The Mystery of Losses in the "Copycat Season": The Market Has Shifted from Broad Gains to Rotation—Opportunities Belong to Those Who Adapt

TechFlow Selected TechFlow Selected

The Mystery of Losses in the "Copycat Season": The Market Has Shifted from Broad Gains to Rotation—Opportunities Belong to Those Who Adapt

The driving force behind the山寨 season is the massive liquidity flooding into the market.

Author: Crypto, Distilled

Translation: TechFlow

Is the "Altseason" a Myth?

Over the past two years, I've focused primarily on the altcoin market.

Yet one puzzle remains unsolved: the long-anticipated 2021 "altseason" never materialized as expected.

Here, I’ll explain why and offer some actionable suggestions for optimizing your altcoin strategy.

First, let’s define what "altseason" means.

Definition: A period when alts outperform $BTC and experience broad-based value surges.

This is the era of altcoin market euphoria, driven by intense market sentiment.

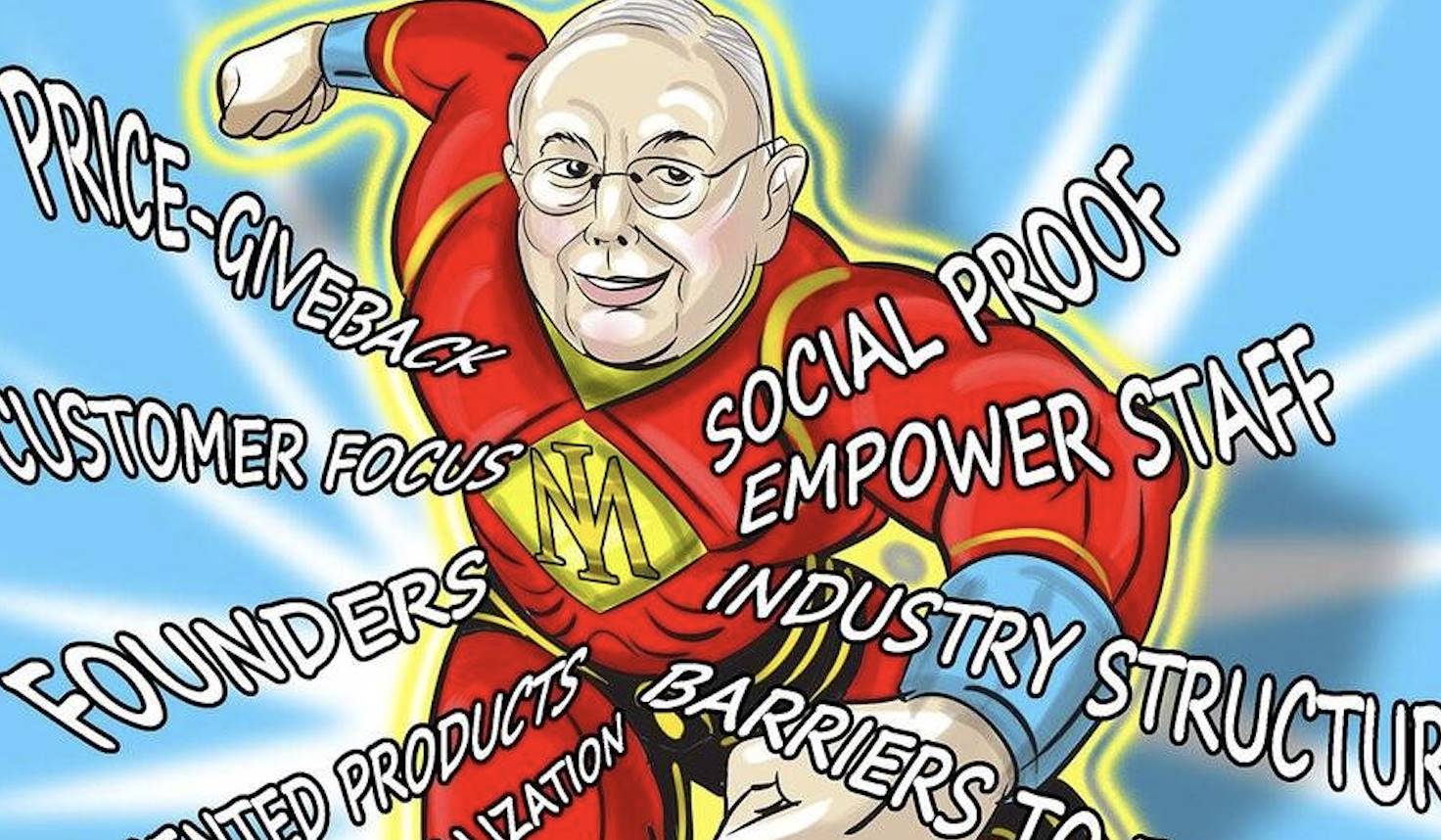

Imagine it as a rising tide that lifts all boats.

That’s exactly what a strong altseason does—it lifts nearly every sector.

What drives this? Massive inflows of liquidity flooding into the market.

Tracking Liquidity Flow

Historically, this liquidity has come from two main sources:

-

New capital inflows from retail investors via CEXs

-

Funds rotating from BTC on CEXs to alts on CEXs

Liquidity then cascades further down the market cap ladder and along the risk curve.

Veteran investors are very familiar with this dynamic, often calling it the “path to altseason.”

The Lalapalooza Effect

In 2021, the path to altseason was clear—but today, it no longer exists.

I believe this is due to multiple converging factors.

Individually, each factor may not seem powerful enough to shift the market significantly.

But when combined and moving in the same direction, their collective impact is immense.

Famed investor Charlie Munger described such phenomena as the "Lollapalooza effect."

(TechFlow note: The Lollapalooza effect refers to the powerful influence produced when multiple psychological and behavioral economics biases simultaneously affect human decision-making. It suggests that when several mental factors jointly influence judgment, the outcome can be far greater than the sum of individual effects.)

So, which forces are combining here?

I see several, and will do my best to explain them:

-

Project Overload

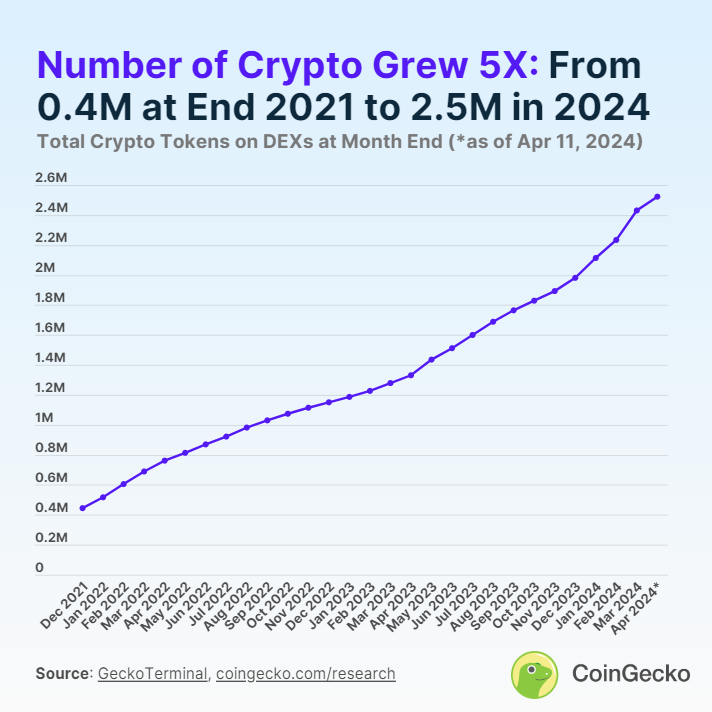

Despite ample market liquidity, the extreme saturation of projects overwhelms the system.

Imagine there are now more boats on the water than any rising tide could possibly lift.

Only select sectors—such as AI and the SOL ecosystem—have truly experienced strong “altseason” growth.

The old model of a rising tide lifting all boats has evolved into a selective rotation game.

As @Rancune_eth put it, it feels somewhat like PvP combat in *The Hunger Games*.

-

Token Dilution: The Hidden Drag

Token dilution, especially from token unlocks, has suppressed a 2021-style “altseason.”

This often-overlooked factor absorbs substantial organic capital inflows.

No matter how advanced the technology, if supply exceeds demand, prices struggle to rise.

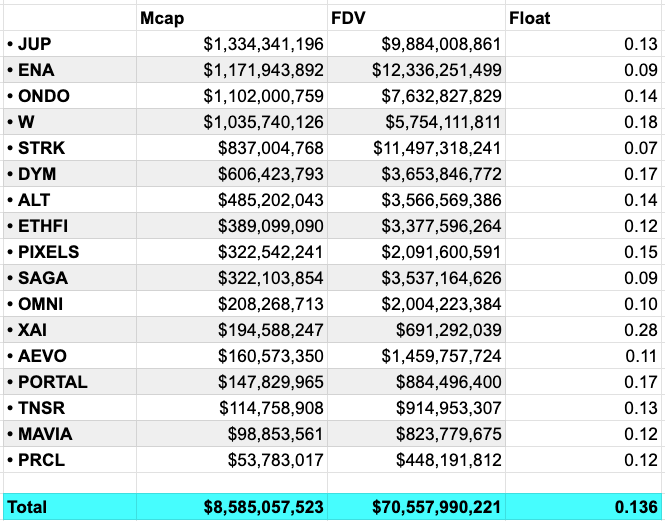

@thor_harvisten recently analyzed major 2024 token releases.

These projects have an average circulating supply of about 14%, with $70 billion worth of tokens awaiting unlock.

When project overload combines with oversupply, it creates a challenging environment for altseason.

-

The Double-Edged Sword of Adoption

Increased adoption from traditional finance is a double-edged sword for crypto.

On one hand, it enhances crypto’s credibility;

On the other, it attracts a flood of smart talent into the space.

While more talent may seem beneficial, it actually increases market efficiency.

The more sharp minds entering crypto, the harder it becomes to gain a competitive edge.

-

Bitcoin ETFs: A New Market Dynamic

Yes, you read that right.

The approval of Bitcoin ETFs has fundamentally changed the altcoin market landscape.

Before ETFs, investors typically bought Bitcoin through Tier-1 centralized exchanges (T1-CEXs).

This was beneficial for alts, as it enabled a natural liquidity spillover effect.

Investors could easily rotate from Bitcoin into alts.

Now, however, investor behavior is different.

Those buying Bitcoin via ETFs face a more complex pathway into the altcoin market.

The current on-chain user experience deserves its own dedicated article.

-

The Perfect Storm: Impact of the Pandemic

Why was 2021 so exceptional for the altcoin market? Much of it was tied to unique environmental conditions.

Lockdowns led to unusually high capital availability and screen time.

This created ideal conditions for crypto to capture the attention of retail investors.

Given the rarity of such circumstances, it's reasonable to view 2021 as an outlier.

Many remain nostalgic for the 2021 boom—an era that now seems distant and unrepeatable.

Quick Recap

We’ve covered a lot. Let’s summarize:

-

The alt market has shifted from broad-based rallies to a rotation-driven game.

-

As markets grow more efficient, gaining an investment edge requires more effort.

-

Excessive projects and oversupply are draining market liquidity.

-

The traditional alt bull market path has been disrupted by Bitcoin ETFs.

Practical Suggestions

Here are some actionable takeaways:

-

Pay attention to fully diluted valuations (FDVs) and market saturation levels.

-

Monitor ETF developments and areas with deep institutional involvement, such as RWA. These sectors may exhibit different and more favorable dynamics in the coming years.

-

In an oversaturated alt market, don’t focus solely on USD-denominated value. Compare altcoin valuations against Bitcoin ($BTC). Holding high-risk, low-return assets is unwise. Evaluating alts relative to BTC offers a clearer measure of strength.

-

Actively build your edge. This isn't just about accumulating assets, but also enhancing your knowledge, skills, and network.

Conclusion

The crypto market still holds abundant opportunities—but they require more effort and a fresh perspective.

Markets evolve rapidly, and success will favor those who adapt quickly.

Note: This is not financial advice—only my personal opinion.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News