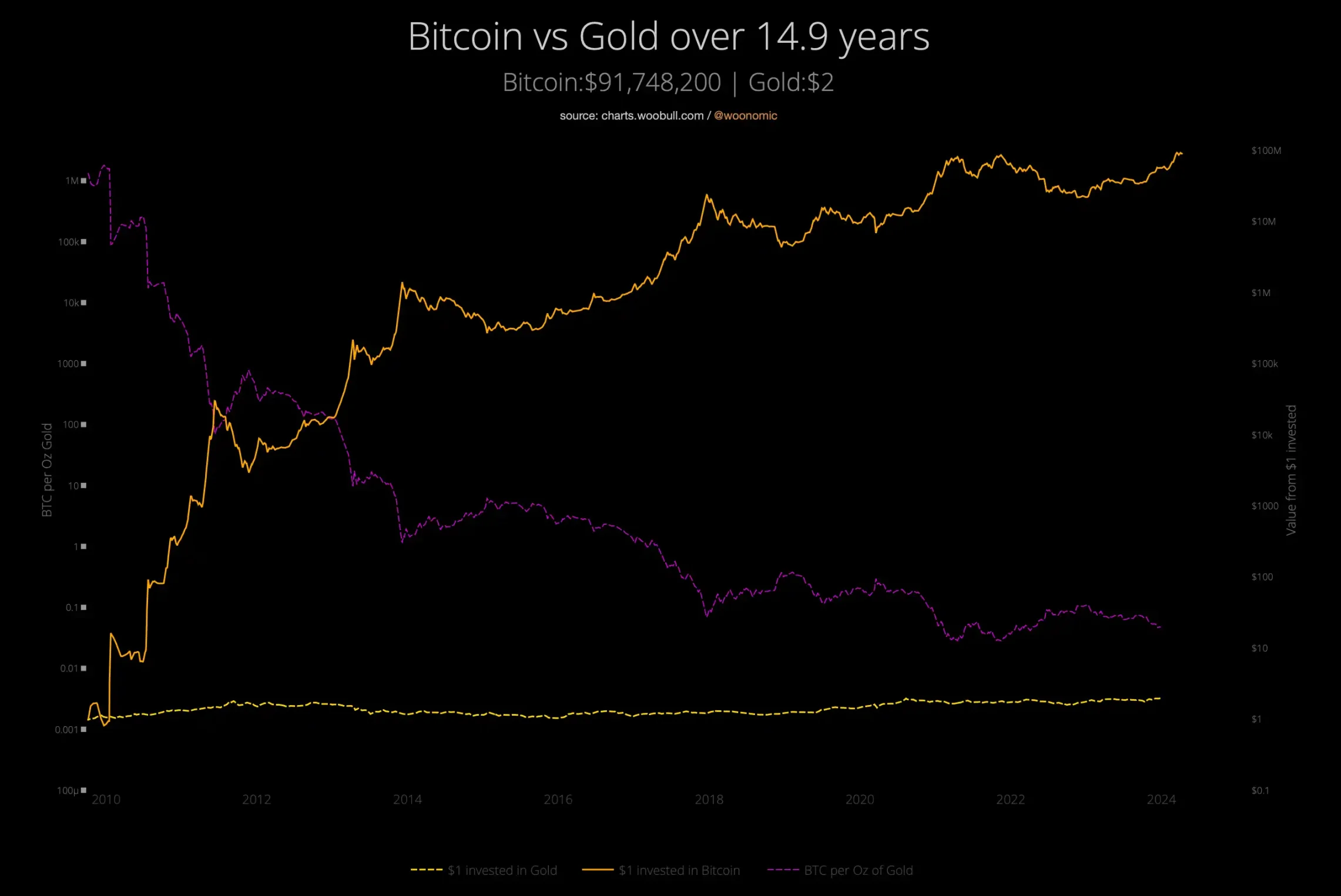

Ansem: Gold has a market cap of about $13 trillion, while Bitcoin is only around $1.2 trillion. The comparison between Bitcoin and gold is strong. Stocks keep rising because capital needs places to go—and the same will happen in crypto.

Gold vs. Bitcoin price performance over the past nearly 15 years. Source: Woobull

Threadguy: Do you have investments outside of crypto right now?

Ansem: A bit of diversification. Recently bought Galaxy stock, plus some Robinhood and Coinbase shares, but I haven’t spread my investments too far beyond crypto yet.

Threadguy: What’s your take on the 2024 cycle?

Ansem: My thinking has shifted multiple times. The年初 rally was extremely strong—almost a V-shaped rebound—but not all altcoins hit new highs. I think the bigger move might come later in 2024.

What really interests me is whether something as explosively disruptive as NFTs or DeFi will emerge this cycle. Every time such a thing appears, no one sees it coming. Memecoins are already strong this round, but we’ve seen Dogecoin and Shiba before.

Threadguy: Do unknowns like DeFi and NFTs need to change every cycle?

Ansem: I don’t think they must change every cycle, but there’s always some never-before-seen innovation that goes parabolic. Because there’s no precedent, no historical data, its upside potential is unknown. Today’s DeFi protocols generate real revenue, backed by solid teams and funding, but their performance hasn’t stood out. Look back at 2019–2020—Aave surged ~2000x. That was the first time people saw anything like it.

Why He Turned Bearish

Threadguy: You publicly turned bearish at a good timing recently—what was your logic? And how are you managing risk now?

Ansem’s tweet stating he lost about $250,000—roughly a quarter of his assets—in the past month and is seriously considering cashing out and permanently leaving crypto. He admitted to losing his edge, feeling directionless, and trading poorly (“trading like dog shit”), making a series of bad decisions.

Ansem: I turned bearish after the probability of Ethereum ETF approval jumped from 20% to 80%. At 20%, ETH was around $3,200–$3,300. When odds rose to 80%, sentiment turned optimistic instantly—ETH jumped from $3,300 to $3,900, nearing its yearly high.

I became very bullish, expecting new all-time highs—Bitcoin to $75K, Ethereum to $4K or $4.5K. I thought even memecoins would hit new highs. But that week, nothing big happened. The next week, just sideways action near highs.

I thought: impossible. So much good news—regulatory tailwinds, presidential candidates talking crypto, institutional promotion of Bitcoin ETFs, ample liquidity—yet the market couldn’t break through. That’s when I turned bearish. Maybe BTC and ETH would consolidate, while memecoins kept rising.

My strategy was to hold most of my SOL and memecoins, short some ETH, and see what unfolded. But after a brief memecoin pump, prices fell back. I realized: nope, the whole market might drop. We hadn’t seen a real correction yet—BTC had only pulled back 15–20%, not the 30–40% drops typical of deeper corrections.

I wrote a long thread saying we were approaching the top of the range—you could sell part of your position and buy back at the bottom, or hedge. If you did nothing, your portfolio could shrink 40% during a correction, leaving you stuck, unwilling to sell at support. Around early June, I reduced exposure. During the pullback, I bought back in, then shorted again—repeating the process. Now I’m not taking risks; I’m mostly waiting. I remain highly optimistic for late 2024 and 2025. Patience is key right now.

Threadguy: What are your main holdings now?

Ansem: I’m relatively bullish on Solana versus other assets. If I’m bullish on the SOL/ETH pair, I can hold SOL spot while shorting ETH to maintain net long exposure. My overall positioning is neutral except for Solana—I also hold some Helium and memecoins.

SOL/ETH exchange rate has remained strongly bullish since late last year

Threadguy: Are you Ethereum’s public enemy number one?

Ansem: They definitely don’t like me. Last year, when I pushed this view hard, everyone thought it was impossible. Now look—SOL’s market cap has hit new highs.

Which Narratives Are You Watching?

Threadguy: If we’re in the second or third stage of a bull market, which major narratives haven’t played out yet?

Ansem: Several big narratives haven’t fully unfolded. One is L2 tokens, which aren’t getting much attention and have performed terribly this year. Ethereum sentiment is slowly turning negative. I think EVM-based L2s don’t make sense—if you want a chain more efficient than Ethereum L1, you shouldn’t use EVM. Use another VM instead. That way, rollups can handle more transactions at lower fees. So non-EVM L2s have more potential.

I also think DePIN is undervalued—that’s why I hold Helium. These networks make sense to outsiders: using distributed resources with incentives to collaborate, drastically reducing costs.

Another underappreciated trend is the shift from CEX to DEX. Look at on-chain trading volume vs. CEX—the difference this cycle is huge. Many teams are building here, not just AMMs but also on-chain perpetuals. We now have infrastructure good enough to compete with Binance-level CEXs.

Memecoins Are the Primitive Form of SocialFi

Threadguy: How will SocialFi evolve?

Ansem: I love SocialFi. Memecoins are its primitive form—they show people’s enthusiasm for community-driven buying behavior, competing or collaborating in groups. Now that everyone wants to launch their own token, a social app will inevitably emerge to financialize viral moments. Pump.fun might be that app, but others will follow and ride this wave.

Some complain these SocialFi apps are extracting too much value from the Solana ecosystem, but that always changes. In crypto, if a platform earns big profits and finds clear product-market fit, but the community feels it’s overharvesting, competitors emerge or existing teams adjust to improve UX. That’s how crypto works—copying products or building similar ones is easy. Competition always arises, pushing things toward maximum efficiency.

Threadguy: Did Pump.fun “kill” memecoins?

Ansem: No, I don’t think Pump.fun killed memecoins. Memecoins aren’t dead—I still believe their supercycle continues. They’ll remain excellent risk-on exposure for all these L1s and L2s. But people underestimate how fast memecoins rise and how inevitable the cooling period is. The market either corrects sharply or pumps and then ranges before rising again. Now I believe even more in this supercycle.

Initially, I thought BONK would do well because it was the only risk-on token on Solana at the time—there were almost no other altcoins. I kept saying: if you use Solana DeFi, you’ll eventually profit because no one was using those protocols—Jupiter, Jito—all undervalued. SOL had just broken above $30, holding steady for nearly a year. Once it broke out, I knew people would migrate to Solana—and when they arrived, they’d buy BONK.

The idea of memecoins as Solana exposure isn’t crazy. Since then, I’ve grown even more confident in the memecoin supercycle because their performance has vastly outpaced other altcoins. That doesn’t mean they won’t fall—anything up 100x or 1000x will correct. That’s normal in crypto.

Threadguy: Could any memecoin surpass Doge’s all-time high this cycle?

Ansem: If total crypto market cap reaches $10 trillion, then yes, it’s possible. When these coins approach Ethereum’s market cap, things get wild.

Threadguy: DOGE is a veteran coin, but seems outdated now. Do you know anyone actively discussing Doge?

Ansem: Honestly, no one. Old memecoins have lost influence compared to new ones. There’s a lot of old money in crypto that usually drives Doge volatility, but Elon Musk tweeted a Doge meme two days ago—price didn’t budge. It’s like when BTC or ETH gets good news but doesn’t move. If a major event fails to trigger a reaction, market sentiment is clearly weak.

Threadguy: What do you think of veteran traders turning deeply bearish just because memecoins are going crazy?

Ansem: Their view is reasonable. In the past, when memecoins and small altcoins pumped hard, it signaled the market was near the top. But this cycle is different—besides memecoins, no other sectors are going wild. So I think we’re still early. Also, BTC and ETH haven’t broken their all-time highs. If we’re topping now, that’d be absurd.

Threadguy: What impact has Pump.fun had on the memecoin space?

Ansem: It’s diluted low-market-cap memecoins. Back when Solana first gained traction, some coins could stay at $1M market cap for days or weeks. That almost never happens now.

Threadguy: How do you find the next WIF in this memecoin frenzy?

Ansem: I usually watch coins in the $5M–$10M market cap range and look for ones with unique themes. If a coin’s theme is a specific animal, its ceiling is typically the highest market cap of similar coins today. But if you find a completely new theme with a forming community, that’s where “crazy” moves happen.

Threadguy: Will capital rotate from memecoins into infrastructure or fundamentally valuable projects?

Ansem: Personally, I still think memecoins will have another leg up. But imagine: if multiple memecoins reach $30B, $40B market caps, could they go to $1T? At that point, I’m not sure what percentage of total crypto they’d represent, but once they get large enough, it might be time to reduce exposure and rotate elsewhere.

Threadguy: What’s the best way to launch a token in 2024?

Ansem: Platforms like Pump.fun work well, but the key is not launching at ultra-low market cap. If you do, insiders will always dump on day one. If you have enough influence, launch at a higher market cap. Ideally, even if you decide to issue a token, it doesn’t need immediate circulation—lock supply for a period. That ensures focus stays on building the project, not just day-one or week-one price action.

Threadguy: Recently, as crypto feels sluggish, people are turning to sports betting. What’s your take on crypto vs. sports betting and the future of gambling?

Ansem: Memecoins feel a bit like sports betting. Buying ultra-low-cap coins is like placing a 5x odds bet—most of the time, you lose. But the difference is, while hit rates are low, returns in memecoins are much higher. In sports betting, unless you place exotic multi-leg bets with 10x+ odds, you can’t achieve those returns.

Threadguy: Could memecoins replace low-end sports betting?

Ansem: I wouldn’t say replace, but I think they’ll become equally common. People will “bet” on low-cap cryptos the way they place bets in sports.

How Did You Spot the “Solana Opportunity”?

Threadguy: If someone hasn’t made millions—or even hundreds of thousands—yet, is focusing on memecoin trading smart, or should attention shift elsewhere?

Ansem: I wouldn’t advise going all-in on memecoins. For crypto newcomers, the best portfolio is 70% in “safe” assets—for me, that’s Solana, but it could also be Bitcoin, Ethereum, Coinbase stock—relatively safe bets in crypto.

I also think there’s opportunity in overlooked altcoins that have crashed hard from highs or new ones flying under the radar. Right now, all attention is on memecoins—almost no one looks elsewhere. If you research other areas and find promising altcoins, that’s a solid path.

Last year’s Solana trade was exactly this. Everyone thought Solana was dead after FTX—but a few caught the opportunity, making it one of the best trades of the cycle.

There will always be Solana-like opportunities because most people don’t do their own research—they rely too much on market movements and what others are talking about. When a sector gets massive attention, prices surge fast, and everyone jumps in quickly. But if you find these opportunities before they explode, that’s when you get 100x returns.

Threadguy: Was Solana your most profitable trade ever? How did you spot it and gain such confidence? If you repeated this in this cycle, what would you look for?

Ansem: Yes—it was a combination of factors. I was lucky to follow Solana’s ecosystem long-term and understand its entire journey. I bought SOL at $1.50. In early 2021, I saw Ethereum and its DeFi doing well and believed crypto needed multiple successful L1s, especially as Ethereum faced congestion and high fees. Solana’s narrative was “cheaper, faster.”

I participated in many Solana projects, witnessed the ecosystem grow, saw its struggles, tracked all technical upgrades, and attended Breakpoint 2022. There, I talked to developers and community members. Everyone discussed progress behind the scenes. Even though some early Solana projects underperformed, teams kept working.

By late 2022, public perception of Solana was terrible—people said it constantly went down. But at Breakpoint, I saw the opposite. I remember they announced a Google Cloud partnership—SOL jumped to $39. I attended the final party at Breakpoint, felt everything was great, and decided to go all-in, seeing it as a prime opportunity for the next cycle.

Atmosphere at Solana Breakpoint event in May 2023. Source: Solana Foundation

Then FTX collapsed. I remember being at a club, someone told me to withdraw funds from FTX—I didn’t care much. After landing, I realized it was worse. Then someone said CZ just bought FTX. SOL dropped from $20 to $8.

After experiencing Breakpoint and FTX’s collapse, I knew that if another bull market came, developers who stayed and kept building would drive the chain forward. SBF’s fallout would eventually fade. I thought: if Solana rebounds, now is the perfect time to buy—but I didn’t buy yet. I waited, thinking it might drop to $2 or lower. I held off until it returned to $15–$20, then started accumulating. Around May 2023, I began openly expressing my bullishness on Solana.

Threadguy: What’s the next crypto trend exciting you now?

Ansem: I see memecoins and Pump.fun trading as a mini-game—not a full game, but guessing which coin will pop and quickly entering liquidity pools. I think there’s room for more creativity in these mini-games on-chain. Solana is a great platform for this—it handles high-volume, low-cost transactions, enabling users to easily conduct micro-transactions.

Games like Flappy Bird went viral on iPhone and Android—players chased high scores with no financial incentive. But in crypto, we can build similar on-chain games with financial elements. Add community competition—everyone racing on-chain—and there’s huge creative potential here, largely unexplored.

Threadguy: So you see Pump.fun as just one of millions of apps in an app store?

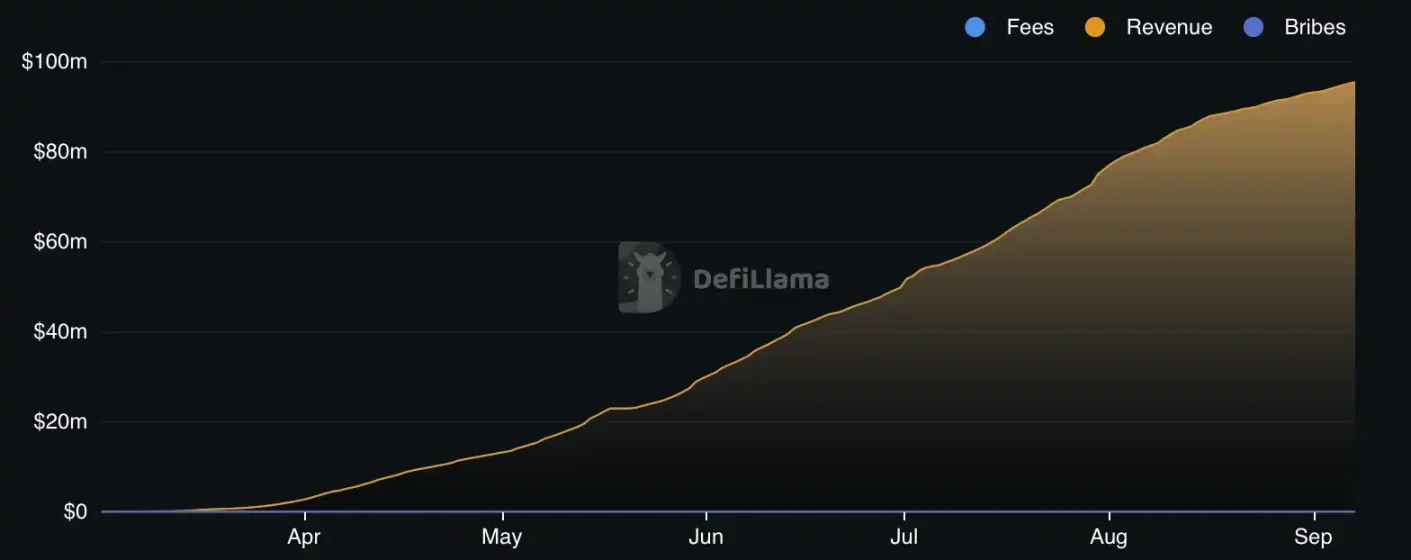

Ansem: Yes. To me, Pump.fun is one of the clearest examples of product-market fit on Solana. Its daily revenue sometimes exceeds Solana’s itself. It achieves this because Solana easily handles massive on-chain transaction volume at low fees. Many apps like Pump.fun can exist because Solana’s architecture supports parallel processing. Even if one area sees high fees, it doesn’t affect other apps—parallelism allows many applications to coexist.

Pump.fun protocol cumulative revenue nearing $100 million. Source: DeFiLlama

Threadguy: Early iPhone-era developers were like gold rush miners, rushing to build apps and list them. Will we see a similar gold rush on high-performance chains like Solana or Monad?

Ansem: I think so. Crypto apps differ greatly from app store apps. While some traditional apps have monetization, crypto apps have far greater financialization potential.

Threadguy: True—traditional apps struggle to monetize. Either charge 99 cents or use microtransactions like Clash of Clans, but it’s hard to scale profits.

Ansem: Theoretically, blockchain app margins should be much better—especially on high-performance chains. So yes, it’s a wide-open design space, still largely unexplored.

The Neiro Drama

Threadguy: Tell us about the Neiro incident—how did it happen?

Ansem: I was on vacation with family, saw Twitter buzzing about Neiro, wasn’t sure what was going on, so I asked which Neiro was the real one. Someone sent me (lowercase neiro), I assumed that was it, and shared it. Then someone told me it was a scam and invited me to a Space. I joined, said in the discussion: “Buy whatever you want—I won’t endorse any specific coin,” because I didn’t want to cause backlash by supporting one.

I emphasized this multiple times in the Space, but clearly it didn’t help.

Threadguy: Do you feel you personally “killed” Neiro?

Ansem: Maybe I did, but I know it would’ve played out this way regardless.

Threadguy: This felt like some chaotic “cabal coin” with a wild narrative—a second Doge. Yet your joke cat coin Pups ended up with higher market cap.

Ansem: That was one thing I mentioned in my tweet—the second coin reached a certain level, maybe $800M or $9.8B, and suddenly my cat coin jumped to $10B market cap.

Threadguy: This “main character” phenomenon is fascinating. It’s an awkward position—you can’t act like a victim. But realistically, being the “main character” leads to only three outcomes: one, you build something and succeed like a unicorn; two, you collapse under the spotlight and get destroyed; three, you disappear.

Ansem: Few people experience this—gaining massive attention overnight, with countless eyes on you, unable to control the stories people fabricate. Like when Iggy’s situation happened, I voiced support, and a week later someone released an AI-generated fake video of me chatting with her on the street.

Someone at a party told me they met my friend Drew, but I had no idea who Drew was. He said he talked to Drew for an hour, and Drew spun wild stories—“Ansem’s partnering with me,” “I’m helping his company build X, Y, Z”—and this guy actually believed Drew. I wondered—how often does this happen?

Threadguy: Was the interaction between Arthur Hayes and Pups pre-arranged?

Ansem: I swear it wasn’t. I was shocked when he messaged me. We’d chatted before, but never planned anything together.

Celebrity Coins Chaos: Being a KOL Isn’t Easy

Threadguy: What’s your take on celebrity token launches this cycle?

Ansem: At first, seeing celebrities enter crypto felt logical—memecoins were exploding, I already had ideas about social tokens. These figures have massive followings; if they join crypto, they could earn big, and fans would be incentivized to engage with artists and celebs.

I actively tweeted about it. First was Iggy—I remember she revealed her contract address, market cap around $10M. I tried to buy, but my first trade failed. I didn’t even realize it failed—found out much later. Price dropped, I bought again.

Later she tweeted asking how to manage supply—should she burn some? We discussed in a Space, and I suggested burning part. We talked about celebrities entering crypto, her views, her plans. That’s when I learned she said people were maliciously manipulating these tokens, talking to communities, trying to launch coins in her name. She said, “No, I’ll do this myself.”

Iggy discussing her meme coin MOTHER on a podcast. Source: Zach Song Show

Then Caitlyn Jenner—didn’t really participate, just asked questions in a Space.

Then DeVito—really hurt me. I was very supportive because he’s a hugely influential artist. I knew if he became active in these crypto apps, he could bring tons of new users. If he brought his whole community into crypto, even better.

So I helped him register, co-hosted a Space. Then someone said devs were selling from the dev wallet—right now. I was stunned—I was literally talking to him. Then in the Space, I told them: “If you start selling on day one, no one will trust you.” Many team members don’t understand crypto—they just know they can make quick money here.

Threadguy: If a celebrity enters crypto just risking their brand to launch a meme coin without real capital commitment, they’re likely just here to cash grab.

Ansem: I agree. As soon as you have even slight association or interaction with something, regardless of actual involvement, people treat it as your endorsement. That bothers me.

Even if I believe in the potential of celebrity tokens and social economy, it shouldn’t be for those rushing to launch and exit for a quick $300K. That’s where I was wrong—I thought these people, with such massive influence outside crypto, wouldn’t just launch and rug. But time and again, it ends the same.

NFTs Aren’t Dead, Ordinals Hurt Me

Threadguy: Is NFT over?

Ansem: I don’t think NFTs are dead—they’ll revive with the rise of GameFi. Many long-term games in development will integrate NFTs, either for in-game use or holder rewards. This cycle, memecoins have performed strongly, and I see similarities with NFTs—especially community interaction and gamified experiences, like the thrill of early entry. I believe someone will crack combining gamification and NFTs—maybe teams are already working on it.

Threadguy: What’s your take on Ordinals and the Bitcoin ecosystem?

Ansem: I lost a lot on Ordinals—got involved in some projects and got trapped.

On Bitcoin’s ecosystem: Bitcoin’s market is huge. Bitcoin DeFi and related sectors will do well because many BTC holders have massive cash reserves. Veteran BTC whales may use DeFi or Ordinals. That was my initial thought. But now I’m unsure if this can attract new markets. Many old BTC whales are already active on Ethereum and Solana. The key for Bitcoin’s ecosystem is attracting those who’ve never done anything on-chain.

Threadguy: Have you considered putting all your money into Bitcoin and not touching it for two years?

Ansem: I’ve thought about it—sometimes I want to tell everyone: sell everything else, put all your money in a Bitcoin cold wallet.

Quickfire Round

Threadguy: Thoughts on angel investing in crypto in 2024?

Ansem: I think the current angel investing landscape is quite good. I didn’t invest at all last cycle, but I heard most deals were in infrastructure. Opportunities for infrastructure projects to hit $10B valuations are mostly gone—unless you can prove it.

Last cycle, if you invested super early in an L2 at a low valuation, you knew it’d go up—someone would always find it. But app investing is harder. You need to judge founder quality, product potential—more complex. But if you access such deals, you could do very well—it’s the most likely area to explode this cycle.

Threadguy: Months ago, a popular idea was: the only way to profit is via secret deal flow. Can you still make money without angel investing this cycle?

Ansem: Definitely yes—especially now that this idea is consensus. Many people now avoid overvalued infrastructure projects. By the time they launch, valuations drop. If a team builds an ecosystem and valuations fall while some products explode, you can buy below IPO price.

Threadguy: Under what conditions could a new chain surpass Solana?

Ansem: Time is the biggest factor. Even if a new L1 launches today with Solana-level performance and can run the same apps, it still needs developer communities, users, and traders to activate on-chain.

This cycle, I keep thinking: Solana will outperform expectations—and it already is. Once it performs well, many projects will launch late-cycle, many not live yet. If SOL hits $1,000 or higher, and new projects launch at 1/10th the valuation, many will seek that alpha, hunting new opportunities.

Last cycle, almost all projects launched simultaneously—I could rotate fast between Solana, Luna, Avalanche. This cycle is different—Solana may explode first, then Monad or other L2s later. These new projects won’t appear all at once.

Threadguy: Do you really think Solana can hit $1,000?

Ansem: I truly believe it can.

Threadguy: How high do you think Bitcoin will go?

Ansem: Maybe around $250,000.

Threadguy: Is now the time to reset, recalibrate mindset, shift perspective, and prepare for mid-to-late cycle?

Ansem: I think so—especially if you feel you’ve underperformed. We’re in a ranging phase—months without big moves. Most altcoins peaked in March; even BTC, ETH, SOL haven’t hit new highs in five months. I truly believe it’s time to rethink.

Threadguy: Suppose you start from zero, all cash—how would you allocate in crypto?

Ansem: Ignore “it’s already up 7x or 10x”—start fresh, allocate based purely on current market conditions.

Threadguy: Side question—what was it like when Vitalik retweeted you?

Ansem: I’ve never met him or talked to him. When he retweeted me, I was shocked—thought: no way, why would Vitalik pay attention to me? He never engages in anything.

Threadguy: For a new trader, is now a good time to learn leveraged trading?

Ansem: If you have a small amount of capital, sure.

Threadguy: You once said you turned $3K into $100K—was that via leveraged trading?

Ansem: Most of my money came from futures trading. I made a lot on Luna too—back when it went up ~10x.

Threadguy: Should skilled on-chain traders switch to futures?

Ansem: No, I don’t think so. To survive long-term, you must master both. Spot trading is inherently safer, but risk management is crucial.

Threadguy: What were your best and worst trades?

Ansem: Best was Solana—I made a lot this cycle. Worst was shorting Luna—I lost badly.

Threadguy: Which coin do you think will “die” this cycle?

Ansem: Probably Cardano—there are now many strong L1s with solid communities and tech, and Cardano hasn’t kept up.

Threadguy: Which coin is most undervalued?

Ansem: MetaPlex. People see it as just an NFT platform, but it sets many standards across the ecosystem. The team is stable, has operated on Solana for a while, and may be doing token buybacks—an extremely undervalued project.

Another is Kamino—also solid. People are talking about it lately. If Solana keeps rising, people will keep using its DeFi apps. Though most capital is in memecoins now, Solana’s DeFi hasn’t exploded yet.

Threadguy: In this cycle, do you see yourself as hero or villain?

Ansem: Probably 50/50 now—ultimately I’ll be the hero. But there’s a big gap between public perception and what I actually do.

Threadguy: Any advice for young crypto players on how to “turn things around” this cycle?

Ansem: Like my example—if you want 1000x or 10,000x returns from zero, you must be the first participant in every opportunity. If you’re always first, you’ll eventually catch a big one. Staying active matters—find a small group of like-minded people to research together; they’ll spot things you miss. Finally, don’t rely only on CT—by then, info is usually stale.

Be active in project communities—join Discord, chat groups, even reach out to strangers you want to talk to. That’s how I did it in the first cycle—talked to as many people as possible. No one knew who I was—I engaged on Twitter, commented. Honestly, those interactions create countless opportunities.

Threadguy: Last cycle, you were among the first in nearly every new project. How did you balance personal life and work during peak bull market?

Ansem: It was impossible. The hardest part last cycle was staring at charts all day, barely living in the real world. That’s partly why I lost money in 2022—even if you’re deeply active in crypto, you need to maintain real-world relationships.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News