All declines are paper tigers—will the rate cut trigger a wild altcoin season in Q4?

TechFlow Selected TechFlow Selected

All declines are paper tigers—will the rate cut trigger a wild altcoin season in Q4?

Early signs of a altcoin season have emerged, with the bull market expected to peak in the fourth quarter.

By: Ben Strack

Translation: AididiaoJP, Foresight News

Following dovish comments from Federal Reserve Chair Jerome Powell, now appears to be a good time for portfolio rotation, especially as macroeconomic factors increasingly influence the cryptocurrency market over time.

We still don't know what the Fed will do at its September 17 meeting. But for many, Powell's remarks carried dovish undertones, opening the door for rate cuts next month.

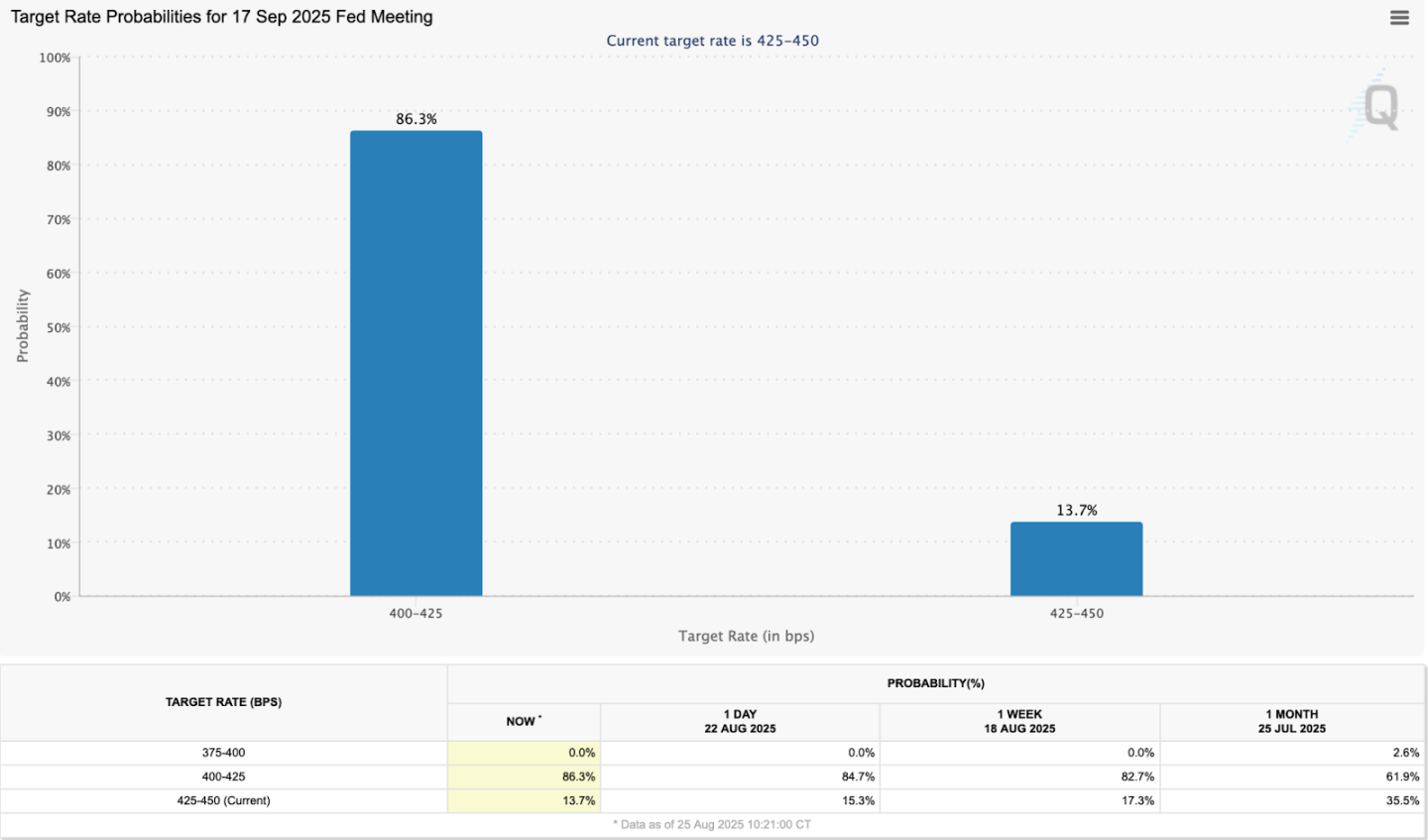

If we look at CME Group’s FedWatch tool, which is based on 30-day federal funds futures pricing, by Monday noon, the likelihood of a 25 basis point rate cut had risen significantly compared to a month ago:

While rate cuts are generally positive for risk assets like Bitcoin, the reality is more nuanced. Bitcoin surged above $117,000 on Friday before pulling back below $111,000. It was trading around $112,600 at 1:30 p.m. Eastern Time and has since fallen below $110,000.

Ruslan Lienkha, Market Director at YouHodler, believes the broader trajectory of the crypto market will still depend heavily on the macro backdrop.

"If inflationary pressures persist, the Fed may be forced to extend its pause again, limiting the sustained impact of any single rate cut," he told me. "Additionally, if rate cuts are seen as an emergency response to recession, they could weigh on cryptocurrencies and other risk assets."

The best-case scenario? Rate cuts become part of the Fed's successful soft landing efforts.

"In such an environment, given Bitcoin’s status as the most mature digital asset, it could attract the majority of institutional inflows," said Lienkha. "Some altcoins may outperform due to their higher volatility and lower liquidity, amplifying gains when capital flows expand beyond Bitcoin."

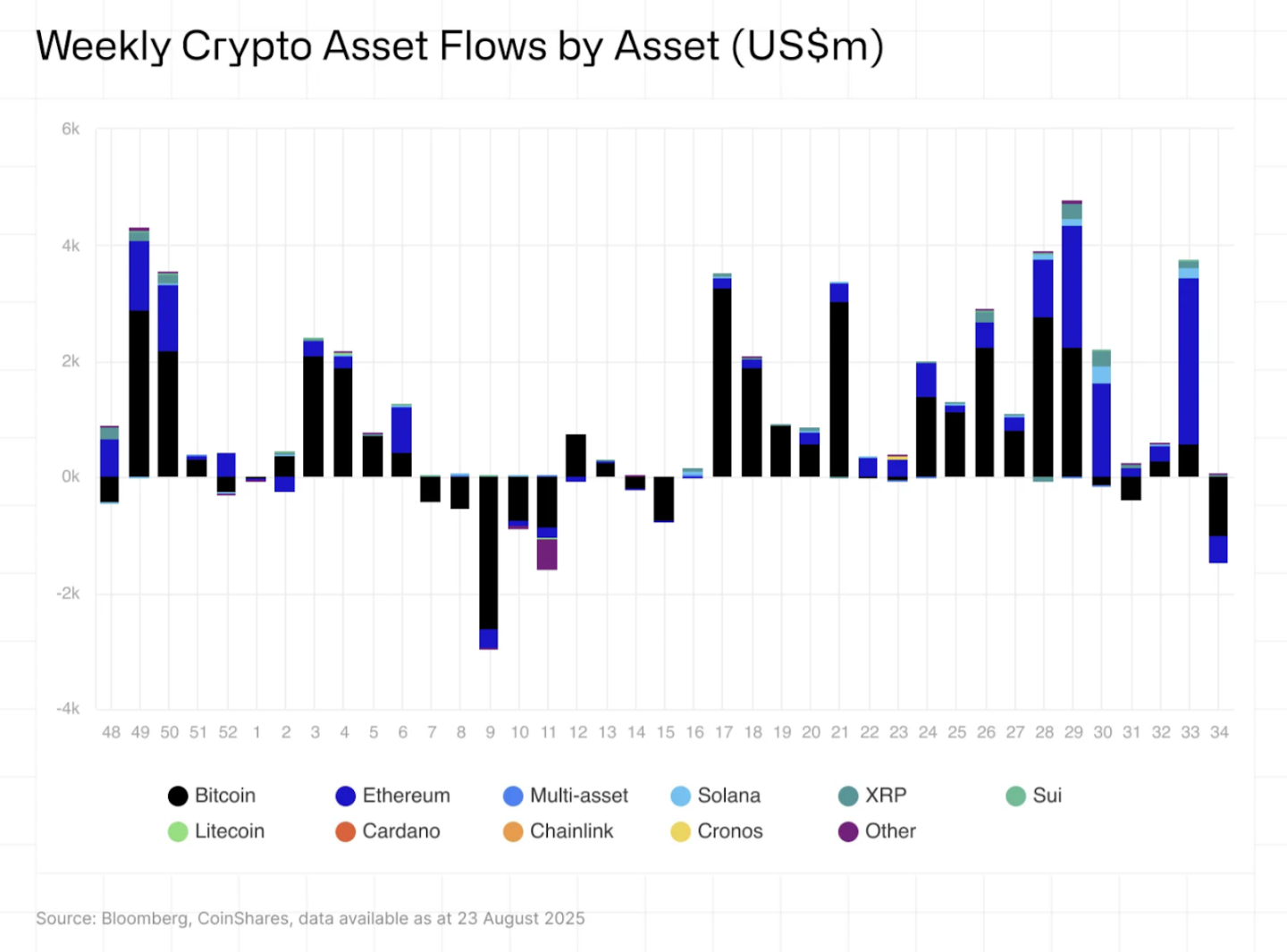

Speaking of institutional flows, according to CoinShares data, crypto investment products saw over $1.4 billion in outflows last week—the highest weekly outflow since March. Within this data, early-week bearish sentiment toward the Fed’s stance appeared to drive outflows, followed by a recovery after Powell’s comments—mainly in Ethereum products.

Despite combined U.S. ETH ETF inflows of $625 million on Thursday and Friday, BTC funds saw outflows of $217 million during those two days. Year-to-date, ETH and BTC ETFs have net inflows of +$2.5 billion and -$1.0 billion respectively, "marking a significant shift in investor sentiment toward these two assets," noted CoinShares’ James Butterfill.

What signals did investors receive on Friday?

CK Zheng, co-founder of crypto hedge fund ZX Squared Capital, said Powell’s pivot toward potential rate cuts is “significant” for risk asset classes.

He forecasts Bitcoin’s year-end target between $125,000 and $150,000. He expects ETH to end the year between $6,000 and $7,000 (currently hovering around $4,600 on Monday afternoon).

Matt Lason, Chief Investment Officer at Globe 3 Capital, said any signal of rate cuts confirms the fund’s bullish positioning, as increased liquidity is crucial for cryptocurrencies. He expects the current bull market’s strength to peak in the fourth quarter.

The anticipated rate cuts prompted Globe 3 Capital to rotate more of its holdings into small-cap tokens, "as we see early signs of the long-awaited altcoin season," Lason added.

What comes after Q4? Dan Tapiero, founder of 50T Funds, shared thoughts over the weekend on X, citing Morgan Stanley research:

Zheng said he expects Bitcoin’s dominance to continue declining following the signing of the GENIUS Act, and estimates the stablecoin market could grow tenfold in the coming years (from approximately $270 billion). Coinbase’s latest projections suggest stablecoin market cap could reach $1.2 trillion by the end of 2028.

We know the crypto market moves quickly, but I think these reflections on where we stand are worthwhile—even if everything changes in weeks, days, or even hours.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News